- HOME

- Expense Management

- IRS Publication 535: A strategic guide to maximize tax savings and manage business expenses

IRS Publication 535: A strategic guide to maximize tax savings and manage business expenses

Business owners often find it difficult to understand business expenses and tax deductions, leading to mismanagement and bottom-line losses. According to the 2025 survey report by IPX1031, one out of four Americans feel unprepared to file taxes. To help each entrepreneur navigate through the overwhelming tax regulations and develop an understanding about which expenses are taxable and which ones are not, the IRS had released Publication 535 titled Business Expenses. Though discontinued in the year 2022, this document still serves as the best source to learn and understand IRS rules and the US tax regulations. Reading this complete document line by line can be hard, which is why we created this comprehensive guide as a one-stop solution to all your business expenses and tax related problems.

IRS Publication 535 serves as the go-to resource for understanding which costs qualify as business expenses, how they’re defined, and the right way to record them to legally reduce your taxable income.

This in-depth guide unpacks everything you need to know about Publication 535, from what counts as a business expense to its classifications, deduction rules, and limitations. You’ll also find practical insights on integrating this knowledge seamlessly into your workflows with modern expense management solutions.

What is a business expense?

In essence, business expenses are the costs necessary to keep your business running smoothly. According to the IRS, they must be both “ordinary and necessary” for your trade or profession. If you’ve ever wondered what qualifies as a business expense, think of it as any expense directly tied to your operations that isn’t personal or capital in nature.

Take, for example, a digital marketing agency. Payments made to freelance designers, monthly subscriptions for SEO tools, or advertising spend on social platforms, all of these are legitimate business expenses that can be deducted from taxable income.

What are ordinary and necessary expenses?

Publication 535 places strong emphasis on these two terms. An ordinary expense is one that is common and accepted in your field. For instance, an ecommerce brand investing in Google Ads is routine and expected in that line of work.

On the other hand, a necessary expense is one that is helpful and appropriate for your business, even if it isn’t indispensable. For example, buying an ergonomic chair for your home office is necessary to support long working hours, even though technically you could sit on a basic chair.

Here’s a quick table summarizing these definitions for easy recall:

Expense type | Definition | Example |

Ordinary | Common and accepted in your trade | Accounting software for a tax firm |

Necessary | Helpful and appropriate for business operations | Leadership training for managers |

Can you claim deductions for using your home and car for business?

When you’re running your business from home or driving your car for work, understanding what counts as a deductible business expense can save you thousands over the years. But it’s not always straightforward. Let’s break down these two areas clearly so you can claim what’s fair without worrying about crossing any lines.

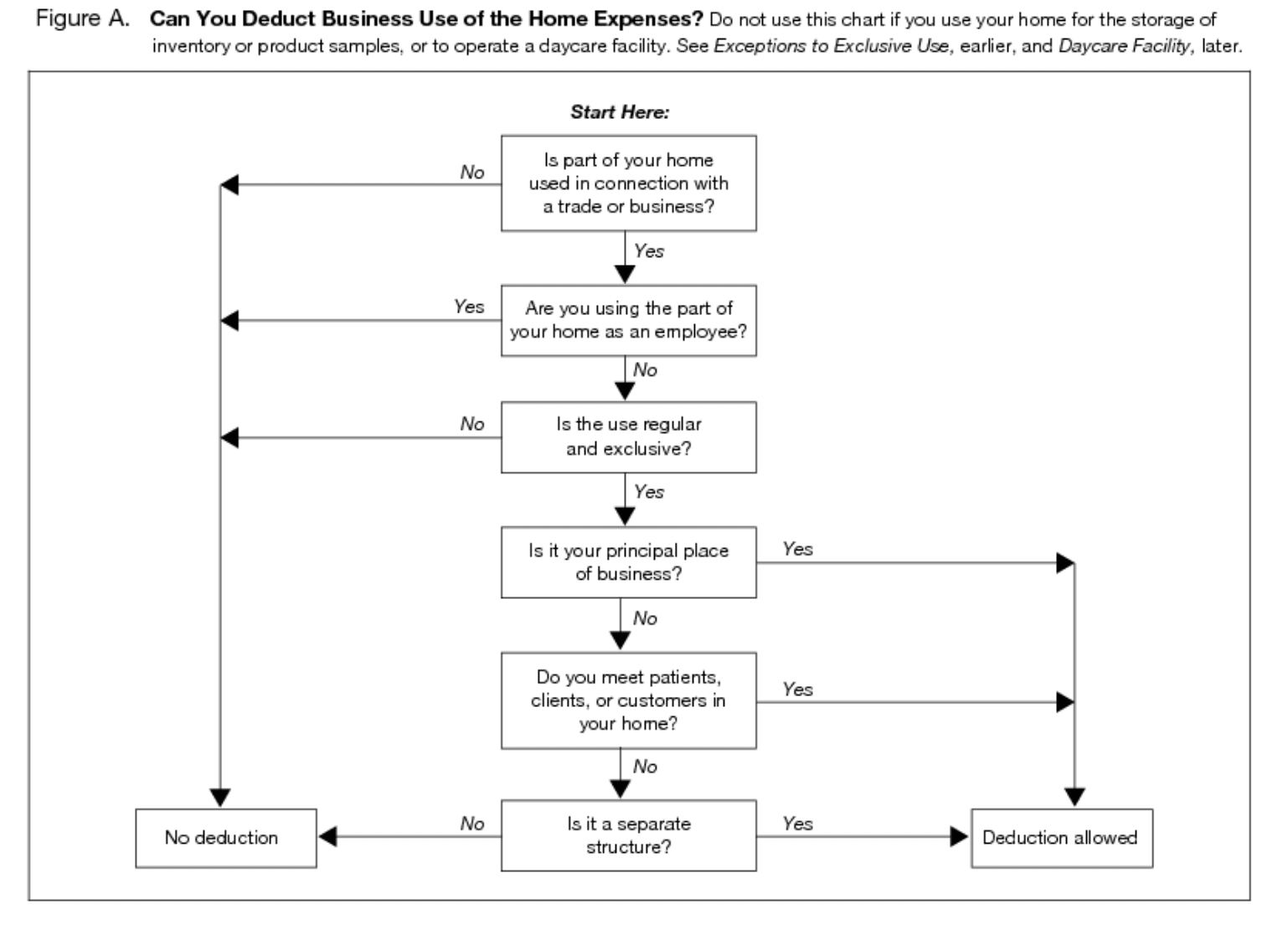

Home business use

If you work from home, you might be able to write off part of your housing costs. But there’s a catch. The IRS wants to see that you’re using part of your home regularly and exclusively for your business. What does that mean in real life? If you’re working at the kitchen table during the day but eating dinner there with your family at night, that doesn’t count. However, if you have a spare room turned into your graphic design studio, that dedicated space qualifies.

Here’s another detail people often miss: it needs to be your principal place of business. Maybe you sometimes meet clients at their offices or a coffee shop, but if your home office is where you handle admin tasks, manage client communication, and run operations, you’re eligible for the deduction.

Now, how do you calculate it? There are two options:

The simplified method

The regular method

When following the simplified method, it allows you to deduct about $5 per square foot, up to 300 square feet. Quick math: if your workspace is 200 square feet, that’s a $1,000 deduction. The regular method is a bit more detailed. You calculate your actual home expenses with components like rent or mortgage interest, utilities, homeowners insurance, and property taxes and deduct the percentage that matches your home office’s square footage. If your office takes up around 10% of your home, then you are allowed to deduct 10% of those costs.

Source: IRS Publication 587 (2024), Business use of your home

Remember, routine repairs in your office space are fully deductible. So, if you repaint your office or fix a broken window in your workspace, those costs can be written off in full. Improvements that benefit your whole house, like installing a new HVAC system, get depreciated over time instead.

Business use of car

Now let’s talk about your vehicle. Whether you’re driving to meet clients, visiting suppliers, or picking up inventory, those miles add up to legitimate expenses for a business. But how do you claim them?

You have two choices here, too. The standard mileage rate method is the easiest. You track your business miles throughout the year and multiply them by the IRS standard rate (for 2025, it’s 70 cents per mile). So, if you drive 5,000 miles for business, that’s a $3,500 deduction.

When following the actual expense method, you calculate what you spent on gas, oil changes, maintenance, insurance, registration, and even depreciation for the year. Then, you deduct the percentage that matches your business use. If you used your car 60% for business, you can deduct 60% of those total costs.

Which method is better? It depends. If you drive an older car that’s fully paid off and cheap to run, the standard mileage rate usually works out better. But if you lease an expensive vehicle or have high operating costs, calculating actual expenses can give you a larger deduction. Just remember that whichever method you choose in the first year you use your car for business locks you into certain rules for future years.

And here’s something people often forget: your commute doesn’t count. Driving from your home to your main office isn’t deductible. But driving from your home office to a client site or supplier is.

Check out Business Mileage Reimbursement 2025: A complete guide to updated IRS rates, rules, and best practices for more details.

What is the difference between capital expenses and business expenses?

One of the frequent areas of confusion for business owners lies in differentiating between capital expenses and operational business expenses.

Capital expenses are costs that bring benefits extending beyond the current year. These include purchases like office buildings, commercial vehicles, or heavy machinery. Instead of deducting the entire cost in the year you incur it, you capitalize these expenses and depreciate them gradually over their useful life.

In contrast, business expenses cover your day-to-day operational costs such as rent, salaries, internet bills, and office supplies. Provided they meet IRS guidelines, they are fully deductible in the year they are incurred.

For example, if you pay $1,000 monthly in office rent, it’s a deductible business expense. But if you buy an office property for $200,000, that’s a capital expense requiring depreciation over its lifespan.

What are startup costs?

Another key distinction made in Publication 535 is between startup costs and operational expenses. Startup costs refer to expenses you incur before launching your business, such as market research, pre-launch advertising, legal fees for incorporation, and related preparatory activities.

Here is a clear summary of how the IRS allows deductions for these costs:

Total startup costs | Deduction allowed | Remaining costs treatment |

Up to $50,000 | Deduct up to $5,000 in the first year | Amortize remainder over 15 years |

Over $50,000 | Deduction reduced dollar-for-dollar above $50,000 | Amortize excess over 15 years |

For instance, if your startup costs are $52,000, your first-year deduction reduces to $3,000 ($5,000 minus the $2,000 excess). The remaining $49,000 is then amortized over 180 months.

What are the types of deductible business expenses according to Publication 535?

Employee compensation

Components of employees' pay, such as salaries, wages, commissions, and bonuses paid to employees, are considered deductibles, provided they are reasonable for the services performed. For example, a bakery can deduct payments to pastry chefs, sales staff, and delivery drivers as part of its business expenses. But, if compensation seems unusually high, especially for family members, the IRS might scrutinize it to ensure it aligns with fair market value.

Rent

Rent payments for office spaces, co-working facilities, or equipment leasing are deductible. However, if you are renting from a related party, ensure the amount is in line with market rates to avoid dis-allowances.

Utilities

Expenses for electricity, water, gas, the internet, and telephone used for business operations are deductible. For a consultancy firm operating remotely, internet and phone bills are essential operating expenses recognized by the IRS.

Insurance

Insurance premiums protecting your business operations are deductible. This includes general liability insurance, workers’ compensation, property insurance, and business interruption coverage. However, if you pay premiums for a life insurance policy where your business is the beneficiary, these are not deductible under IRS rules.

Taxes

Certain taxes, such as state and local income taxes (for C-corps), payroll taxes, and property taxes on business assets, are deductible. However, federal income taxes and personal income taxes for sole proprietors are not deductible business expenses.

Interest

Interest on business loans is deductible if the loan was used for genuine business purposes and there is a repayment obligation. For example, interest on a $30,000 loan to purchase inventory is deductible. But if the funds were used for personal expenses, the interest is not deductible.

Depreciation

Depreciation lets you break down the cost of a business asset and deduct it gradually over the years you use it. For example, a $10,000 server with a five-year lifespan gives you a $2,000 depreciation deduction annually under the straight-line method.

Advertising

Any advertising costs used to promote your business, from digital campaigns and printed brochures to radio ads and event sponsorships, are deductible under Publication 535.

Legal and professional fees

Payments to accountants, lawyers, or consultants for business-related services can be deducted. However, legal fees incurred in acquiring capital assets must be added to the asset’s cost basis and depreciated accordingly.

Meals

Business meals are generally 50% deductible if they are directly related to business activities, not extravagant, and either you or an employee is present. Entertainment expenses, like sporting event tickets or club memberships, are no longer deductible under the 2017 tax reforms.

Education and training

Training expenses to improve skills required for your current business are deductible. For instance, a CPA attending continuing annual education classes can claim these costs. However, education that qualifies or helps you for a new trade will not be eligible for deduction.

Repairs and maintenance

Routine repairs, like fixing a leaky pipe or replacing worn-out office flooring, are deductible. However, significant renovations or upgrades must be capitalized.

Other expenses

Other common deductible expenses include bank fees, software subscriptions for business operations, office supplies, travel costs (transportation, lodging, business meals), and vehicle expenses calculated either by standard mileage rates or actual costs incurred.

Check out A complete guide to business expense tax deductions to maximize write-offs for US businesses for more details.

What are the limits and special rules for business expenses in the US?

Capitalization requirements

Certain costs must be capitalized rather than deducted outright. This includes property improvements, purchases of buildings or equipment, and significant upgrades. The IRS does offer a de minimis safe harbor for small businesses, allowing immediate deduction for items costing $2,500 or less per invoice or item if they don’t maintain audited financial statements.

At-risk limits

Your deductible business losses are limited to the amount you have at risk in the activity, including investments and loans for which you’re personally liable. Any loss exceeding your at-risk amount is carried forward to offset future income from that same business activity.

Passive activity rules

If you have losses from passive activities, like rental properties, you can only use them to offset income from other passive sources. They cannot reduce your active business income, although unused passive losses can be carried forward or fully deducted upon disposal of the activity.

Not-for-profit activity limits

If the IRS deems your business to lack a profit motive (like a hobby business), your deductions cannot exceed the income generated from that activity.

Net operating losses (NOL)

If your deductible business expenses exceed your income for the year, you may carry forward the resulting NOL to reduce taxable income in future years, offering financial relief during periods of fluctuating profitability.

How to avoid mistakes that can trigger an audit

Here’s something many business owners don’t realize small businesses get audited nearly twice as often as individuals. Surprising, right? But the reason behind it is pretty simple. Most audits stem from mistakes that could have been avoided in the first place.

One common slip-up is blurring the line between personal and business spending. Think about it: You take your family out for dinner and later decide to label it as a client meeting to write it off. Without proper proof, that’s a surefire way to get the IRS on your back with penalties you don’t want to deal with.

Another area people often get wrong is how they treat large purchases. Say you buy new desks and chairs for your team. That isn’t like paying your monthly Wi-Fi bill. Such purchases are capital expenses. You cannot just deduct the whole amount at once. If you do, it will catch the IRS’s attention and can throw off your books and tax planning down the road.

Then there’s record-keeping or the lack of it. Imagine you’re claiming thousands of dollars for business travel, but when asked to submit the proof, you don’t have half of your receipts. This will create a highly doubtful situation and result in an audit trigger.

Here’s another thing to keep in mind. Always check if your deductions make sense against your income. If your business brings in $50,000 a year but you’re writing off $40,000 for meals and travel, don’t be surprised if the IRS comes knocking with questions.

So, what’s the smartest way to stay clear of these problems?

Keep your expense records neat and updated.

Make sure each expense is categorized properly.

Before you file your taxes, take a little time to review everything. It’s a simple habit, but it could save you a lot of stress and money in the long run.

What are the best record-keeping practices?

The IRS expects you to maintain thorough records to justify every deduction. This includes receipts, invoices, bank and credit card statements, mileage logs, contracts, and payroll records. Today, many businesses simplify this process by adopting expense management software, keeping their records organized, accessible, and audit-ready at all times.

Why smart expense management really matters

Think managing your business expenses is only about tax deductions? It’s much more than that. When you keep a close eye on what goes out, you get a clear picture of your cash flow. You’ll know exactly where your money is going each month, which makes planning and budgeting far easier. No more guessing whether you can afford that new hire or marketing campaign. You will have the numbers to back your decisions.

Tracking expenses properly also helps you spot areas where you’re overspending. Maybe you’re paying for software subscriptions you no longer use or spending too much on unnecessary travel. Identifying these leaks frees up cash that can go into things that actually drive growth.

Plus, staying on top of expenses keeps you compliant with IRS rules. The last thing you want is to scramble for receipts at tax time or get caught out in an audit because your records are incomplete. Overall, managing expenses well isn’t just good housekeeping. It gives you confidence to make smarter choices and build a business that’s financially strong and sustainable in the long run.

How can Zoho Expense simplify business expense management?

While Publication 535 clarifies what counts as business expenses, managing these expenses manually can be inefficient and error-prone.

Zoho Expense will help you ensure every expense is tracked efficiently, recorded promptly, and complies with regulations, allowing your team to focus on strategic initiatives and growth. Use Zoho Expense to streamline the entire process. It can:

Capture and categorize expenses instantly via digital receipts and autoscan.

Automate mileage, per diem, and travel expense tracking.

Ensure policy enforcement with real-time violation alerts and fraud detection.

Generate detailed expense reports with time-stamped audit trail records and digital support documents for tax filing and audits.

Easily integrate with your organization's accounting software and other IT stacks for clean, accurate books and reports.

Conclusion

Publication 535 by the IRS continues to be the basic and essential resource for any business aiming to manage its finances wisely and comply with tax laws. While understanding what qualifies as a business expense is crucial, integrating that knowledge with smart expense management solutions like Zoho Expense gives your business the edge to operate efficiently, remain compliant, and scale confidently.

Anu Sathian

Anu SathianAnu Sathian is a passionate FinTech content writer and a seasoned marketing professional with over 5 years of experience and a robust background spanning diverse industries, including FMCG, SaaS, IT Services, Higher Education, and Corporate and Commercial Travel. As a contributing expert at Zoho Expense Academy, Anu leverages this broad understanding to deliver insights that help businesses optimize their financial operations, with a particular emphasis on business travel, expense management, and corporate spend management. With a deep understanding of the evolving landscape of business spend and a knack for simplifying complex financial topics, Anu's content aims to empower businesses with actionable strategies.