- HOME

- Payroll administration

- Children Education Allowance: Rules, eligibility, and exemption

Children Education Allowance: Rules, eligibility, and exemption

Children Education Allowance (CEA) is a salary component provided to certain employees to support the educational expenses of their children. This allowance is designed to ease the financial burden of schooling, helping employees manage these costs.

As an employer, understanding how CEA works can help you assist eligible employees in taking advantage of this benefit. We'll learn the meaning of Children Education Allowance, its eligibility criteria, rules, and how it benefits both employees and their families in this article.

What is a Children Education Allowance?

Children Education Allowance is a type of allowance offered to government employees in India to help them cover their children’s education expenses. This benefit is meant to help with costs like school fees, books, uniforms, and other school-related expenses. Offered as a fixed monthly amount, it aims to ease the financial burden on employees.

Starting from January 2024, the education allowance is set at ₹2,812 per month, while the hostel subsidy is ₹8,437.5 per month. Government employees receive this amount regardless of the actual expenses incurred.

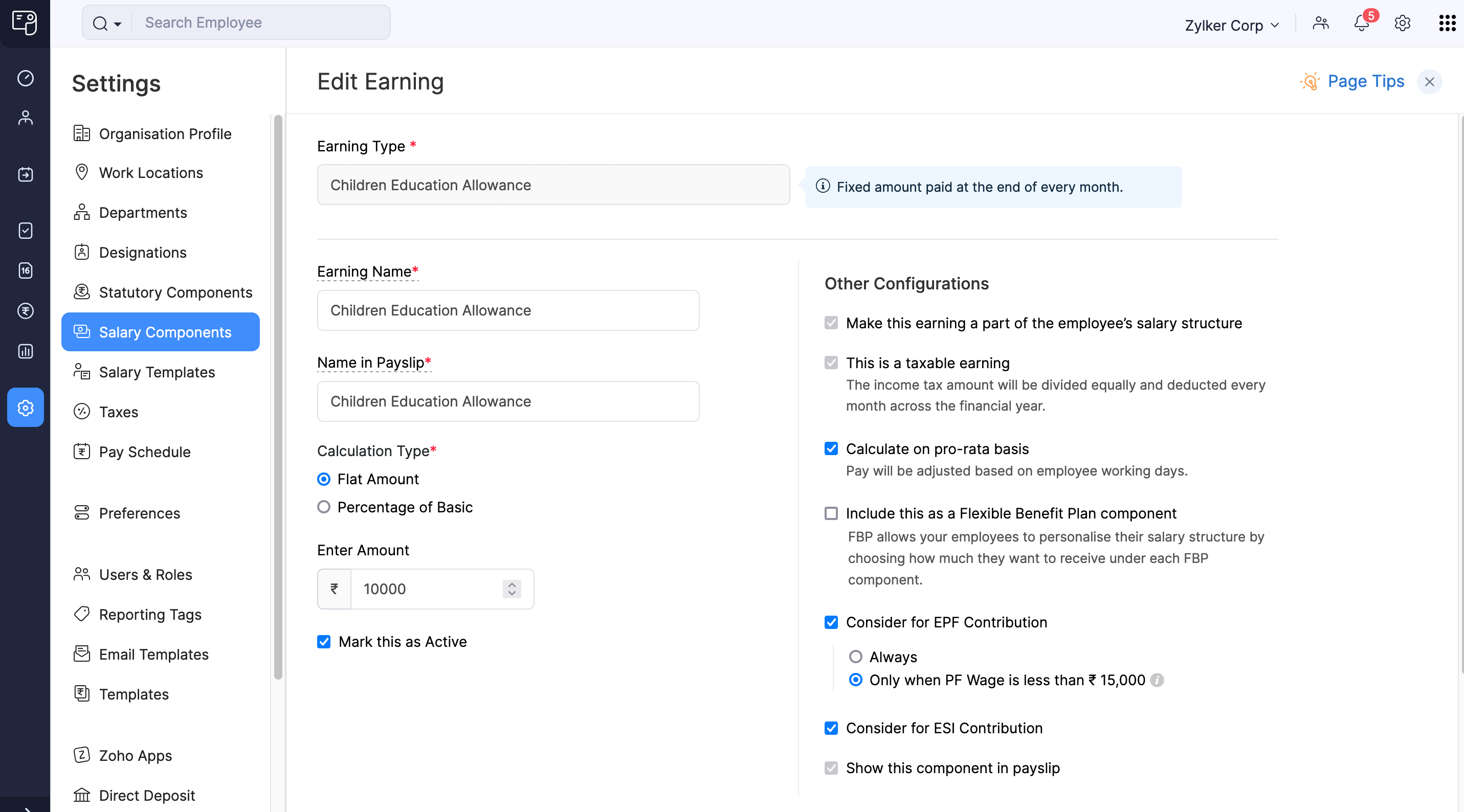

Calculation of CEA in Zoho Payroll, a cloud-based payroll software.

How the Children Education Allowance process works

To receive the CEA and hostel subsidy amount, employees must submit CEA claims. The process to claim CEA varies depending on whether the employee’s department has implemented the e-HRMS system.

- e-HRMS submission:

- e-HRMS: In ministries or departments where the electronic Human Resource Management System (e-HRMS) is operational, employees must claim the CEA through this digital platform.

- Online submission: The employee can log into the e-HRMS portal, fill out the form, and upload the necessary documents, such as, fee receipts and certificates from recognised educational institutions.

- Manual submission:

- Employees should submit their CEA and hostel subsidy claims at the office or department where they are currently serving.

- Employees will need to provide relevant documents as evidence, such as fee receipts, school certificates, or other proof of educational expenses.

Once the claim is submitted, it undergoes verification by the designated authorities in the department. Upon successful verification, the claim is approved, and the approved amount is reimbursed to the employee's bank account, typically along with the monthly salary.

Types of fees reimbursable as Children Education Allowance

- Tuition fee: Regular tuition costs assessed by the school or educational centre, which include academic learning and classroom teaching expenses.

- Admission fee: The one-time charge paid at enrollment to secure the child’s place in the institution.

- Library fee: Fees for using the school library and its resources.

- Lab fee: Fees for using laboratory facilities and conducting practical work.

- Special fee: Fees for specialised courses or disciplines, such as electronics, agriculture, music or any other courses.

- Fee for use of appliances: If the child needs to use any tools or appliances as part of their academic program, the cost is reimbursed.

- Extracurricular activity fee: Fees for participating in activities such as debates, arts and crafts, sports, and other events.

- School uniforms and shoes: Covers costs for two sets of required uniforms, including summer, winter, PT uniforms, and one pair of shoes.

- Textbooks and notebooks: Costs for up to one set of textbooks and notebooks needed for the academic year.

Employees must pay these charges directly to the school to be eligible for reimbursement.

Children Education Allowance eligibility criteria

Employees can claim CEA or hostel subsidy for their two eldest surviving children. However, there are exceptions:

- If their second child is part of a twin or multiple birth, they can claim for all children born from that pregnancy.

- If they had a sterilisation operation that failed, they can claim CEA/hostel subsidy for the first child born after the failure, even if this means they have more than two children.

This allowance and hostel subsidy can be claimed for children studying from nursery to 12th grade. Additionally, if the child enrols in a diploma or certificate course at a Polytechnic, IT, or Engineering College right after completing 10th grade, they can also claim these benefits for the first two years of the course. However, this is only applicable if they haven't already claimed the CEA or hostel subsidy for your child during their 11th and 12th grades.

Source: https://documents.doptcirculars.nic.in/D2/D02est/CEAORDER71Mu5.pdf

Children Education Allowance age limit

Employers should ensure the below criteria are met when processing CEA claims.

- Minimum age for nursery classes: There is no minimum age requirement for children in nursery classes to be eligible for CEA reimbursement.

- Maximum age for children: The CEA can be claimed for a normal child's education up to the age of 20 years. Government employees can receive this allowance until their child reaches this age.

- Maximum age for disabled children: For physically challenged or specially-abled children, the maximum age limit to claim CEA is extended to 22 years.

Is children education allowance taxable?

Yes, the children education allowance is considered a taxable salary component. Under the old tax regime, CEA is tax-exempt up to ₹100 per child per month for a maximum of two children. Any amount exceeding this limit is taxable.

However, in the new tax regime, this allowance is fully taxable, added to the employee’s net taxable income, and taxed according to the applicable slab rates.

Children Education Allowance exemption rules

CEA covers two main expense areas for eligible employees: Education and hostel charges.

- Education charges: Government employees can claim tax exemption of ₹100 per month for each child, up to two children in the old tax regime. Claims for a third child are not eligible for reimbursement.

For example, if an employee has one child and receives ₹33,744 per year as a children education allowance based on the recent amendment, they can claim a tax exemption of ₹1,200 on this amount, and the remaining ₹32,544 will be added to the employee’s net taxable income.

- Hostel charges: The allowance for hostel charges is ₹300 per month for each child, limited to two children in a family.

In addition to the above exemptions, employees can also claim additional tax relief under Section 80C of the Income Tax Act.

They can claim tax deductions on tuition fees paid to schools, colleges, universities and other educational institutions in the old tax regime. The exemption applies only if central or state authorities recognize these institutions.

Exclusions from tax exemptions

Certain expenses are not eligible for exemptions under CEA, including:

- Payments made as development fees do not qualify for tax benefits.

- Expenses for transportation purposes are not eligible for tax exemption.

- Any payment not directly associated with education, such as fees for non-educational activities, does not qualify for tax benefits.

CEA rules for central government employees

Employers should note that all Central Government employees, including those from Nepal and Bhutan working for the Government of India, qualify for CEA even if their children attend schools abroad.

To claim this allowance, employees must provide a certificate from the Indian Mission abroad. This certificate confirms that the relevant educational authority officially recognises the child's school in that region.

Children Education Allowance form for reimbursement

To apply for the children education allowance reimbursement, employees need to fill out the designated form. You can download the form using the following link:

Frequently asked questions on CEA

What is the age limit of children education allowance?

The maximum age limit for claiming CEA is 20 years for normal children and 22 years for specially-abled or physically challenged children.

Can employees claim CEA for more than one child?

Yes, employees are eligible to claim CEA for up to two children.