Zoho Books with Zoho Payroll

Keeping track of the salaries you pay your employees is as important as paying them on time. You will have to record the wages you pay and the taxes you deposit in your Zoho Books organisation. Posting manual entries after every pay run could be time-consuming and demanding.

This is where Zoho Payroll comes to the rescue. Zoho Payroll is a complete payroll management solution which automatically calculates salaries, taxes, deductions, sends out payslips and performs all other payroll related activities.

It comes integrated with Zoho Books so your payroll and accounting is in sync. All payroll expenses and tax liabilities will be recorded in their respective Expense and Liability accounts. This will then reflect in your Profit and Loss report so your financial statement is accurate.

Note: If you are using the Standard Plan of Zoho Books, you will have access only to the free version of Zoho Payroll, by default.

Set up Zoho Payroll

If you are new to Zoho Payroll, you can easily set up your organisation and get started.

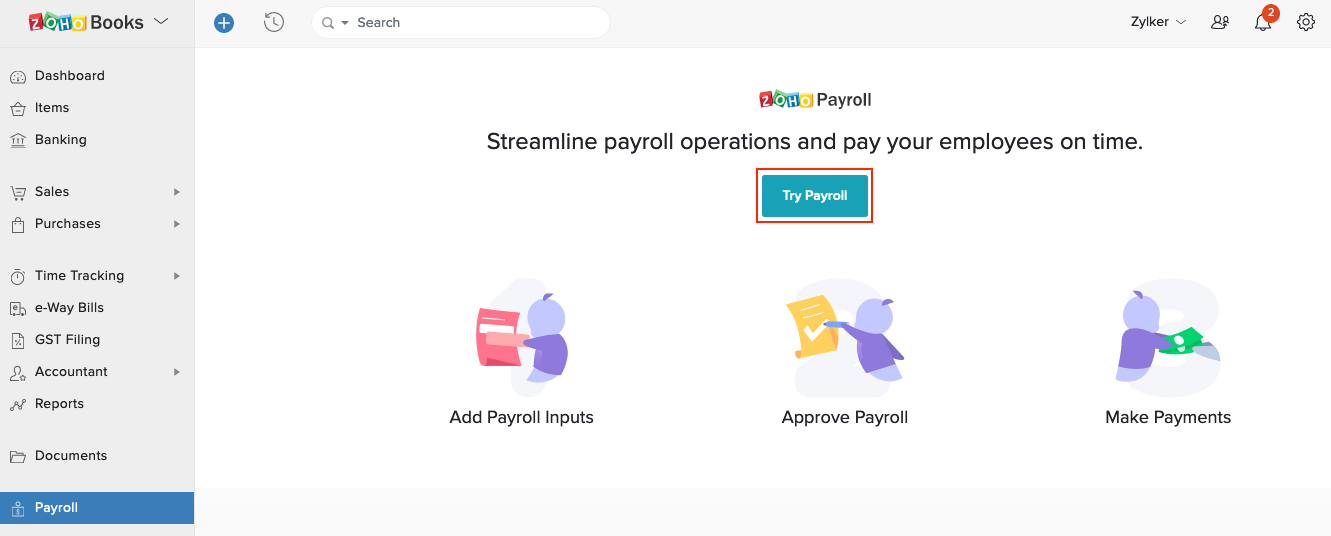

- Go to Payroll from the left navigation pane of Zoho Books.

- Click Try Payroll and you will be redirected to Zoho Payroll.

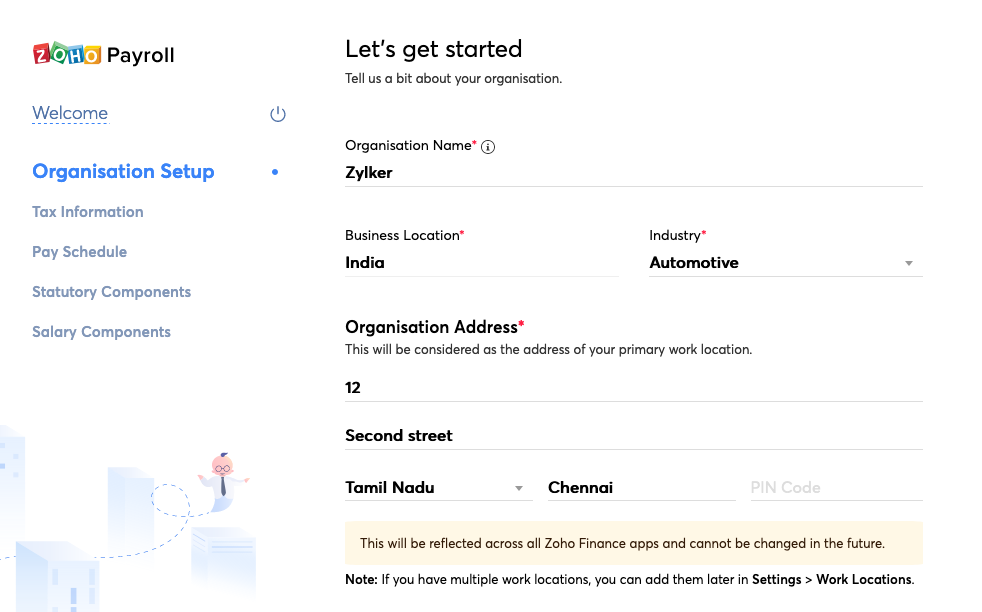

- Get started by entering your Organisation Setup. Click Save and Continue to proceed with setting up.

- Enter your Tax Information such as PAN, TAN, TDS Circle and Tax Payment Frequency.

- Set up your Pay Schedule.

- Configure Statutory Components such as PF, ESI, Professional Tax and Labour Welfare Fund.

Once you’ve finished configuring all the salary components, click Finish Setup.

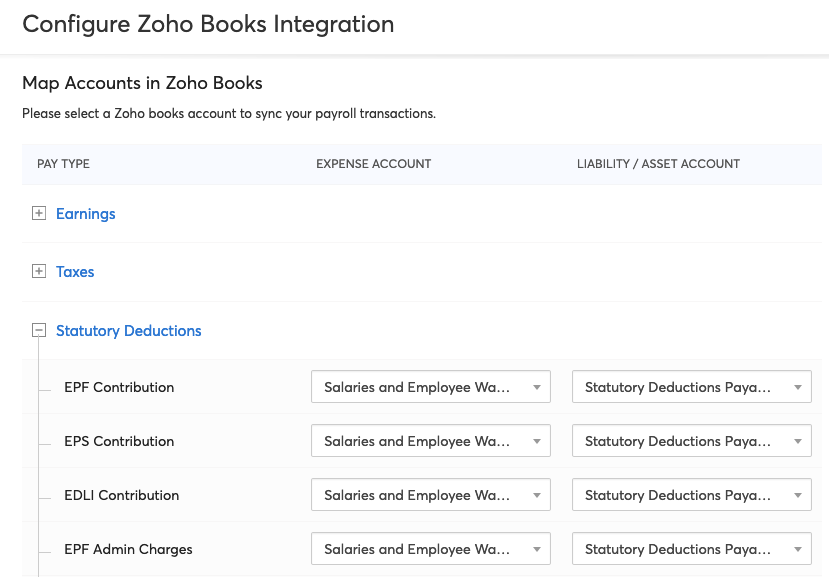

Configure Accounts

Once you’ve set up your payroll, you can configure the accounts with which the accounts in which you want the payroll transactions to be recorded in. For instance, you can either choose to track all statutory deductions under a single account, or track EPF, ESI and PT under different accounts. You can also create sub-accounts to track them based on your requirements.

To do this:

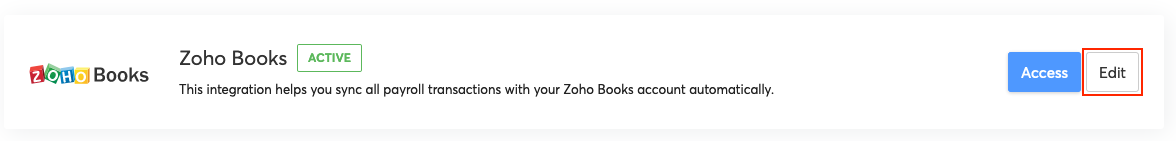

- Go to Zoho Payroll and head to Settings.

- Navigate to Integrations and then Zoho Apps.

- Click Edit near Zoho Books to configure your accounts.

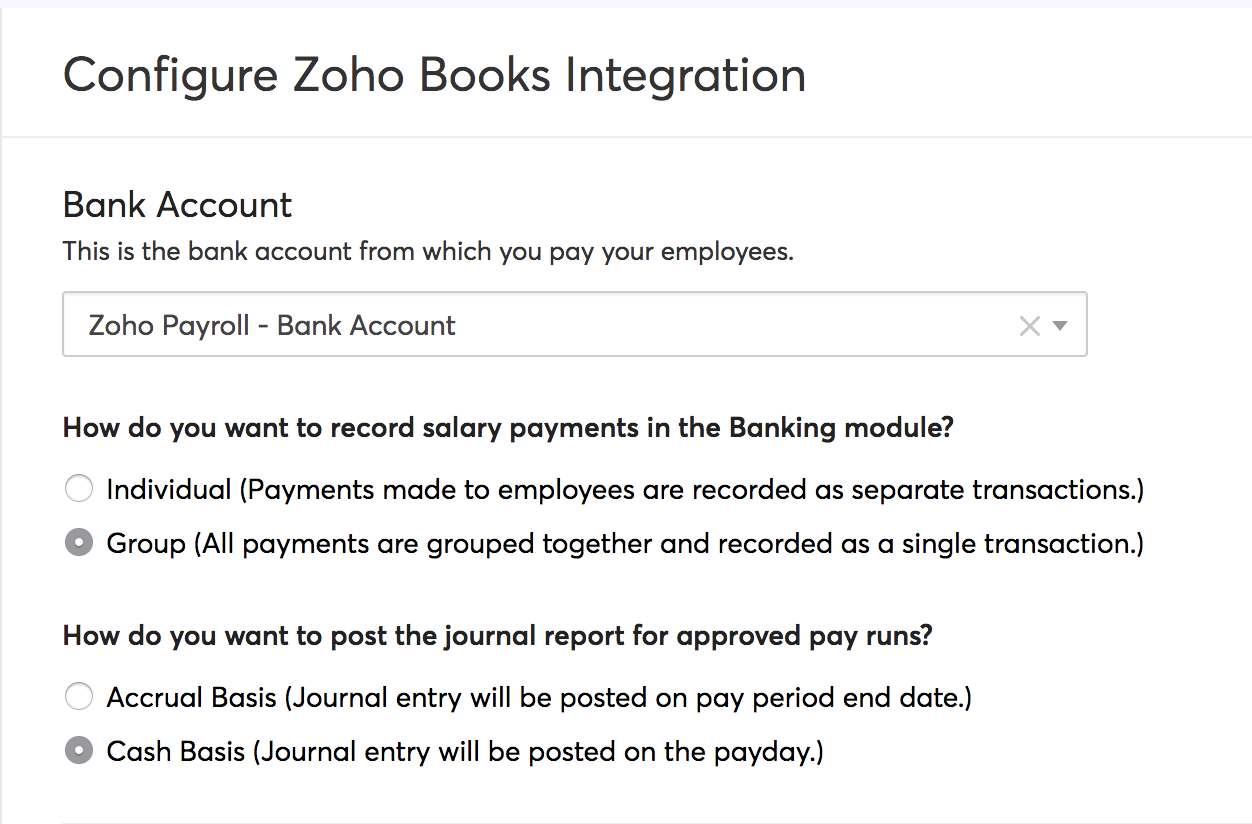

- Select the Bank Account from which payroll expenses are paid.

- Select whether you want to record payments individually or as a group.

- Individual - Payments made to each employee will be recorded as individual transactions in the Banking module of Zoho Books.

- Group - All salary payments will be grouped together into a single transaction in the Banking module of Zoho Books.

- Select whether you want to post the journal on an accrual basis or cash basis.

- Accrual Basis - The journal entry will be posted on the last day of the pay period.

- Cash Basis - The journal entry will be posted on the organisation’s payday.

- Choose the Expense and Liability accounts for each payroll transaction under Compensation, Taxes, Benefits, and Deductions. By default, this will be tracked under the Salaries and Employee Wages account. You can change this, if required.

- Click Save.

Functions in Zoho Payroll

Here are some of the key functions you will be able to perfom with your Zoho Payroll organisation:

- Add Employees

- Set up Statutory Components

- Process Pay Runs

- Create Salary Templates

- Direct Deposit of Salaries

- Employee Portal

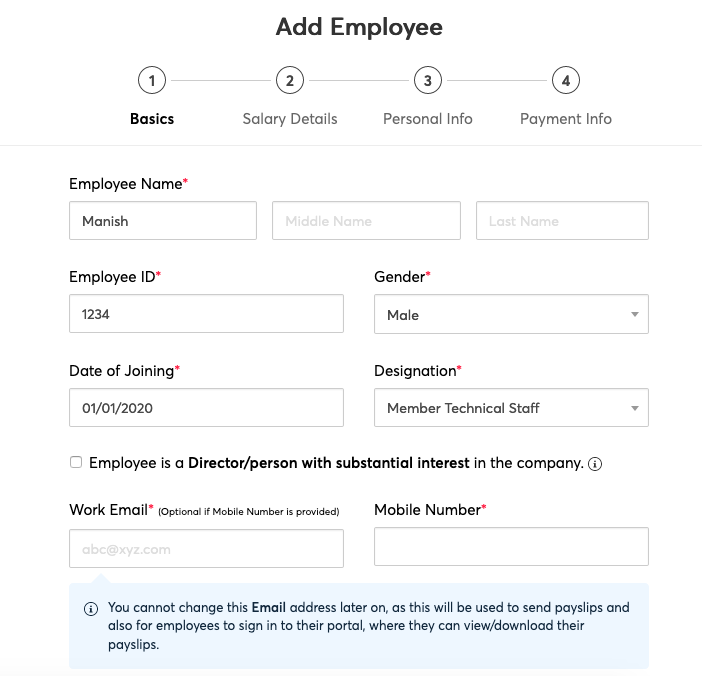

Add Employees

The Employees module in Zoho Payroll allows you to add and manage employees’ personal and salary details, assign deductions to them, upload their IT Declaration and so much more.

To add an employee in Zoho Payroll,

- Go to Zoho Payroll and navigate to the Employees module.

- Click Add Employee.

- Enter their Basics, Salary Details, Personal and Payment Info.

- Click Save and Continue to finish.

Once you’ve added your employees, you can also add pre-tax deductions, post-tax deductions, add perquisites, revise salary and submit IT Declaration and POI on your employees’ behalf. Learn more about managing employees.

Note: Based on your Zoho Books plan, you will be able to manage either 10 or 20 employees.

Set up Statutory Components

These are components defined under certain enactments passed by government bodies like Employee Provident Fund Organisation (EPFO). Contributions are made by employees and employers towards the employees’ long term financial and social well-being. There are 4 main statutory components in India. Learn the guidelines and how to set up each of them in Zoho Payroll:

- Employee Provident Fund (EPF)

- Employee State Insurance (ESI)

- Professional Tax (PT)

- Labour Welfare Fund (LWF)

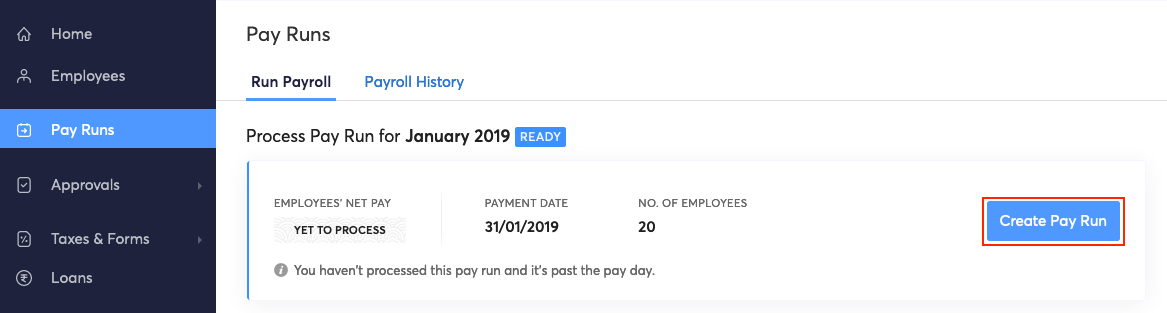

Process Pay Runs

Pay run refers to the act of compensating your employees for the days they’ve worked in a month. Using Zoho Payroll, you can configure the payroll structure for your company and process pay runs for your employees effectively. To do this:

- Go to Zoho Payroll and navigate to the Pay Runs module.

- Click Create Payrun.

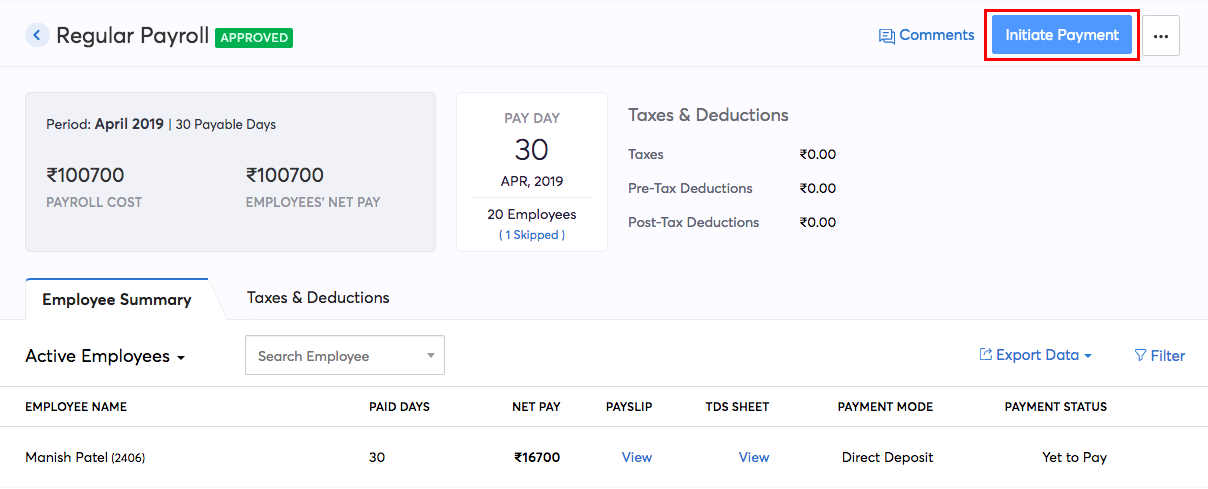

The following page displays all the key information related to the pay run such as Payroll Cost, Payday, Net Pay, Taxes & Deductions Summary and Employee Summary. Learn more about processing pay runs.

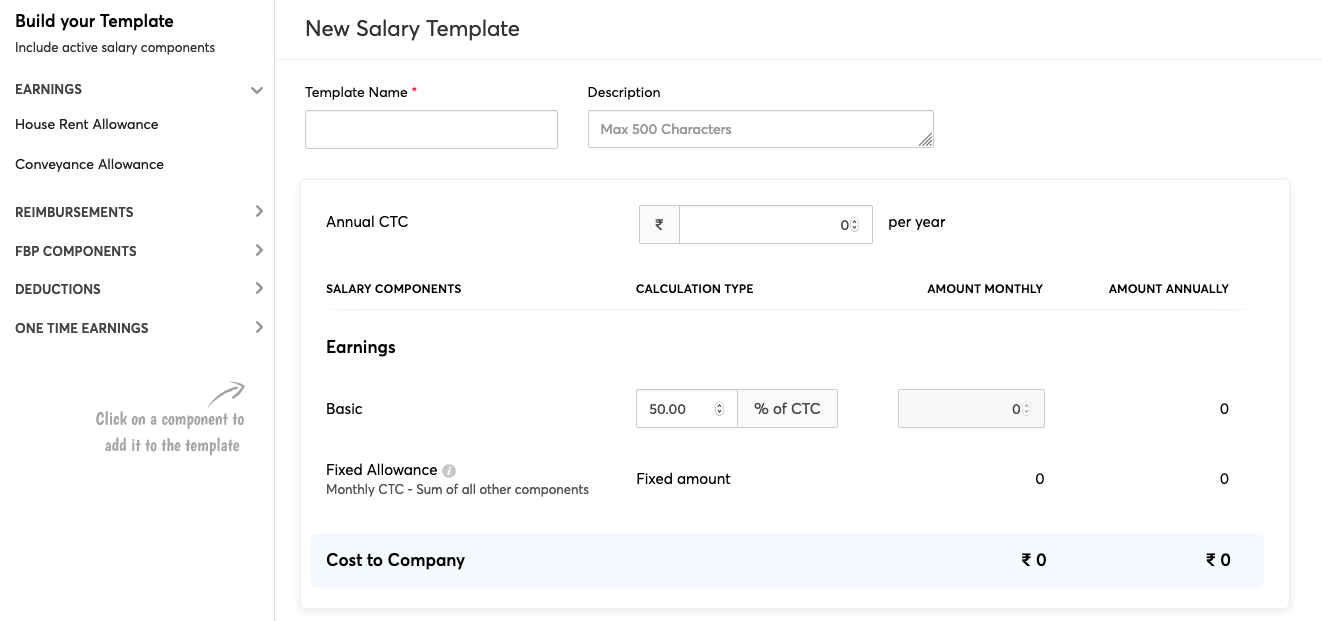

Create Salary Templates

Create templates for commonly used salary structures and save time and effort. Instead of manually entering the salary details for employees having the same salary structure, you can create a common salary template and assign them to employees. To create a salary template:

- Go to Zoho Payroll and navigate to the Salary Templates tab under Settings.

- Click Create Salary Template.

Learn more about salary templates.

Direct Deposit of Salaries

Once you generate pay runs, you will be able to deposit salaries directly from Zoho Payroll to your employees’ accounts. The payment will be initiated for the Direct Deposit enabled employees and if you have integrated your organisation with ICICI Bank. To make payments:

- Go to Zoho Payroll and navigate to the Pay Runs module.

- Generate a New Pay Run for the particular period and approve it.

- Click Initiate Payment in the top right side of the page and proceed to make the payment.

Learn more about the ICICI Bank integration and direct deposit of salaries.

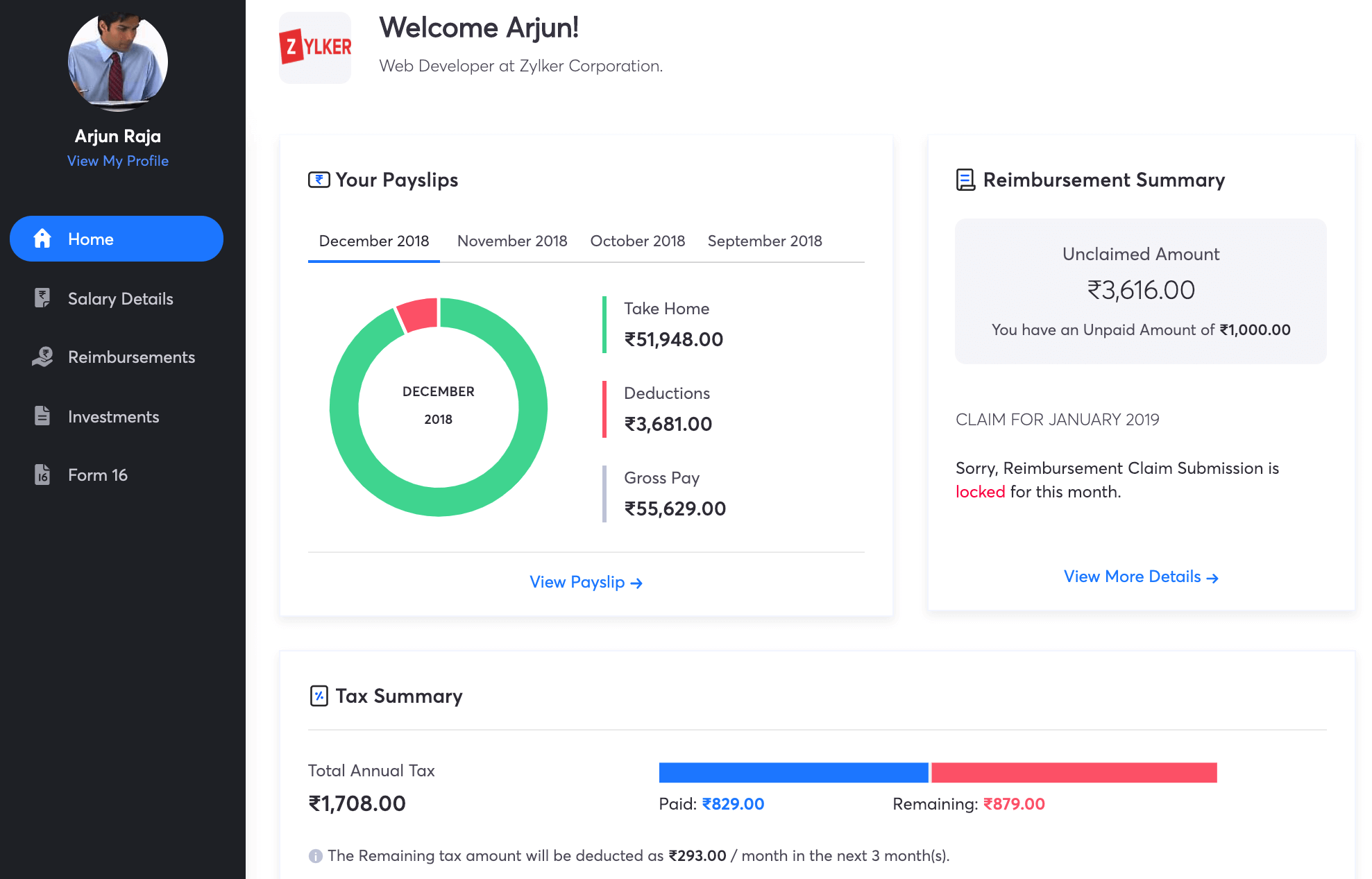

Employee Portal

Employee Portal allows your employees to view their salary details and perform all payroll related activities like declaring FBP and IT, submitting investment proofs and creating reimbursement claims. Once your employee accepts the invitation, they would have to set up their portal account.

Learn more about accessing the employee portal.

Not just this, you can head over to the Zoho Payroll’s help guide to view all the available features.

Yes

Yes