Plans for Zoho Payroll

Zoho Payroll offers flexible pricing plans designed to support businesses of all sizes. Visit our pricing page to explore the features included in each plan.

Free Trial

Before subscribing to a paid plan, you can sign up for a 14-day free trial to experience all the features Zoho Payroll. You can upgrade to the paid plan anytime during or after the trial.

NOTE Learn how to sign up for Zoho Payroll.

Paid Plan

Zoho Payroll currently offers 2 pricing plans: Standard and Professional.

Subscribe to a Paid Plan

To subscribe to a paid plan:

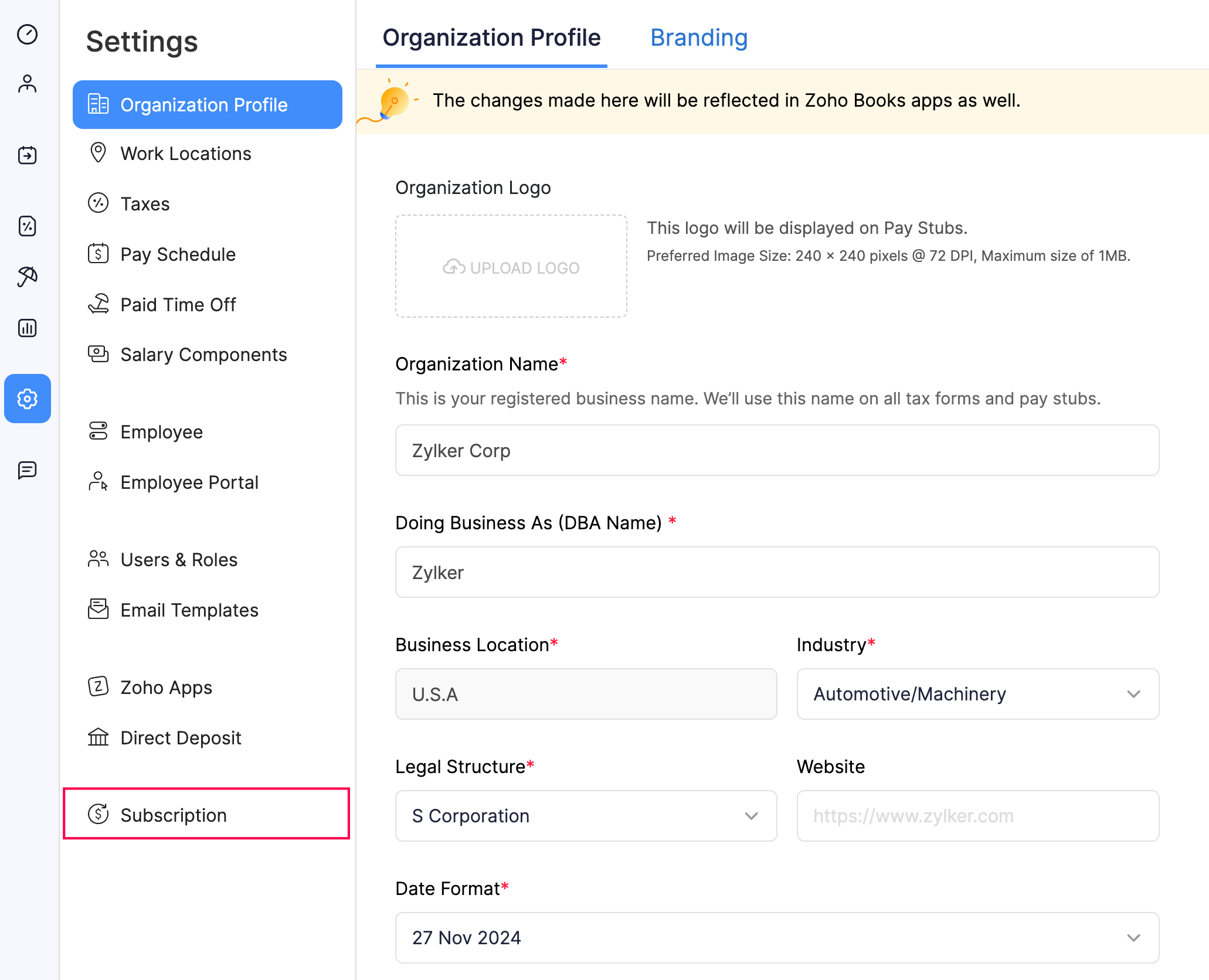

- Go to Settings and click Subscription.

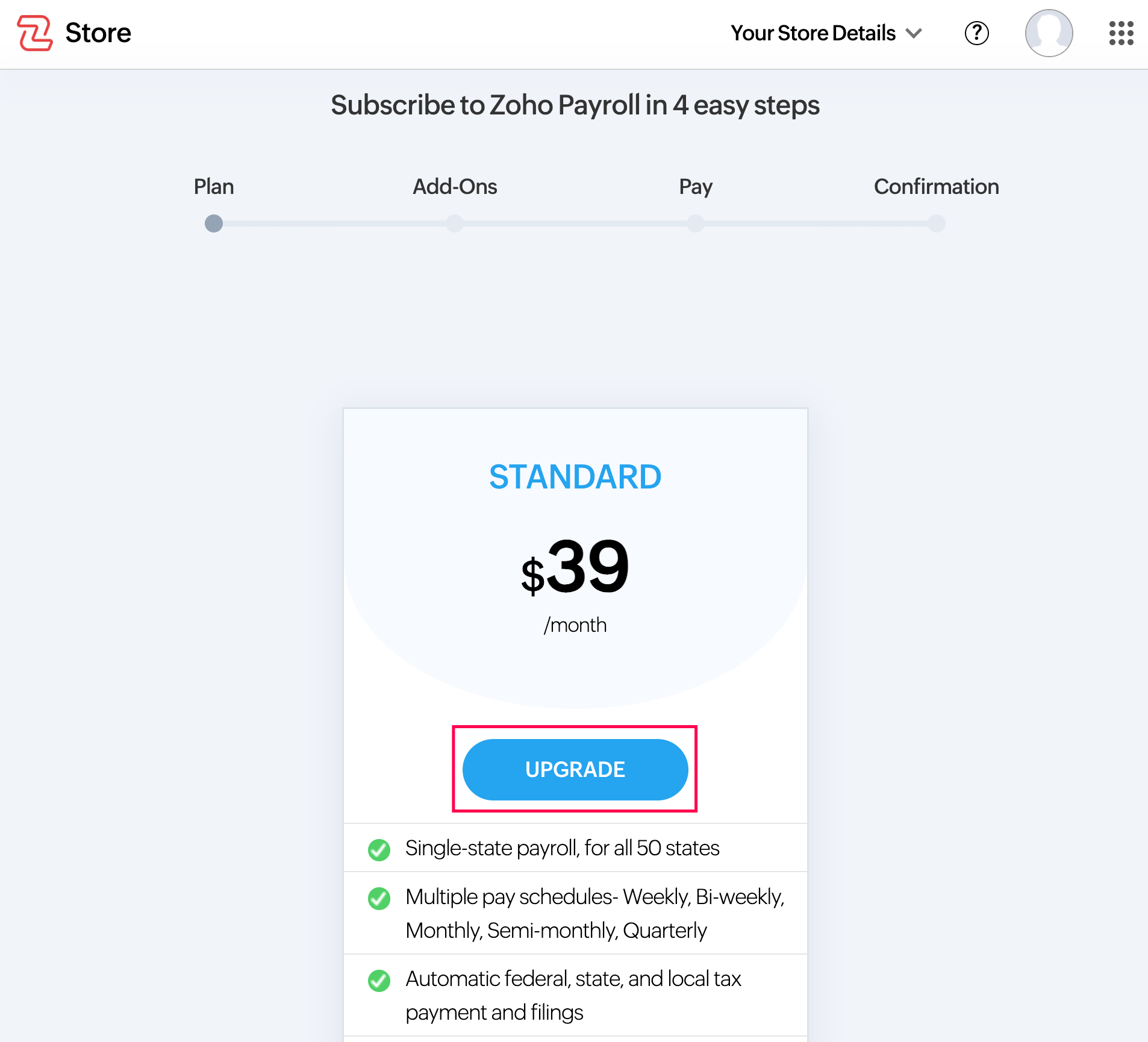

You’ll be redirected to the Zoho Store.

You’ll be redirected to the Zoho Store. - Click Upgrade under your preferred plan.

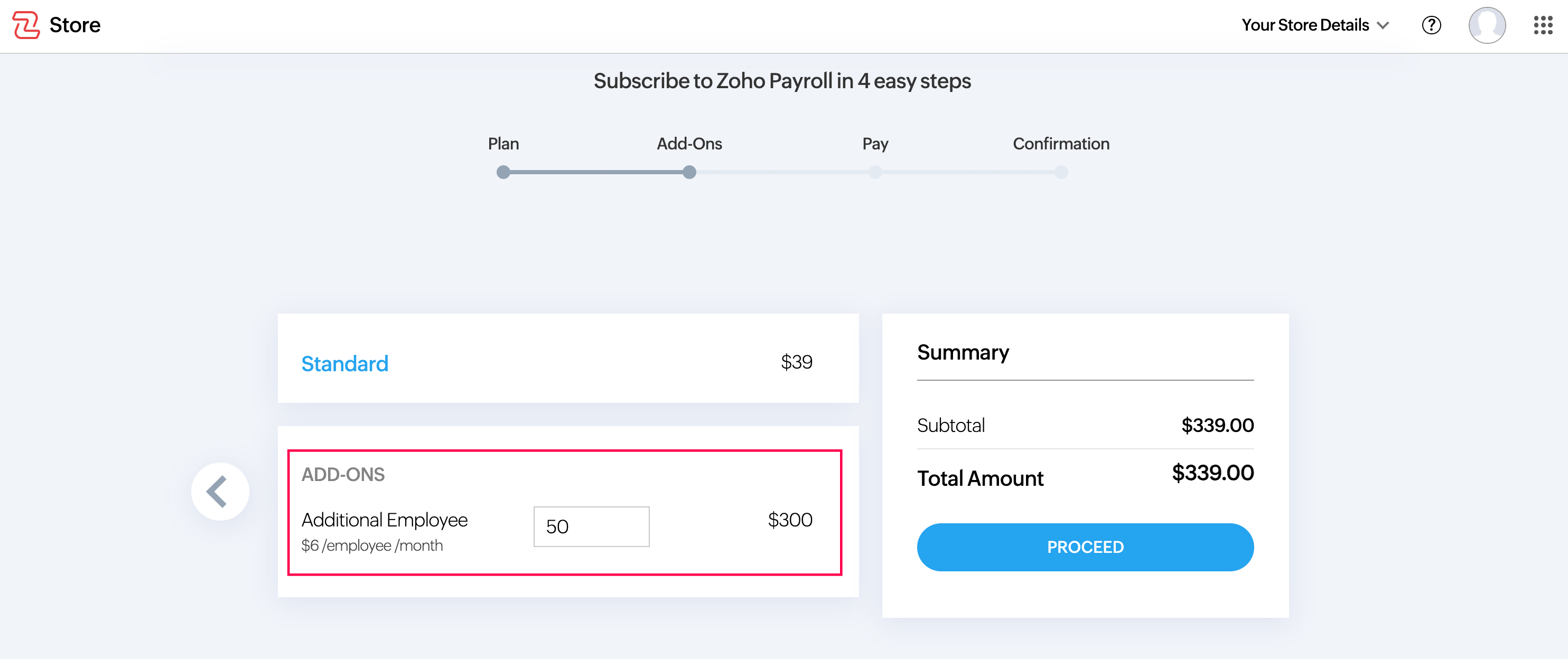

- In the Add-Ons section, specify the number of additional employees units you need.

- Click Proceed and enter your billing and payment details.

INSIGHT

- Your billing details will be auto-filled if you’ve previously purchased a paid plan for another organization.

- Local taxes will be calculated based on your billing address, and the total payable amount will be displayed.

- Review the total amount and proceed to make the payment.

Once your payment is processed successfully, your organization will be upgraded to the paid plan.

Add-Ons

As your business grows, you may need additional features or employee units. Zoho Payroll offers add-ons to scale with your needs.

Employee Add-Ons

Let’s say your current subscription allows you to add up to 10 employees to your organization. However, you want to add more than 5 employees. Then, you can purchase the required number of employee units as an add-on. Here’s how:

- Go to Settings and click Subscriptions. You’ll be redirected to the Zoho Store.

- Click Upgrade Add-Ons.

- Select the required number of additional employee units and click Proceed. You’ll be redirected to the Confirm Order section.

- Verify your order details and the payment method.

INSIGHT You can update the payment method if required. Learn how.

- Click Make Payment.

Once the payment is processed, the additional employee units will be added to your Zoho Payroll organization.

1-Day Processing Speed Add-On

Processing speed determines how quickly funds move from your business bank account to your employees’ accounts.

The 1-Day Processing Speed Add-On allows you to approve payrolls up to 1 business day before the pay date.

NOTE Eligibility to purchase this add-on depends on your organization’s payroll history and successful bank verification. Once eligible, you can purchase the add-on.

This add-on is employee-specific. For example, if you have 10 employees and only 4 are paid via Direct Deposit, you can purchase 4 add-ons.

To purchase the 1-day processing speed add-on:

- Go to Settings and click Direct Deposit.

- Click Buy Add-On.

- In the popup, enter your payment details and click Make Payment.

Once the payment is processed, the 1-day processing speed add-on will be activated for your organization.

Additional Charges

To address payroll-related requirements like payment or tax filing failures, Zoho Payroll includes some additional charges. These charges will either be included in your next billing cycle or as a separate invoice. Below is an overview of these charges:

| Scenario | Unit | Description | Cost |

|---|---|---|---|

| Wire Transfer | Per wire transfer | Fee for processing payroll through employer-initiated wire transfers. | $10 |

| Failed Employee Payment | Per employee | Fee for employee account validation or payment failures. | $8 |

| Employer Fund Transfer Failure | Per return | Fee for unsuccessful employer fund transfers, including wire fees for each return. | $100 |

| Delayed Tax Filing | Per filing | Fee for late tax filings caused by unavoidable circumstances, excluding delays due to processing issues. | $150 |

| Form W-2 Postal Delivery | Per employee | Fee for mailing printed Form W-2s to employees or your organization via postal service. | $3 |

| Amended Return | Per filing | Fee for filing an amended tax return. | $150 |

NOTE These charges are automatically applied when applicable and will appear on your renewal invoice. We recommend reviewing your billing details regularly to stay informed about any such charges.