- HOME

- Financial Management

- An overview of revenue recognition

An overview of revenue recognition

No matter the size of the business, at the end of the day, we all look forward to the earnings we receive after delivering a product or a service. It is one of the driving forces that excites us and keeps us moving forward toward our business goals.

The more significant the income is, the more crucial it is to recognize revenue at the right time. Payment terms vary depending on the type of goods and services. You don’t always receive payment immediately after completing the work—sometimes it's paid in advance, sometimes in installments, and in certain cases, only a partial amount is received. So, when and how do you determine that the revenue has actually been earned?

This guide provides a comprehensive overview of revenue recognition and its importance. Let's delve into the key principles, steps, and practical applications.

Revenue recognition

Revenue recognition is an accounting principle and a key component of accrual basis accounting. It defines the conditions under which income is formally recorded as revenue. The focus is on recognizing the revenue when the goods or services are being delivered to the customers and not when the payment is made. This helps identify the growth track of the business.

Revenue recognition model

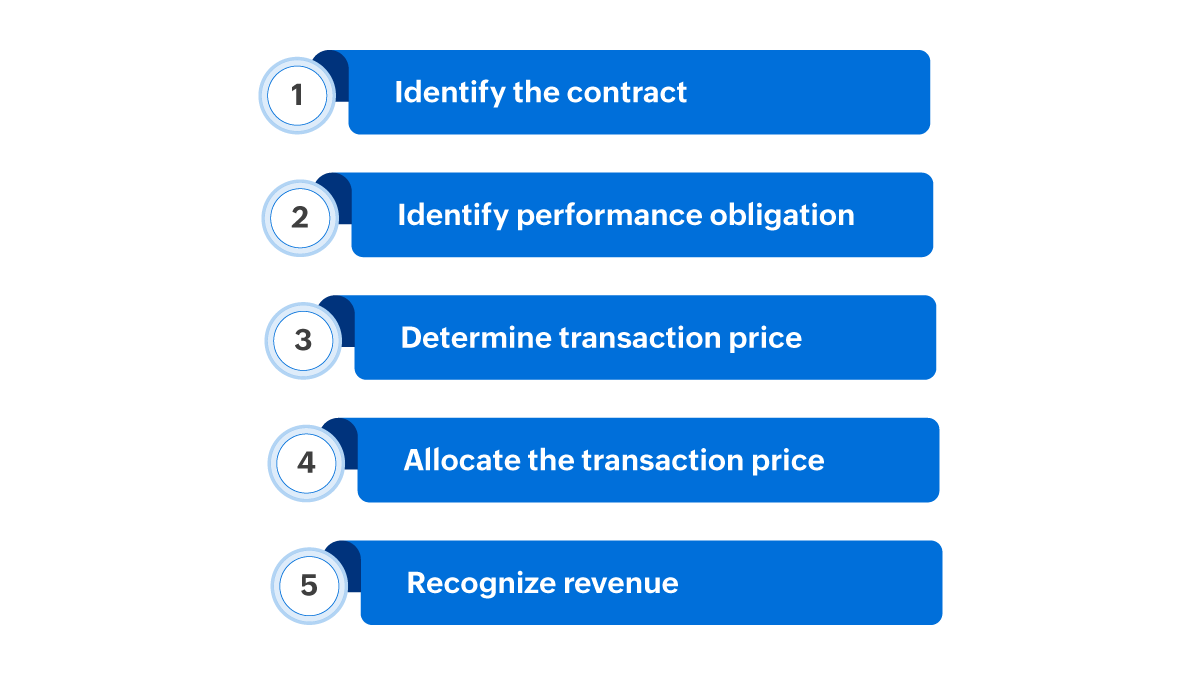

The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) jointly developed a unified framework for revenue recognition to enhance consistency across industries and regions. This framework was introduced as ASC 606 under US GAAP and IFRS 15 under international standards.

Identify the contract

To begin, determine whether there is a mutual agreement between you and the customer. An agreement needs to include all essential details, such as payment terms, pricing, delivery dates, and other key elements. A contract is typically a formal written agreement between two parties, though in some cases, a verbal agreement may also be valid.

Identify the performance obligations

In this step, you need to analyze what has been agreed upon with the customer. Performance obligations refer to goods or services that a business promises to deliver under a contract.

Here are the two criteria for goods or services to be considered distinct; following both of these is a must:

The consumer can use the product or service independently or in conjunction with other easily accessible resources.

The goods or services must be separately identifiable from the other resources in the contract. For instance, if you are selling a water heater, the product is considered distinct because the customer can use it independently. However, if you are selling a warranty along with it, the warranty may not be considered distinct on its own; it is often bundled as part of the overall service.

Determine the transaction price

This is the straightforward step of the process where you determine the amount you will receive in exchange for the goods and services you provide. This does not include the amount collected on behalf of third parties, such as sales tax. Below are a few factors that affect the transaction price.

Uncertainty around the amount of consideration: This includes discounts, refunds, incentives, and similar items.

Likelihood and magnitude of the potential revenue reversal: This includes market uncertainty, third-party control, and similar factors.

Financing component in the transaction price: A significant time gap between the delivery of goods or services and the receipt of payment may require adjustment for the time value of money.

Non-cash considerations: This occurs when the customer pays with goods, services, stock, or other non-cash items instead of cash.

Consideration payable to the customer: This includes payment such as slotting fees, buy downs, coupons, and similar items.

Allocate the transaction price

Once the transaction price is determined, it must be allocated to each performance obligation in the contract. This is done by identifying the standalone selling prices of each obligation and distributing the total transaction price proportionally based on their relative values.

Recognize revenue

Revenue should not be recognized as earned until the performance obligation is fulfilled. Even if payment is received in advance, it should be recorded as "deferred revenue" until control of the goods or services is transferred to the customer.

Example: Five-step revenue recognition model

Scenario: An electronics store sells a smart printer with installation services.

STEP | EXAMPLE |

Identify the contract |

A valid contract exists with mutual agreement. |

Identify performance obligations | The seller identifies two distinct obligations:

Both are distinct and will be accounted for separately. |

Determine transaction price | The total contract price is $30,000. No discounts, non-cash considerations, or payments to the customer are given. The transaction remains the same. |

Allocate the transaction price | Revenue is allocated based on standalone selling prices:

|

Recognize revenue |

If the payment is received in advance, the unearned portion will be recorded as deferred revenue until each obligation is fulfilled. |

IFRS reporting criteria for revenue recognition

According to IFRS 15, businesses must meet specific criteria before recognizing revenue. These criteria fall into three key categories:

Performance: The seller must fulfill the contract and transfer control of goods or services to the customer.

Collectability: The seller must have a reasonable expectation of receiving payment.

Measurability: Revenue and related costs must be reliably measurable, aligning with the matching principle.

The below table highlights the criteria along with the categories they fall under:

Category | Criteria |

Performance |

|

Collectability | Reasonable assurance of payment from the customer. |

Measurability |

|

Importance of revenue recognition

Revenue recognition is one of the important principles of a business and offers multiple benefits. Businesses that fail to follow revenue recognition standards face the risk of numerous SEC fraud cases. Listed below are the few areas that have an impact from revenue recognition.

Helps prevent financial misreporting and maintains investor trust.

Maintains compliance with the provided guidelines to ensure revenue is recorded consistently across industries.

Gives reliable revenue data for better business decisions and financial forecasting.

Bottom line

Revenue is a critical component of any business. Recognizing it at the right time is essential for financial growth and maintaining accurate records. For those managing the company's finances, juggling these tasks amid a packed schedule can be challenging.

That's where accounting software comes in. Tools like Zoho Books help with revenue-related tasks by automating:

Deferral of excess revenue

Scheduling and calculation of recognized revenue

Presentation of revenue in financial statements

By automating the revenue recognition process, Zoho Books helps ensure the accuracy of financial reports while enabling better forecasting, allocation, and auditing. This not only saves time but also reduces errors and improves compliance with standards like ASC 606 and IFRS 152.