GST Filing Approval

Zoho Books enables you to set up an approval workflow for filing your GST returns to ensure that the returns filed are error-free.

In an organisation that has multiple users in Zoho Books, setting up an approval workflow will make sure that the approvers (administrators/accountants) of the organisation verify the returns before it is submitted and filed them. A user will be able to file the returns only after the approver accepts what the user had submitted.

Enabling GST Filing Approval

The admins of the organisation will be able to enable the approval process. All users of the organisation will be able to submit reports whereas only approvers will be able to approve or reject them. To enable GST Filing Approval:

- Go to Settings on the top right corner of the page.

- Select Taxes under Taxes & Compliance

- In the Taxes pane, select GST Settings.

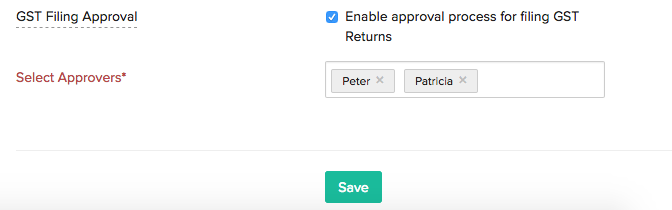

- Check the Enable approval process for filing GST Returns option to enable GST Filing Approval.

- Select your approvers in the next step and click Save.

Note: Only the Accountants and Admins of the organisation will be listed as approvers here and you can select a maximum of 5 approvers.

Understanding the Approval Process

Once you have enabled the option, approvers will have to approve your GSTR-3B and GSTR-1 before the returns are submitted and filed to the GSTN. Let’s say you would like to submit and get your GSTR-1 approved. Here’s how you can do it:

Submit GST Returns for Approval

The first step in filing your GST returns is to push your data to the GSTN Portal. Once you have pushed all your data, you can submit your returns for approval. To do this:

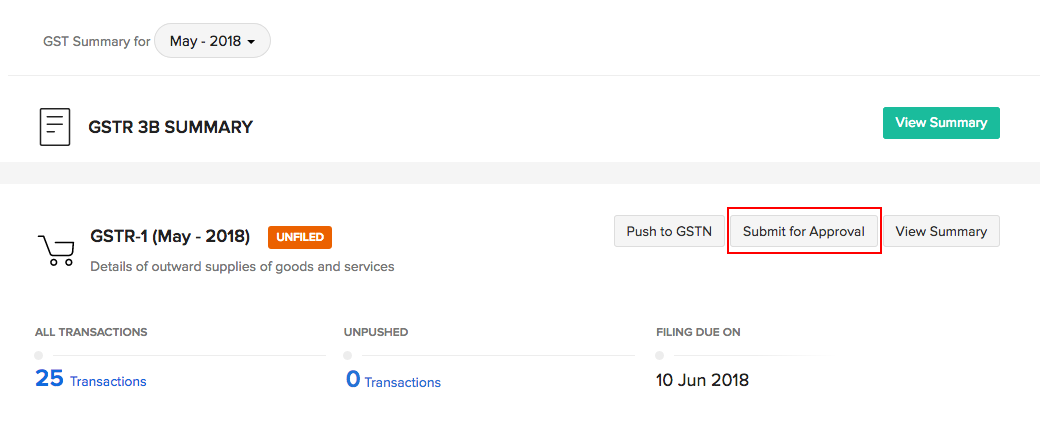

- Go to Zoho Books > GST Filing.

- Choose the period for filing your returns under GST Summary for: (Month and Year)

- Push all your transactions if you haven’t pushed them yet by clicking Push to GSTN.

- Click Submit for Approval to submit the return for approval.

(OR)

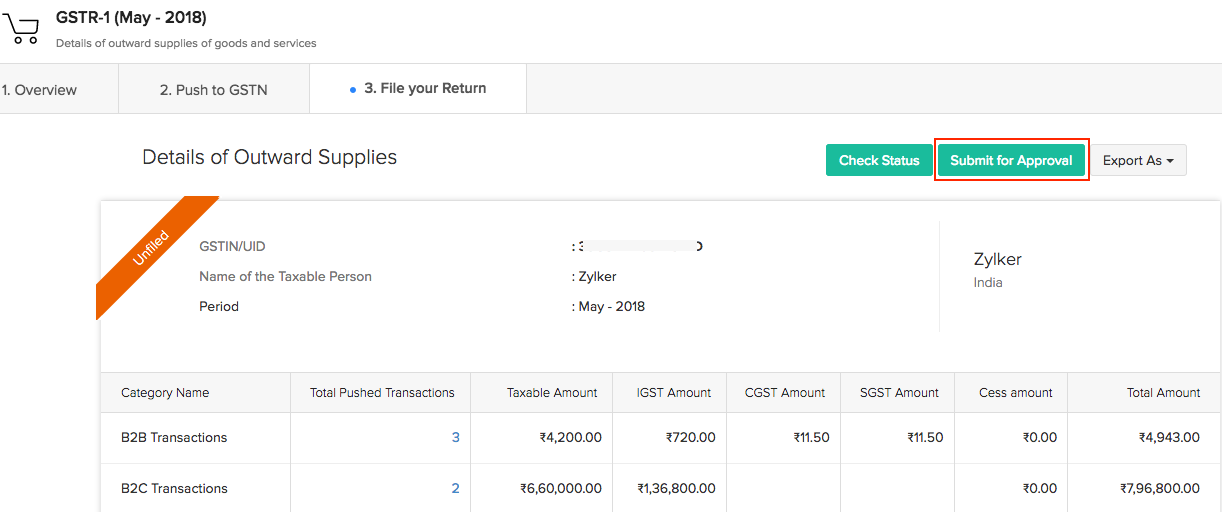

You can go to GST Filing > GSTR-1 > View Summary > File your Return and click Submit for Approval.

The approvers of the organisation will be notified when a user has submitted a return for approval.

Recall Submitted Returns

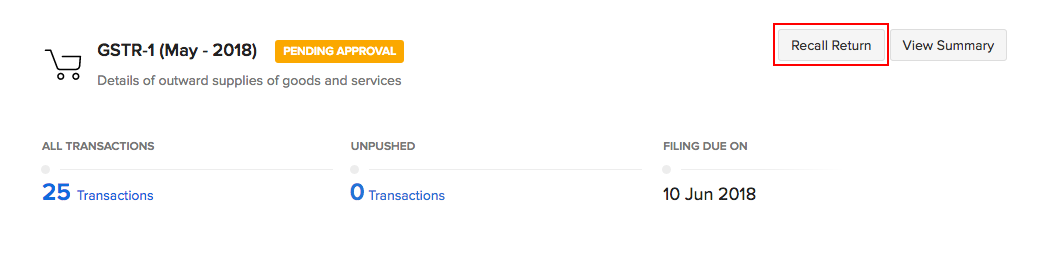

Once you have submitted your returns and if you wish to make any changes to them before they are approved, you will be able to recall the return. To recall:

- Go to Zoho Books > GST Filing.

- Choose your return filing period and click Recall Return.

- Enter the reason for recalling the return and click Confirm.

Only the user who has submitted the return will be able to recall it. Once the return has been recalled, the approvers will also be notified. The user can then make changes to the data, push them again and re-submit them for approval.

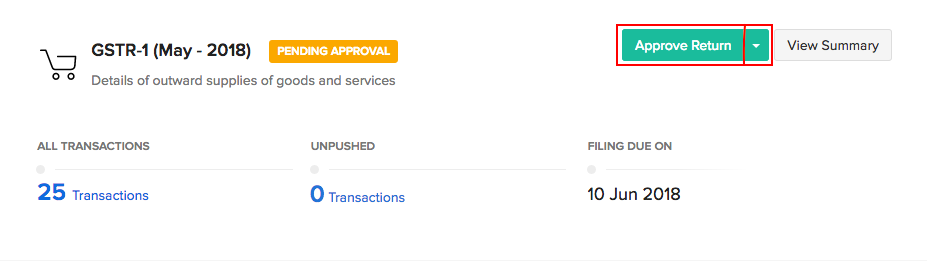

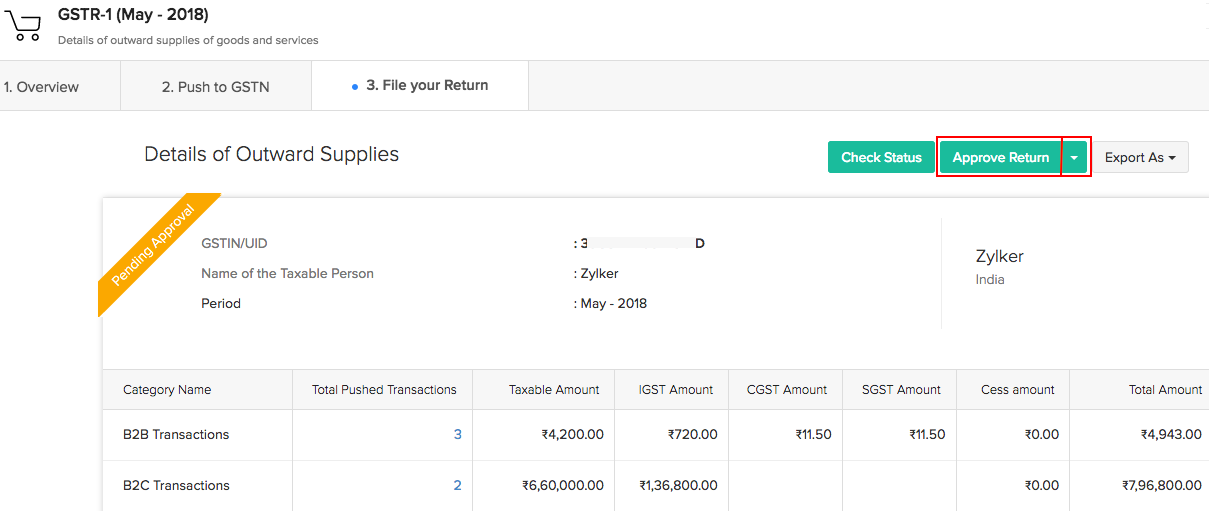

Approve/Reject Returns

Once a user has submitted returns for approval, the approvers will be able to verify and approve or reject the returns. For an approver to accept or reject a return:

- Go to Zoho Books > GST Filing. Approvers will also be able to access the page by clicking the link in the notification email.

- Verify the return and approve it by clicking Approve Return.

- Click Reject Return from the dropdown if you want to reject the return.

- Enter the reason for rejecting the return and click Confirm.

(OR)

You can go to GST Filing > GSTR-1 > View Summary > File your Return and verify all transactions before approving or rejecting the return.

Once the return is approved, you can click Submit in the File Your Returns Tab to submit and file your returns to the GSTN.

In case of GSTR-3B, once the return is approved, you can proceed to make payments to the GSTN and mark your return as filed.