- HOME

- Enterprise

- Shortcomings of Inefficient Enterprise Billing Systems

Shortcomings of Inefficient Enterprise Billing Systems

Introduction

Picture an enterprise organization that is growing steadily—new product lines, expanding markets, additional branches, larger teams, increasing policies, and the like. The growth is exhilarating, but there's something brewing: An overlooked bottleneck in the operations pipeline—an inefficient billing system that crumbles under pressure.

The modern enterprise world demands a lot from billing systems, and solutions that fail to adapt will eventually become roadblocks that hinder growth, increase scaling risks, and drive customers towards competitors. This article explores the different challenges enterprises might face when working with obsolete billing systems.

The billing facade

On the surface, it may appear that a well-implemented billing system has the enterprise operations running like clockwork. However, this can be deceptive since the billing engine could be an amalgamation of manual workarounds and weak integrations.

For example:

- Invoices are going out on time, but a sales representative has offered an over 20% price reduction without their manager's approval.

- Monthly revenue targets were achieved, but significant manual effort was required to follow up on overdue payments.

- The system handles routine operational load efficiently but had excessive failed transactions at peak hours.

- ARR reports were delivered to the leadership team, but the lack of insights and system-wide visibility delayed decision-making.

It's time to recognize the underlying issue—the inevitable fallout of billing systems that are not future-proofed. These platforms will eventually fail to scale, costing enterprises millions due to a lack of well-thought-out functionalities, driven by outdated architecture.

5 gaps in enterprise billing systems

Here are five billing inefficiencies in enterprise solutions that should nudge a shift towards more sophisticated billing infrastructure.

1. Rigid billing and pricing models

Billing platforms built around flat-fees or fixed rate structures offer only limited flexibility to adapt to the evolving needs of a dynamic market. With competitors moving towards powerful pricing strategies like hybrid or usage-based, enterprises that use older billing systems will struggle to keep pace. This typically leads to businesses deploying manual workarounds and hiring administrative resources for repetitive billing tasks, drastically depleting productivity and reducing operational efficiency.

2. Lack of automation rules and AI

In an era where nearly every workflow can be automated using rule-based engines and MLL, enterprises still heavily rely on manual processes to manage critical billing operations. This includes dunning retry logic, customizable revenue recognition rules, or report breakdowns, all of which can be streamlined through intelligent automation. In the absence of such AI-powered algorithms, the gaps can be increasingly costly for finance and operational teams.

3. Weak internal governance

Robust internal controls are essential for enterprises to define set policies for teams and gain visibility into user actions. Without these controls in place, there are pricing overrides, unauthorized changes to invoices, and untraceable activities. This leads to unpreparedness for audit trials, risk of internal fraud, and poor accountability across departments. There needs to be a clear definition of hierarchical roles and approval criteria for transactions for smooth internal operations.

4. Manual adherence to compliance and updates

While compliance with tax regulations and e-invoicing mandates is non-negotiable, many outsourced billing and legacy ERP systems lack these critical requirements. The consequences are dire as teams are obligated to manually oversee regulatory changes and apply tax calculations, with no room for mistakes. As billing systems update to newer versions, connected systems and government portals must also be updated to ensure seamless interoperability.

5. Limited scalability

As enterprises grow—whether in transaction volume, customer numbers, broader functionalities, or expanding geographies—weaker enterprise billing systems will begin to start sounding alarm bells. Common warning signs are excessive failed transactions during peak hours, minimal support for local and international payment modes, and a lack of multi-currency handling or native integration options. This would mean adopting third-party customizations, leading to external dependencies and increased overheads.

Enterprise billing: A strategic lever

Combating these shortcomings is key to building a resilient enterprise billing infrastructure—to go beyond a mere invoicing solution in order to support the business's ambitious strategies. Today, monetizing and billing have emerged as levers of strategic competence to uniquely position a company's offerings to its audience.

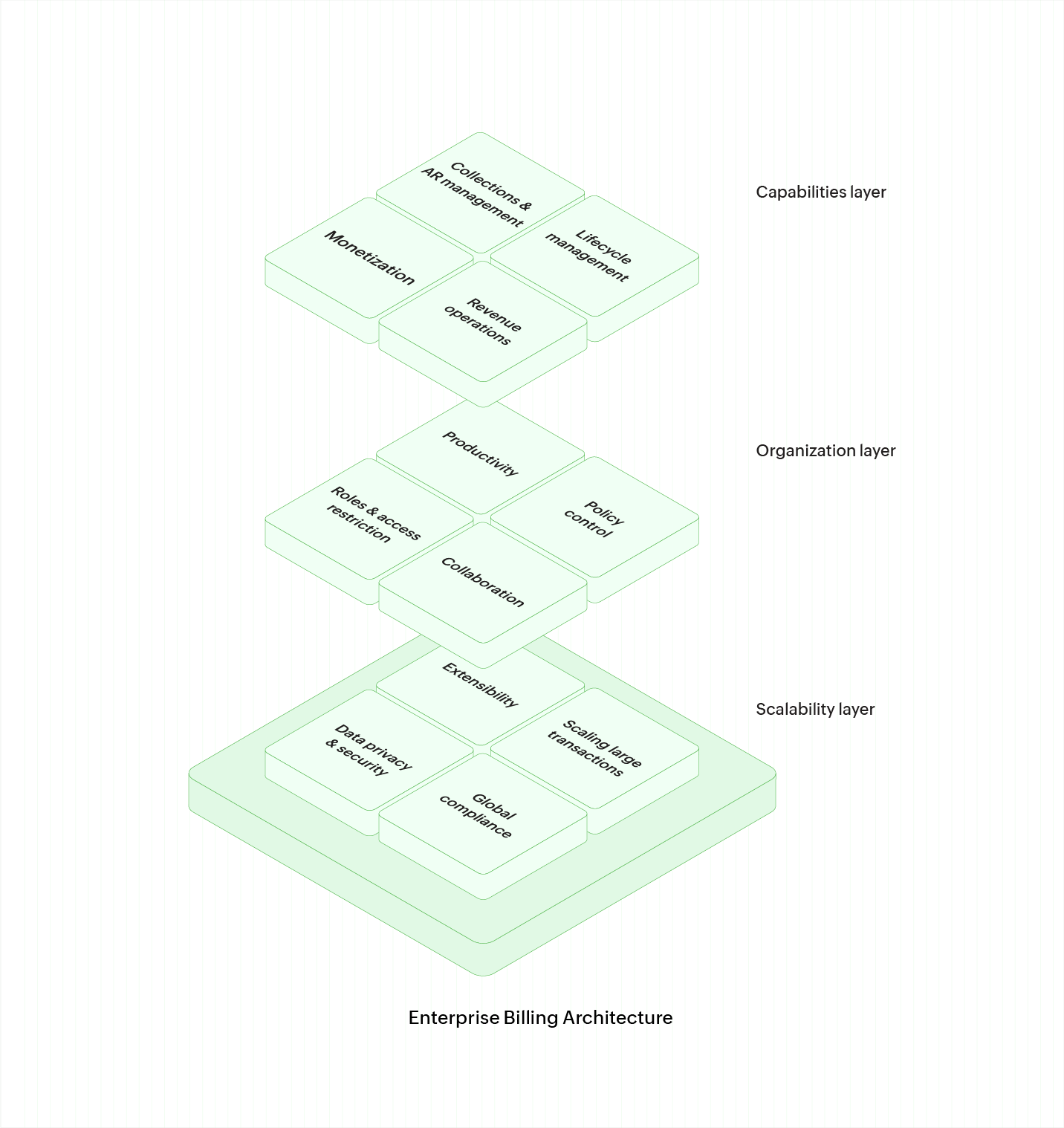

Agile billing platforms like Zoho Billing Enterprise are equipped to enable go-to-market strategies, monetization models, payment and collection experiences, customer lifecycles, and revenue frameworks. With the right systems and data architecture, billing systems can have the enterprise's revenue operations running like a well-oiled machine.

Conclusion

Billing systems have evolved from what was previously expected to be "good enough" to a revenue growth engine that businesses can leverage to adapt to dynamic pricing, smooth out revenue streams, and foster better customer relations. In today's competitive landscape, it is imperative that enterprises identify shortcomings, limitations, and inefficiencies in their existing billing operations before the flaws reveal themselves, leading to exorbitant consequences.

As CXOs, finance leaders, and IT decision-makers of your organization, it's your responsibility to ensure your billing infrastructure is well-equipped for operational resilience and long-term scalability.