Get MTD Ready with Zoho Books

Our MTD-compliant accounting software helps you file VAT and Income Tax returns directly to HMRC and stay tax-season ready.

What is Making Tax Digital (MTD)?

Making Tax Digital (MTD) is HMRC's initiative to help you maintain digital records and simplify their tax obligations by using online accounting software. Whether you are filing VAT or Income Tax returns, MTD aims to make accounting simpler and efficient, while ensuring tax compliance

MTD ready software for online Income Tax filing

Sole traders and landlords can now manage their income tax obligations for free with Zoho Books. You can now send quarterly updates to HMRC directly from Zoho Books.

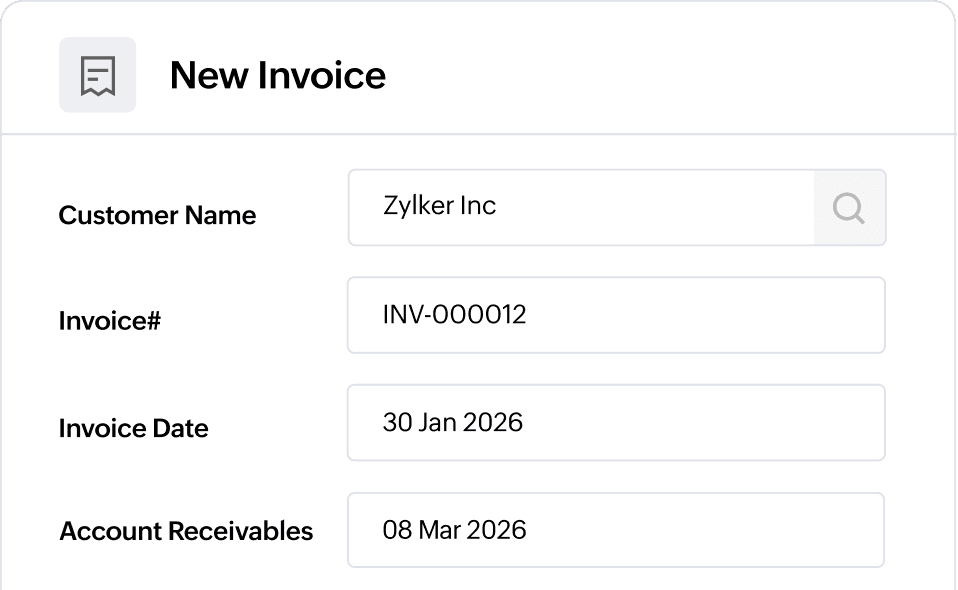

Effortless digital bookkeeping

Create and send professional invoices instantly from anywhere, track their status, and get paid online for all your hard work. You can also record expenses within Zoho Books.

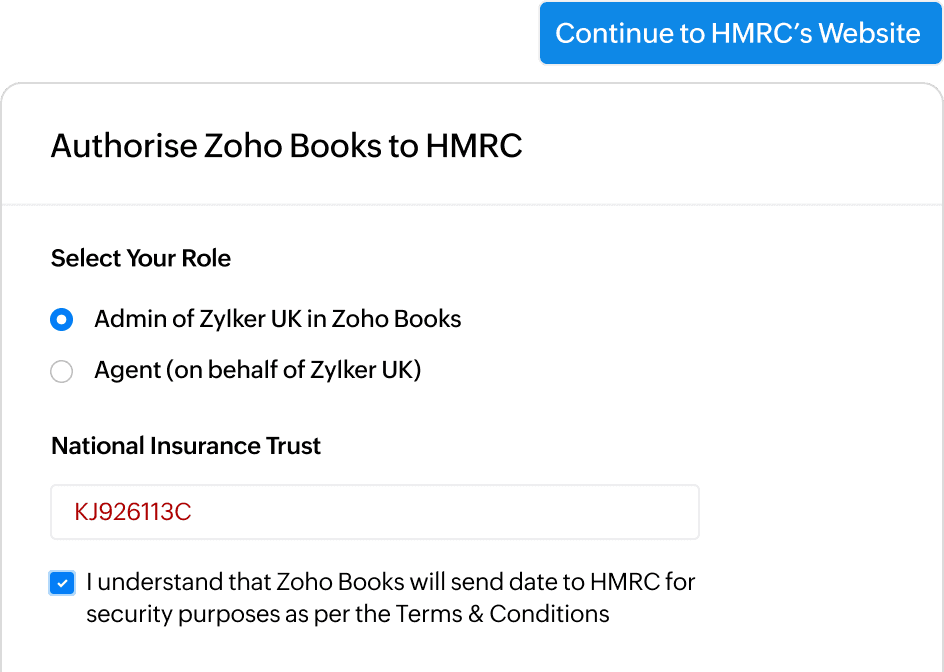

Stay connected with HMRC from Zoho Books

Zoho Books helps you stay connected with HMRC. Once your Zoho Books account is authorized, you can effortlessly manage Income Tax obligations and stay tax-season ready.

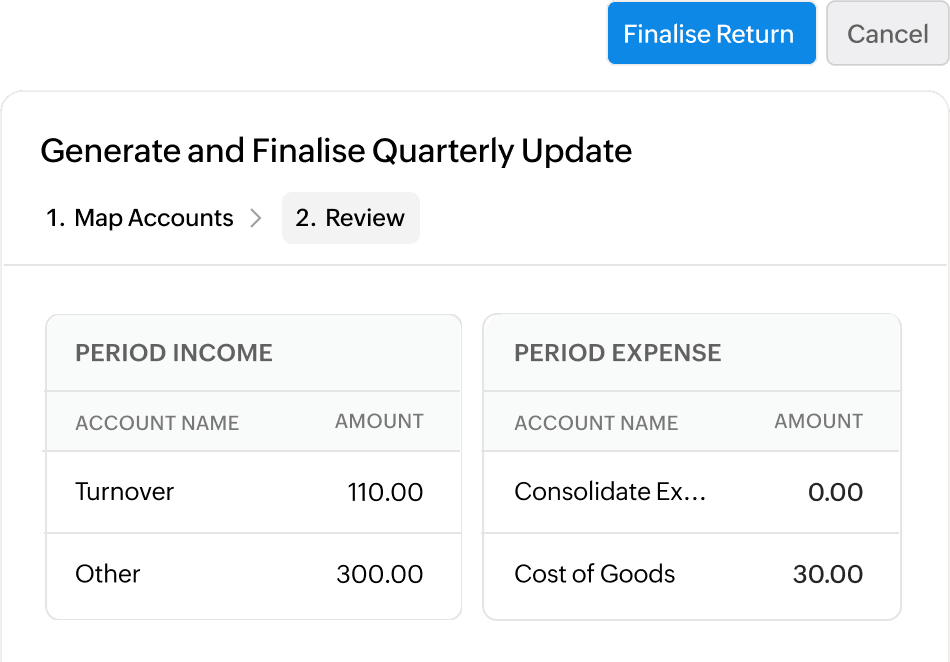

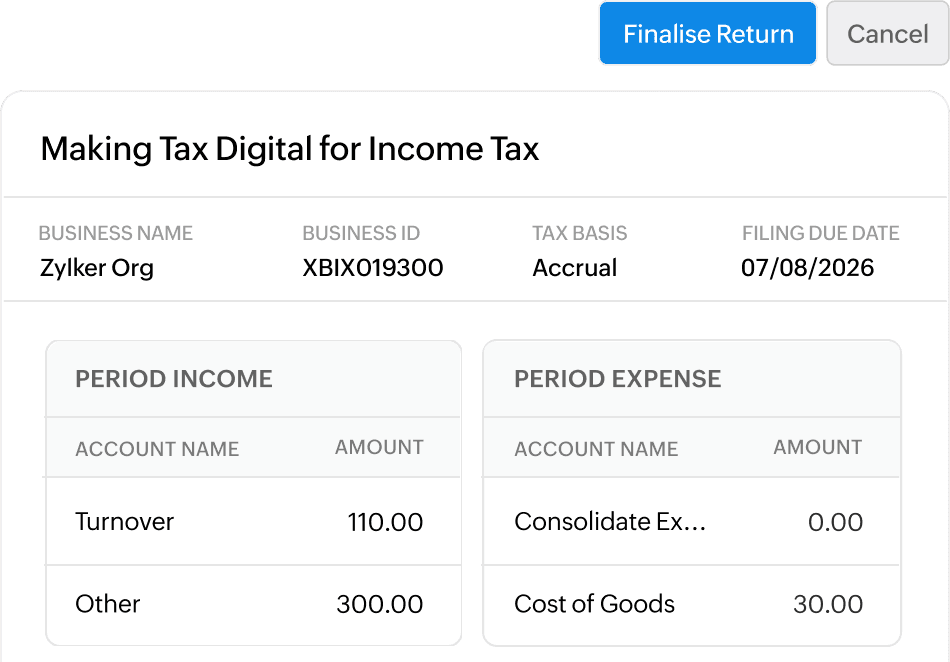

Generate and review your returns

Based on your account, Zoho Books will let you know the consolidated income and expenses in the review page. You can review the numbers and then generate the quarterly update.

Submit quarterly updates to HMRC

For those eligible for the MTD Income Tax mandate from April 2026, you will be able to file quarterly income tax updates to HMRC directly from Zoho Books.

What more can you do with Zoho Books?

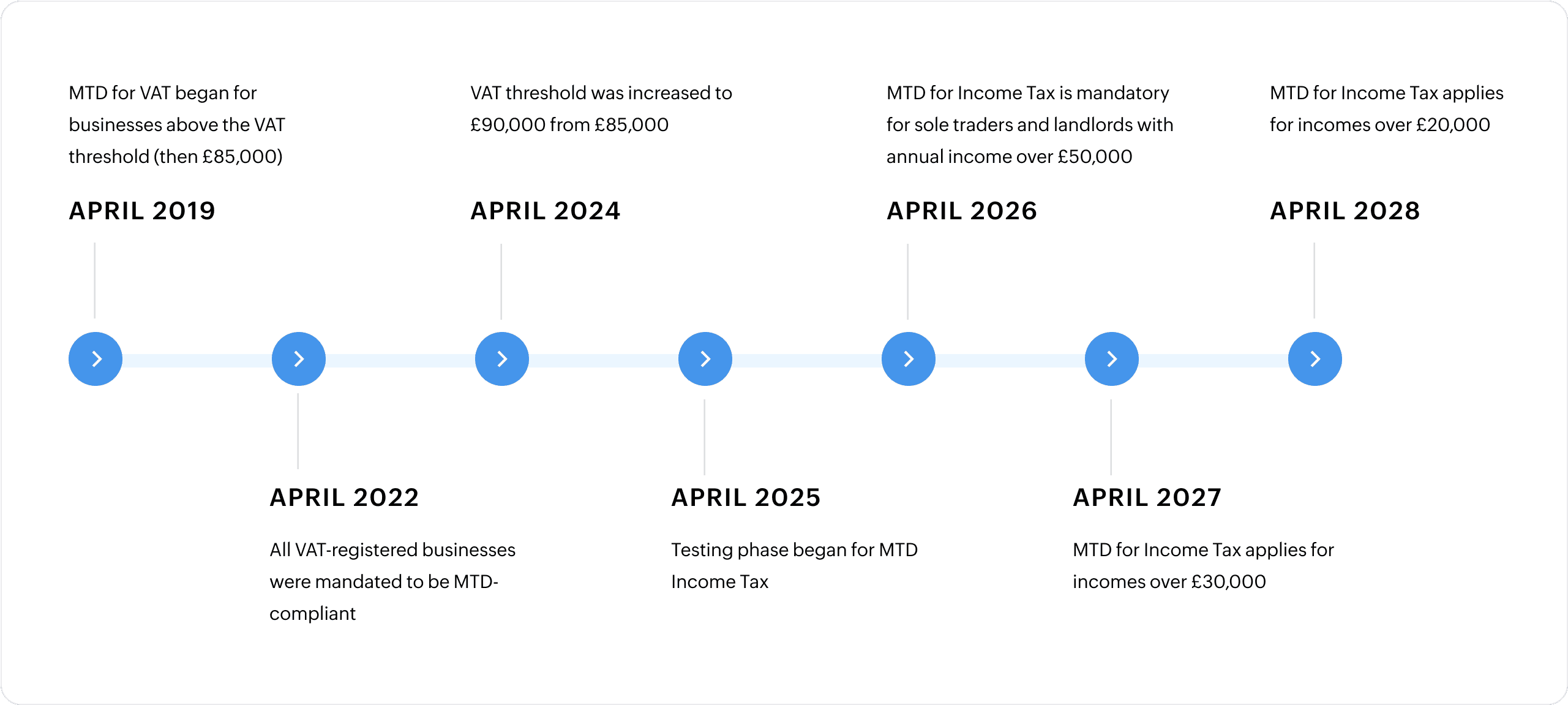

MTD timelines from HMRC you don't want to miss.

Trusted by businesses and accountants worldwide

We have been using Zoho Books for the past ten years, and it has always been a sturdy and reliable software for our financial needs. Our company has grown to almost 400 employees worldwide, where we use Zoho Books to handle our accounting and invoicing needs. It is a fantastic product!

Julian Weber

CEO, SELISE Rockin Software

Explore more MTD resources

Frequently Asked Questions

MTD : Your questions answered

In the following section, we hope to provide sufficient clarification on MTD and Zoho Books. For more information on VAT record keeping, we suggest you visit the VAT knowledge center of HMRC or our knowledge center.

What is Making Tax Digital (MTD)?

Making Tax Digital or (MTD) is HMRC's initiative that requires businesses and individuals to start maintaining digital records of their income and expenses. As a taxpayer, you are required to use online accounting software to submit your VAT or Income Tax returns to HMRC.

Is MTD mandatory for businesses and individuals?

While MTD is already mandatory for all VAT-registered businesses since 2022, sole traders with annual income of £50,000 and above will have to be MTD-compliant from April 2026.

Can I submit my returns via spreadsheets?

Yes, but make sure you're using spreadsheets that can be integrated with accounting software to upload in HMRC. Bridging software can also help you connect your spreadsheets to HMRC systems.

Can I opt out of MTD?

MTD is mandatory for all businesses and individuals. However, you can opt out of MTD. Please check the eligibility here.

Is Zoho Books MTD compliant?

Yes, Zoho Books is HMRC-recognised, MTD compliant accounting software. All VAT-registered businesses and sole traders who are eligible for MTD Income Tax can switch to Zoho Books to simplify accounting, compliance, and online return filing.

How can I get started with filing VAT returns in Zoho Books?

You can get started right away! Check out how to set up MTD for VAT in Zoho Books.

Is Zoho Books ready for MTD Income Tax?

Yes, Zoho Books is ready for MTD Income Tax. Sole traders can now prepare for self assessment by generating SA103F/SA103S report if they don't meet the revenue threshold set by HMRC. For sole traders with annual income of over £50,000 in the 2024-25 tax year, Zoho Books supports quarterly income tax return filing to HMRC. Sole traders can sign up for the FREE plan of Zoho Books to get started right away.