- HOME

- Accounting Principles

- Invoice Processing in Accounts Payable (AP): A practical guide from bill receipt to payment

Invoice Processing in Accounts Payable (AP): A practical guide from bill receipt to payment

Key Takeaways

Invoice processing or bill processing is a control system. It ensures clean inputs, verified matches, and timed approvals that turn vendor bills into predictable cash flow.

- Centralize bills or vendor invoices: One queue for all vendor invoices to kill lost bills.

- Standardize: Clean fields power validation, approvals, and audits.

- Match: Two‑way bills-purchase orders for simple buys; three‑way (including purchase receives) for complex.

- Control: Route by thresholds; batch, partial, advance, and discount‑aware payments.

- Integrate: Tie AP, accounting, OCR, and portals for instant reconciliation.

Why do some businesses breeze through vendor payments, always knowing where their money flows, while others get bogged down by lost invoices, endless approvals, and costly errors? The difference isn’t luck, it’s the power of efficient invoice processing. With a streamlined supplier invoice workflow, approvals speed up, mistakes drop, and vendor relationships thrive, all leading to reliable, healthy cash flow.

Ready to discover how smart bills or vendor invoice processing workflow can transform accounts payable from chaos to control? Let’s dive in.

What is invoice processing?

Invoice processing or the invoice lifecycle covers the steps from receiving a supplier invoice or bill to paying it and recording the transaction. Done well, it ensures the right amounts are paid on time, to the right vendors, with clean records for audits and reporting.

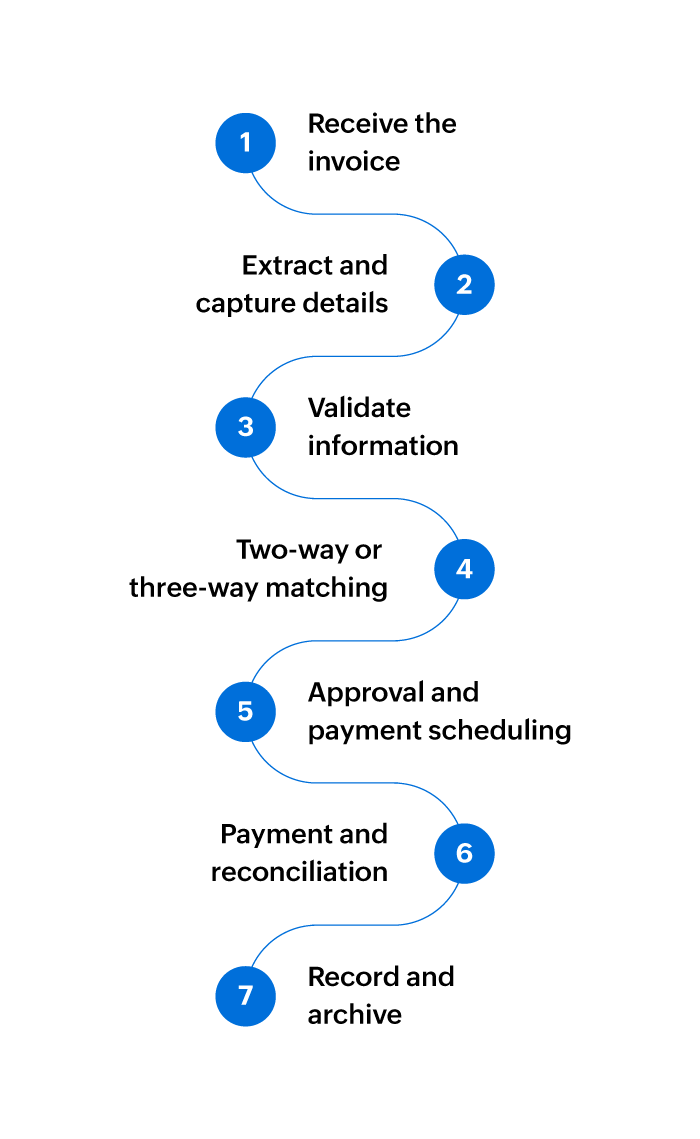

Bill or vendor Invoice processing, step by step

- Receive the bill or vendor invoice: Paper, email, PDF, image capture, or an e‑invoice—centralize intake so nothing gets lost.

- Extract and capture details: Capture all relevant details from vendor name, company and address, dates, line items, amounts, taxes, payment terms, and payment details in consistent fields for reliable checks downstream.

- Validate information: Confirm totals, invoice numbers, tax IDs, payment details, and required references. Flag duplicates and missing data before approvals.

- Two-way or three-way matching: Compare invoices against purchase orders for two-way matching for simple, regular, or online purchases and consumption of services; for complex purchases and goods rely on three‑way matching, to verify against goods received using a reliable reference like the purchase receives, goods received note (GRN) or service entry records. Apply tolerance thresholds and duplicate checks to prevent overbilling and quantity/price errors.

- Approval and payment scheduling: Route invoices to the right people or departments. Define thresholds for simple and multi-level approvals and schedule payments to align with cash flow and terms.

- Payment and reconciliation: Pay via your chosen methods and reconcile statements. Remittance advice is optional but helpful for consolidated or high‑value payments to speed vendor reconciliation.

- Record and archive: Store the invoice, ensure accurate journal entries are posted after payment, and related documents are available for audits. Keep everything searchable for future reference.

A strong process lays the foundation—but smart tools take it further. In the following sections, we’ll explore best practices, automation strategies, and how modern accounting software and tools can simplify every step from capture to payment.

AP Automation to streamline supplier invoice lifecycle

The scope for automation in invoice processing workflow isn’t limited to speed, it can potentially transform how teams collaborate and make every step easier, smarter, and more reliable.

Automation can be used to remove manual data entry by picking up all received invoices, extracting invoice details, performing validation, and streamlining approvals, and payment reminders. With tools and solutions like OCR, leveraging integrated systems, and simple workflow automation tailored to your business needs you can process invoices faster, track every step, and maintain a reliable audit trail.

The result is less paperwork, fewer bottlenecks, and more time for teams to focus on bigger priorities—not just chasing bills.

Best practices for smooth processing

- Standardize data capture, input, and formats to avoid duplicates or errors. This prevents lost or overlooked invoices, creates better tracking and control.

- Set clear approval rules: Define roles, thresholds, and escalation paths for who approves which supplier invoice.

- Workflow automation: Always look for automation opportunities—such as data extraction, validation, workflow routing, and notifications—to cut down on manual work and improve accuracy in your invoice process.

- Efficient record and document management: Organize invoices with consistent naming and tagging, store them centrally with controlled access to ensure the right people have context. This enables quick retrieval, supports collaboration, and maintains audit readiness.

- Review and improve: Analyze and gather feedback from teams (procurement, payments, inventory). Use these practical insights to spot opportunities to simplify and improve process. Particularly to prepare for higher volumes and complex invoices.

Practical enhancements for superior invoice processing

Modernizing invoice processing goes beyond good practices. Smart features combined with purpose-built software and integrations can lead to unseen levels of efficiency and control at every stage of the invoice processing lifecycle. Let’s look at some of these features or capabilities to keep an eye out for.

Vendor Portals: Empowering Collaboration and Speed

Vendor portals provide a centralized platform where suppliers can submit invoices, track payment status, upload clarifications, and communicate directly with your team. This reduces back-and-forth emails, accelerates issue resolution, and boosts vendor satisfaction. With self-service portals, vendors have greater visibility and control, leading to faster payments and stronger relationships.

Automation in two-way and three-way matching

Look for software that offers two-way and three-way matching to automatically compare invoices against purchase orders and goods received. This helps catch discrepancies early, prevents duplicate or incorrect payments, and enforces spending controls.

Autoscanning and optical Character Recognition (OCR)

OCR technology can extract invoice data to reduce manual entry and speed up validation, enabling a smoother, error-free process.

Payments: Streamlining with Batch Processing and Advanced Capabilities

Modern payment solutions support batch payments, allowing you to pay multiple invoices in one go, saving time and reducing transaction costs.

Another valuable feature to look for is the ability to record advance payments made against a purchase order (PO) and adjust those amounts during final payment—this can be especially helpful for high-cost or long-duration projects, keeping payment tracking accurate and simple.

More automation to look out for

Automation can schedule payments aligned with cash flow and terms, send automatic payment reminders, and handle complex payment scenarios like partial payments or early payment discounts, increasing control and flexibility.

Learn more about simple automation you for your accounting software here.

Integrated invoice processing

When your invoice processing workflow connects directly to or is part of your accounting software, everything clicks into place. Invoices, payments, and vendor details sync automatically, removing manual entry and reconciliation from your team’s to-do list. The result? One seamless workflow with instant visibility, rock-solid financial records, and a reliable audit trail.

Lasting Business Impact

Reliable invoice processing isn’t about chasing perfection—it’s about putting consistency first. With a clear workflow, a dose of automation, and committed record-keeping, your team will pay accurately, on time, and keep everyone in sync as your business grows.

Streamline your invoice processing and benefit from predictable cash flow, stronger vendor partnerships, fewer late fees, and accounts payable and back-office operations that runs smoothly and scale effortlessly as your business grows.