What should I do if the filing status and withholding allowance of my employees change?

If an employee’s tax situation changes (for example, due to marriage or dependents) you can update their federal and state tax withholding details.

To edit the tax details of an employee:

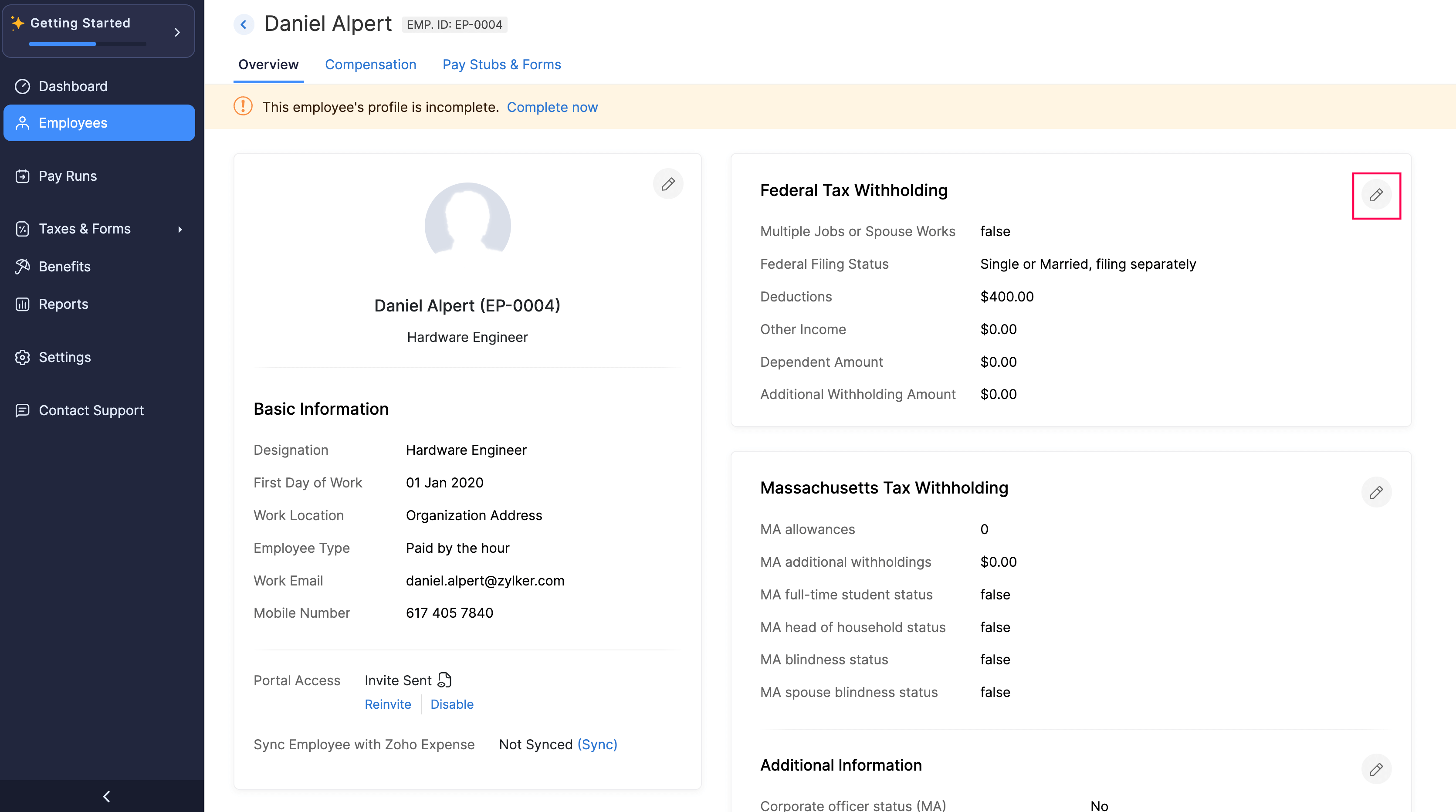

- Go to the Employees module.

- Click an employee.

- To edit the employee’s federal tax details, click the edit icon in the Federal Tax Withholding section.

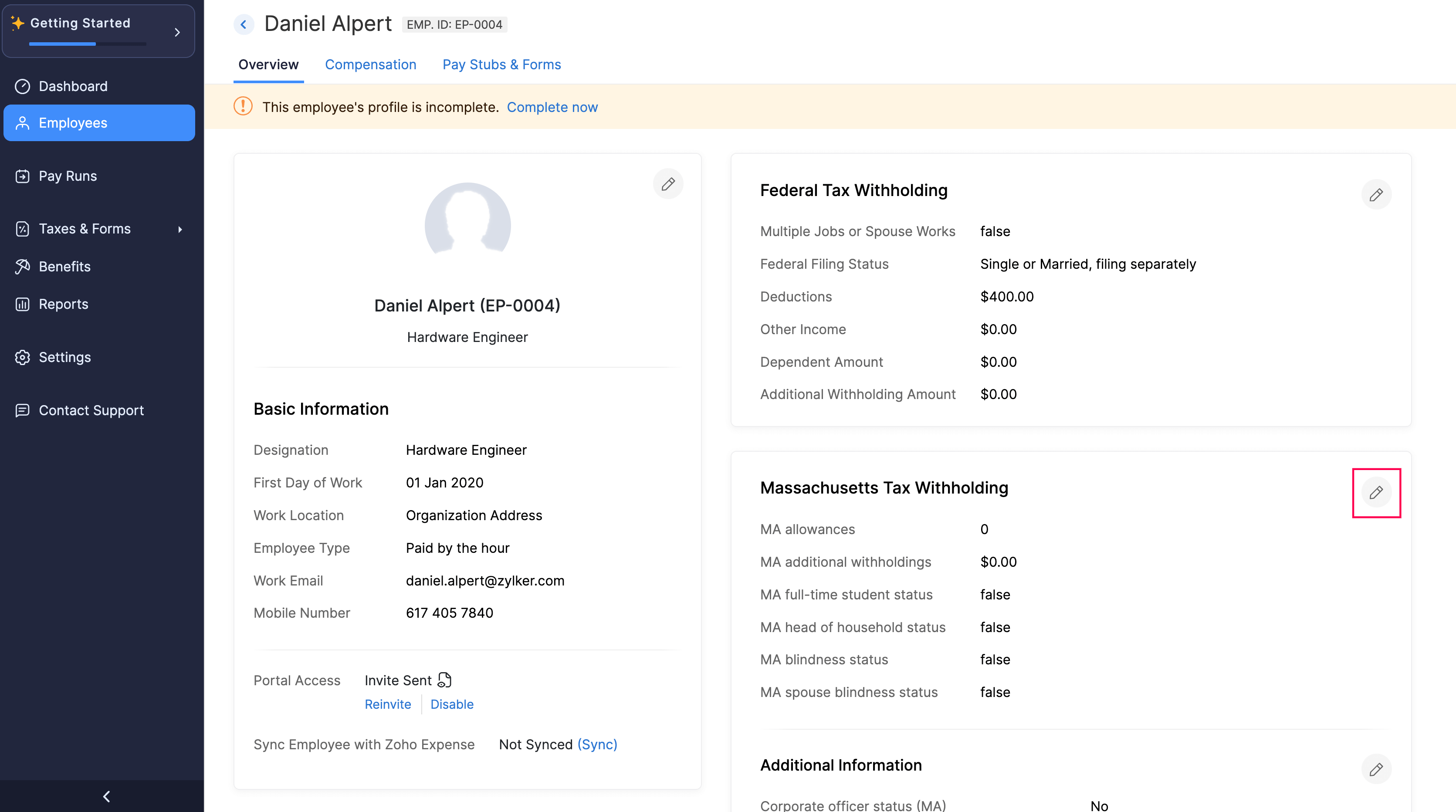

- To edit the employee’s state tax details, click the edit icon in the Tax Withholding section for the corresponding state.

- To edit the employee’s federal tax details, click the edit icon in the Federal Tax Withholding section.

- Make the necessary changes and click Save.

NOTE These changes will apply only to upcoming pay runs. They will not be reflected in any pay run that is already in the draft or approved stage.