- HOME

- Payroll administration

- What is a flexible benefit plan and how does it work?

What is a flexible benefit plan and how does it work?

As companies adapt to the ever-changing landscape of modern business, employers are constantly redesigning their salary structures. Employers must be mindful of the fact that every employee's needs are different, and should offer customizable perks and benefits as part of their employees' cost to company (CTC). One such perk is a flexible benefit plan (FBP), which is a great tool for personalizing an individual's salary structure.

A well-thought-out FBP empowers your employees to better manage their expenses. This increases both recruitment and retention rates for your organisation. Read more to understand how it works, and how you can establish the most effective FBP for your company.

FBP full form and meaning in salary

FBP stands for flexible benefit plan. It is a scheme that helps employees structure and modify their CTC according to their financial needs. Many companies offer allowances for food, travel, and telephone and internet bills as part of their flexible benefit plans. Typically, the employer will set a maximum limit for each of these components.

Employees can customize their FBP by choosing which allowances they want to utilise and how much they want to spend under each. Through an FBP, employees in India can avail non-taxable benefits, such as medical expenses, conveyance allowance, leave travel allowance, food allowance, children's education allowance, and even house rent allowance.

Understanding FBP policies

Usually, employers and HR professionals decide on a flexible benefit package, and maximum allowance limits for each component. Companies declare their FBP policies to their employees at the start of the financial year, or at the time employees join the company. Following are the predefined policies according to which FBPs are structured:

Quantity-based policy: The employer decides on the base value of the components, and the employees determine the quantities they require. Let's say an organisation offers telephone bills as part of a quantity-based FBP with a base spending value of Rs. 1,000. An employee uses two telephones and wants both bills reimbursed. The employee would declare two quantities of the component, which amounts to Rs. 2,000 (1,000 x 2).

Opt-in policy: Employers define their FBP components as "opt-ins" and set a fixed amount as FBP pay. Employees can only receive fixed-pay compensation for their claims, and cannot modify the monetary benefits they receive for a component.

Mutual exclusion: Under this policy, the employer declares components as mutually exclusive. Let's assume that a company provides travel allowance and vehicle allowance as their components, and defines them as mutually exclusive. Employees will have the option to select only one of the two components.

Dependant policy: Here, the employer defines certain components as dependant on others. Consider an organisation that declares fuel allowance and vehicle maintenance allowance as dependant components. If an employee raises a claim for fuel allowance, they must also submit claims for the dependent FBP component—vehicle maintenance allowance.

Different types of flexible benefit plans

There are several types of FBP components you can offer depending on your organisation and its policies.

Leave travel allowance: Many companies these days encourage their hard-working employees to take a break and go on vacation. Some companies also offer monetary benefits, like leave travel allowance, as part of their flexi benefit plan to motivate their workforce. These can be availed twice in four block years. Block years are decided by the central government. Employees can only use this type of allowance to travel within India.

Food and beverages cost: Food and non-alcoholic beverages provided to employees by employers during working hours are exempted from income tax calculations. The income tax department also allows employers to provide non-taxable food vouchers, like Sodexo meal coupons, to their employees.

House rent allowance: Some organisations provide house rent allowance (HRA) as an FBP component. Employees who opt for HRA will be paid monthly along with their basic salary.

Telephone and internet bills: Communications that happen within the teams are of utmost importance in running a business. Understanding this, most companies provide an allowance based on employees' postpaid mobile and internet bills. Employees can submit relevant receipts at the end of the year to have their bills reimbursed.

Conveyance allowance: To show that they value the efforts of employees who commute long distances for work, many organisations provide fuel reimbursements under their conveyance policies. A handful of companies in India also provide senior employees with vehicles that can be used for official purposes.

How FBP works in CTC

Flexible benefit plans are an integral part of CTC. But do you know how an employee's CTC is structured in India?

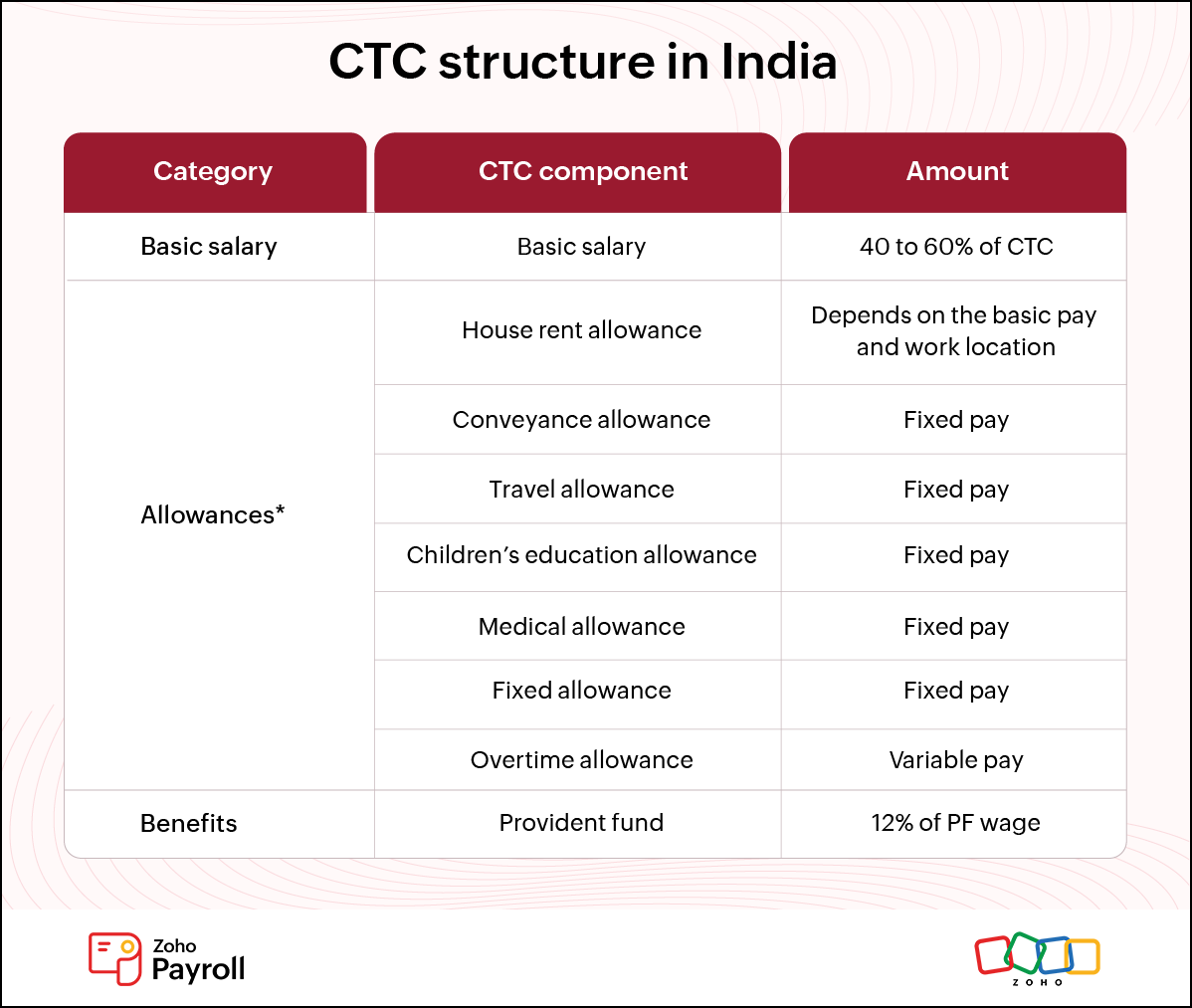

CTC is simply the cost a company incurs in a year by employing a given individual. It includes gross salary and the cost of all benefits. CTC can be broadly broken down as a sum of basic salary, allowances, and deductions.

The following framework can be considered as the standard CTC structure in India.

*Organisations can declare their CTC allowances, like HRA, conveyance allowance, travel allowance, medical, and children's education allowance as FBP components, enabling employees to choose the allowances they need.

To understand this better, assume that "Company A" offers HRA and conveyance allowance as part of their FBP. HRA can be claimed by employees living in rented apartments, while conveyance allowance can be claimed by those who commute long distances to work.

Benefits of FBP

For employers

Increased retention and recruitment rates: In a 2019 study, employees around the world said that benefits customised to their needs are one of the top five drivers of happiness at work. When you have a streamlined flexi benefit plan in place, you emphasize that you care about your employees' financial wellbeing. This helps in increasing retention and recruitment rates.

Better productivity: When their financial needs are met, employees often feel they have a healthy atmosphere to work in. This results in an increase in productivity for your firm.

For employees

Tax savings: Employees can reduce their tax burden by declaring FBP allowance with relevant receipts. FBP components, like food allowance and travel allowance, are non-taxable. Restructuring employees' CTC with FBP components can help them limit their tax rate without affecting their take-home salary.

Effective financial management: When employees are allowed to claim a certain amount of expense, other than their basic salary, they are often motivated to budget their expenditure for the month or even for a year accordingly.

Challenges involved in framing FBP policies

Before structuring an FBP policy for your organisation, it is crucial to be aware of the immense amount of administrative work the process involves.

If you still rely on legacy payroll methods and don't have employee self-service portals, streamlining FBP declarations and approvals will be a tedious process. The process demands seamless collaboration between your HR team and employees to ensure timely payouts.

If you have not automated payroll computations within your company, you will also face the challenge of calculating allowances manually.

You can overcome these challenges and greatly reduce paperwork by switching to cloud payroll software built to make things easier for business owners and payroll administrators.

How Zoho Payroll simplifies the FBP process

Zoho Payroll is smart cloud payroll software designed to automate all payroll activities.

Using this highly customisable software, you can add and edit different salary components as earnings. With just a few clicks, you can include an earning as an FBP component and create a customized flexible benefit plan for your organisation. You can even restrict employees from overriding the maximum FBP limit.

Payroll also comes with a dedicated employee self-service portal (ESS), where employees can opt for an FBP of their choice. Through ESS, individuals can view the total allocated amount under each component and submit the required monthly amount.

In a nutshell

A flexible benefit plan is a part of an employee's CTC, which empowers individuals to modify their salary structure. It provides much-needed perks to both employers and employees. Employers can put together a flexi plan and set a maximum spend limit to each of the components. How do you do that? By following any of the four established FBP policies and deciding upon the components. The four policies are:

Quantity-based policy

Opt-in policy

Mutual exclusion

Dependant policy

Business owners can offer various allowances as part of their flexi plan and reduce the tax burden on their employees. This way, organisations can show they care about their employees' welfare and create a better workplace atmosphere.

Implement a flexible benefit plan for your organisation now using Zoho Payroll, and foster a healthy employer-employee relationship.