- HOME

- Taxes and compliance

- How to Calculate Income Tax on Salary with Example

How to Calculate Income Tax on Salary with Example

Earning a salary is rewarding, but when tax season arrives, many employees feel overwhelmed by the numbers. "How much of my salary will I actually take home? Which tax regime should I choose?" These are common concerns. Understanding how income tax on salary is calculated can empower individuals to make informed financial decisions, save on taxes, and plan better for the future.

In this guide, we’ll break down the income tax calculation step by step, comparing the old and new tax regimes, illustrating with examples, and explaining deductions and exemptions that can help minimize your tax burden.

What is income tax on salary?

Income tax on salary is the tax deducted from an employee’s earnings as per the Income Tax Act, 1961. This amount, known as income tax, serves as a revenue for the government.

Not all of your salary is taxable—only the amount left after considering exemptions, deductions, and rebates is subject to tax.

The taxable portion of your salary includes components like your basic salary, allowances, bonuses, and perquisites, while exemptions like House Rent Allowance (HRA) and the standard deduction reduce your taxable income. Your tax rate depends on your income and age, with different slabs applying to senior and super senior citizens.

Employers deduct tax at source (TDS) every month before paying salaries and deposit it with the government.

What are old tax and new tax regimes?

The old and new tax regimes are two different ways to calculate income tax in India. The old tax regime allows you to claim various deductions and exemptions, such as ₹1.5 lakh under Section 80C (for investments like Provident Fund, LIC, and Equity-Linked Savings Scheme), medical insurance under 80D, house rent allowance (HRA), and more. These help reduce taxable income, but the tax rates are slightly higher.

The new tax regime, introduced in 2020, offers lower tax rates but removes most deductions and exemptions. This means you pay tax on almost your full income without many reductions.

For example, under the old regime, if your salary is ₹10 lakh and you claim ₹2 lakh in deductions, you pay tax only on ₹8 lakh. But in the new regime, you pay tax on the entire ₹10 lakh. The new tax regime has simpler tax slabs and is better for those who don’t have many deductions to claim. However, if you use tax-saving investments and exemptions, the old regime may be more beneficial. Every financial year, you can choose between the two based on what saves you more tax.

How to calculate income tax on salary: Step-by-step process

Calculating income tax on salary involves understanding salary components, exemptions, deductions, and applicable tax rates. Follow these steps to compute your tax liability accurately.

Step 1: Calculating gross salary

Step 2: Calculating taxable income

Step 3: Applying the relevant tax slab and calculating the tax amount

Calculate gross salary

The first step to calculating income tax includes calculating the gross income of an individual. Gross salary includes multiple components, such as basic salary, allowances, bonuses, and perquisites.

- Basic salary:This is the fixed component of your salary and serves as the foundation for many other calculations, including allowances and deductions.

- Allowances: These are additional payments made by the employer, including House Rent Allowance (HRA), Dearness Allowance (DA),transport allowance, and special allowance. Some of these allowances are partially or fully exempt from tax, depending on the conditions met.

- Bonuses:Any performance-based bonuses, festival bonuses, or one-time incentives form part of the gross income.

- Perquisites:Benefits like company-provided accommodation, car, employee stock options (ESOPs), meal coupons, and medical insurance premiums paid by the employer are also included in gross salary and are taxable as per their valuation rules.

The sum of all these components forms the gross income. However, not all of it is taxable—certain exemptions apply before arriving at taxable income.

Calculate taxable income

The next step is to subtract applicable exemptions and deductions from the gross salary to arrive at taxable income.

I) Exemptions from salary income

Exemptions are income components that are partially or fully tax-free under the Income Tax Act. Key exemptions include:

- House Rent Allowance (HRA): If you live in a rented house, a portion of HRA is exempt based on factors like actual rent paid, location (metro/non-metro), and basic salary.

- Leave Travel Allowance (LTA): Expenses incurred on domestic travel (flight/train/bus fare) for self and family during leaves are tax-exempt if claimed under eligible conditions.

- Reimbursements: Some allowances like mobile phone and internet bill reimbursements, newspaper reimbursements, and travel expenses for official purposes are exempt from tax.

- Standard deduction: Every salaried individual can claim a ₹50,000 standard deduction in the old regime without investing in any scheme. If you opt for the new regime you can claim a deduction of ₹75,000 starting from FY 2024-25 (increased from ₹50,000 to ₹75,000 in Budget 2024).

Subtracting these exemptions from the gross salary gives the net taxable salary.

II) Deductions Under Chapter VI-A

After exemptions, deductions further reduce taxable income. Some of the common deductions include:

- Section 80C (₹1.5 lakh limit): Investments like EPF, PPF, life insurance premiums, ELSS mutual funds, and repayment of home loan principal qualify for deduction.

- Section 80D (Medical insurance): Premiums paid for health insurance are deductible up to ₹25,000 (₹50,000 for senior citizens).

- Section 80E (Education loan interest): Interest paid on education loans is deductible without an upper limit.

- Section 80TTA (Savings interest): Interest earned on a savings account (up to ₹10,000) is deductible.

- Section 80CCD(1B) (NPS contribution): An additional ₹50,000 deduction is allowed for investments in the National Pension System (NPS).

After deducting exemptions and deductions, the amount left is the final taxable income—this is the amount on which income tax is applied based on the chosen tax regime.

Apply the relevant tax slab

The applicable tax rate depends on whether the taxpayer has opted for the old tax regime (which allows the above mentioned deductions) or the new tax regime (which has lower tax rates but no deductions).

Tax slabs under the old tax regime for FY 2024-25 and FY 2025-26

| Income slab | Income tax rate |

| Up to ₹2.5 lakh | Nil |

| ₹2.5 lakh to ₹5 lakh | 5% of income above ₹2.5 lakh |

| ₹5 lakh to ₹10 lakh | ₹12,500 + 20% of income above ₹5 lakh |

| Above ₹10 lakh | ₹1,12,500 + 30% of income above ₹ 10 lakh |

To note

- The tax-free limit for senior citizens (60 to 80 years old) is ₹3 lakh instead of ₹2.5 lakh in the old regime.

- In case of super senior citizens (80+ years old), the tax-free limit is ₹5 lakh.

New tax regime rates for current FY 2024-25

| Income slab | Income tax rate |

| Up to ₹3 lakh | Nil |

| ₹3 lakh to ₹7 lakh | 5% of income above ₹3 lakh |

| ₹7 lakh to ₹10 lakh | ₹15,000 + 10% of income above ₹6 lakh |

| ₹10 lakh to ₹12 lakh | ₹45,000 + 15% of income above ₹9 lakh |

| ₹12 lakh to ₹15 lakh | ₹90,000 + 20% of income above ₹12 lakh |

| Above ₹15 lakh | ₹1,50,000 + 30% of income above ₹15 lakh |

Union Budget 2024 update

As per the Union Budget 2024 announcement, the standard deduction for salaried individuals and pensioners in the new regime has been revised from ₹50,000 to ₹75,000. This change means individuals earning up to ₹7.75 lakh annually do not have to pay income tax by utilising the standard deduction and the rebate under section 87A for the current financial year (2024-25).

Tax slabs under the new tax regime for FY 2025-26

| Income slab | Income tax rate |

| Up to ₹4 lakh | Nil |

| ₹4 lakh to ₹8 lakh | 5% |

| ₹8 lakh to ₹12 lakh | 10% |

| ₹12 lakh to ₹16 lakh | 15% |

| ₹16 lakh to ₹20 lakh | 20% |

| ₹20 lakh to ₹24 lakh | 25% |

| Above ₹24 lakh | 30% |

Income tax calculation example

Different tax rates apply to different income slabs under both regimes. In the old regime, no tax is levied on the first ₹2.5 lakh. The next ₹2.5 lakh is taxed at 5%. Income between ₹5 lakh and ₹10 lakh is taxed at 20%, while any amount exceeding ₹10 lakh is taxed at 30%.

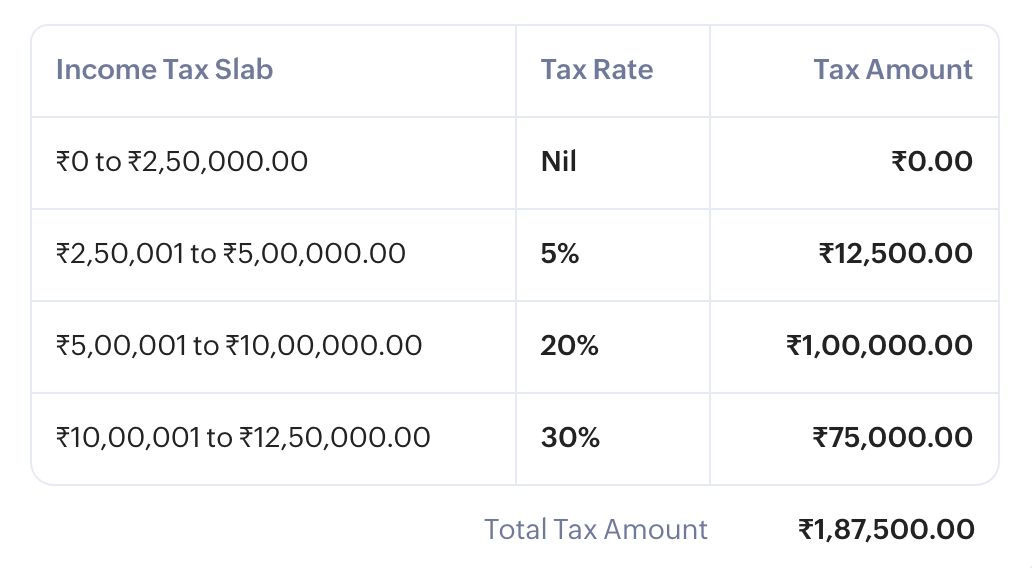

For example, if an individual has a taxable income of ₹13 lakh under the old regime, the tax calculation would be as follows:

Under the new regime for FY 2024-25, the tax would be lower due to reduced rates.

Calculate income tax on salary with ease using Zoho's free income tax calculator.

Apart from the above tax amount, taxpayers may also have to pay additional charges in the form of cess and surcharge. These are imposed by the government to generate revenue for specific purposes.

1. Cess in income tax

A cess is a tax levied on top of the income tax payable. It is collected by the government for a particular purpose, such as education or healthcare. Currently, the health and education cess applies to all taxpayers in India at the rate of 4% of the total income tax payable.

For example, if an individual’s tax amount is ₹1,00,000, the cess would be 4% of this amount, i.e., ₹4,000, making the total tax payable ₹1,04,000.

2. Surcharge in income tax

A surcharge is an additional tax on individuals whose total income exceeds a certain threshold. It is levied to ensure higher-income groups contribute more to government revenues. Unlike cess, which applies to all taxpayers, a surcharge is applicable only to individuals earning more than ₹50 lakh per year.

Learn everything you need to know about surcharge rates.

The surcharge amount is calculated on the tax payable before adding cess. Once the surcharge is determined, the 4% health and education cess is applied to the total tax amount, including the surcharge.

Income tax calculation for ₹1 lakh per month salary in India

To better understand how income tax is calculated, let's consider an example with a detailed salary structure. Assume the individual earns a monthly salary of ₹1,00,000, which consists of various components such as basic salary, allowances, and deductions.

| Salary component | Monthly amount | Annual amount |

| Basic salary | 40,000 | 4,80,000 |

| House Rent Allowance | 25,000 | 3,00,000 |

| Conveyance allowance | 20,000 | 2,40,000 |

| Medical allowance | 5,000 | 60,000 |

| Other allowance | 10,000 | 1,20,000 |

| Gross salary | 1,00,000 | 12,00,000 |

Step 1: Calculate exemptions

Under the old tax regime, certain exemptions can be deducted from gross salary.

- Standard deduction - ₹50,000 (available for all salaried employees).

- House Rent Allowance exemption - Let’s assume the individual lives in a metro city and pays ₹25,000 as rent. The HRA exemption is calculated as the least of:

- Actual HRA received - ₹3,00,000

- 50% of Basic salary (for metro cities) - ₹2,40,000

- Rent paid minus 10% of Basic salary - ₹(3,00,000 - 48,000) = ₹2,52,000

- HRA exemption = ₹2,40,000 (minimum of the above three values)

After exemptions, the net taxable salary is:

₹12,00,000 - ₹50,000 (Standard deduction) - ₹2,40,000 (HRA) = ₹9,10,000

Step 2: Apply deductions

- Section 80C (₹1,50,000 max) - Let’s assume the individual contributes ₹80,000 to EPF and ₹70,000 to PPF, making full use of this limit.

- Section 80D (Medical insurance premiums) - Assume ₹25,000 is paid for health insurance.

So, after deductions, the final taxable income becomes:

₹9,10,000 - ₹1,50,000 - ₹25,000 = ₹7,35,000

Step 3: Calculate income tax amount

Now, apply the tax slab rates.

Up to ₹2,50,000 - No tax.

Next ₹2,50,000 (₹2,50,001 - ₹5,00,000) - 5% of ₹2,50,000 = ₹12,500

Next ₹2,35,000 (₹5,00,001 - ₹7,35,000) - 20% of ₹2,35,000 = ₹47,000

Total income tax before cess = ₹12,500 + ₹47,000 = ₹59,500

Step 4: Add cess

A 4% health and education cess is applied on the total tax: 4% of ₹59,500 = ₹2,380

Thus, the final tax payable is: ₹59,500 + ₹2,380 = ₹61,880

Final tax liability and summary

The individual earning ₹1 lakh per month under the old tax regime will pay a total income tax of ₹61,880 per year after exemptions and deductions.

| Component | Amount |

| Annual gross salary | 12,00,000 |

| Less: Standard deduction | 50,000 |

| Less: HRA exemption | 2,40,000 |

| Less: Section 80C deduction | 1,50,000 |

| Less: Section 80D deduction | 25,000 |

| Net taxable income | 7,35,000 |

| Income tax amount before cess | 59,500 |

| Cess (4%) | 2,380 |

| Total tax payable | 61,880 |

How to calculate income tax on salary in the new regime

Under the new tax regime, a standard deduction of ₹75,000 is allowed, but no other exemptions or deductions (such as HRA, 80C, or 80D) apply. The tax is calculated directly based on the taxable income using the applicable slab rates.

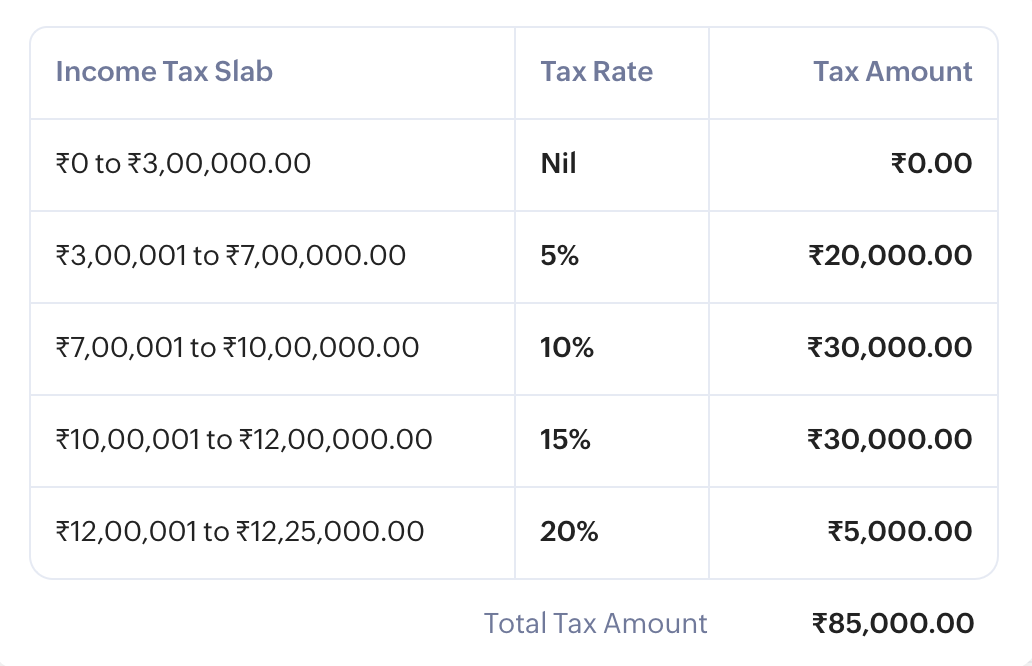

Let’s consider an employee with an annual gross salary of 12 lakh opts for the new tax regime. Here’s how to calculate income tax on his salary:

| Component | Amount |

| Gross salary | ₹12,00,000 |

| Less: Standard deduction | ₹75,000 |

| Net taxable income (Gross salary - Standard deduction) | ₹11,25,000 |

Now, apply new regime slab rates for current FY (2024-25):

| Income slab | Income tax rate calculation | Tax amount |

| Up to ₹3,00,000 | Nil | 0 |

| ₹3,00,001 - ₹7,00,000 | ₹4,00,000 @ 5% | ₹15,000 |

| ₹7,00,001 - ₹10,00,000 | ₹3,00,000 @ 10% | ₹30,000 |

| ₹10,00,001 - ₹11,25,000 | ₹1,25,000 @ 15% | ₹18,750 |

| Total tax before cess | ₹15,000 + ₹30,000 + ₹18,750 | ₹68,750 |

| Add 4% health and education cess | ₹78,750 × 4% | ₹2,750 |

| Final income tax payable | ₹68,750 + ₹2,750 | ₹71,500 |

For an annual salary of ₹12 lakh, the total income tax under the new regime is ₹71,500 after applying the standard deduction of ₹75,000.

When and how income tax is deducted from the salary?

Income tax on salary is deducted every month by the employer before paying the salary. This deduction, known as Tax Deducted at Source (TDS), is governed by Section 192 of the Income Tax Act, 1961.

Employers calculate TDS based on the employee's estimated annual taxable income, considering exemptions and deductions declared by the employees at the start of the financial year.

Here’s how the process works:

- Calculate employee’s gross annual salary at the beginning of the financial year.

- Allow employees to choose a tax regime–old or new, and declare investments. If no choice is made, the new regime must be applied by default.

- Apply the right exemption amounts (HRA) and deductions like Section 80C, 80D, and the standard deduction.

- Subtract eligible exemptions and deductions and arrive at the net taxable income for the year.

- Calculate tax on the net income as per the slabs in old or new regime.

- Divide the total tax liability for the year by 12 months and deduct this amount as TDS from the monthly salary.

- Deposit the deducted TDS with the Income Tax Department by the 7th of the following month (except for March, where the due date is April 30).

- At the end of the financial year, provide Form 16 to employees, summarizing the salary paid, tax deducted, and deposited.

Key takeaways

Clear understanding of income tax on salary is crucial for both employers and employees in India. From determining taxable income to applying deductions and selecting the right tax regime, accurate tax calculation can be complex and time-consuming. Employers must deduct TDS correctly and deposit it with the government on time. Employees, on the other hand, need to plan their investments, submit proofs, and choose the right tax regime to optimize their tax liability.

This is where Zoho Payroll simplifies the entire process. With automated tax calculations, Zoho Payroll ensures that TDS is deducted accurately based on the employee’s taxable salary, applicable deductions, and chosen tax regime.

The software provides an intuitive self-service portal where employees can declare their investments, upload proof of tax-saving investments, and view their estimated tax liability in real-time. Whether an employee opts for the old regime with exemptions and deductions or the new regime with a lower tax rate, Zoho Payroll helps them make an informed decision by clearly displaying the tax impact of both options.

Switch to Zoho Payroll today and make income tax calculations effortless for your business and employees.

FAQs on income tax on salary

1. Is tax calculated on basic salary?

No, income tax is not calculated solely on the basic salary. Instead, tax is levied on the total taxable income from salary, which includes the basic salary, house rent allowance (HRA), conveyance allowance, bonuses, and other components.

2. Is income tax calculated on gross salary or net salary?

Income tax is calculated on taxable income, not the gross salary. Taxable income is derived by subtracting eligible exemptions (such as HRA and standard deduction) and deductions (such as Section 80C and 80D) from the gross salary.

3. What are the salary components considered for tax calculation?

The key salary components considered for tax calculation include:

- Basic salary

- House rent allowance (subject to exemption rules)

- Conveyance allowance (subject to exemption rules)

- Bonus and incentives

- Perquisites (such as rent-free accommodation or employer-provided car)

- Other allowances (e.g., travel and medical allowances)