- HOME

- Taxes & compliance

- The basics of GST for Singaporean companies

The basics of GST for Singaporean companies

The goods and services tax, or GST, is an important means of indirect taxation that exists in Singapore. Almost every product or service you purchase will be subjected to GST in one way or the other so, it is important to understand what it is, and how to manage it as a business entity.

What is GST?

Singapore's Goods and Services Tax (GST) is levied on consumption; it is a tax charged on the sale of services and goods. GST resembles any Value Added Taxes (VATs) in different countries. Goods and services sold in Singapore today fall under either 0%, 9%, or are exempt from GST.

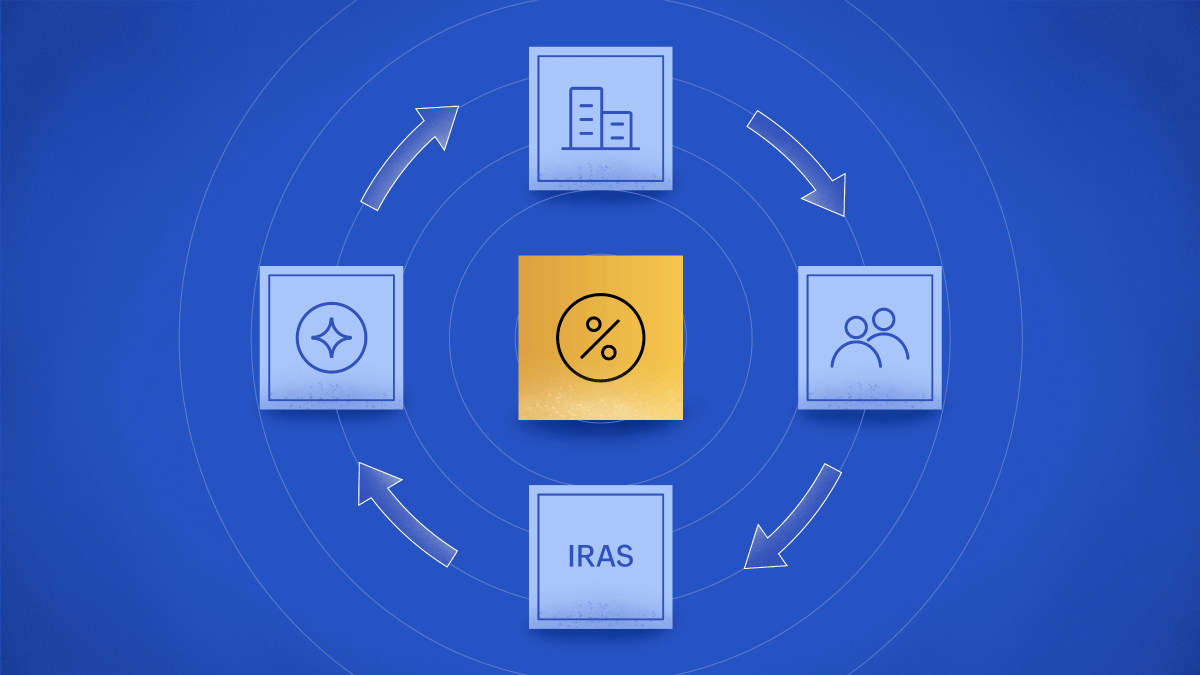

Businesses registered under GST are required to issue GST-compliant invoices to their customers, collect GST on sales, generate GST reports, and pay the tax collected to the IRAS (Inland Revenue Authority of Singapore). Any GST paid on purchases is given back to the business as input tax credit upon sale of the same product.

Who needs to register for GST?

Businesses with an annual turnover of over 1 million SGD are required to register themselves under GST. This also includes businesses that predict a potential revenue of over 1 million SGD in the upcoming financial year. This is known as compulsory registration under GST.

That being said, businesses can, by their own volition, register under GST even if their revenue does not exceed 1 million SGD. This is known as voluntary registration.

To begin, businesses can apply to register under GST through the myTax Portal on the IRAS website by providing the necessary documents specified by the IRAS. Voluntary registered businesses will need to stay registered for a minimum of two years before they can apply for deregistration.

How does GST work?

A business pays GST when making purchases. The tax paid on purchases will henceforth be known as input tax. They then charge GST when selling goods or services. Tax collected on sales will be known as output tax. The difference between the two is the total GST owed by the business to the IRAS. This is tracked using GST invoices and consolidated into a report called a GST return or Form F5. Finally, this total amount is paid to the IRAS by the business.

To understand this better, let us assume that the total GST collected by a business from its customers is SGD 5,000 and the GST paid to their vendors is SGD 3,000.

Now the tax owed by the business to IRAS will be:

Output tax - Input tax = 5,000 - 3,000 = SGD 2,000/-

In situations where the input tax is greater than the output tax, the IRAS will refund the difference back to the business.

How to track, submit, and pay for GST?

Registered businesses are required to track all sales and purchases in the form of a report known as Form F5. This needs to be compiled and filed once every three months.

Businesses that fail to submit these returns in time may be subject to penalties, fines, and some kind of disciplinary measures. In addition, to filing F5 and paying GST to the IRAS, businesses are required to safely store and maintain GST invoices for both purchases and sales for a minimum of five years.

What are zero-rated and exempt supplies in GST?

While the majority of goods and services attract a standard 9% rate (as of 2025), there are some goods and services which either attract a 0% GST rate or are completely exempt from the considerations of GST.

For instance, any item or service sold overseas or exported to other countries will attract a 0% GST on sale even if the same item or service may attract a 9% GST when sold locally.

As for exempt supplies, or the sale of goods or services totally outside the scope of GST, here are a few examples:

Financial services

Residential properties

Select digital payment services

Irrespective of the GST rate associated by items and services, registered businesses are invariably required to issue GST invoices, consolidate sales and purchase data as returns, and file them to the IRAS without fail.

What are the benefits of registering under GST?

Registered businesses find it easier to streamline their sales and purchases under a common trade and filing system that is followed by all others in their supply chain. This increases trust and credibility amongst associates and peers while also increasing transparency and accountability within.

They can claim input tax credit, or in simple terms, refunds on tax paid by them to their vendors whenever they sell the same item or service to their customers. This transfers the liability or burden of tax to the end customer and off the business without burdening the end consumer too much.

Registering under GST facilitates tax compliance and simplifies internal and external audits.

Allows one to export goods and services to markets outside of Singapore and price them competitively owing to a zero rate on exports.

How to spot and avoid some common GST mistakes

Maintaining compliance with GST can also prove challenging to many businesses and mistakes can often lead to penalties and fines. Let's look at a few common mistakes that may arise and how we can avoid them.

Incorrect application of GST rates to items or services: This can be avoided by regularly referring to the latest GST rates and tax categories published by IRAS.

Late filing and payment: This can be avoided by using compliant accounting software that automates F5 return generation, facilitates filing, and has reminders to alert you of the upcoming GST filing dates.

Claiming ineligible input tax: This usually happens when there is a lack of clarity or classification between business and non-business transactions. This can be sorted out by maintaining business and personal transactions separately or using different tools to manage them.

Improper record keeping: The IRAS has laid out clear instructions on how to store, consolidate, and share business data with them. One easy way to do this is to use GST-compliant accounting software for managing sales and purchases.

Performing regular audits can help you spot potential shortcomings and errors that may arise from gaps in the workflow between your business operations and the software.

How to deregister for GST?

Businesses that no longer meet the basic requirements to be registered under GST may apply for GST deregistration under the following situations:

They stop having a taxable turnover of SGD 1 million.

They stop conducting business or go through a merger or reorganisation.

They stop making taxable supplies.

Deregistration can be done through the myTax Portal; the IRAS will deny the deregistration application until the business stops filing taxes. Businesses must manually file taxes until their request for deregistration is accepted by the IRAS. This process needs to be done in a timely manner to avoid potential penalties and punishments.

What are some key considerations for GST registered businesses?

Maintain proper records of purchase and sales invoices, along with the taxes collected and paid, and the e-invoices and tax returns filed and finalised.

Review your GST returns regularly to identify and minimize potential errors in tax calculation.

When in doubt, consult with accounting and tax advisors. Find the answers you need and resolve accounting discrepancies, if any, as early as possible.

Pay attention to changes to the GST laws. Keep track of changes in tax rates and processes to prepare for and adopt them at the right time.

Make sure supplies are classified correctly to prevent mischarging customers on sales and overpaying GST on purchases.

Train staff periodically on operational and legal compliance to minimize invoicing and reporting errors.

How are digital goods and services sold via ecommerce handled under GST?

Any foreign businesses that offers digital goods and services to users in Singapore must follow the Overseas Vendor Registration (OVR) GST rules if their sales in Singapore exceed the SGD 100,000 mark. This includes companies involved in:

Streaming movies and videos

Online publication subscriptions

Digital advertising

Cloud-based services

Foreign providers of digital services need to apply for GST registration and are required to include tax in Business to Consumer (B2C) sales to Singapore residents.

Stay on top of gst filing

Most goods and services in Singapore attract GST, and businesses eligible for registration under the GST laws must adhere to the laws of GST. This article aims to give you the necessary basic information to get started on your journey of compliance. Please check out Academy by Zoho Books for more content on all things accounting and try [Zoho Books for free today.