- HOME

- Expense Management

- Discretionary expenses: 5 smarter ways to keep them in check

Discretionary expenses: 5 smarter ways to keep them in check

When businesses try to cut costs, they often focus on the obvious: hiring freezes, office downsizing, or trimming enterprise software licenses. And while those cuts can certainly make an impact, they’re not always the root of the problem.

The real leak often lies in places no one’s watching too closely: discretionary expenses.

So, what are discretionary expenses, really?

Discretionary expenses are non-essential business costs. These are the “nice-to-have” spends that support employee satisfaction, client relationships, and team flexibility but aren’t mission-critical for daily operations. They're typically decentralized, spread across departments, and often go unnoticed unless actively tracked.

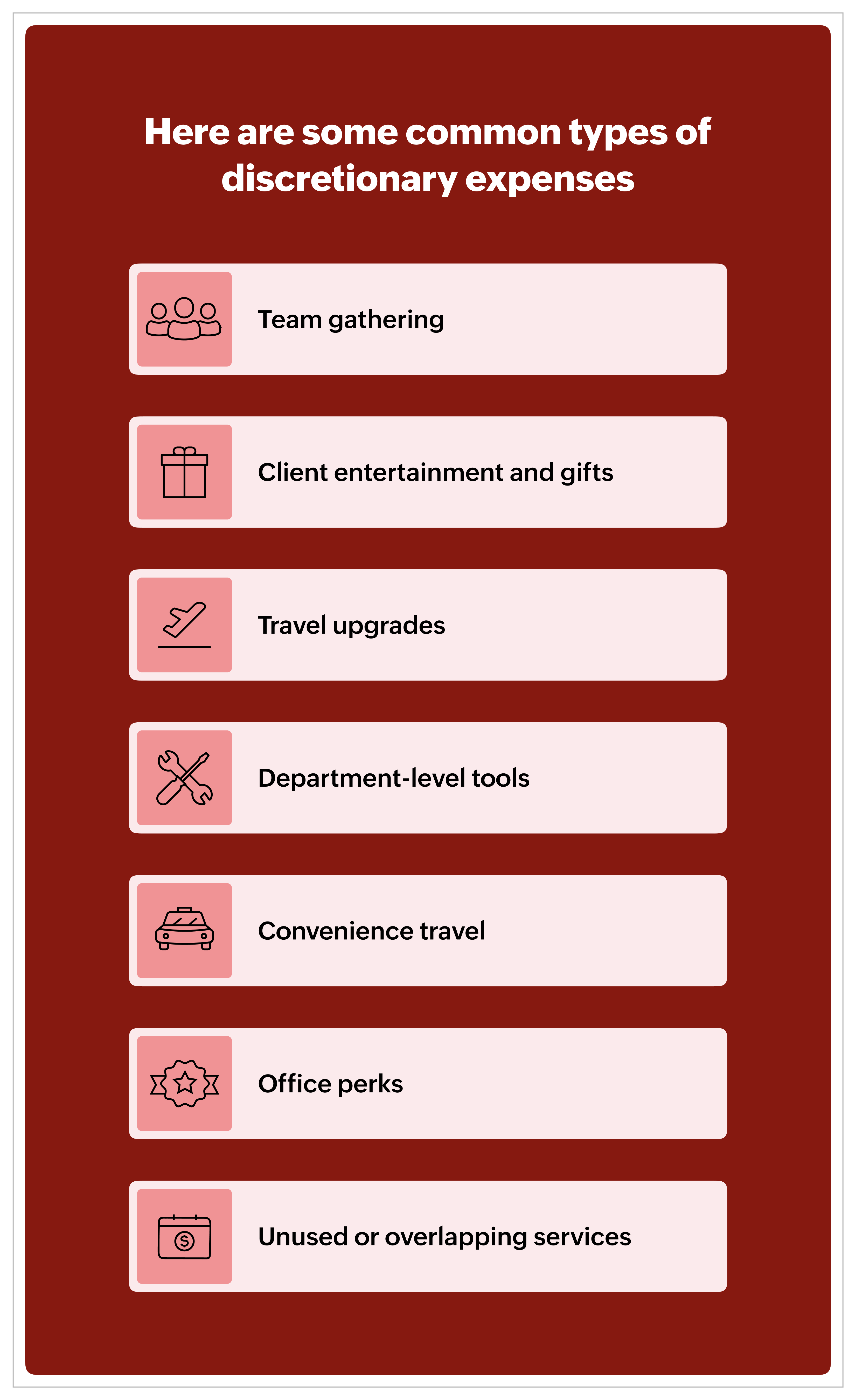

Here are some common types of discretionary expenses:

Team gatherings

Lunches, dinners, or offsites for internal celebrations or bondingClient entertainment and gifts

Dinners, branded gifts, or event passes to build relationshipsTravel upgrades

Business-class flights, premium hotels, or lounge accessDepartment-level tools

SaaS subscriptions or apps purchased outside centralized procurementConvenience travel

Cab rides taken instead of public transport or shared vehiclesOffice perks

Decor, snacks, wellness services, or flexible furniture purchasesUnused or overlapping services

Tools or subscriptions still active despite low usage or redundancy

These are the small, non-essential purchases that feel harmless. A team lunch here. A cab ride there. That software someone signed up for and forgot about. None of it looks like a problem until you zoom out.

Suddenly, what looked like a series of justifiable one-offs becomes a pattern. And that pattern can quietly derail budgets, confuse reporting, and make it harder for finance teams to stay ahead.

That said, discretionary spending isn’t inherently bad. Done right, it can help build client relationships, reward teams, and support operational flexibility. The issue isn’t the spending itself; it’s the lack of clarity and control around it.

This isn’t a blog about cutting perks or saying no more often. It’s about building a smarter system where discretionary expenses are visible, purposeful, and managed with just enough oversight to prevent chaos without slowing teams down.

Here are five ways to make that happen.

1. Define discretionary expenses clearly

One of the fastest ways discretionary spending spirals is when no one really knows what counts as discretionary.

What you consider a non-essential business expense might seem entirely justifiable to someone else, especially when there’s no clear policy or framework to refer to.

Start by getting specific.

Is a business-class upgrade for sales travel discretionary?

What about team dinners after a product launch?

Or monthly SaaS tools paid for with corporate cards?

List out common expense categories and clarify what falls under “discretionary” for your business. Then communicate that clearly. And by clearly, we mean not buried in a 20-page policy PDF that no one will read.

With Zoho Expense, you can build those definitions right into the system. Set rules, apply limits, and show employees what’s acceptable before they even hit “submit.”

Why this works: Removing ambiguity reduces friction. Employees don’t have to guess. Finance doesn’t have to chase. Everyone operates on the same page.

2. Give managers real-time visibility

Discretionary spending isn’t always a finance problem. Sometimes, it’s a visibility problem.

Often, department heads approve expenses in isolation, without any view into team-wide or month-over-month spending. And by the time finance steps in, it’s too late to make changes.

Real-time visibility changes that. Equip your department leaders with live dashboards and alerts, so they can:

- Track spending in categories like travel, meals, or software

- Compare actual spend against budgets

- Spot repeat offenders or out-of-policy claims early

Zoho Expense makes this easy. Managers get notified when team members approach spend limits, and unusual expenses are flagged before they reach the final approval queue.

Why this works: Visibility builds accountability. When managers have context, they can correct overspending before it becomes a trend.

3. Monitor recurring charges closely

Recurring discretionary expenses are a sneaky kind of spend. A tool gets purchased. A subscription gets renewed. A payment goes out monthly without anyone thinking twice.

And just like that, you're paying for services no one’s using.

Make it a quarterly habit, if not monthly, to audit your recurring charges. Look for:

- Duplicate tools serving the same purpose

- Subscriptions without recent usage

- Old vendor contracts still being charged automatically

Zoho Expense makes this easier by identifying recurring vendors and highlighting patterns, so you’re not starting from scratch every time.

Why this works: This is one of the easiest wins. You free up budget without cutting anything painful, just the stuff no one noticed was still running.

4. Normalize conversations around spending

Let’s face it. Conversations around spending can get tense. No one likes being told they went overboard on lunch or shouldn’t have taken that cab.

But if you only talk about expenses when there’s a problem, your teams will start seeing finance as a roadblock.

Flip that narrative.

Share trends with teams. For example, “Last quarter, entertainment spend went up 40 percent. Here’s what we learned.”

Celebrate smart decisions. “The Ops team saved ₹25,000 by consolidating tools.”

Include a slide in all-hands meetings showing how discretionary budgets are being used.

This isn’t about micromanagement. It’s about context. When people understand the why behind the rules, they’re far more likely to follow them.

Why this works: Spending is cultural. If the conversation is open, respectful, and backed by data, people pay attention and take ownership.

5. Automate what doesn’t need human intervention

No CFO wants to spend their time checking if someone crossed a ₹1,000 meal cap.

That’s where automation steps in.

With Zoho Expense, you can:

- Auto-flag expenses that exceed policy

- Set different rules for different departments or roles

- Match credit card transactions automatically

- Detect unusual spending patterns using built-in intelligence

This isn’t about removing the human touch. It’s about freeing your team to focus on strategy instead of chasing receipts and spotting duplicates.

Why this works: Automation brings consistency. Policies are enforced fairly, and teams spend less time policing expenses.

The real goal: Intentional spending

Managing discretionary expenses isn’t about saying “no” more often. It’s about creating room to say “yes” to the right things.

You don’t need a hard reset or a company-wide crackdown. What you need is clarity, visibility, a bit of automation, and a culture that sees spending as a shared responsibility.

The outcome? Predictable budgets. Cleaner books. Fewer awkward conversations. And the confidence to support the kind of spending that actually moves your business forward.

Zoho Expense helps you do this right

We built Zoho Expense to help finance teams get a handle on discretionary spending without slowing the company down.

You get better control, less clutter, smarter tracking, and policies that actually stick. Because when finance has the right tools, everyone spends more intentionally.