- HOME

- Taxes & compliance

- Learn everything about Making Tax Digital (MTD) for Income Tax for sole traders

Learn everything about Making Tax Digital (MTD) for Income Tax for sole traders

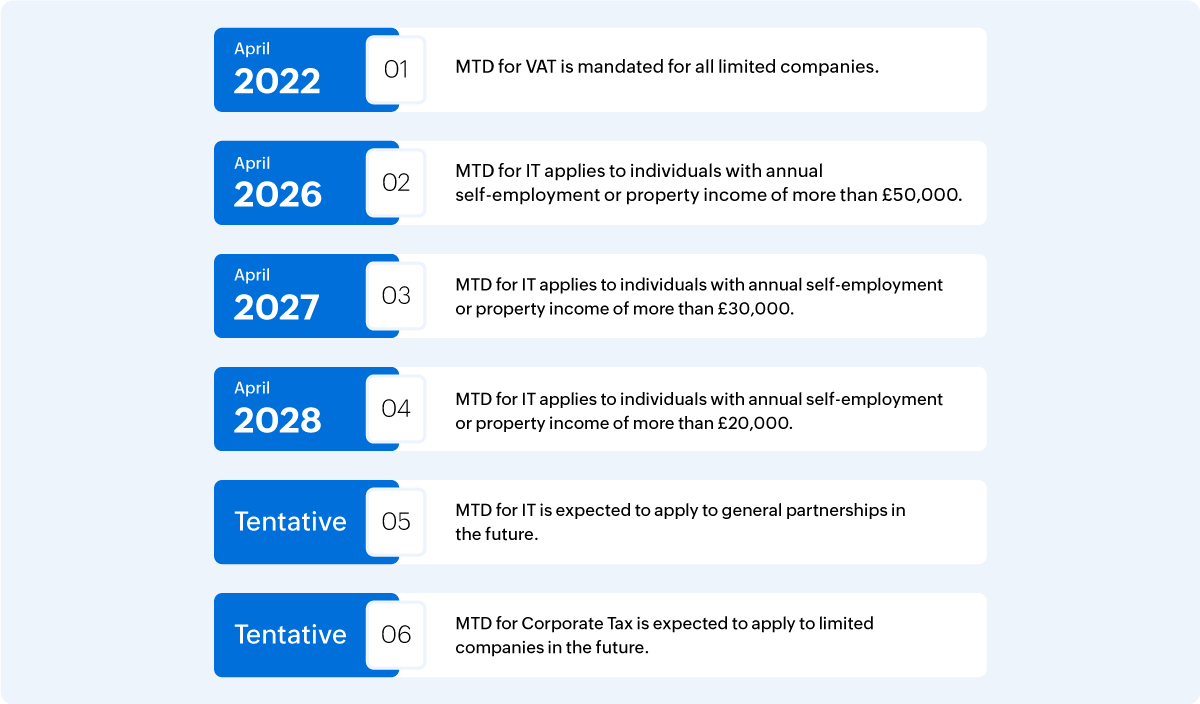

The implementation of Making Tax Digital for Income Tax (MTD for IT) is one of the key elements of HMRC's digital transformation. It's predecessor, MTD for VAT, initially began as a pilot program by HMRC to digitize tax, but it is now mandatory for all VAT-registered businesses to comply with. Now, the implementation of MTD for IT, set for April 2026, is meant to revolutionize the way sole traders report their earnings.

This guide explores more about MTD for IT and its benefits for sole traders.

What is a sole trader?

An individual who is self-employed and runs their own business is known as a sole trader. As a sole trader, you work for yourself and make all the business decisions. You are responsible for all business operations and bear full responsibility for the company's financial outcomes. This business type does not have a distinct legal identity from its owner.

What is the self-assessment tax and how does it work?

Self-assessment tax is the amount paid on your income after deducting advance tax and TDS for the respective financial year. It is done to ensure individuals meet their full tax obligation. Sole traders typically submit their self-assessment tax returns using the SA100 form through online or paper filing. They generally maintain their records independently through paper logs or spreadsheets, often leading to errors and missed deadlines.

Overview of Making Tax Digital for Income Tax (MTD for IT)

MTD for IT is a new initiative developed to replace self-assessment returns for sole traders and landlords. Under this initiative, individuals with qualifying income must maintain digital records of all their income and expenses and update HMRC quarterly using compatible software.

Timeline: MTD for IT

Objective of MTD Income Tax

MTD will utilize the potential of digitalization to simplify the process of ensuring tax compliance for all individuals. According to the UK government, the tax gap for self-assessment businesses is around 18.5%, or £5 billion. The implementation of MTD will also reduce errors in handling tax affairs.

The objectives of MTD for IT are as follows:

Save time when submitting year-end tax returns.

Minimize the risk of oversight and inaccuracies in reporting.

Reduce the time spent on paperwork, thereby increasing productivity.

Enhance client services.

Requirements under the new MTD for IT regulations

If you are a sole trader exceeding the annual revenue cap of £50,000, here's what the latest HMRC mandate entails:

Keep digital records of your business income and expenses.

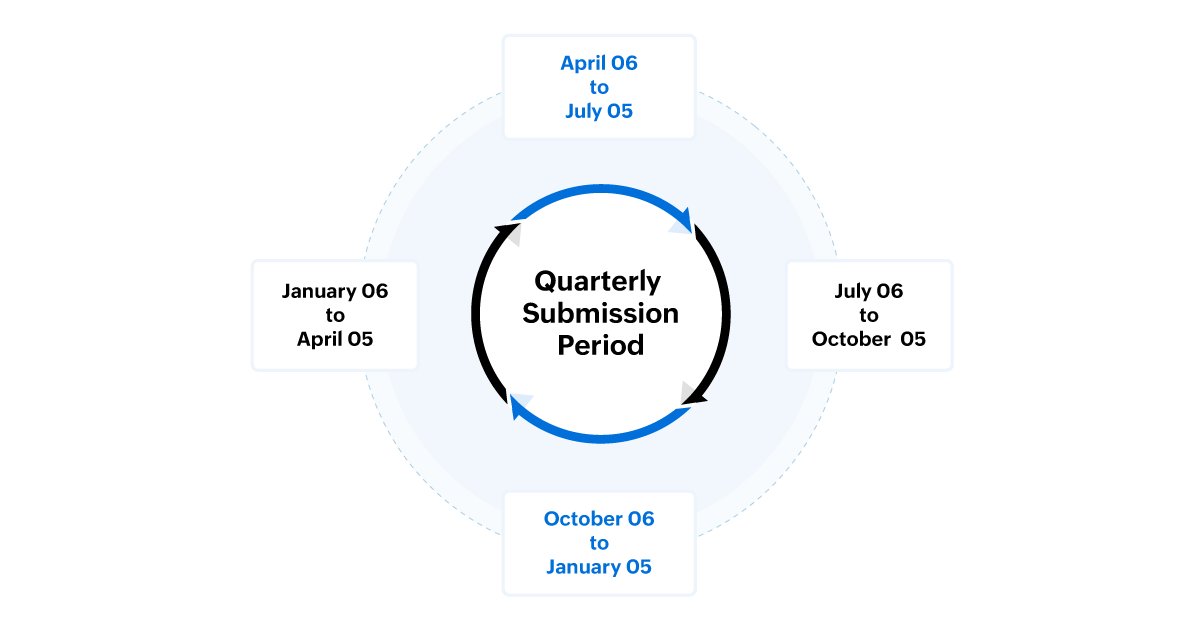

Send quarterly updates to HMRC on your business's income and expenses using MTD-compliant accounting software. The deadline for quarterly updates will be consistent for all, aligning with the start of the tax year.

You have to submit the quarterly report within one month after the update period has ended. For instance, the deadline for the first quarter is August 5. The same applies to all the quarters.

Finalize your business income at the end of the tax year by completing the final declaration, which replaces the self-assessment tax returns; the tax you owe must be paid by January 31 of the subsequent tax year.

Before April 2026 vs. after April 2026

Before April 2026 | After April 2026 |

1 annual submission | 4 quarterly submission (April 6 to April 5 cycle) |

Filing by Oct. 31 | 1 annual final submission |

Online filing by Jan. 31 | Online filing by Jan. 31 (filing only via MTD-compliant software) |

Can have a paper record | Keep a digital record |

Prepare now by taking the following steps

Begin your transition towards MTD by understanding the regulations, maintaining digital records, finding the right software, and gradually adapting.

Start by converting all your paper-based records to digital format. This will not only ensure MTD compliance but also reduce the risk of error and missing documents.

Evaluate and choose an MTD-compliant accounting software that suits your business. By opting for accounting software, you can easily file Income tax returns and maintain digital records.

Develop a thorough training program for your team to enhance their understanding of the software.

Plan your quarterly reporting and begin integrating such practices into your business.

How MTD for IT helps sole traders

From automation to security, MTD-compliant accounting software simplifies bookkeeping and income tax filing for sole traders to ensure efficiency and compliance.

Automation: You don't have to track invoices manually. Accounting software sends you automatic reminders for payments. You can also set recurring invoices to bill regular clients without repetitive effort.

Financial control: You can have real-time visibility of your income, expenses, and profit. With real-time cash flow tracking, you can always be aware of your financial health and tax liabilities.

Collaborating with an accountant: Cloud-based accounting software makes it easier to collaborate with an accountant and helps them access real-time data.

Multi-factor authentication: MTD-compliant software provides enhanced security through MFA, which protects your data from cyber threats.

Who gets an exemption from this?

Exemptions can be applied when the application process opens in the following scenarios:

Individuals who cannot use software for digital record-keeping due to reasons including age, disability, location, or similar factors.

Individuals who are practicing members of a religious society/order whose beliefs do not align with electronic communication or having electronic data.

You will be automatically exempt and cannot sign in for the following circumstances:

Individuals who are the representatives of someone who died.

Customers with power of attorney.

Recipients of married people allowance.

Foreign entertainers or sports persons who are non-residents and do not have any other income that qualifies for MTD.

Individuals who do not have a National Insurance number are exempted only for the tax year in which they do not have one as of January 31, before the start of that year.

If you are a non-resident company.

Charitable trustee or trustee of non-registered pension schemes.

What makes Zoho Books the ideal accounting software?

Zoho Books offers a free plan for sole traders to help streamline their accounting processes and ensure compliance with government regulations.The plan includes:

Digital records with audit trails to ensure accuracy and transparency.

Preparation for self-assessment (SA103F, SA103S).

Direct VAT filing to HMRC for eligible businesses.

Income tax filing for sole traders

and many more. To access the free plan, check out: https://zoho.to/PrUk

MTD Income Tax for sole traders is one of the significant steps towards the digital transformation. By understanding the regulations and starting to prepare in advance, you can ensure compliance. Implementing MTD doesn't have to be stressful; with the right software and guidance, it can be hassle-free.