- HOME

- Payment collection and compliance

- FAQs on ACH, SEPA, Direct Debit, BACS and other Subscription Payment Methods

FAQs on ACH, SEPA, Direct Debit, BACS and other Subscription Payment Methods

Q. What is an ACH payment?

Automated Clearing House (ACH) payment is an electronic money transfer system between bank accounts. These payments are processed by a centralized ACH network in the United States. ACH payment setup is suitable to collect both one-time and recurring payments. The customers only need to authorize the merchant to directly debit the payments automatically from their bank account at specific billing intervals.

The payments are then divided into batches, and processed at the end of that business day.

Q. How long does ACH network take to process payment?

ACH payments are processed in batches. It typically takes between three and five days for the transfer to be complete, and for the funds to appear in the account. However, there is a provision of same-day processing in ACH, where the outstanding requests will be processed by bank three times a day, instead of only once at the end of the day, to speed up the payments. All types of ACH payments are eligible for same-day processing, except international transactions (IATs) and high value transactions above $25,000.

Q. Are there any penalties associated with ACH payment processing?

Yes, there are penalties in ACH payment processing. They are applied in the following scenarios.

When a merchant is not authorized to debit an amount from the customer's bank, or when the customer's bank did not enable ACH provision. In such cases, the payment will be rejected and will attract a penalty fee.

When the frequency of withdrawals from the savings account exceed the prescribed limit of six per month.

When the account is short of funds to cover the initiated payment, a non-sufficient penalty fee shall be applied. However, charging this type of penalty depends upon the financial institution.

Q. What are the benefits of ACH for businesses?

Lower processing fee compared to paper checks and credit cards

The cost involved in transaction through credit card ranges between 2% to 5%, while checks involve printing, postage, and other charges. ACH generally costs between $0.20 - $1.50 per transaction.

Secure

ACH transfer is only initiated after strictly authorizing both sender and receiver. It therefore eliminates the intrusion of third parties, risk of fraud, and tampering.

Set it and forget it

ACH payments are suitable for subscription businesses, as payments can be debited automatically from the customer's account at scheduled dates once authorized by the customers.

Reduced risk of payment failure

Because this is a bank to bank transfer, there is less chance of payment failure or non-payment of invoice when compared to other online methods of payment like credit cards and debit cards.

Q. What information does a merchant need from customers who want to pay by ACH?

A merchant needs to obtain the following information from customers to initiate ACH payment processing:

Customer account name

Routing account number

Account type (savings or checking)

Besides this information, a merchant must acquire authorization to debit or refund a customer's account. That authorization document should include details such as transaction amount, one-time or recurring payment (if its recurring), the billing period, and frequency.

Q. How do you start accepting ACH payments?

For the merchant to accept payments through ACH, the customer must get an authorization form from their bank and provide it to the vendor. This form authorizes the vendor to pull funds from the customer's account.

The vendor (Originator) should send the data files that include details like transaction type (credit or debit), routing number and customer's account number to his own bank(Originating Depository Financial Institution)

The vendor's bank will send these data files to the ACH network in batches.

The ACH network will forward these files to the customer's bank account (Receiving Depository Financial Institution).

The funds will then be pulled from customer's bank account. If they get credited to the vendor's account, the transaction is successful.

Q. What is the cost associated with ACH payments?

ACH payment cost depends on various factors, including transaction volume. Businesses with large transaction volumes have less ACH fee associated per transaction.

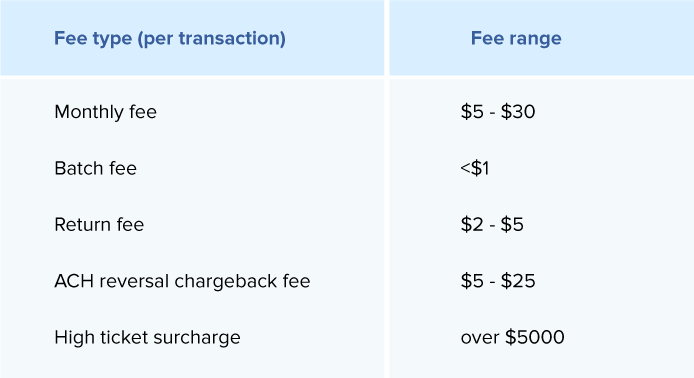

Other than this, ACH payment fee varies between banks and third parties. As per the data from NACHA, the average ACH processing fee is 11 cents. Many types of fees may be involved while accessing ACH through third party, such as:

Q. Which regions support ACH payments?

ACH is a US-based financial network. USD can be sent to any bank account in the US that accepts ACH payments. You can also make ACH payments to bank accounts in Canada, Mexico, United States, United Kingdom, Australia, European countries, Hong Kong, India, and New Zealand.

Q. What is SEPA Direct Debit?

SEPA (Single Euro Payments Area) is a payment method that was introduced to unify payments across Europe. It allows a merchant to pull amount from the customer s account directly after getting the consent from the account holder or the customer. The consent document is called a mandate, and has to be signed by the customer to authorize the vendor to collect payments directly from their bank account.This is a bank-to-bank transfer method used in countries belonging to the European Union.

Q. What are the advantages of SEPA Direct Debit (SDD) for businesses?

Using SDD, cross-border payments can be received with the same ease and comfort as those received within the home country.

SDD can be set up to automatically obtain recurring payments at scheduled intervals. This way, a business can avoid delayed payments.

With SDD, payment failures are low compared to credit cards, because cards eventually expire or are cancelled, leading to payment failure. Payments through SDD are processed directly between banks, reducing payment failure.

There is no cap on the amount per transaction, unlike in other types of international transactions.

Q. What are the prerequisites to accept payments through SEPA Direct Debit?

A merchant need to get approval from the customer in FAQs on MRR, Churn rate, ARR, ARPU and other Key Subscription Metrics order to debit the funds from the customer's account through SEPA network. This approval can be obtained through a Mandate.

A mandate is a signed document that authorizes the vendor to withdraw funds form the customer's account at anytime. With this document, a vendor can pull payments in the future without asking permission from the customer each time.

After obtaining the mandate, the merchant must notify the customer 14 days before pulling funds, informing them that the amount will be debited from the customer's account. If it is a recurring payment, sending one notification is enough.

Q. What information does a SEPA direct debit mandate need to have?

The customer's mandate must have the following information:

Name of the customer

IBAN of the customer

BIC code of the customer

Payment type

Merchant's details

Signature of the customer

Q. How payments through SEPA Direct Debit are processed?

The merchant is authorized by the customer to debit payments from customer's account by issuing mandate with relevant details.

Then, to transfer funds, the merchant will send a payment request along with a copy of the mandate to his bank.

The merchant's bank will authorize and forward the mandate to the customer's bank.

The merchant will get a notification on the payment status within 3-5 days.. If successful, the funds will be credited to the vendor's bank account. If failed, the merchant will receive a notification with the reason for failure

Q. What is a mandate in SEPA Direct Debit?

A mandate is a legally binding document that authorizes and allows the vendor to debit funds from the customer's account. It can exist in paper or electronic form, with the customer's signature.

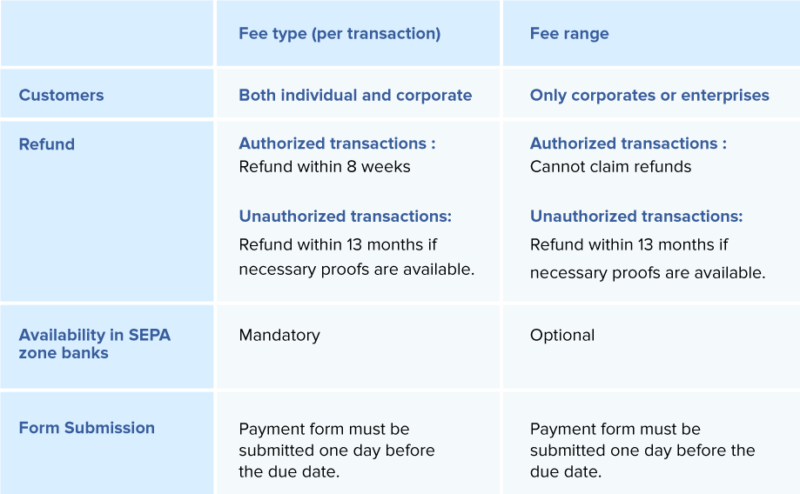

Q. What is SEPA Direct Debit Core transfer scheme?

The SEPA Direct Debit core scheme or B2C(Business to Customer)scheme can be used by both individual customers and enterprises to collect payments. Providing the core scheme is mandatory for all SEPA banks providing direct debit option in euros.

Users under the core scheme can claim refunds. They will receive their refund within eight weeks. If there is no valid mandate, the amount will be refunded within 13 months from the payment date.

Q. What is SEPA Direct Debit B2B transfer scheme?

The SEPA Direct Debit Business to Business scheme is only meant for fund transfer between enterprises or corporations. This scheme is not meant for B2C businesses. B2B scheme users cannot claim refunds for authorized transactions. Whereas, for unauthorized transactions, refunds can be obtained only if it is proved that there is no valid mandate within 13 months from the debit date.

In B2B, the payments must be made a day before the due date. If the amount is not credited due to any technical issues, notification will be sent within two days after the payment is initiated.

Q. How SEPA Direct Debit B2B scheme is different from B2C scheme?

- B2B is a voluntary scheme, unlike B2C. Hence, it is not mandatory for all banks to provide B2B direct debit facility.

Customers using the B2B scheme do not have the provision to claim refund, unlike users under the B2C scheme.

Q. What is SEPA Credit Transfer Scheme?

The SEPA Credit Transfer Scheme (SCT) defines a standard procedure to transfer one-time credit between banks in the SEPA zone. SCT simply debits funds from one euro account and credits them to another euro account. This means there is no need for merchant authorization using a mandate like in SEPA Direct Debit transfer. Using a unique IBAN (International Bank Account Number), a customer can make payments to vendors located anywhere in the SEPA zone.

Q. What is SEPA instant credit transfer scheme?

The SEPA instant credit transfer scheme enables the debtor to instantaneously transfer funds. Through this scheme, the creditor will receive the payment within 10 seconds. It is available 24/7 throughout the year, accelerating direct debit payments.

Q. What is SEPA Cards Framework?

The SEPA Cards Framework(SCF) was introduced to enable European customers to make payments using cards throughout all countries of theSEPA zone, with the same convenience as they enjoy within their own country. In SCF, all SEPA cards are accepted by a single point-of-sale terminal, because of the standardisation provided by the framework. The extent of this currency uniformity in payments provided by SCF is limited to euros.

In some cases, the currency of the payment made may differ from the currency of the business account. Here, the business account can be held in any currency. However, the payment must be in euros and carried out in a SEPA zone.

Q. What is PCI DSS?

Payment Card Industry Data Security Standard (PCI DSS) are the set of standards introduced to ensure and enhance card holder data security in the payment industry globally. All payment service providers and merchants who process, transmit, and store cardholder data must comply with this standard.

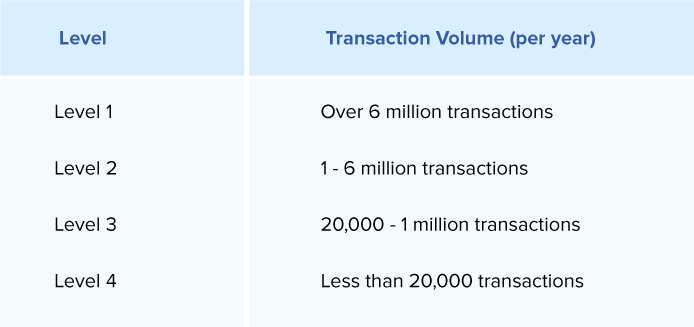

Q. What are the PCI levels?

PCI compliance policies are not the same for all merchants. It varies between business based on the transaction volume that a business processes. Depending on a transaction volume over a year, businesses are categorized into four levels.

The merchants at the top level will be held under the highest level of compliance. As transaction volume increases, the strictness of the compliance policies will also increase accordingly.

Q. What do these PCI compliance levels mean?

Businesses with a Level 1 certification needs an audit processed by a Qualified Security Assessor (QSA). Any business with Level 2, 3, or 4 needs to complete a Self Assessment Questionnaire annually, and will be subjected to quarterly network security scans.

Q. >What is BACS payment?

BACS (Banker Automated Clearing System) is a UK-based financial network used to transfer funds electronically between banks. Subscription businesses, or businesses that accept recurring payments, can use BACS for direct debit payments. The customer authorize the vendor to pull funds from their bank account at scheduled intervals automatically.

Q. How long does a BACS payment take?

BACS direct debit payments take three business days to clear. On the first day, BACS payment processing start with submission of payment data, then processed by respective bank on the second day and funds will be credited to the vendor's account on the third day.

Q. How can you access the BACS Direct Debit scheme?

BACS direct debit scheme can be accessed by different methods. Based on the volume of transactions and company resources, a business can choose any one from the following methods.

Direct debit access via bank through Bacstel-IP software

Access via BACS approved direct debit bureau

Access via third party

Q. How much does BACS payment cost?

BACS charges are very negligible compared to other transactions charges levied by credit and debit card providers. Depending on the transaction volume and the bank involved in payment processing, BACS payment typically costs an average of around 25 cents per transaction.

However, businesses opting to manage direct debit process by themselves might need to incur initial setup cost which is very high. Hence, direct debit scheme access via third party platforms is comparatively cheaper than other methods.

Q. What is SWIFT payment?

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a UK-based financial network used for international money transfers. Using chain of banks as intermediaries, funds can be transferred from UK to bank accounts held abroad. The payments may take between two to five days.

The cost involved per transaction in SWIFT is slightly higher than other methods, as intermediary banks are involved in the transaction process.

Q. What is the difference between SEPA direct debit and BACS direct debit?

The direct debit payment process in both SEPA and BACS are similar. The only difference is that SEPA payments are euro-dominated transfers that are only possible between SEPA zone countries. WithBACS payments, however, funds can be transferred within the UK.