- HOME

- Payroll administration

- Salary certificate: Format, sample and free PDF templates

Salary certificate: Format, sample and free PDF templates

Salary certificates are documents that serve as proof of income for employees in India. Think of it like a letter you will send to your employee confirming their salary and employment with the company.

In this article, you will learn what a salary certificate is, its format, and uses. Plus, you can download ready-to-use salary certificates in formats that you need and share them with your employees.

What is a salary certificate?

A salary certificate is an official document sent by an employer to the employee certifying the employee's CTC, and role in the company. It contains a complete breakdown of their monthly and annual salary, including their earnings and deductions.

Salary certificates are usually distributed to employees on request. As this document serves as proof of income, employees need it when they try to get loans, apply for visas, or file income tax returns.

Salary certificate format

Once your employee requests a salary certificate, ensure you send them an accurate salary certificate letter with the following details:

- Employee information: Include the employee's name, designation, employee ID, and their address.

- Employer information: Include your company's legal name, address, and contact information.

- Salary details: Specify the breakdown of the employee's salary across various components such as basic pay, house rent allowance, conveyance allowance, bonus, and deductions made on their salary.

- Net pay: Mention the total projected amount payable to the employee for the financial year.

- Date and signature: Include the date of issuance of the certificate and signature of your payroll admin or the HR manager.

- Declaration: Include a statement that declares the authenticity of the information provided.

Salary certificate in Word format

[Your company's name, address, and logo]

[Date]

Salary certificate

To whom it may concern,

This is to certify that [employee name], holding the position of [job role] with the [department's name] team, is working at [company name] since [joining date] and is earning [₹ xx,xx,xxx] as CTC annually. A breakdown of their monthly and annual salary is given below:

| Earnings | Monthly amount | Annual amount |

| Basic pay | ₹ xx,xxx | ₹ x,xx,xxx |

| House rent allowance | ₹ xx,xxx | ₹ x,xx,xxx |

| Fixed allowance | ₹ xx,xxx | ₹ x,xx,xxx |

| Flexible benefit plans | ₹ xx,xxx | ₹ x,xx,xxx |

| Total CTC | ₹ xx,xxx | ₹ x,xx,xxx |

| Deductions | Monthly amount | Annual amount |

| Provident fund | ₹ xx,xxx | ₹ x,xx,xxx |

| Income tax | ₹ xx,xxx | ₹ x,xx,xxx |

| Professional tax | ₹ xx,xxx | ₹ x,xx,xxx |

| Total deductions | ₹ xx,xxx | ₹ x,xx,xxx |

This certificate is issued upon the request of the employee for a legal purpose. We confirm that the information provided is true and accurate to the best of our knowledge.

Sincerely,

[Employer's name & signature]

Fill in the placeholders (e.g., employee name, amount, etc.) with the appropriate details and save the document in Word format to maintain formatting when sharing or printing.

Download the salary certificate in Word format

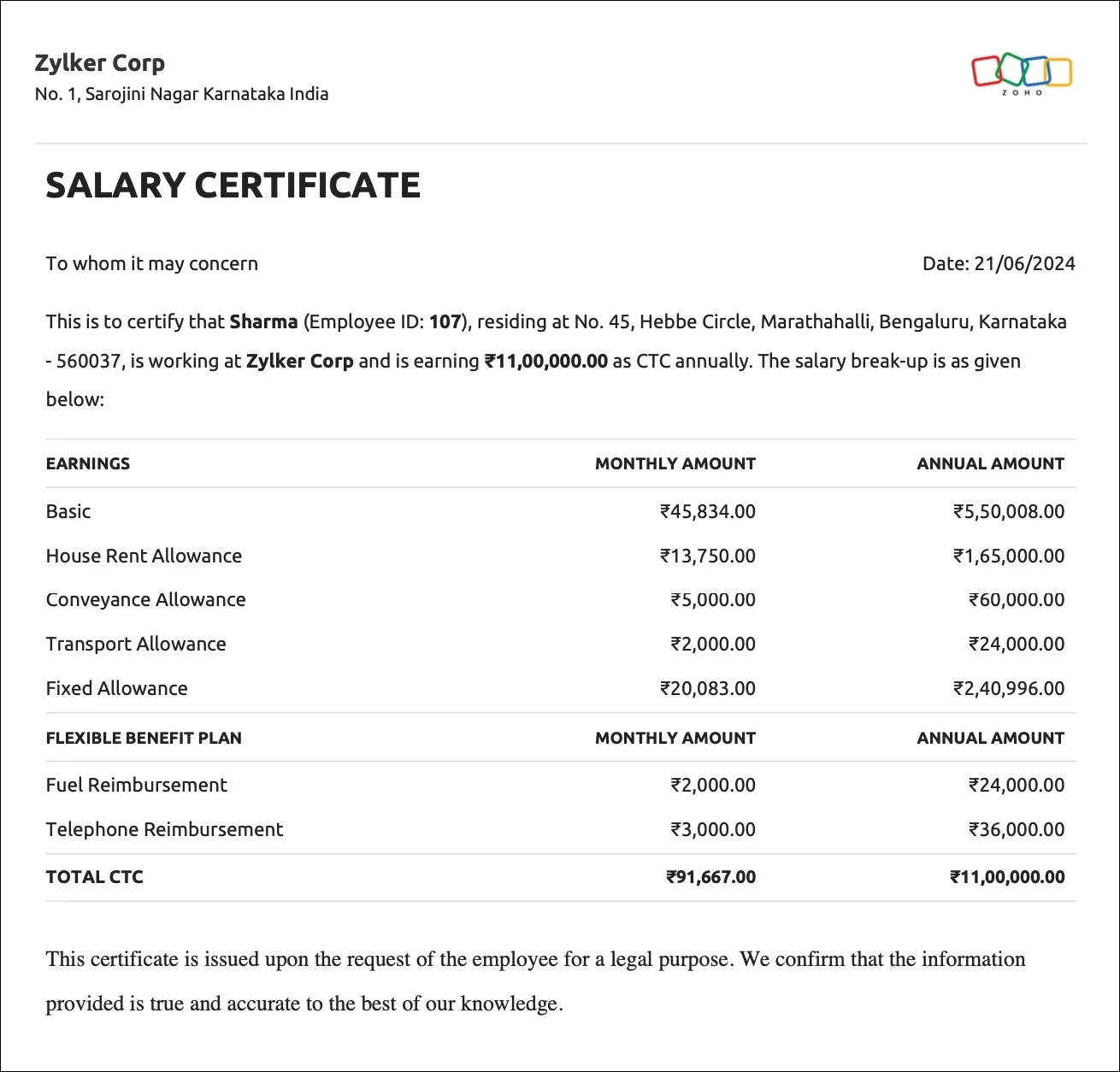

Here's a preview of how the salary certificate should look:

Simple salary certificate format

[Your company's name and logo]

[Date]

Salary certificate

To whom it may concern,

This is to certify that [employee name and ID], is working at [company name] and is earning [₹ xx,xx,xxx] as CTC annually. The salary breakdown is given below:

| Earnings | Monthly amount | Annual amount |

| Basic pay | ₹ xx,xxx | ₹ x,xx,xxx |

| House rent allowance | ₹ xx,xxx | ₹ x,xx,xxx |

| Fixed allowance | ₹ xx,xxx | ₹ x,xx,xxx |

| Total CTC | ₹ xx,xxx | ₹ x,xx,xxx |

This certificate is issued at the employee's request for legal purposes. We confirm that the information provided is true as per our records.

Sincerely,

[Employer's name & signature]

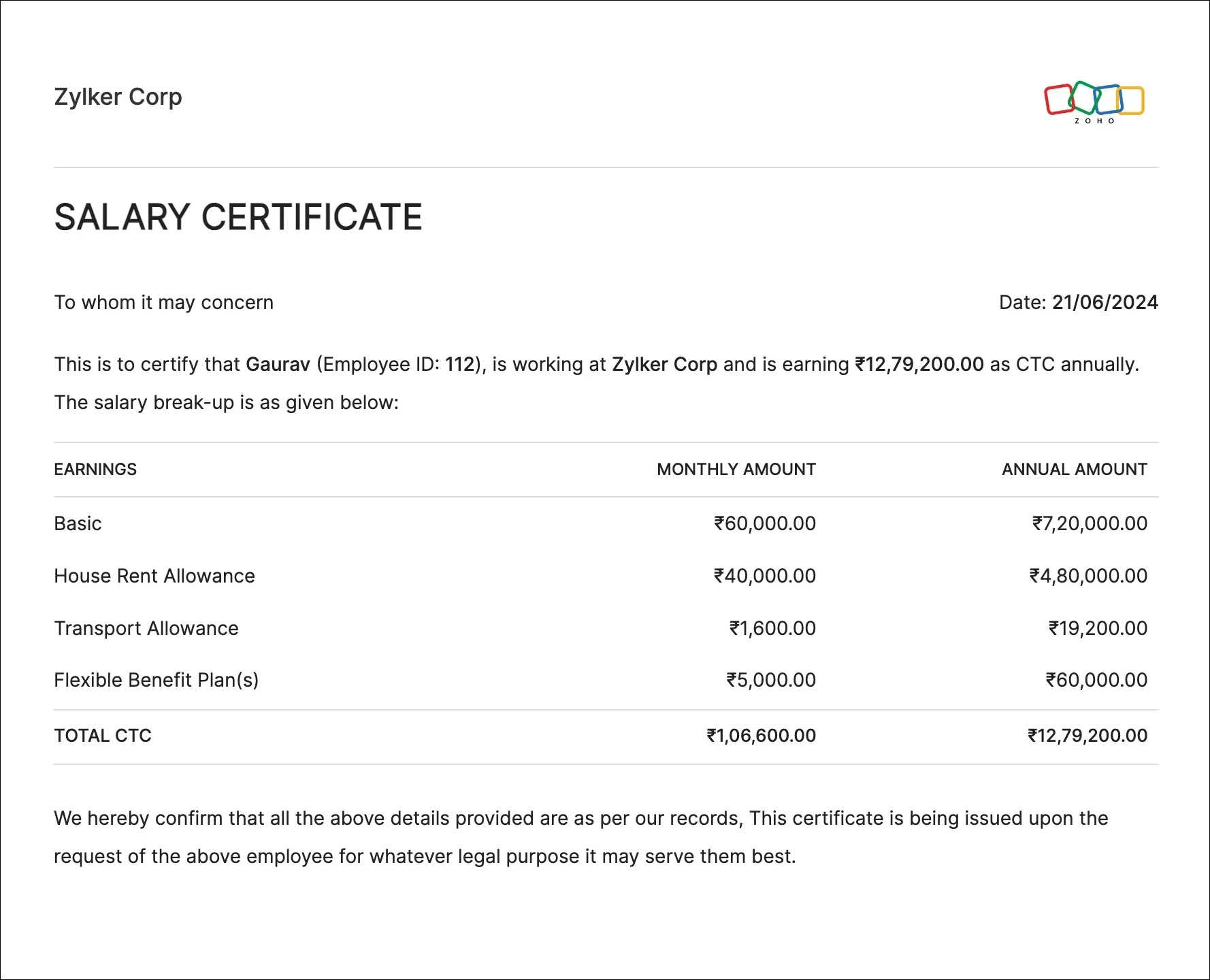

Sample salary certificate

Generate and send salary certificates with payroll software

Salary certificates can be generated in several different ways. If you're just starting out, handling payroll by yourself and creating salary certificates manually can seem painless. As your business expands and your team grows, you'll need a modern tool to streamline this process.

Cloud-based payroll software such as Zoho Payroll automates the generation and distribution of salary certificates, ensuring accuracy and reducing manual efforts.

- Input your employee's details, their salary components, and deductions into the system, and let Zoho Payroll create professional-looking salary certificates in a few minutes.

- Customize certificates by including your company's logo and signature for a branded appearance.

- Securely send and store your employees' salary certificates on the self-service portal to eliminate back and forth emails between your teams.

Frequently asked questions

Where are salary certificates used?

Salary certificates are considered legal documents in India and can be used for the following purposes.

➤ Loan and credit card applications: Banks and other financial institutions often require salary certificates to verify an applicant's income before approving loans or credit cards.

➤ Tax filings: Employees, at times, require salary certificates to file their income tax returns with the government.

➤ Visa applications: When applying for visas for employment opportunities, salary certificates may be requested to verify the individual's financial stability.

Is it mandatory to distribute salary certificates in India?

No, labor laws do not mandate the distribution of salary certificates. However, it is widely considered a necessary practice to help employees with their financial needs and ensure transparency with them.

What is the difference between a salary certificate and a salary slip?

Although salary certificates and salary slips are both documents that detail an employee's earnings, their purposes and uses make them distinct.

| Salary certificate | Salary slip |

| It certifies an employee's annual CTC and employment with a company. | These are issued monthly and provide a breakdown of the employee's salary for a specific pay period. |

| Its purpose is to serve as proof of income for financial transactions. | Its purpose is to inform employees of their monthly earnings, deductions, and net pay. |

| Not legally mandated but often expected for official purposes. | Required to be provided as per the Payment of Wages Act, 1936. |