- HOME

- Payroll administration

- What is basic salary? Basic pay calculation, percentage, and more

What is basic salary? Basic pay calculation, percentage, and more

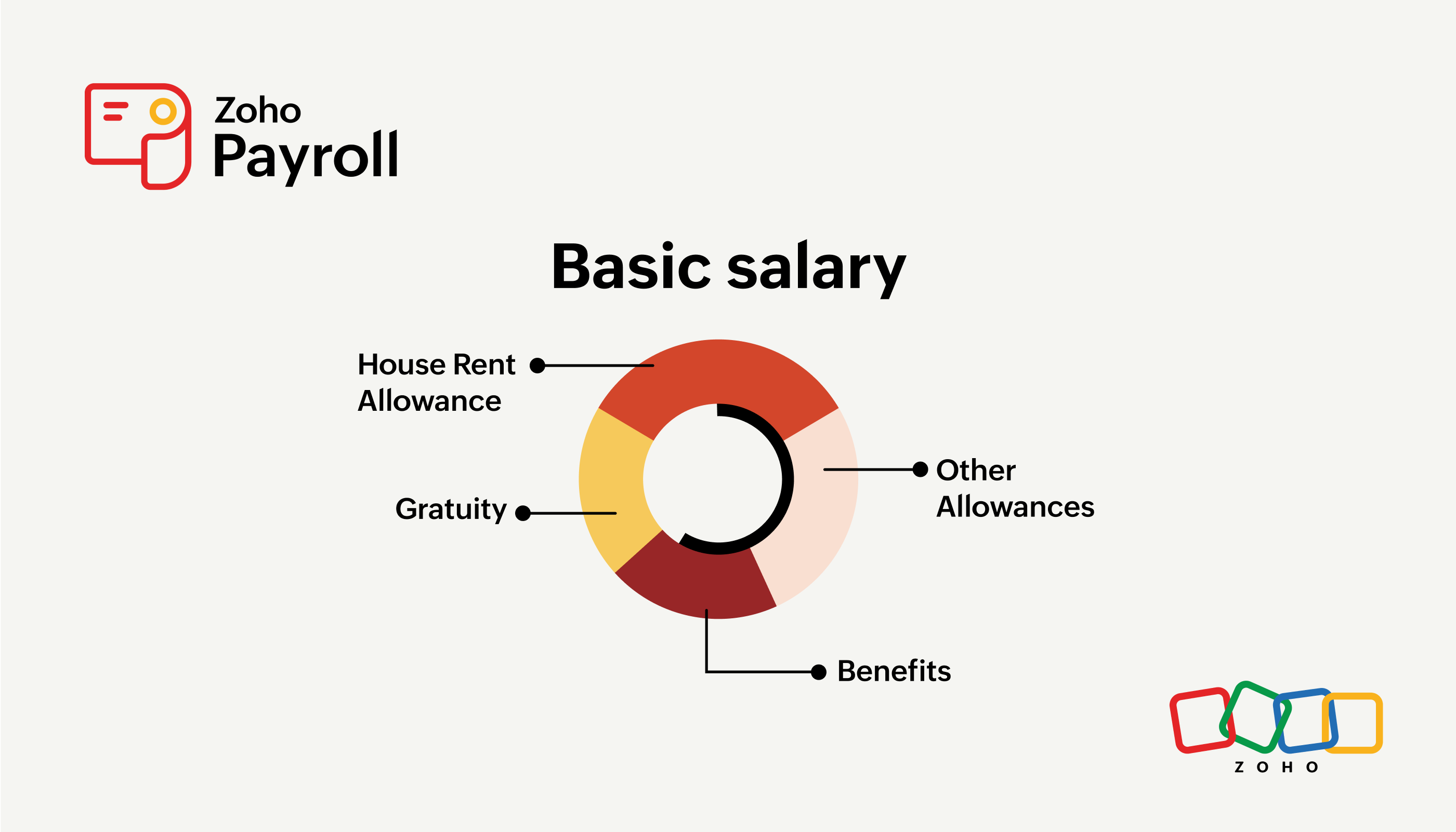

Basic salary is a key part of any salary structure. It is important for both employees and employers to understand basic salary, as it serves as the foundation for various components and deductions. This article covers everything you need to know about basic salary, including its definition, importance, calculation methods, and rules.

Basic salary definition and meaning

A basic salary is a fixed amount that employers pay their employees for performing their job or professional duties. This base salary forms the core of the employee’s earnings, with other components like allowances and benefits calculated as a percentage of this amount.

The basic salary varies by industry and usually depends on the employee's job title or role. For example, employees in managerial positions often receive a higher basic salary than freshers who were recently hired.

Let us now look at the different factors determining the basic salary of an individual.

Factors affecting the basic salary

- Location: The location of the company significantly impacts pay, as demand and supply differ across regions. Jobs in metropolitan areas often require higher basic salaries compared to those in smaller towns due to the cost of living differences.

- Company policies: Each company has its own pay scale policies, which depend on an individual’s job title and skill set. Some organisations have fixed salary structures, while others offer more flexibility. It is crucial for employers to align salaries with the company’s financial situation and policies.

- Education and experience: When setting salaries, employers consider the educational qualifications and work experience of candidates. Employees with advanced degrees or extensive experience typically command higher basic salaries.

- Industry: Salaries can vary significantly across different industries. The basic salary offered to an IT professional can be vastly different from that of a worker in the manufacturing sector.

- Performance: In some companies, basic salary and other salary components are linked to an employee's ability to meet specific targets. High-performing employees are usually rewarded with salary hikes based on their contributions to the company.

- Economic conditions: Economic factors, such as inflation, can affect salary structures. During periods of economic growth, employers might increase salaries, while in economic downturns, they may be more conservative with salary adjustments.

Basic salary calculation formula

You can calculate basic salary either from CTC or gross salary. Here are the different formulas to calculate basic salary:

- From CTC

Basic salary = Percentage mentioned in the employment contract * Total CTC

- From gross salary

Basic salary = Gross salary – Different types of allowances (such as DA, HRA, medical insurance, conveyance allowance, bonus, etc.)

Let us look into the different formulas to calculate basic salary in detail.

How to calculate the basic salary from CTC

Calculating the basic salary as a percentage of the Cost to Company (CTC) helps you determine how much of the total compensation will be allocated to the basic salary. Here is a formula you need to follow to calculate basic salary from CTC:

Basic salary = CTC * Applicable percentage

Example of basic salary calculation from CTC

For instance, if your offer letter mentions that your CTC is ₹10,50,000 per year (₹87,500 per month) and 50% of the CTC is allocated to basic pay, you can calculate it as follows:

Basic salary per year = 50% * Annual CTC

Annual basic salary = 0.5 * ₹10,50,000

Annual basic salary = ₹5,25,000

Monthly basic salary = 50% * CTC

Monthly basic salary = 0.5 * ₹87,500

Monthly basic salary = ₹43,750

In this example, the basic salary would be ₹5,25,000 per year and ₹43,750 per month.

How to calculate basic salary from gross salary?

Gross salary includes the basic pay along with various allowances before any deductions are applied. Basic pay is determined by subtracting all allowances, benefits, bonuses, etc., from the gross salary.

The formula to calculate basic salary from gross pay is:

Basic salary = Gross salary - (DA + HRA + conveyance allowance + medical insurance + other allowances)

Example of basic salary calculation from gross salary

Assume an employee is hired for a company with the following salary structure:

| Components | Amount (in ₹) |

| Gross salary | 60,000 |

| HRA | 3,000 |

| DA | 2,500 |

| Conveyance allowance | 2,000 |

| Medical insurance | 1,500 |

| Other allowances | 4,000 |

Here the employee's basic salary will be:

Basic salary = ₹60,000 – (₹3,000 + ₹2,500 + ₹2,000 + ₹1,500 + ₹4,000)

Basic salary = ₹47,000

Difference between basic salary, gross salary and net salary

| Parameters | Basic salary | Gross salary | Net salary |

| Definition | Fixed part of the income agreed upon by employer and employee. | Total amount before deductions are applied. It includes basic pay, allowances, and other bonuses. | Take-home pay after all deductions like taxes and EPF are applied. |

| Purpose | Offers financial consistency and serves as the foundation for various calculations. | Reflects the total expense for the employer and is used for tax calculations. | Reflects the actual amount paid to the employee as their salary. |

| Depends on | Employee’s designation and industry | Employee’s basic salary and various allowances | Varies due to taxes and other deductions from gross salary |

A quick summary

Clearly understanding and calculating your employees' basic salary is crucial for effective payroll management. By accurately determining basic salary, you ensure that your compensation structure aligns with industry standards and meets both organizational policies and employee expectations.

For a seamless and efficient payroll management solution, consider using Zoho Payroll. It makes it easier for you to handle salary calculations, allowances and deductions. Implement Zoho Payroll in your business today to ensure accuracy and streamline your payroll processes.

Frequently asked questions

Is the income tax calculated on CTC or basic salary?

Income tax is not calculated directly on your Cost to Company (CTC) or basic salary. Instead, it is based on your net taxable income, which is derived from your gross pay. Gross pay includes your basic salary along with allowances, variable pay, and perks. From this gross amount, exemptions and deductions are applied to determine the net taxable income, which is then used to calculate your income tax.

How to calculate the monthly basic salary?

Companies usually determine salary on an annual basis, meaning they have 12 pay periods in a year. To find out the monthly basic salary, divide the annual basic salary by 12. This simple calculation gives you the basic amount an employee receives each month.