Functions in e-Invoicing

This guide will help you learn about the various actions you’ll be able to perform in Zoho Books as part of e-Invoicing.

Statuses of e-Invoicing in Zoho Books

Here are the various statuses related to e-Invoicing in Zoho Books.

| Status | Description |

|---|---|

| Yet-to-be Pushed | The transaction is yet to be pushed to the IRP for e-Invoicing. |

| Pushed | The transaction was pushed to the IRP successfully, and a QR code and IRN has been generated for it. |

| Push Initiated | The transaction is being pushed to the IRP as part of a bulk push action. |

| Cancelled | The e-Invoiced transaction has been cancelled in both Zoho Books and the IRP. The IRN associated with it is no longer valid. |

| Marked as Cancelled | The e-Invoiced transaction has been marked as cancelled in Zoho Books alone. You’ll have to cancel it in the GST portal to make the IRN invalid. |

| Failed | The transaction could not be pushed to the IRP. |

The e-Invoicing system requires the following transactions to be pushed to the IRP. An IRN will have to be generated for each of these transactions:

- Invoices

- Credit Notes

- Debit Notes

Insight: This guide explains how to push invoices to the e-Invoicing portal from Zoho Books. However, Credit Notes and Debit Notes can also be pushed in a similar manner.

Create Invoices

The Government has mandated a set of fields that are required for an e-Invoice. Some of these are available when creating new invoices. The other mandatory fields, will be available for that invoice if you’ve already entered them in Zoho Books (e.g. in the Customers or Items modules ). These mandatory fields depend upon the business needs of the supplier. For example, the Dispatch From address is mandatory if it’s different from the seller address. The Shipping address is mandatory if it’s different from the buyer address.

Here’s a list of the mandatory fields:

| Module | Field Name | Specifications with Sample Inputs |

|---|---|---|

| Organisation (Seller) Details | Supplier_Legal Name | String Max length: 100 |

| Supplier_GSTIN | Max length: 15, Must be alphanumeric | |

| Supplier_Address | Max length: 100 | |

| Supplier_Place | Max length: 50 | |

| Supplier_State_Code | Enumerated list of states | |

| Supplier Pincode | Six digit code | |

| Dispatch From_ Name, Address, Place and Pincode | Max length: 100 each and 6 digit for pincode | |

| Customer (Buyer) Details | Recipient_ Legal Name | Max length: 100 |

| Recipient’s GSTIN | Max length: 15 | |

| Recipient’s Address | Max length: 100 | |

| Recipient’s State Code | Enumerated list | |

| Place_Of_Supply_State_ Code | Enumerated list of states | |

| Pincode | Six digit code | |

| Recipient Place | Max length: 100 | |

| ShippingTo_GSTIN | Max length: 15 | |

| Shipping To_State, Pincode and State code | Max length: 100 for state, 6 digit pincode and enumerated list for code | |

| Transaction Details (Invoice, Credit Note, Debit Note) | Document Type Code | Enumerated List such as INV / CRN / DBN |

| Document Number | Max length: 16 (e.g., “Sa/1/2019”) | |

| Document Date | String (DD/MM/YYYY); sometimes YYYY-MM-DD | |

| Total Invoice Value | Decimal (11,2) | |

| Preceeding_Invoice_Reference and date | Max length: 16 | |

| IRN - Invoice Reference Number | Max length: 64 | |

| Supply Type Code | Enumerated list of codes | |

| Item Details | Item Description | Max length: 300 (e.g., ‘Mobile’) |

| HSN Code | Max length: 8 | |

| Item_Price | Decimal (12,3), e.g., ‘50’ | |

| Assessable Value | Decimal (13,2), e.g., ‘5000’ | |

| GST Rate | Decimal (3,2), e.g., ‘5’ | |

| IGST Value, CGST Value and SGST Value Separately | Decimal (11,2) | |

| Is_Service | String (Length: 1), Y/N |

Note: Addresses must include: Street1, City, Zip/Postal Code, and State

Push Invoices to the IRP

Invoices in Zoho Books can be sent to the e-Invoicing portal with the click of a button. If you have enabled transaction approval, then the invoices must be approved before you can push them to the IRP. If you’ve set up multi-level approval, then you can push invoices only after they’ve been approved by the final approver.

Note: You have to push an invoice to the IRP successfully before sending it to the customer.

Insight: You can generate e-Invoices for transactions dated in the past. However, if your turnover exceeds ₹10 crore, the invoices, debit notes, or credit notes created in your organization must be pushed within 30 days from the date of these transactions. Failing to do so will render these transactions as non-compliant.

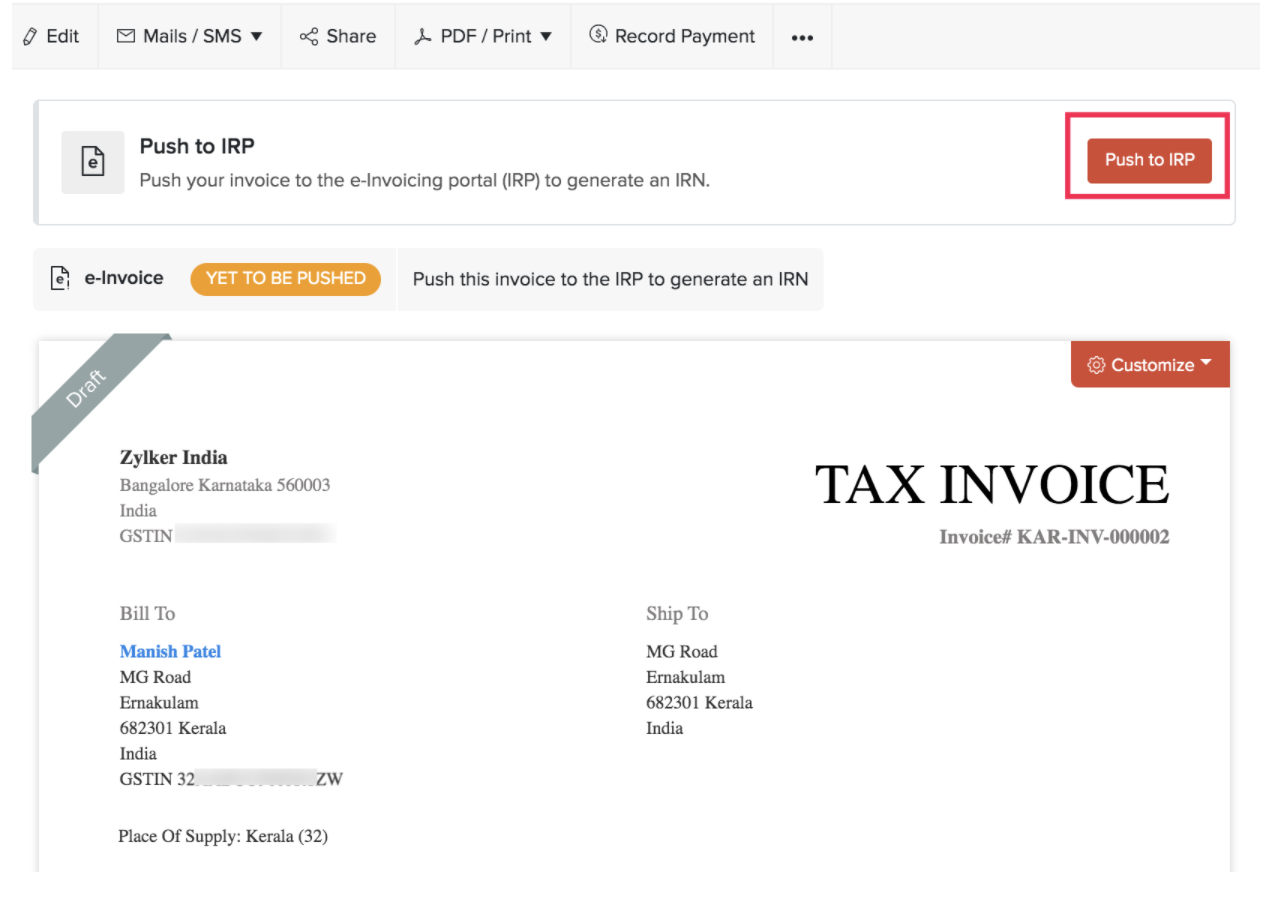

Here’s how you can push invoices to the IRP:

- Go to Sales on the left sidebar and select Invoices.

- Select the invoice that you want to push to the IRP.

- Click the Push to IRP button.

Associate IRN to Invoices

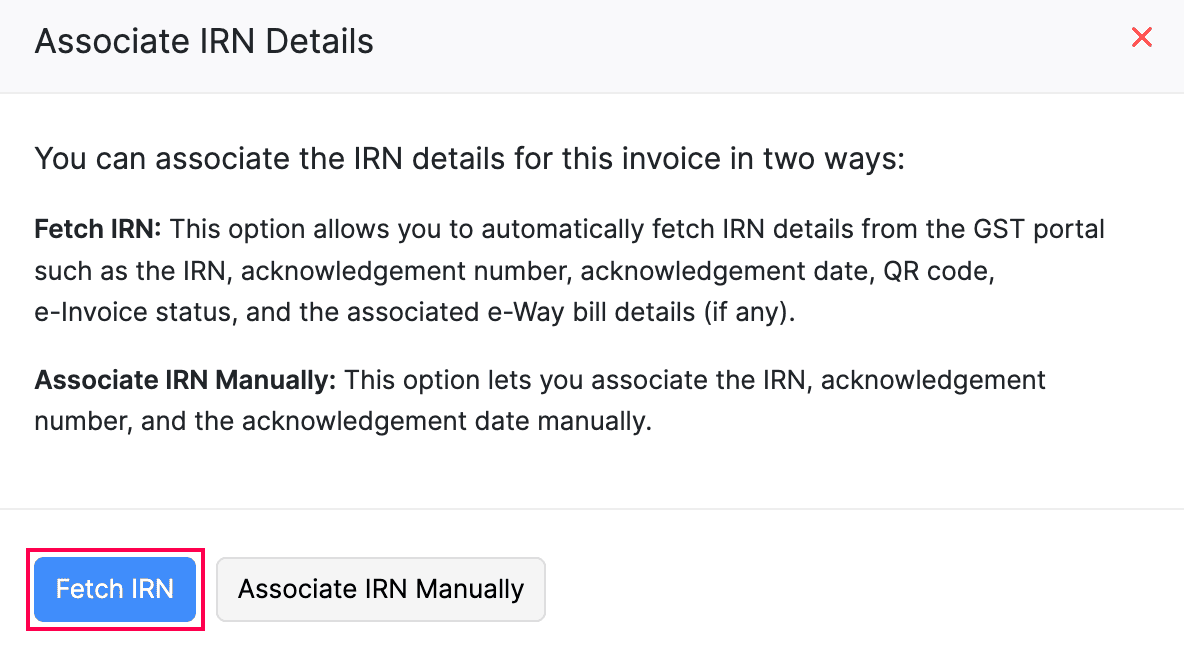

If you’ve generated an e-Invoice directly through the IRP Portal, you can associate the IRN details to your invoice in Zoho Books. You have the option to either automatically fetch the IRN details or manually associate it to the invoice.

Note:This feature is common to invoices, credit notes, and debit notes.

Fetch IRN

If you have pushed an invoice to the e-Invoice Portal, you have the option to automatically fetch the IRN details for that e-Invoice. This includes important information such as the IRN, acknowledgement number and date, QR code, e-Invoice status, and e-Way Bill details (if applicable) which can then be automatically associated with your invoice in Zoho Books. Here’s how:

Prerequisite:Ensure that you have enabled the Online Filing Settings option under Settings > Taxes and Compliance > Taxes > GST Settings. If this option is not configured, the Fetch IRN button will be disabled.

Note:After a transaction is pushed to the IRP, it will take up to 24 hours for the details to become available on the GST Portal. During this initial 24-hour period, users will be unable to fetch the IRN.

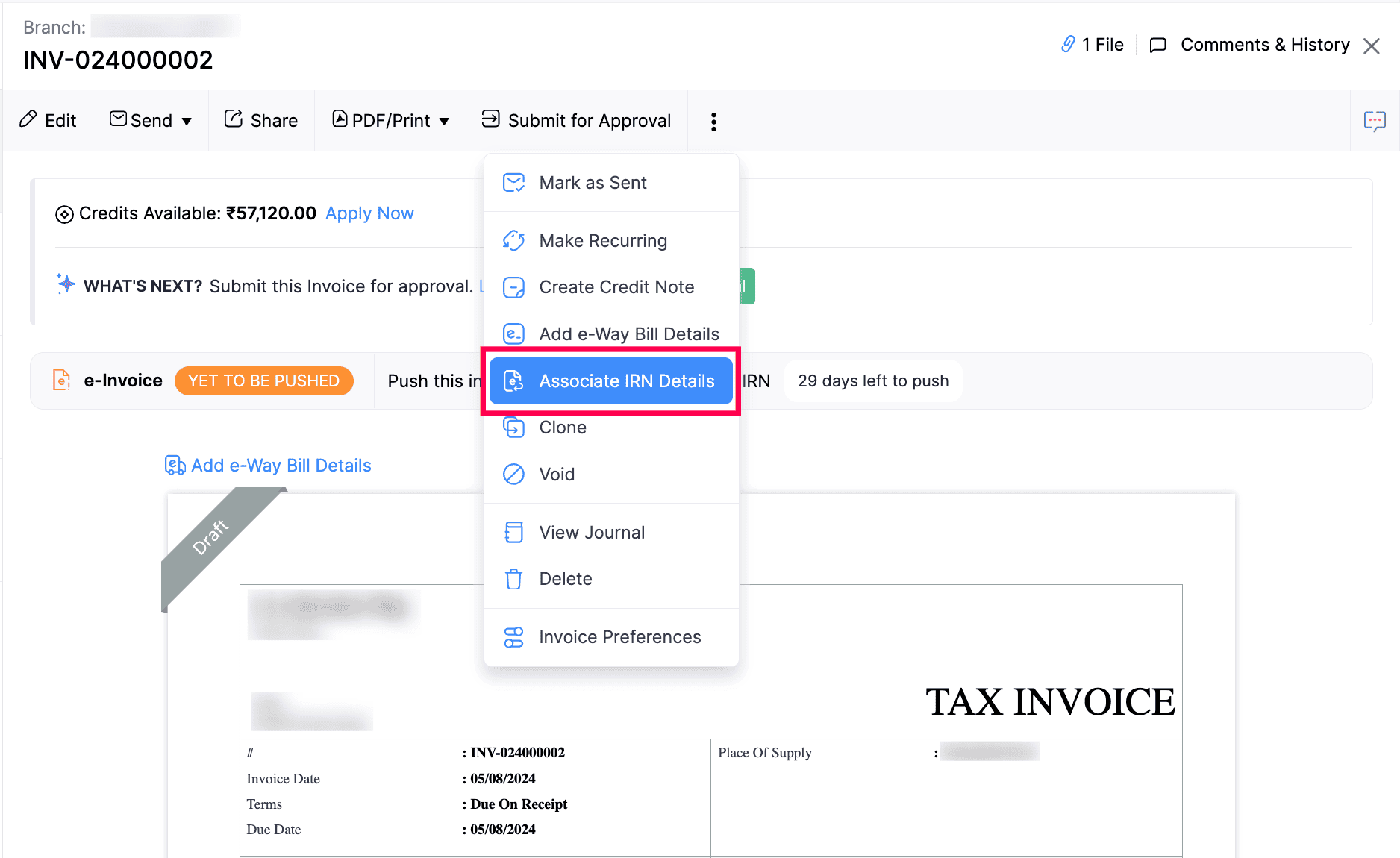

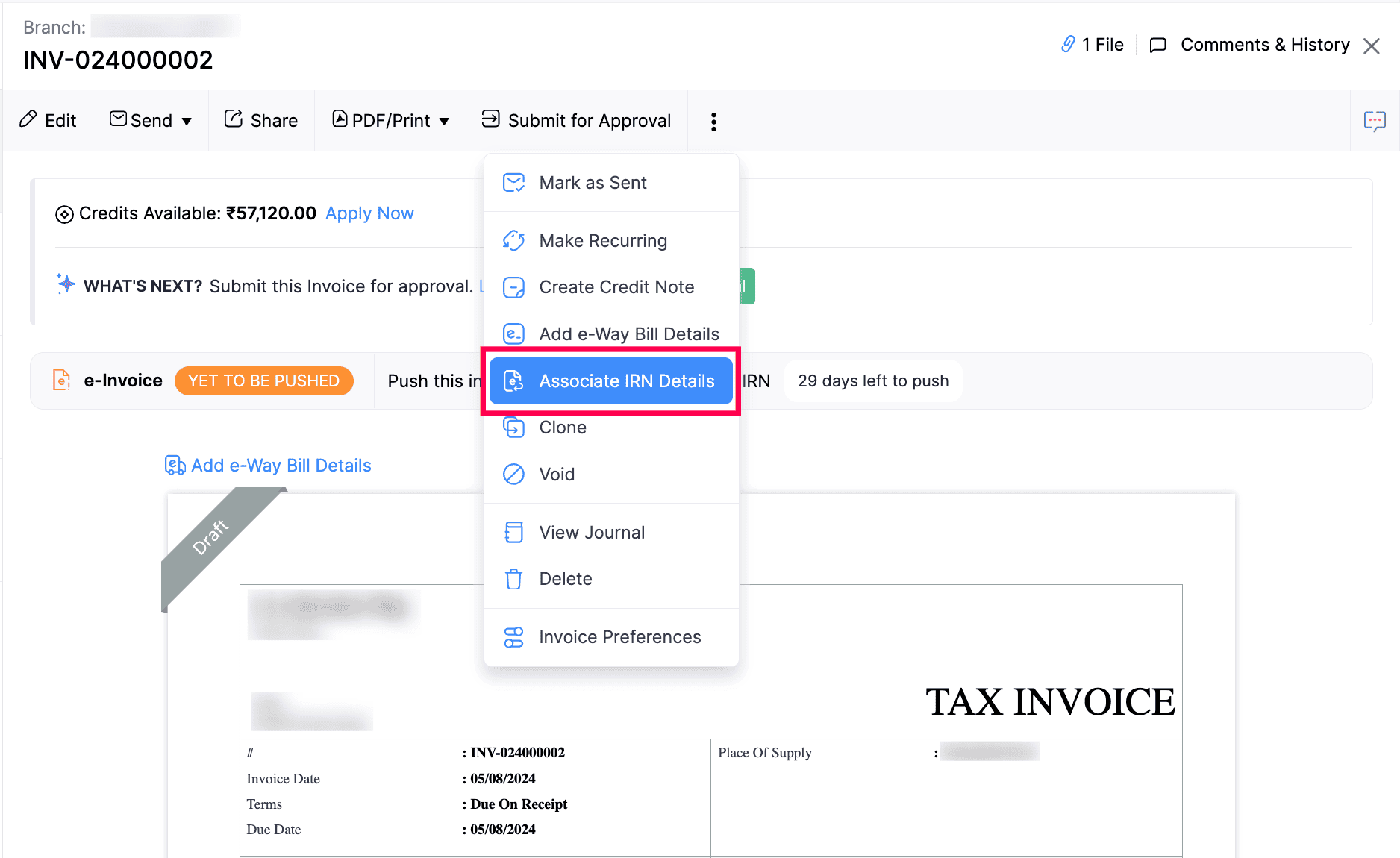

- Go to Sales on the left sidebar and select Invoices.

- Select the invoice for which you want to fetch IRN details automatically.

- Click the More icon at the top of the invoice’s details page and select Associate IRN Details from the dropdown.

- Click Fetch IRN in the pop-up that appears.

The IRN details will be fetched automatically if the GST Portal login session has not expired. If the session has expired, you need to reconnect with the portal. Here’s how:

- Click Generate OTP in the pop-up that appears.

- Enter the OTP sent to your registered email address or phone number on the GST Portal.

- Click Verify OTP.

Now, IRN details will be fetched automatically and will be reflected on the transaction’s details page.

Note:The GST Portal allows users to fetch IRN details only for transactions pushed within the past 6 months. For transactions older than this, you will need to manually associate the IRN details.

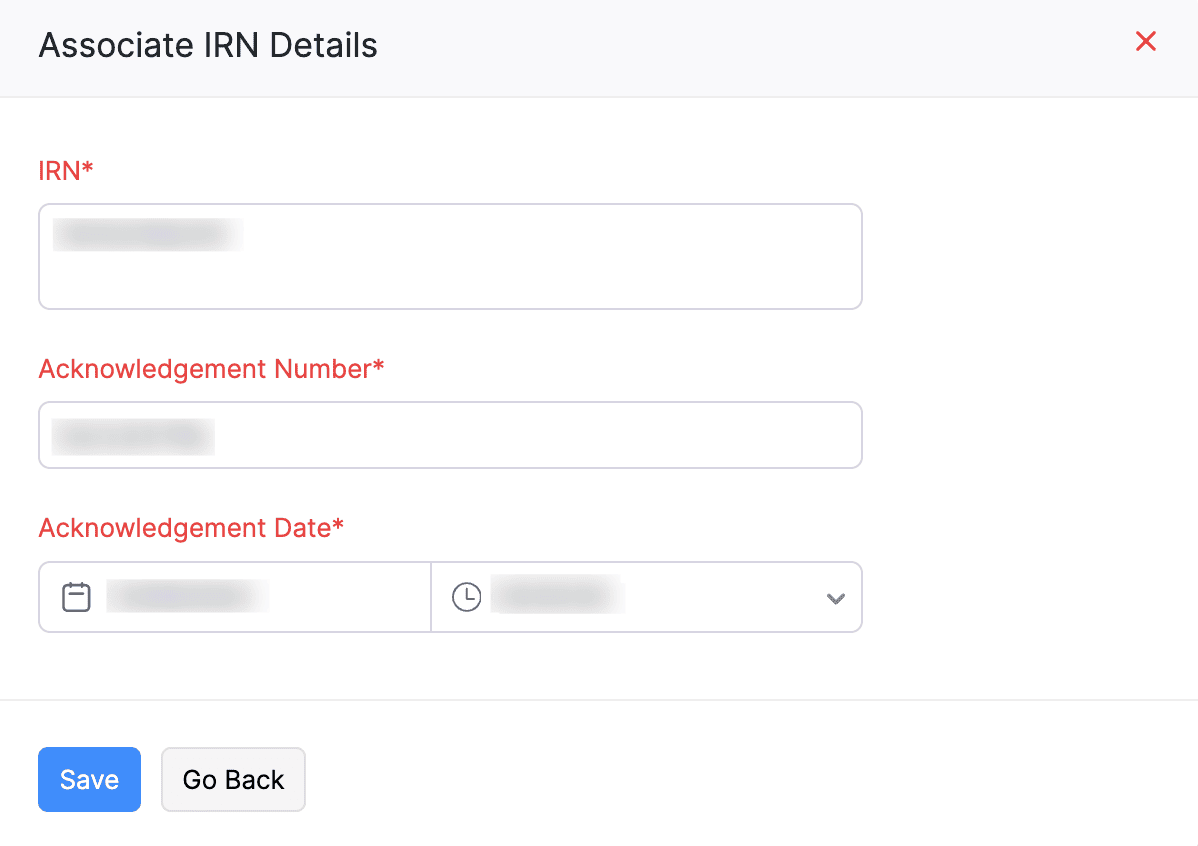

Associate IRN Manually

When you push an invoice directly to the e-Invoice Portal, the Invoice Registration Portal (IRP) will generate a unique Invoice Reference Number (IRN), Acknowledgment Number and Acknowledgment Date for each successfully submitted transaction.

You can manually associate the IRN details issued by the IRP to the invoice that you’ve created in your Zoho Books organisation. Here’s how:

- Go to Sales on the left sidebar and select Invoices.

- Select the invoice to which you want to associate the IRN details.

- Click the More icon at the top of the invoice’s details page and select Associate IRN Details from the dropdown.

- Click Associate IRN Manually in the pop-up that appears.

- In the pop-up that appears, enter the IRN, Acknowledgement Number, and Acknowledgement Date.

- Click Save.

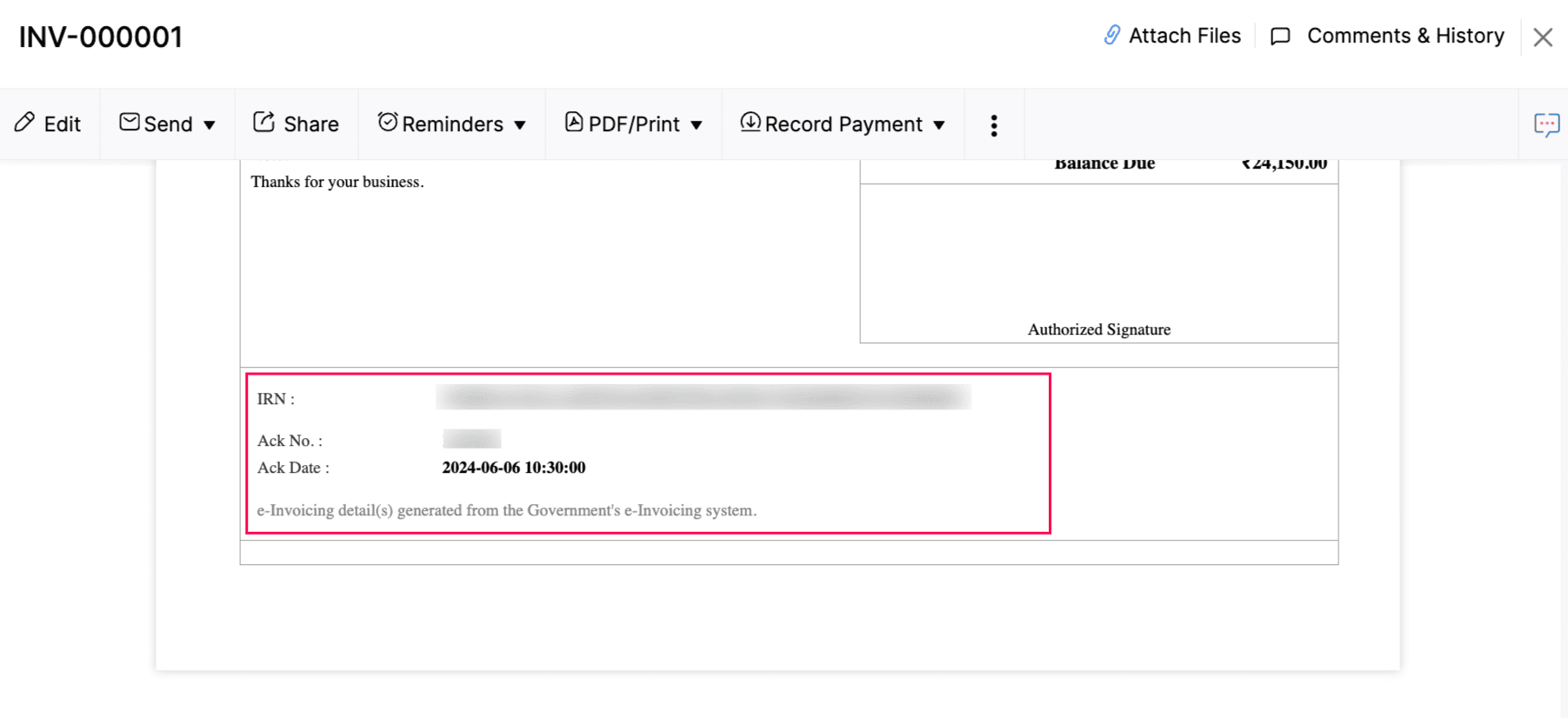

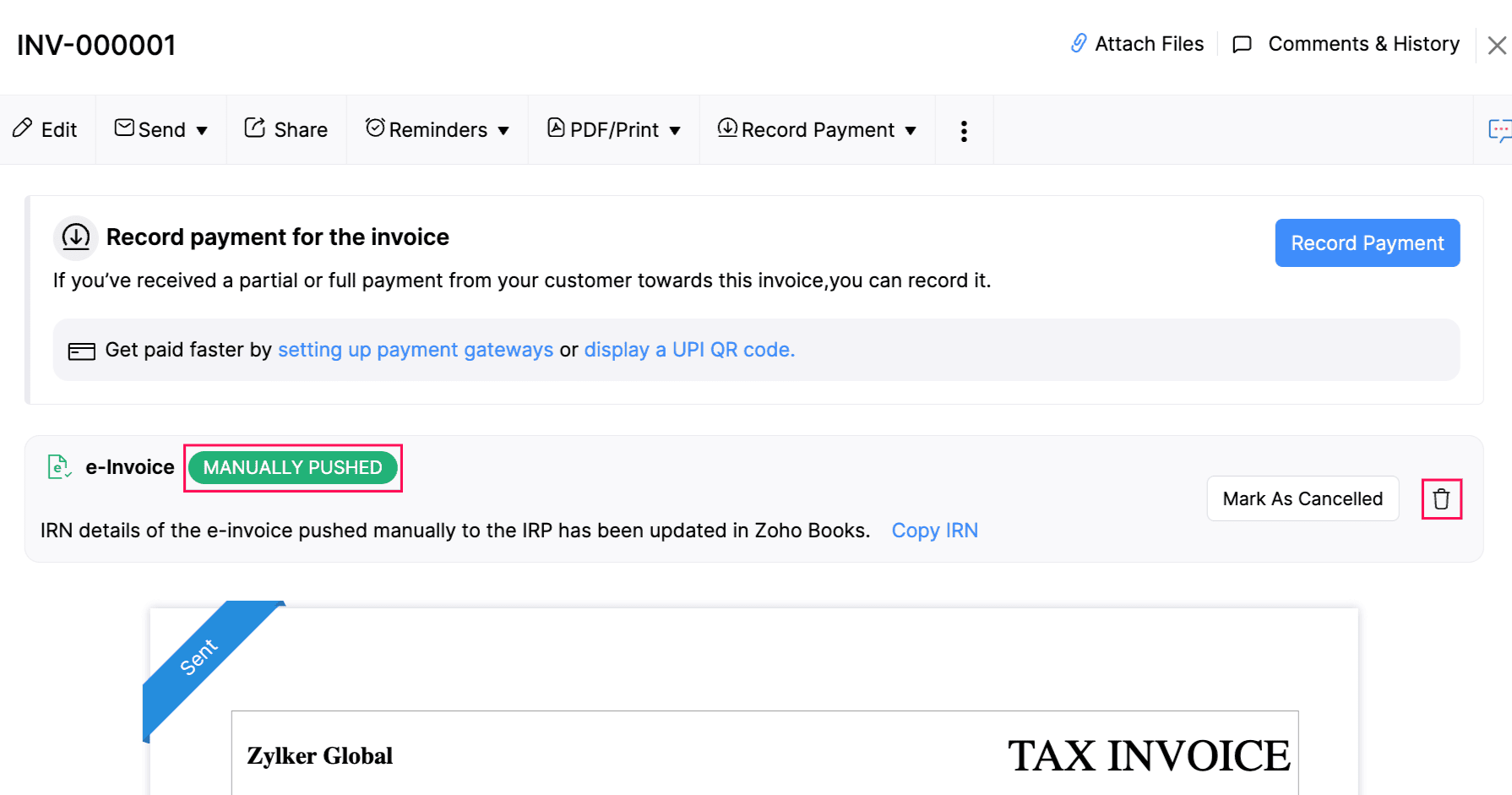

The e-Invoice’s status will be changed to Manually Pushed, and the IRN details associated with the e-Invoice will be displayed at the bottom of the transaction PDF.

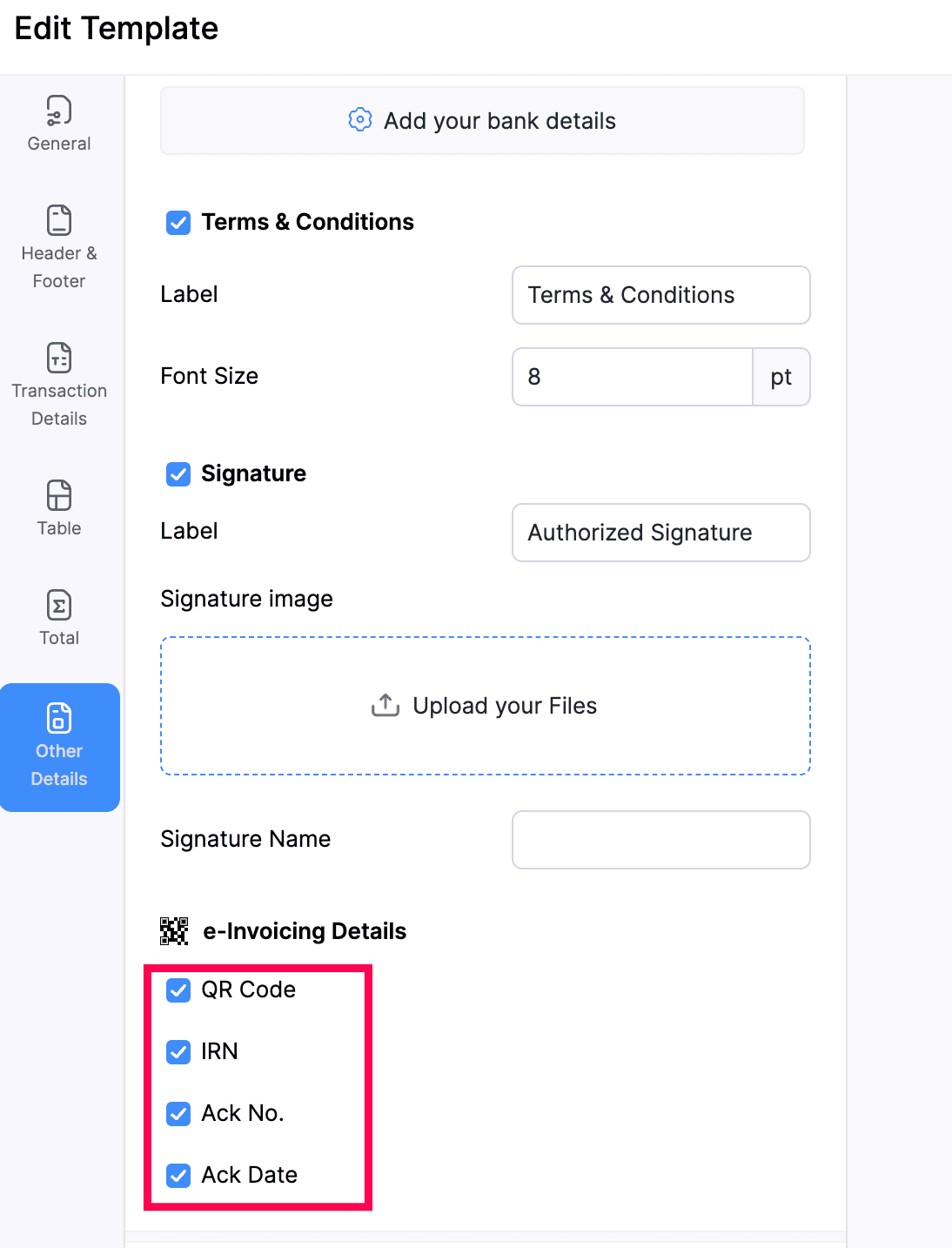

Display IRN Details on Invoice PDF

You can display the IRN details on the invoice PDF. This includes the following: QR code, IRN, Acknowledgment Number, and Acknowledgment Date. Here’s how you can include these details in the invoice PDF:

- Navigate to Settings at the top right corner of the page.

- Click PDF Templates under the Customization section.

- Select Invoices from the list of modules and click Edit next to the template you want to edit.

- On the right sidebar, choose Other Details.

- Check the box against QR Code, IRN, Ack No, and Ack Date under e-invoicing Details.

- Click Save.

Once you do this, the IRN details will be displayed at the bottom of the invoice PDF.

If you wish to change the position of the IRN details, you can do so only by adding placeholders in the Header section of the template. Here’s how:

- Navigate to Settings at the top right corner of the page.

- Click PDF Templates under the Customization section.

- Select Invoices from the list of modules and click Edit next to the template you want to edit.

- On the right sidebar, choose Header & Footer. In the Header section, click Customize your header content.

- In the pop-up that appears, you can add the following placeholders:

- IRN Number - %IRN%

- QR String - %EInvoiceQRSrc%

- QR Image - %EInvoiceQRImg%

- Ack Date - %EInvoiceAckDt%

- Ack Number - %EInvoiceAckNum%

- Click Preview to see how the changes will look on the invoice.

- Click Save.

Delete IRN Details

Sometimes, you might have associated wrong IRN details to you invoice. In such cases, you have the option to delete the IRN details. Here’s how:

- Go to Sales on the left sidebar and select Invoices.

- Select the invoice to which you associated the IRN details.

- Click the Delete icon next to Mark as Cancelled at the top of the invoice’s details page.

The invoice’s status will then be changed to Yet to be Pushed. You can then manually re-associate IRN details, if required.

e-Way Bill Details

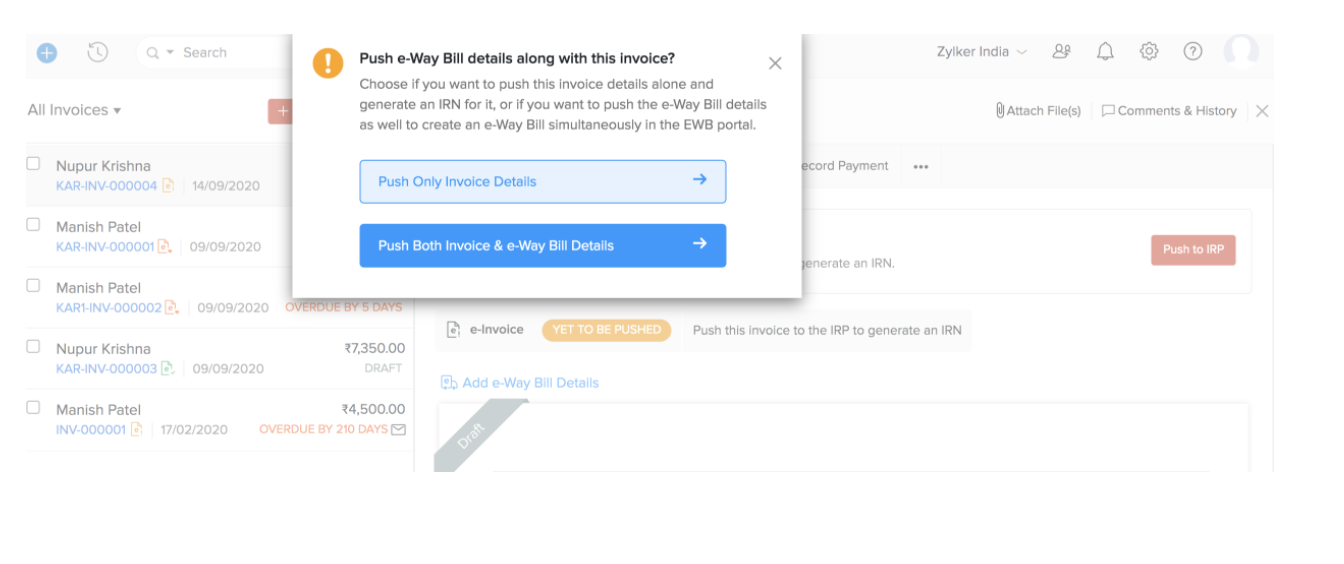

If you have enabled e-Way Bills in Zoho Books, then you can choose to push the e-Way Bill details to the IRP, along with your invoice. This way, you can save time and generate an e-Way Bill as well as an IRN for your invoice. When you click Push to IRP, you can decide which details you want to send to the IRP.

Push only Invoice Details: Your invoice will be pushed to the IRP and an IRN will be generated for it. Your e-Way Bill details will not be sent to the IRP.

Push Both Invoice & e-Way Bill Details: Both your invoice and e-Way Bill details will be sent to the IRP. If you’ve already entered the e-Way Bill details, then you can preview those details and push them along with the invoice. If not, you’ll be prompted to enter the e-Way Bill details, and then push them to the IRP along with the invoice.

If the invoice is pushed to the IRP successfully, then an IRN (Invoice Reference Number) and QR Code will be generated by the IRP. This IRN is unique to each invoice and will be used to identify it for the entire financial year in the GST system. You can click Copy IRN above the invoice preview to copy this IRN if needed.

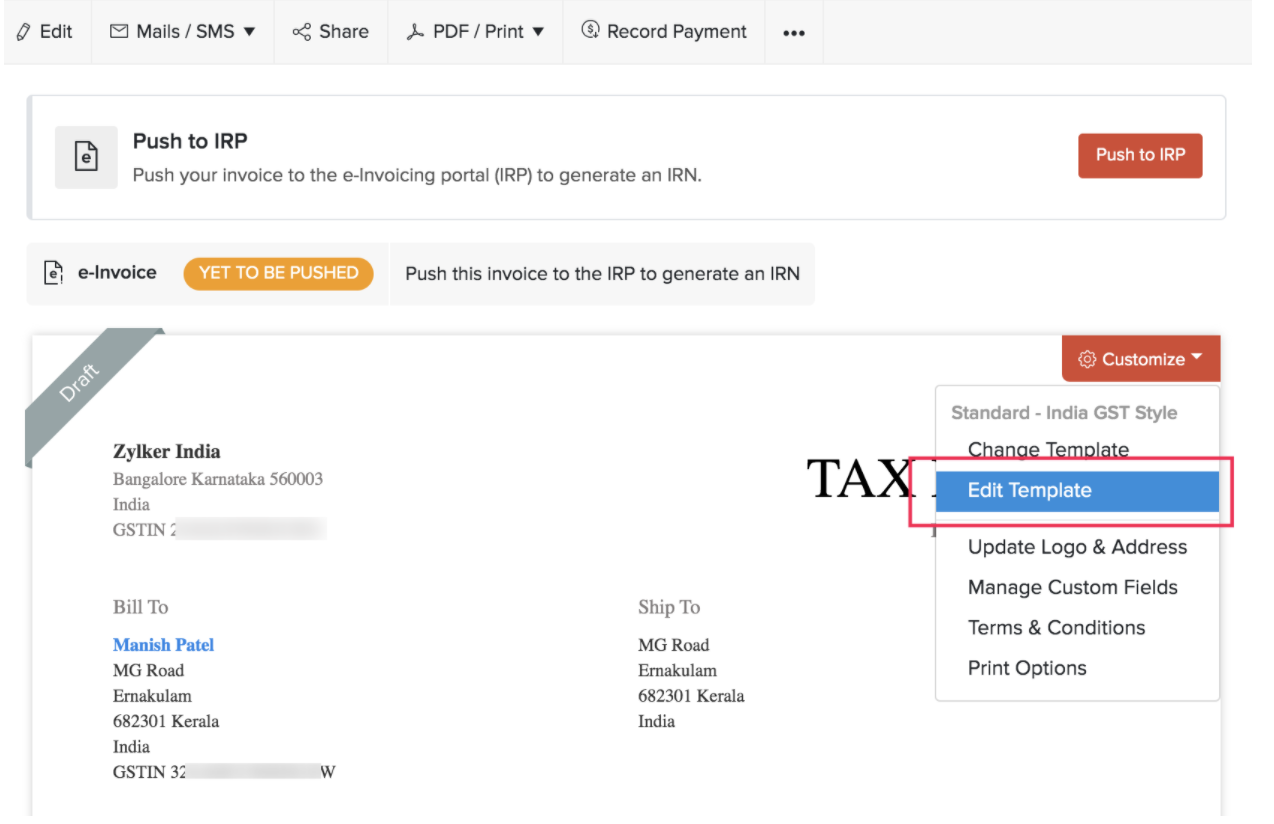

If you want to include this QR code and IRN in your invoice, you can do so by editing the invoice template. Here’s how:

- Hover over the invoice template.

- Click Customize.

- Select Edit Template from the list of options.

- Click Continue in the pop up.

- Click Footer in the left sidebar.

- Scroll down to the e-Invoicing Details section.

- Mark the QR Code and IRN options. You can also include Ack No. and Ack Date.

- Click Save.

Alternatively, you can also configure this option from the PDF Templates section in Settings.

Pro Tip: To help with bulk actions, you can filter the invoices based on their e-Invoicing status in Zoho Books. To do this, go to the Invoices module and click All Invoices. From the list, you can either select Pushed for e-Invoicing or Yet-to-be pushed for e-Invoicing to view the corresponding list.

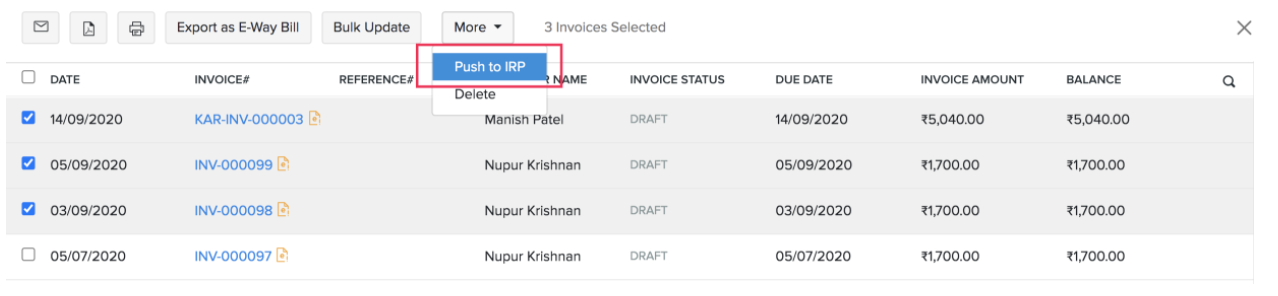

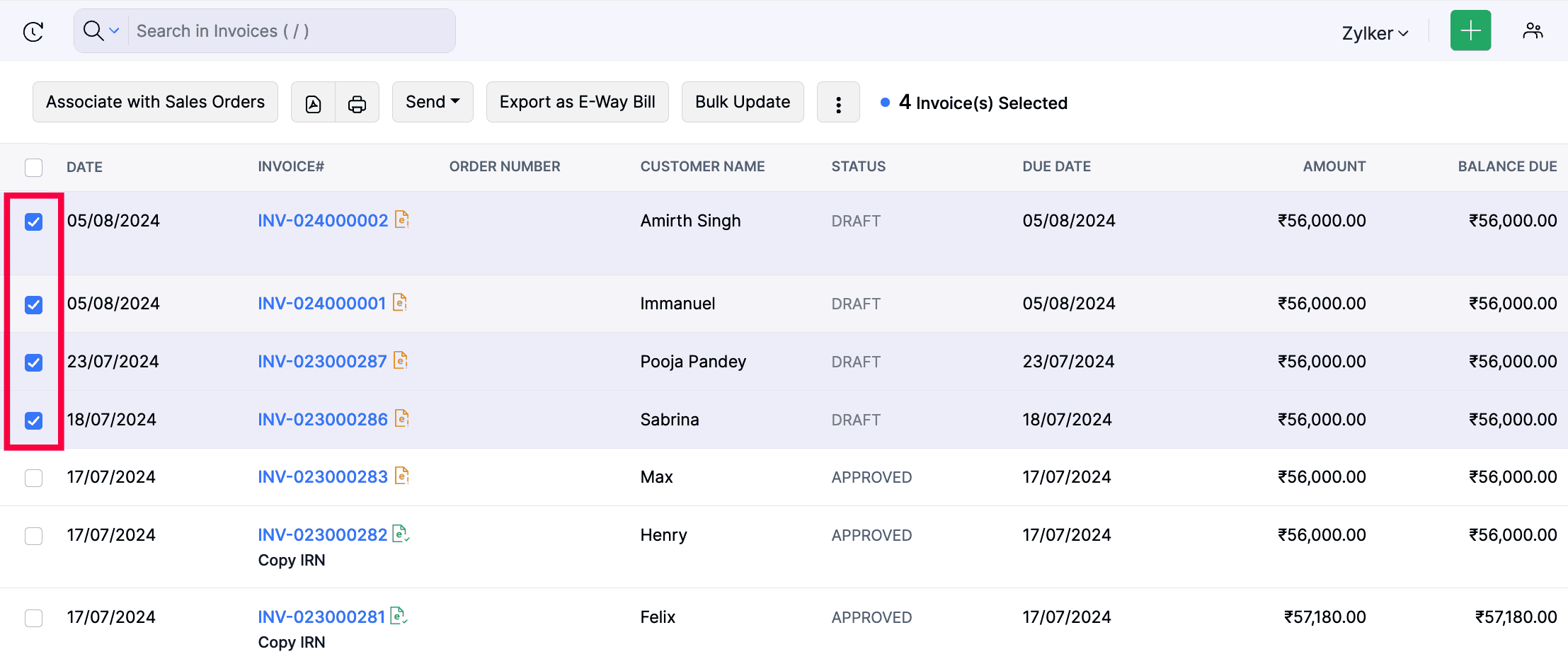

Bulk Push Invoices

You can save time and push multiple invoices to the IRP at once, using bulk actions in Zoho Books. Here’s how:

- Go to Sales on the left sidebar and select Invoices.

- Click All Invoices above the list of invoices.

- Select Yet-to-be pushed for e-Invoicing from the list of filters.

- Select the invoices that you want to push to the portal.

- Click the More button on the top.

- Select Push to IRP.

Now, pushing the selected invoices to the IRP will be initiated. When successful, a QR code and IRN will be generated for all of them.

If any of these these invoices failed to be pushed to the IRP, you will be notified of it and an error summary will be sent to your (the user who initiates the push) email address that’s registered in Zoho Books.

Insight: Once an invoice has been pushed to the IRP and an IRN has been generated for it, you will not be able to edit any of its mandatory fields.

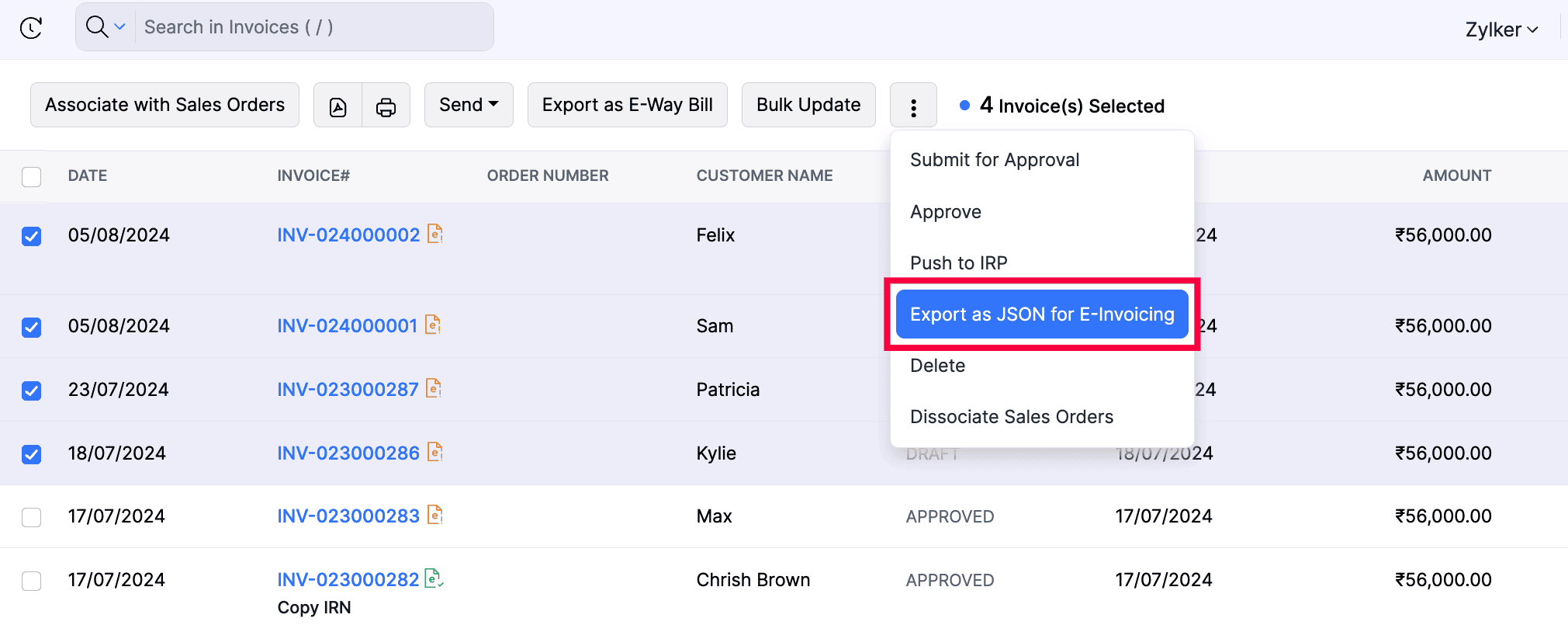

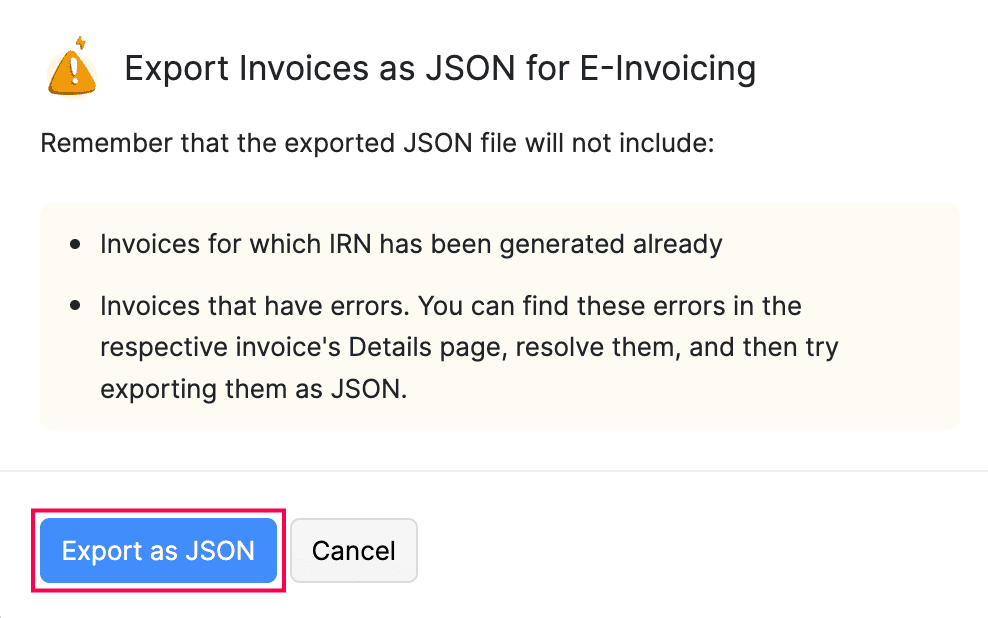

Bulk Export e-Invoices as JSON

In Zoho Books, you can now bulk-export invoices in JSON format and import them directly into the e-Invoice Portal to generate IRN. Here’s how:

- Go to Sales on the left sidebar and select Invoices.

- Select the invoices that you want to export.

- Click the More icon at the top.

- Select Export as JSON for E-Invoicing.

- Click Export as JSON in the pop-up that appears.

The selected invoices will be downloaded to your device in the JSON file format.

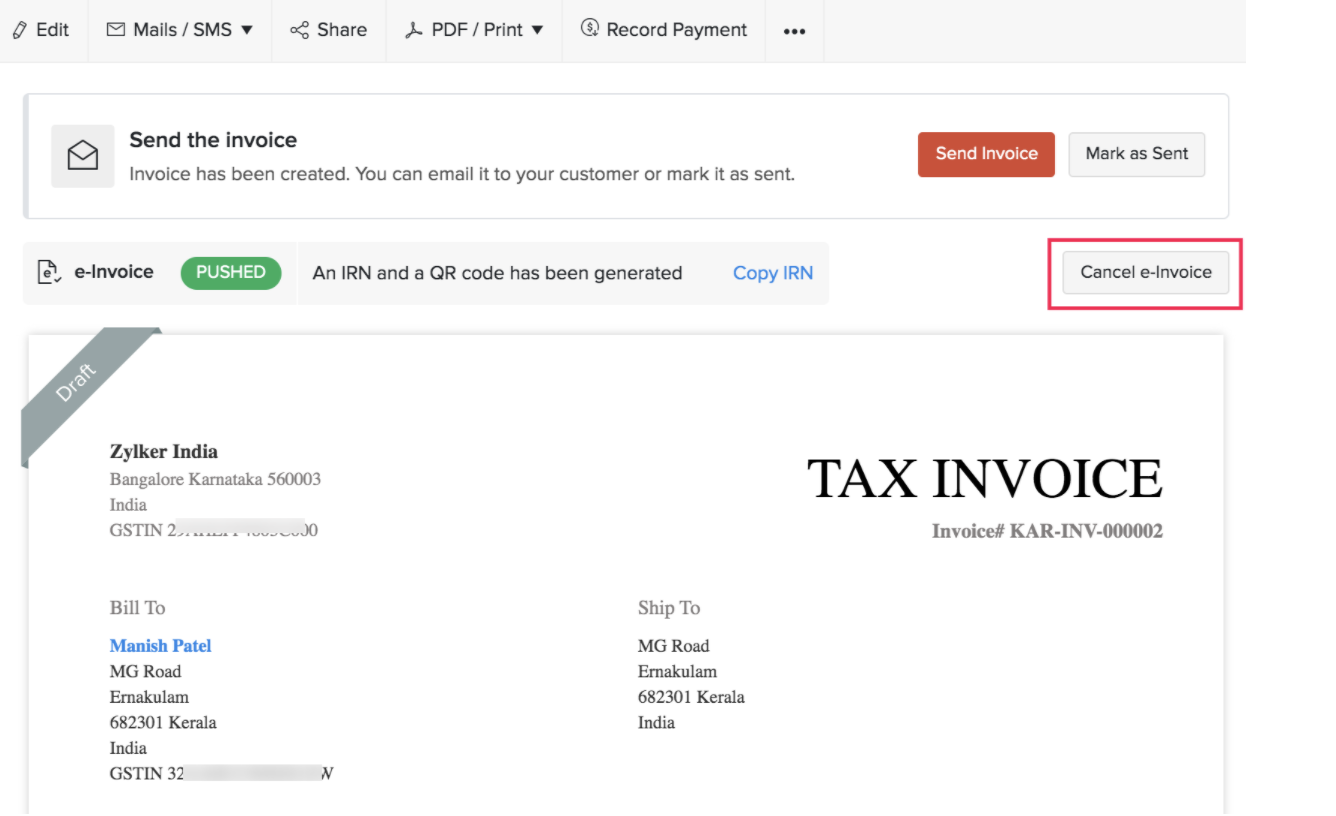

Cancel e-Invoices

You might want to cancel an e-Invoice if you’ve entered any incorrect values or for any other reason. This can be done in Zoho Books easily.

Warning: If you cancel an e-Invoice, the IRN associated with it will no longer be valid, and you’ll have to create a new IRN for the invoice.

Cancelling an e-Invoice depends upon the time lapsed since the IRN was generated:

- Cancelling within 24 hours

- Cancelling after 24 hours

Cancelling an e-Invoice within 24 hours

If you cancel an e-Invoice in Zoho Books within the first 24 hours of generating an IRN for it, then it will be cancelled in the IRP also automatically.

To cancel an e-Invoice:

- Go to Sales on the left sidebar and select Invoices.

- Select the e-Invoice that you want to cancel.

- Click the Cancel e-Invoice button.

- Select the Reason for Cancellation.

- Enter the Remarks.

- Click Cancel e-Invoice.

Cancelling an e-Invoice after 24 hours

After 24 hours of pushing an invoice to the IRP successfully, the IRN generated will no longer be available in the IRP. So cancelling in Zoho Books will not cancel it in the IRP automatically.

Instead, you can mark the e-Invoice in Zoho Books as cancelled, and then go to the GST portal to cancel the IRN manually.

Here’s how you can do this:

- Go to Sales on the left sidebar and select Invoices.

- Select the e-Invoice that you want to mark as cancelled.

- Click the Mark as Cancelled button.

- Enter the Reason for cancelling this e-Invoice.

- Click Mark as Cancelled.

Next,

- Log in to the GST System.

- Navigate to E-invoices and then select Cancel.

- Enter the IRN of the e-Invoice you want to cancel.

- Enter the Reason for Cancellation and Remarks.

- Click Submit.

Once an e-Invoice has been cancelled/marked as cancelled in Zoho Books, its status will change to Void. If needed, you can clone this invoice, make the necessary changes, and then push this new invoice to the IRP.

Note: When an e-Invoice has been cancelled, you cannot generate a new invoice using the same invoice number.

Configure Preferences for e-Invoicing

If your organization has Locations enabled in Zoho Books, you can create and manage multiple Business Locations — formerly known as Branches. Each location can have its own GSTIN. This means that you can set up e-Invoicing for each location separately, and the IRN will be generated based on the location’s GSTIN. Here’s how:

- Go to Settings at the top right corner of the page.

- Go to Taxes & Compliance and choose e-Invoicing.

- On the e-Invoicing page, click the Connect Now button next to the branch/location you wish to connect with the IRP portal.

- In the pop-up that appears, enter the Username and Password for the IRP portal.

- Click Save & Validate.

Once you do this, the IRP will be connected to your Zoho Books organisation. You can now push invoices to the IRP for this branch/location.

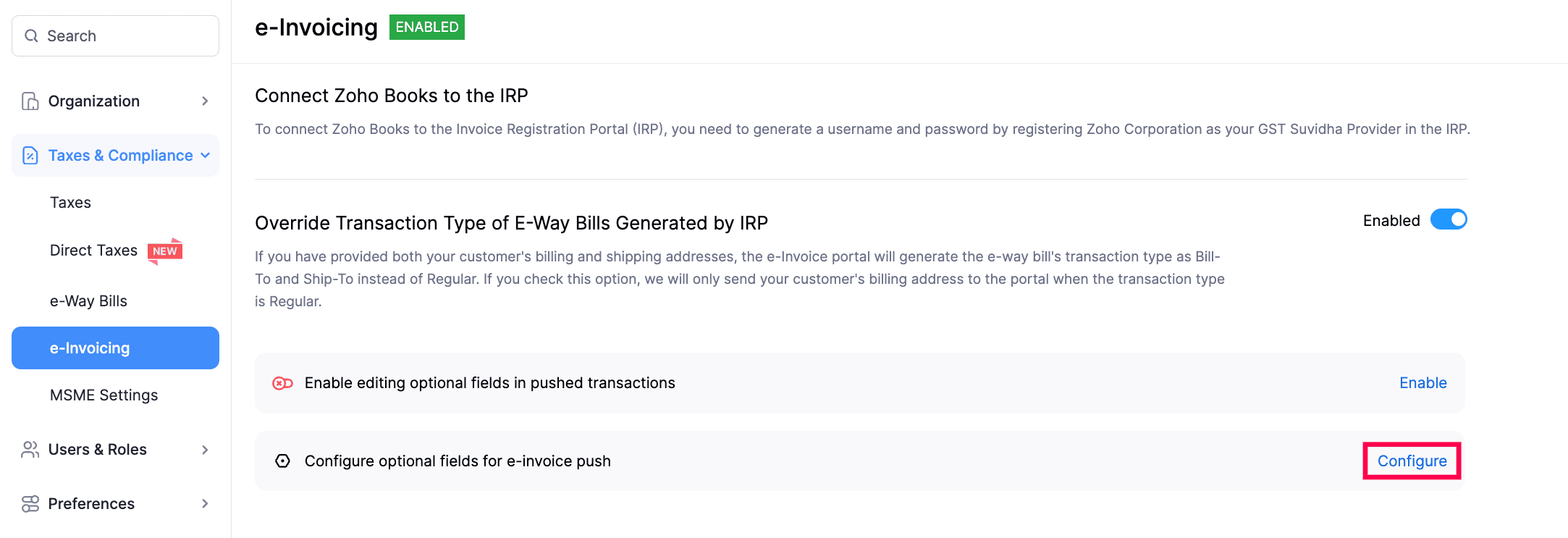

Override Transaction Type of E-Way Bills Generated by the IRP

Scenario: Stellar Distributors is shipping goods from its warehouse in Delhi to a customer in Mumbai. By default, Zoho Books treats this as a Bill To – Ship To transaction. However, for compliance and logistics purposes, the company needs the transaction classified as Regular (Dispatch From – Ship To) to accurately reflect the actual movement of goods. They enable the Override Transaction Type of E-Way Bills generated by the IRP option in Zoho Books to manually set the correct transaction type for the e-way bill.

Here’s how you can override the transaction type of e-Way Bills generated by the IRP:

- Go to Settings at the top right corner of the page.

- Go to Taxes & Compliance and choose e-Invoicing.

- Scroll down and enable the Override Transaction Type of E-Way Bills generated by the IRP option.

- Click Save.

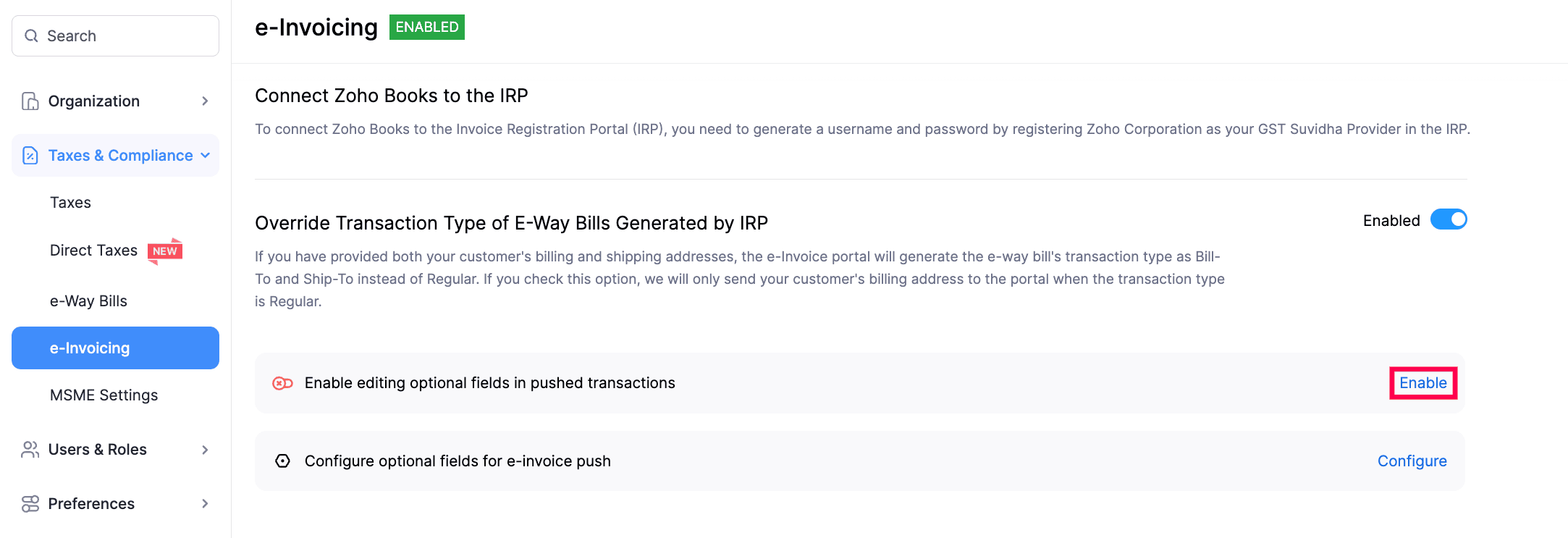

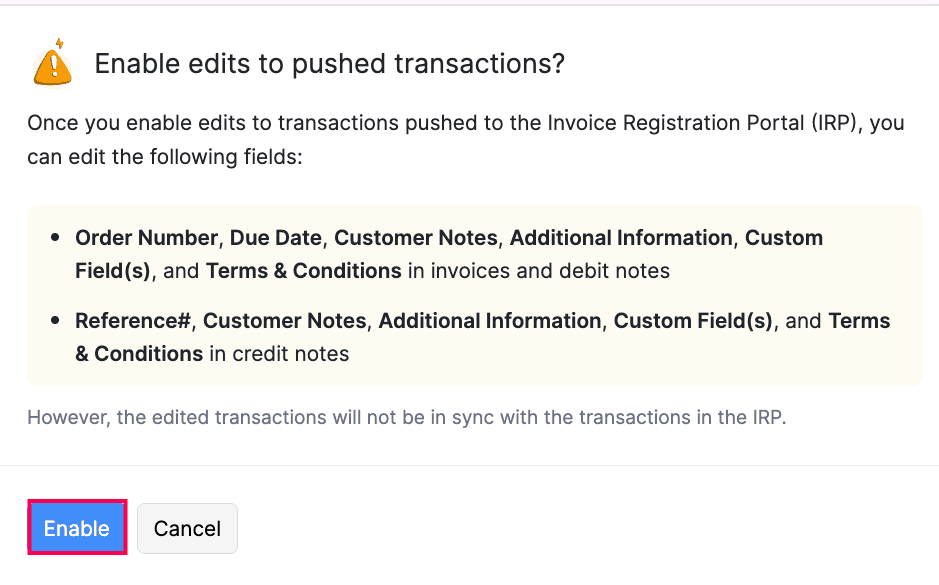

Enabling Editing Optional Field in Pushed Transaction

By enabling this option, you can edit the optional fields in transactions pushed to IRP However, these changes will not be reflected in the IRP but can be used for your internal reference.The optional fields that can be edited are:

- Invoices & Debit Notes: Order Number, Due Date, Customer Notes, Additional Info, Custom Fields, Terms & Conditions

- Credit Notes: Reference, Customer Notes, Additional Info, Custom Fields, Terms & Conditions

Here’s how you can enable to edit the optional fields in pushed transaction,

Navigate to Settings.

Go to Taxes & Compliance and select e-Invoicing.

On the e-Invoicing page, click Enable next to Enable editing optional field in pushed transactions

- In the following confirmation pop-up that appears, click Enable.

You can then edit those optional fields in Zoho Books.

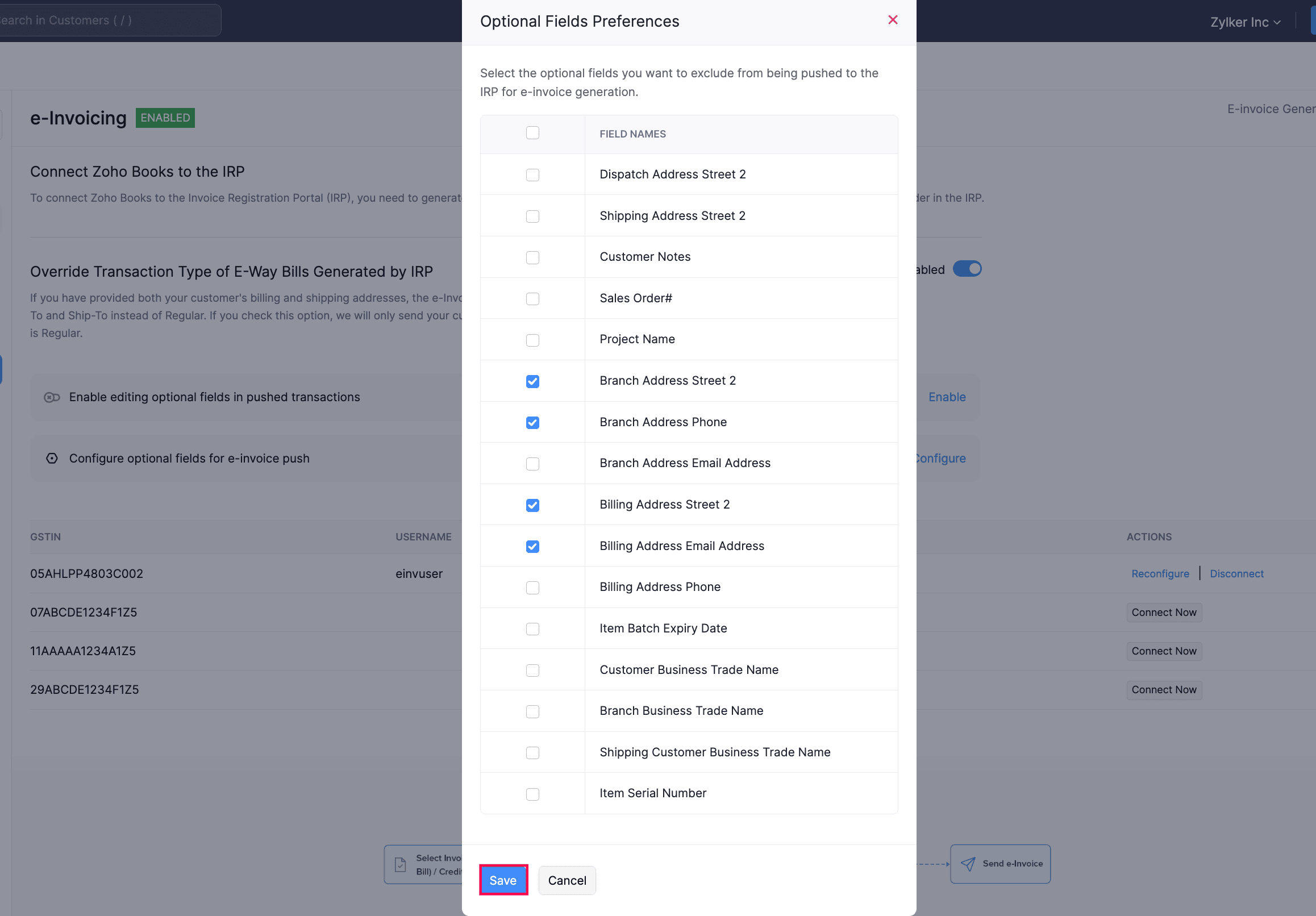

Configure Optional Fields for e-Invoice Push to IRP

Sometimes, there are fields that you may not want to push to the IRP. Additionally, some fields that exceed the e-invoice portal’s allowed length can cause errors during submission.To avoid this, you can exclude some optional fields during the e-invoice push to the IRP.

Here’s how you can exclude the optional fields,

- Navigate to Settings.

- Go to Taxes & Compliance and choose e-Invoicing.

- On the e-Invoicing page, click Configure next to Configure optional fields for e-invoice push.

- In the Optional Fields Preferences pop-up that appears, select the optional fields you want to exclude.

- Click Save

The excluded optional fields will not be pushed to the IRP.

Configure Preferences for Other Modules

Now let’s take a look at how you can set up other preferences for other modules.

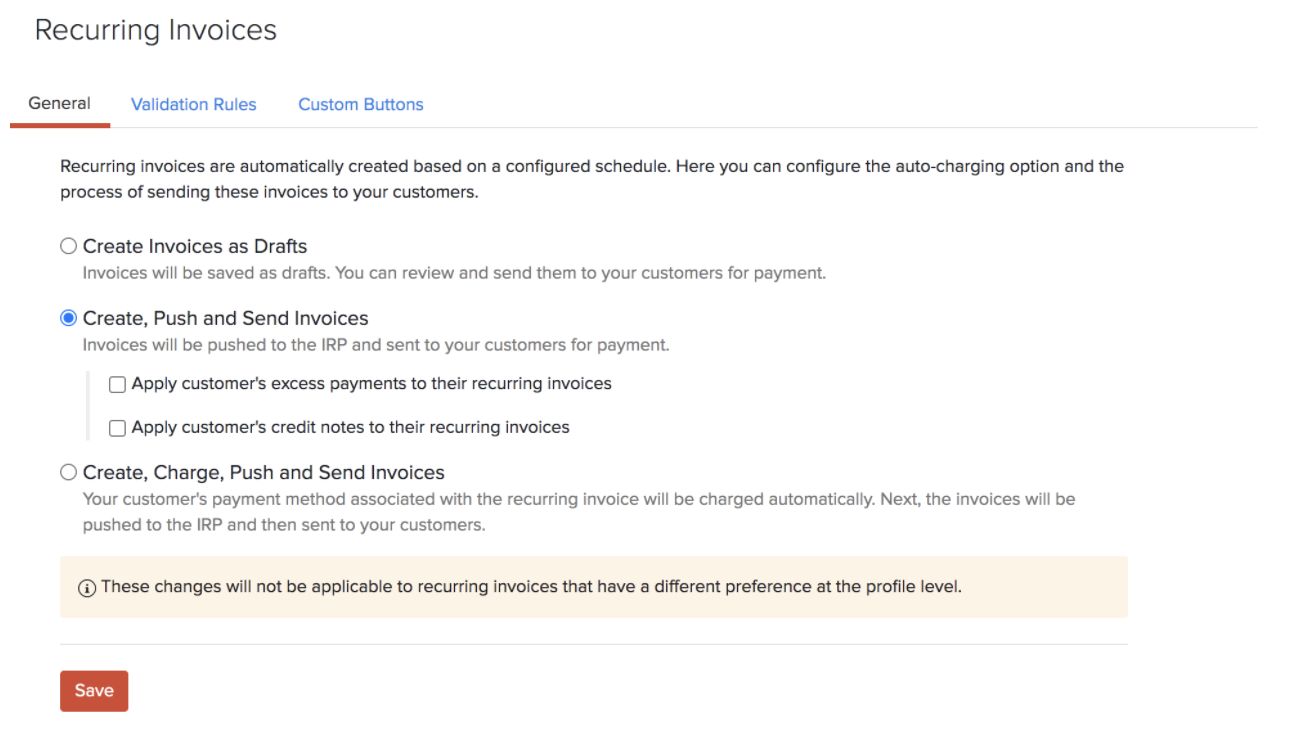

Recurring Invoice Preferences

If you have set up recurring invoices, the invoices generated from the profile will be pushed to the IRP automatically, depending on the Recurring Invoice Preferences which you’ve configured. If your preference is:

Create Invoices as Drafts: The invoices will be created in the Draft status and you’ll have to push them to the IRP manually by clicking the Push to IRP button.

Create, Push and Send Invoices: The invoices will be pushed to the IRP automatically. If it’s pushed successfully, the invoices will be sent to your customer. If the push fails, the invoices will not be sent. An email will be sent to your organisation’s email address, stating the reason for failure.

Create, Charge, Push and Send Invoices: The invoices will be charged and then pushed to the IRP automatically. If it’s pushed successfully, the invoices will be sent to your customer. If the push fails, the invoices will not be sent, but a payment thank-you email will be sent to them. An email will be sent to your organisation’s email address, stating the reason for failure.

Insight: These options will differ accordingly if you have enabled transaction approval or digital signature.

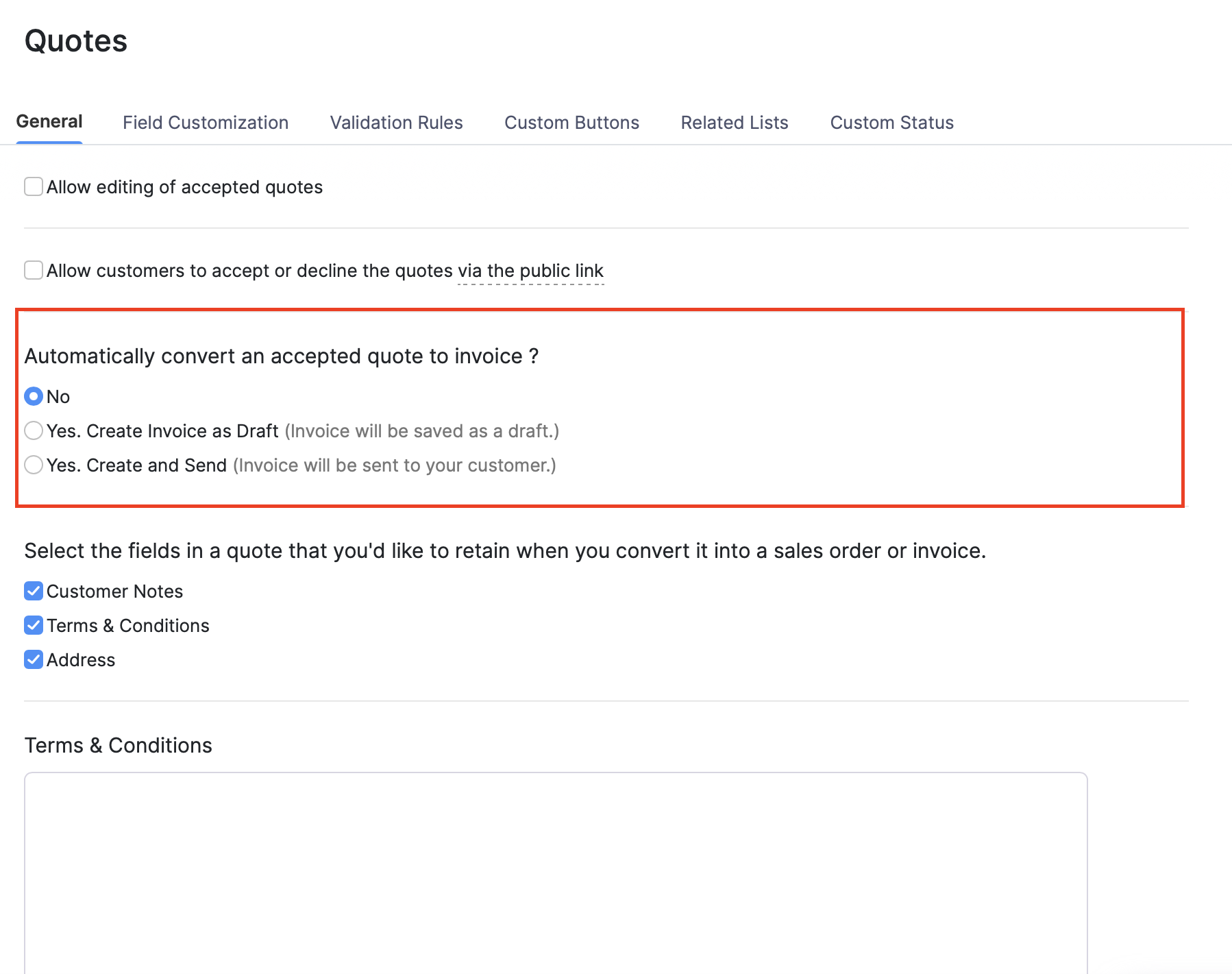

Quote Preferences

If you’ve configured the quote preferences to convert accepted quotes to invoices automatically, then these invoices will be pushed to the IRP depending on your set preference. If your preference is:

- Create Invoice as Draft: The invoice will be created in the Draft status and you’ll have to push them to the IRP manually by clicking the Push to IRP button.

- Create, Push and Send: The invoice will be created and pushed to the IRP automatically. If it’s pushed successfully, the invoice will be sent to your customer. If the push fails, the invoice will not be sent. An email will be sent to your organisation’s email address, stating the reason for failure.

If you have any doubts or need any help with e-Invoicing in Zoho Books, you can reach out to us at einvoicing-support@zohofinance.com. We’ll be there to assist you.

Yes

Yes