How do I record an asset depreciation?

To record a depreciation amount for an asset, you can create a recurring journal profile and set them to recur based on your preference. To do this:

Click the Accountant tab on the left sidebar and go to Recurring Journals.

Click + New in the top right side of the page.

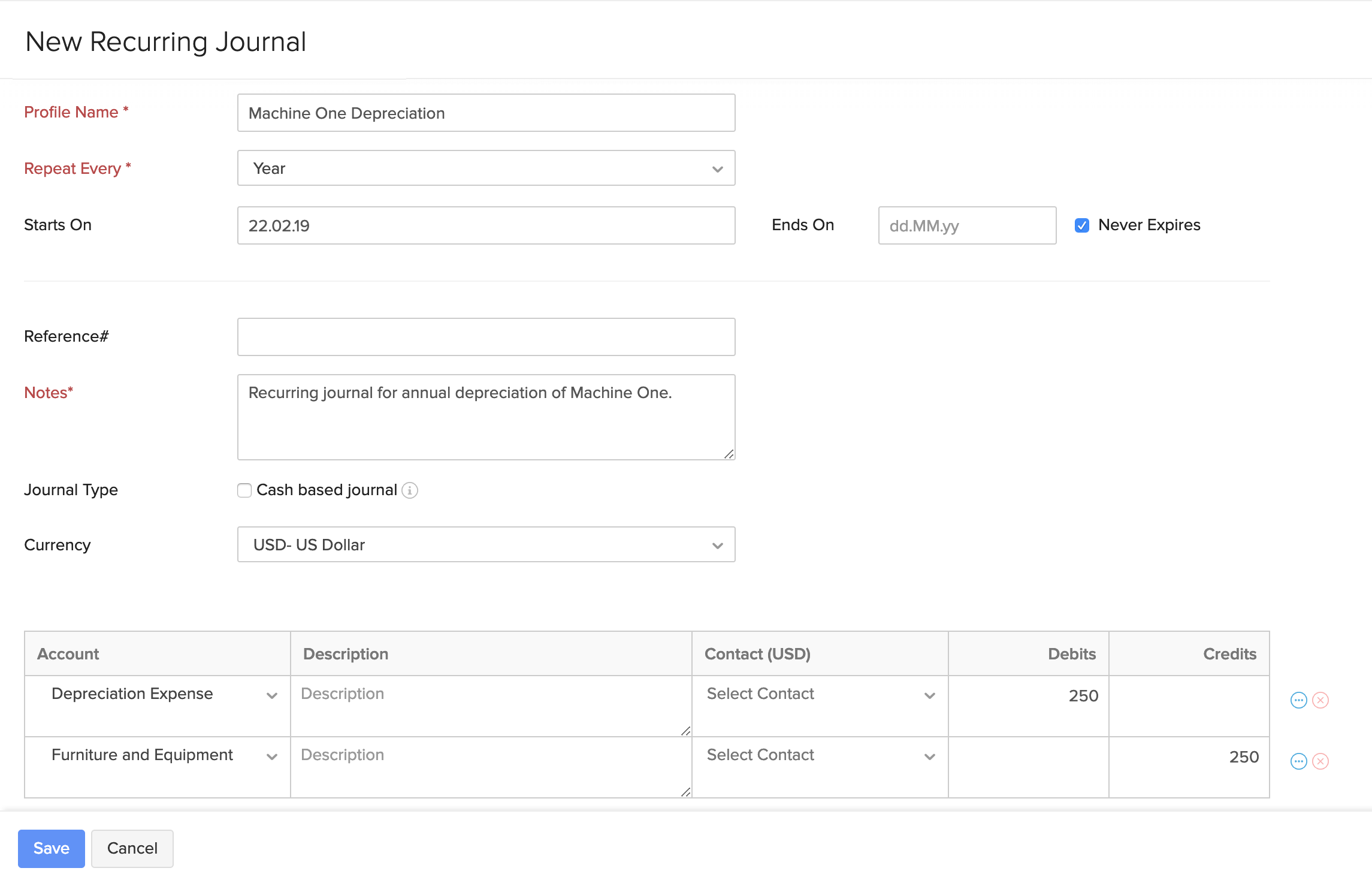

Enter the Profile Name.

Give a short note for the journal entry and add other necessary details.

Select the frequency of the recurring journal under the Repeat Every dropdown.

Insight: You can also enter a frequency of your choice by choosing Custom from the dropdown.

Select Depreciation Expense as the Debit account and the account under which the asset was recorded as the Credit account.

Click Save and Publish or Save as Draft to record the asset depreciation.

Based on the preferences you have set for the recurring journal, the child journals that are created will be saved in the Draft or Published status. All the child journals will be available as journals under Manual Journals.

Yes

Yes