- HOME

- Category: Taxes & compliance

Latest from us

Filter By

Clear filter

Taxes & compliance

How to make TDS payments in India

Taxes & compliance

TDS threshold limits for different sections in India

Taxes & compliance

A detailed guide to TDS reconciliation

Taxes & compliance

FAQs on GST rate changes 2025

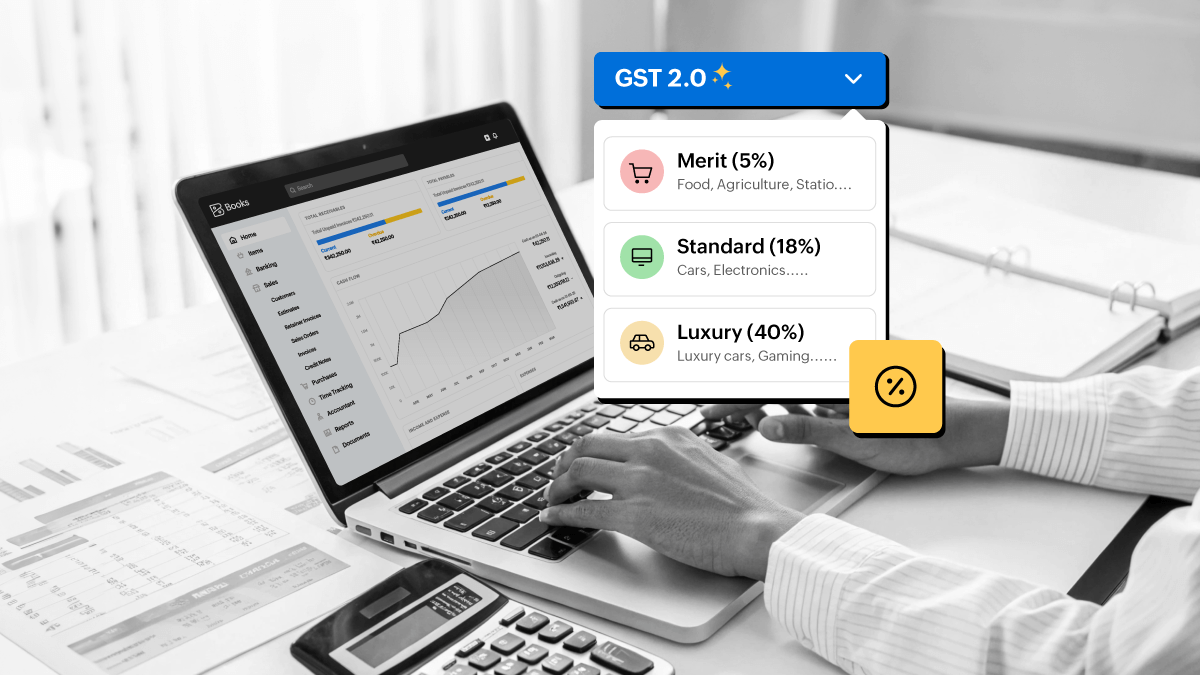

Taxes & compliance

The next generation of GST reforms: New GST rates and more!

Taxes & compliance

FAQs about the IMS in the GST portal

Taxes & compliance

What is the Invoice Management System in the GST portal?

Taxes & compliance

Direct tax: meaning, types, and examples in India

Taxes & compliance

Understanding the MSME 45-day payment rule in India: How Zoho Books can help

Taxes & compliance

Learn how the GSTR-1, GSTR-2 and GSTR-3 work

Taxes & compliance

Learn everything about the composition scheme in India

Taxes & compliance

Everything you need to know about e-Way Bill: FAQs

Taxes & compliance

All about transition to GST in India: FAQs

Taxes & compliance

Know everything about supply under GST in India: FAQs

Taxes & compliance

Get answers to all your questions about shipping bill in India: FAQs

Taxes & compliance