VAT

Value Added Tax or VAT is a tax that is charged on the sale of most goods and services by registered businesses in the UK. To enable VAT for your Zoho Expense account, you should choose your country as United Kingdom while creating a new organisation. Configuring VAT will allow you to associate VAT with the expenses you record in Zoho Expense.

Enable VAT

Once you enable VAT, you will be able to apply VAT to your expenses. You can also gain insights of your taxable expenses by generating tax analytics.

To enable VAT:

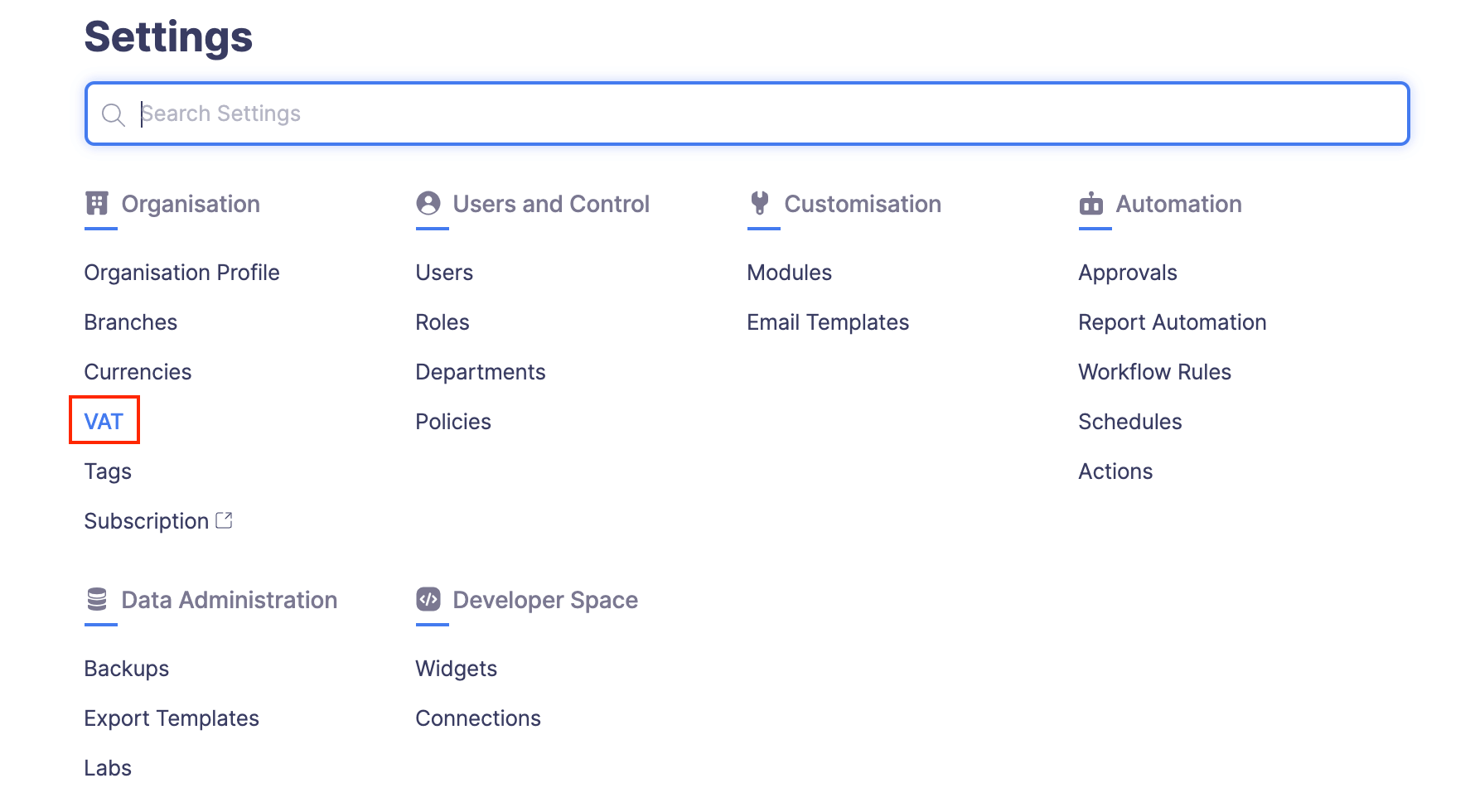

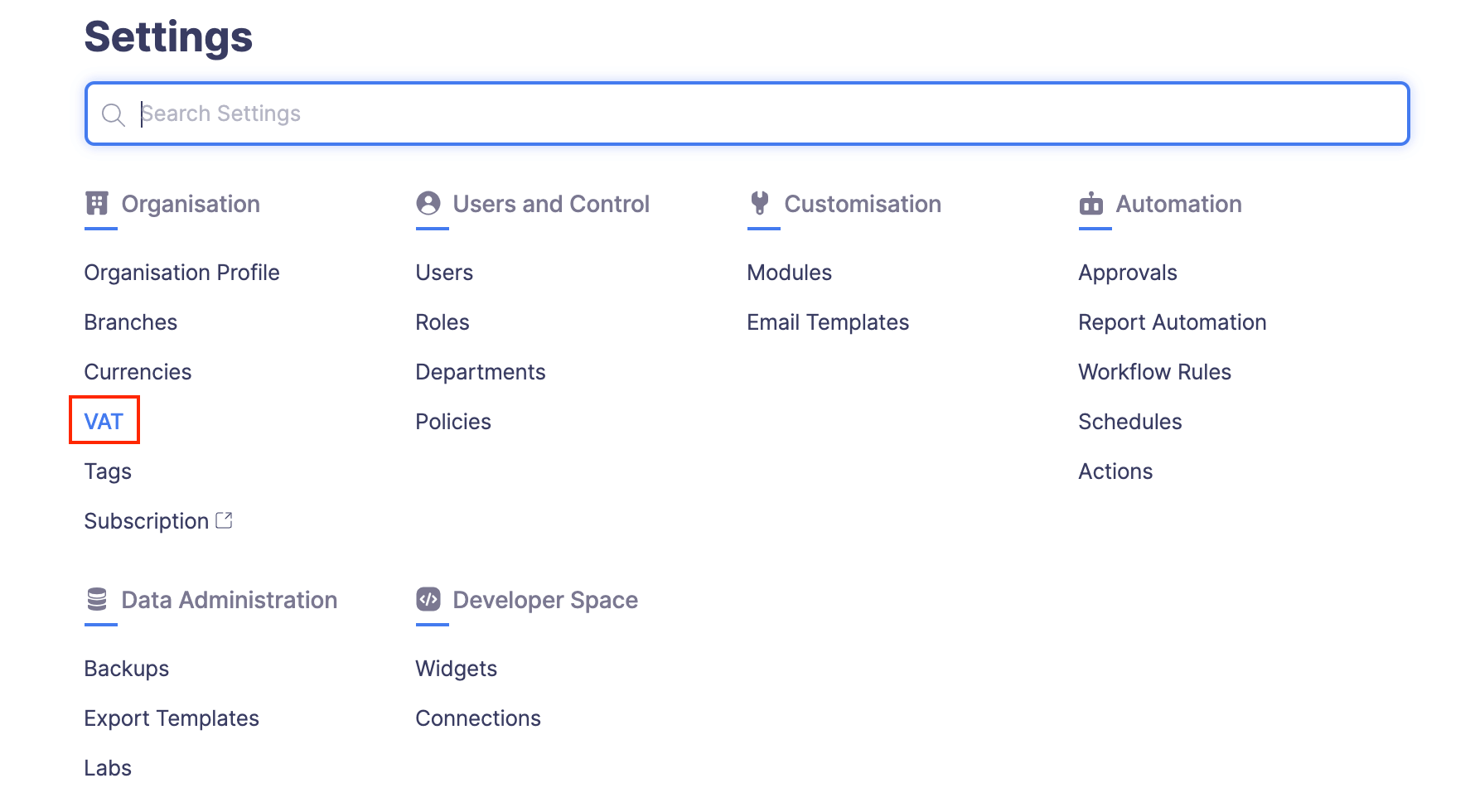

- Click Admin View.

- Click the Gear icon at the top right side of the page.

- Go to VAT under Organization.

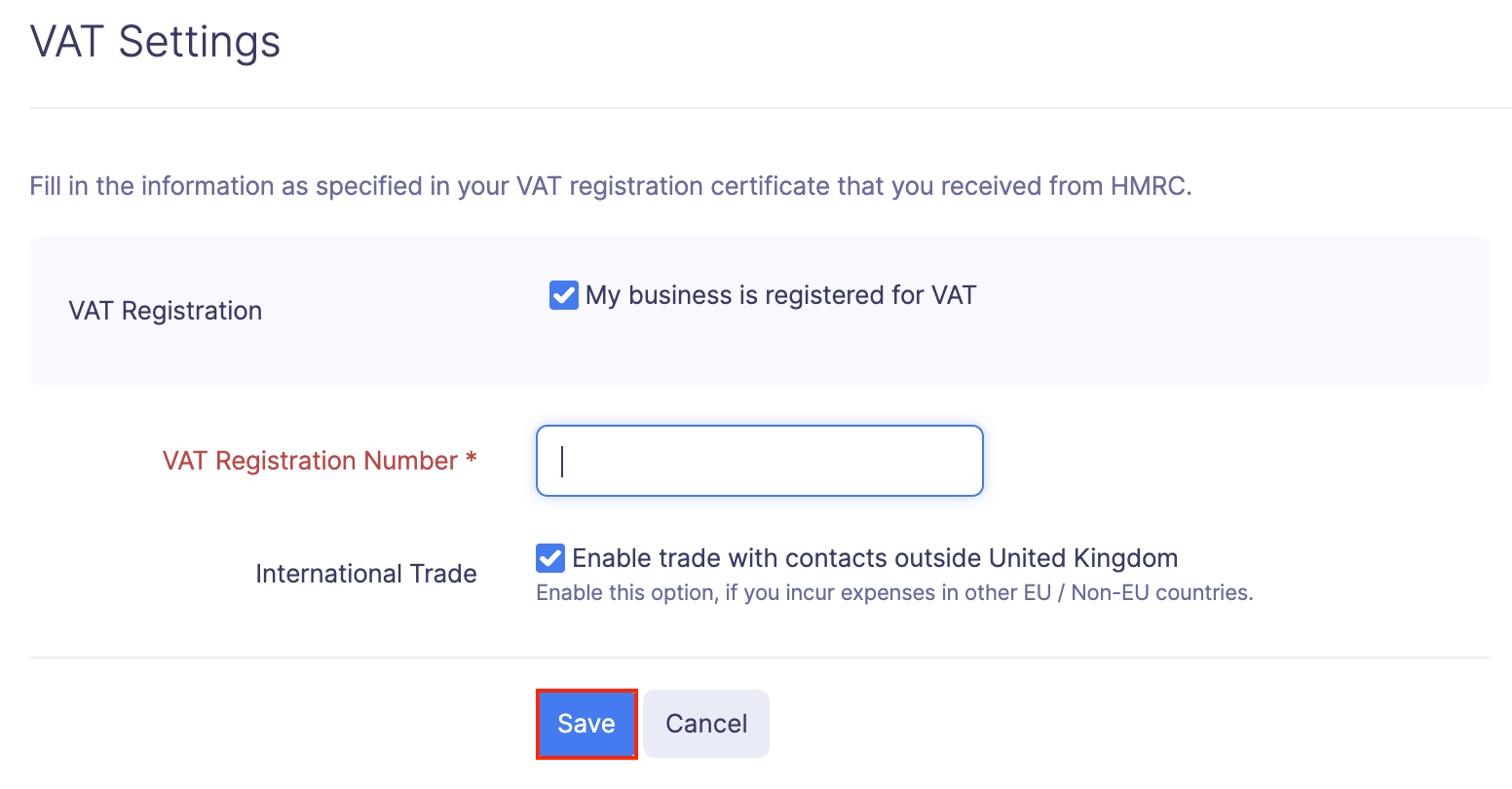

- Mark the My business is registered for VAT option, if your business is registered for VAT.

- Enter your organisation’s VAT registration number.

- If you incur expenses in other EU or non-EU countries, mark the Enable trade with contacts outside the United Kingdom option.

- Click Save. VAT will be enabled for your organization.

If you want to edit your VAT settings, click the Gear icon at the top right corner. Make the necessary changes and click Save.

Note: If the Enable trade with contacts outside United Kingdom option is disabled, then all the expenses that are incurred in foreign currencies (non GBP) will be assumed to be made in the UK, and VAT will be enabled for those expenses.

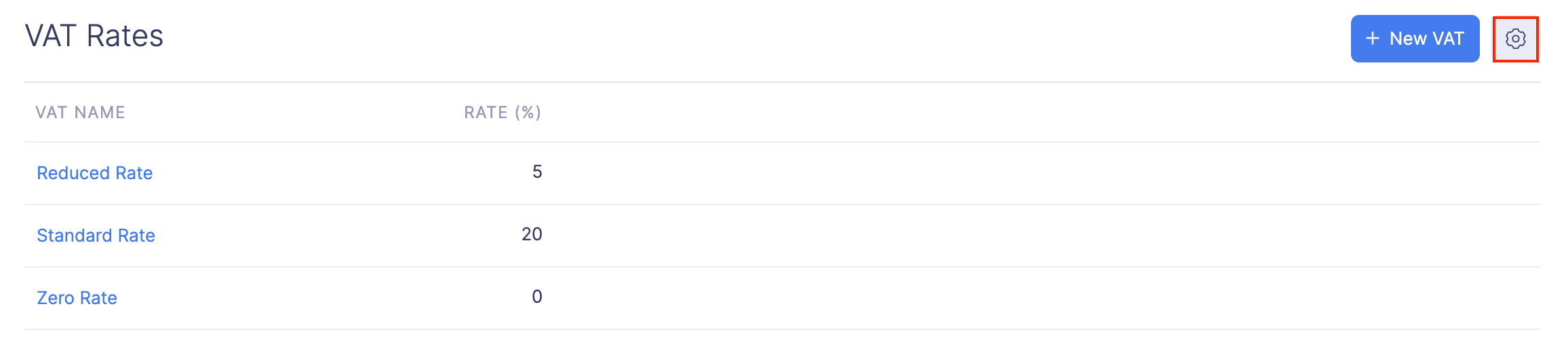

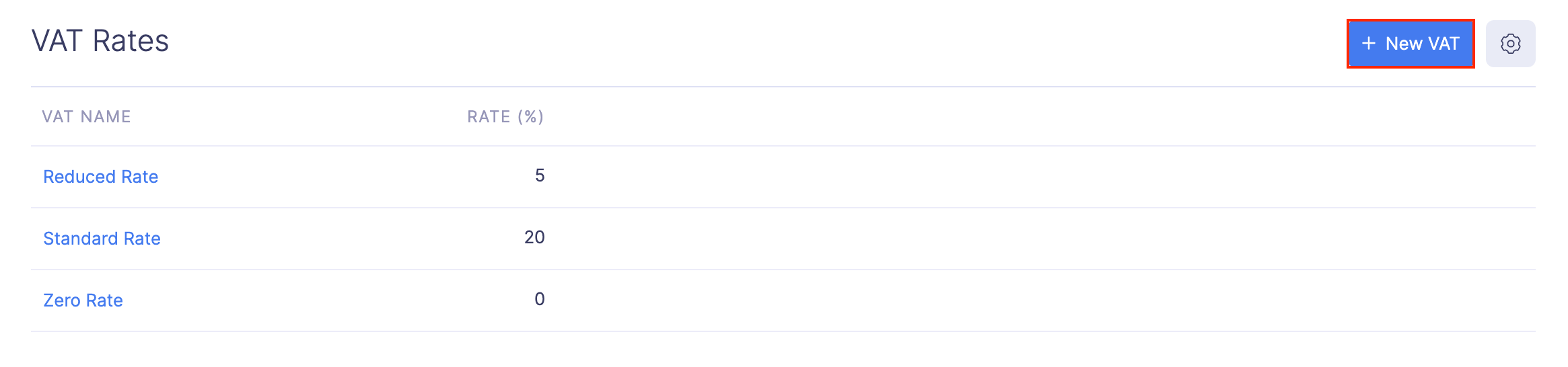

VAT Rates

The UK government and the HMRC has defined the VAT rates. Three default VAT rates will be enabled once you configure VAT in Zoho Expense.

| Rate | % of VAT | What the rate applies to |

|---|---|---|

| Standard Rate | 20% | Most goods and services. |

| Reduced Rate | 5% | Some goods and services, eg: Children’s car seats and home energy |

| Zero Rate | 0% | Zero-rated goods and services, eg: Most food and children’s clothes |

Learn more about the VAT rate on different types of goods and services.

Add a New VAT Rate

Once you enable taxes, you can add the VAT rates in Zoho Expense based on your country’s tax policies.

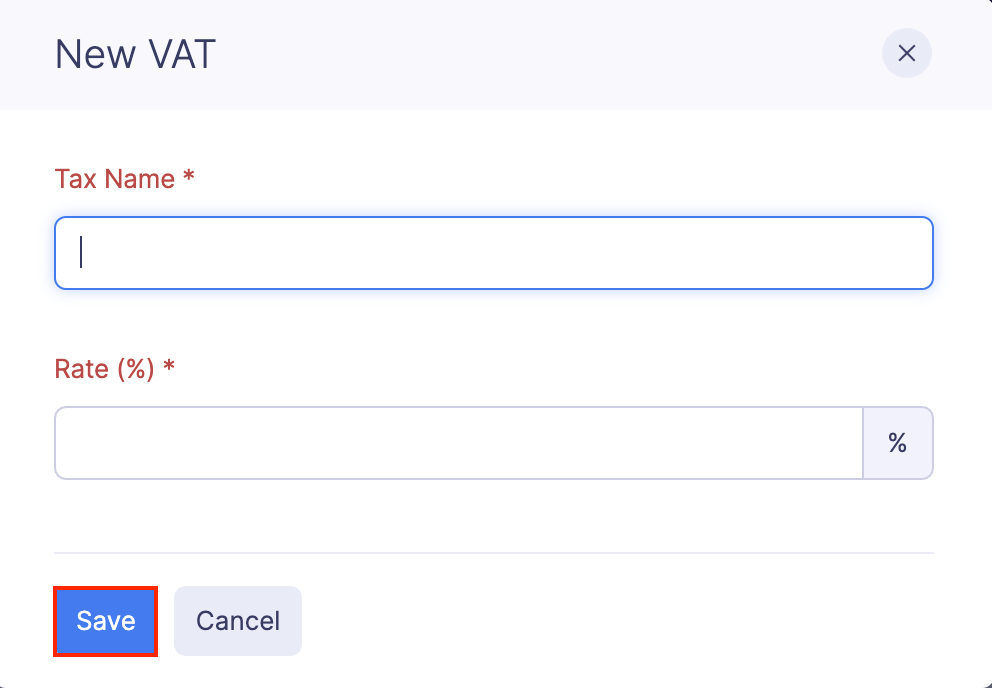

To add a new VAT rate:

- Click Admin View.

- Click the Gear icon at the top right corner of the page.

- Go to VAT under Organization.

- Click + New VAT at the top right corner of the page.

- Enter a name for your tax and set a percentage.

- Click Save to save your newly created VAT.

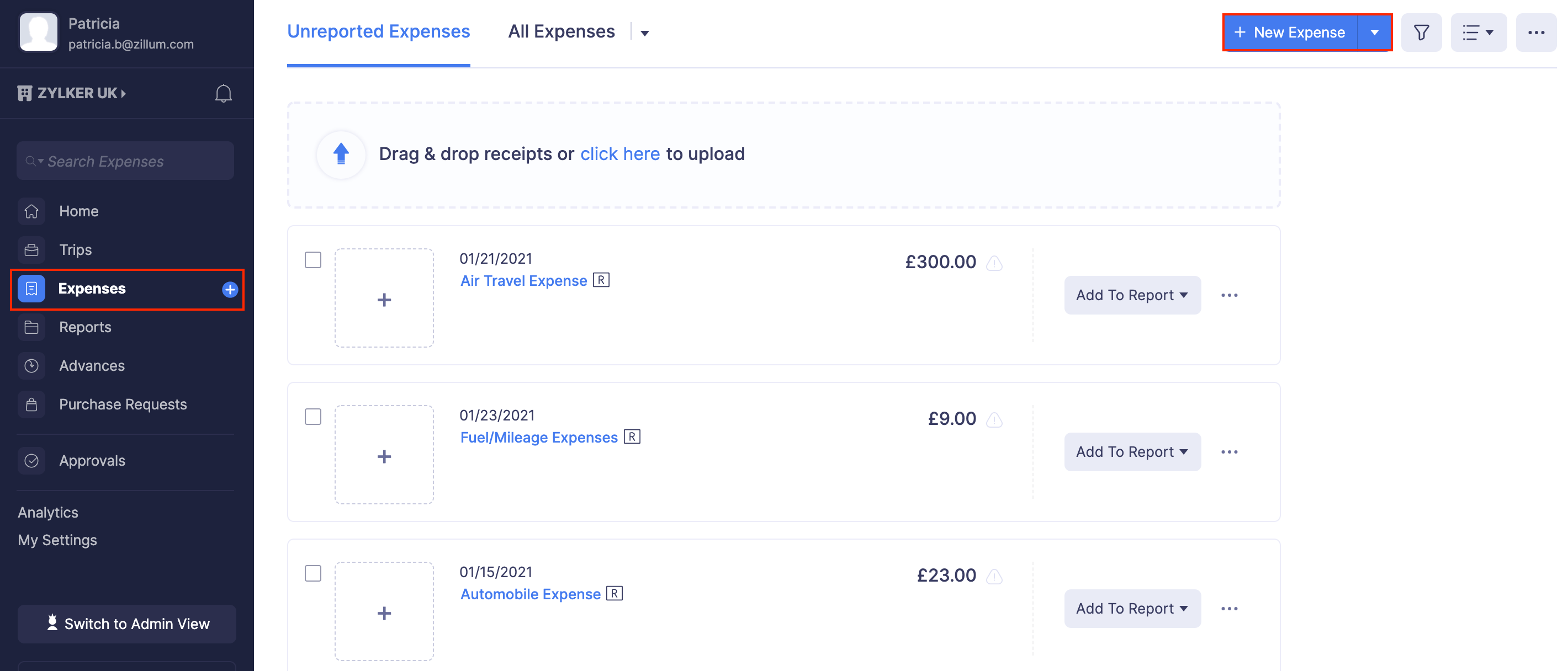

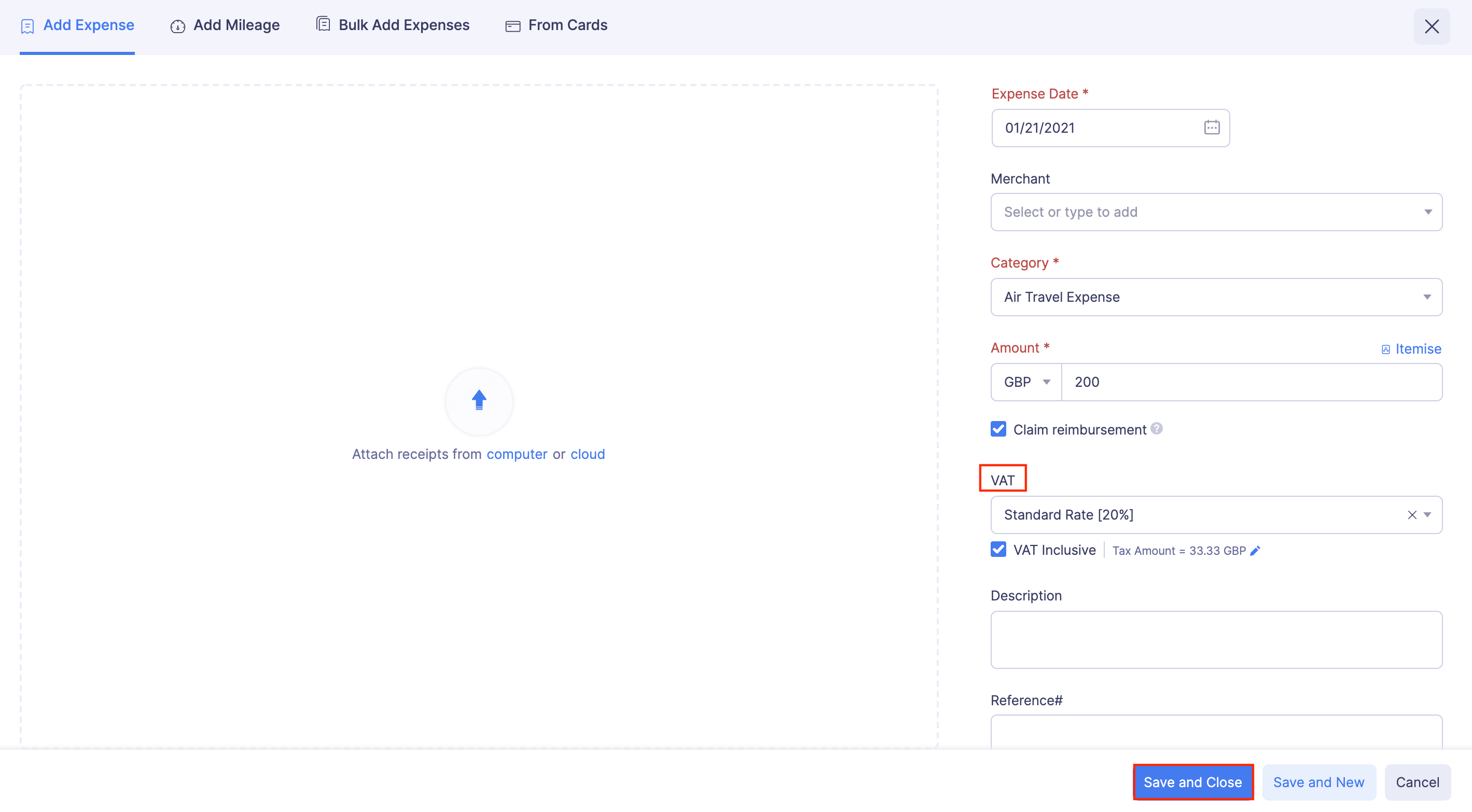

Apply VAT to Expenses

- Go to the Expenses module in the left side bar.

- Click + New Expense at the top right corner of the page.

- Enter essential details such as Date, Category, and Amount.

- In the VAT dropdown, select the VAT rate you want to apply.

- If the amount you’ve entered is inclusive of VAT, mark the Tax Inclusive option.

- Click Save and Close to save your newly created expense.

Yes

Yes