Streamline your ITC claim with Invoice management system

Easily manage your transactions, ensure accurate Input Tax Credit (ITC) claims, and eliminate self-assessment errors in GSTR-3B. Enjoy simplified GST compliance with the new Invoice Management System.

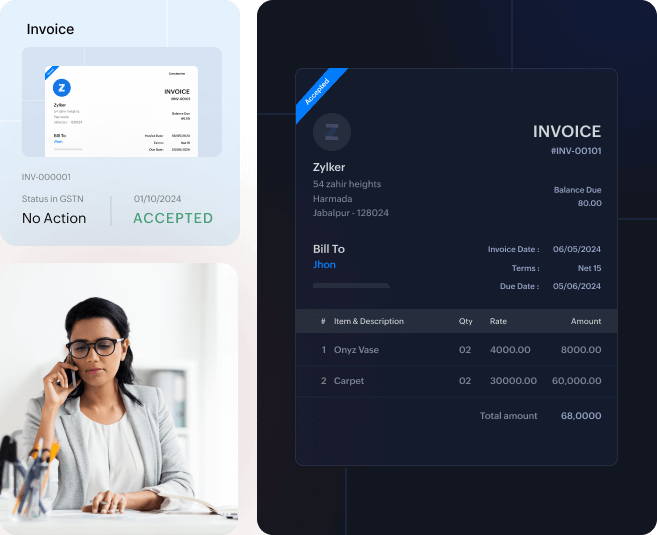

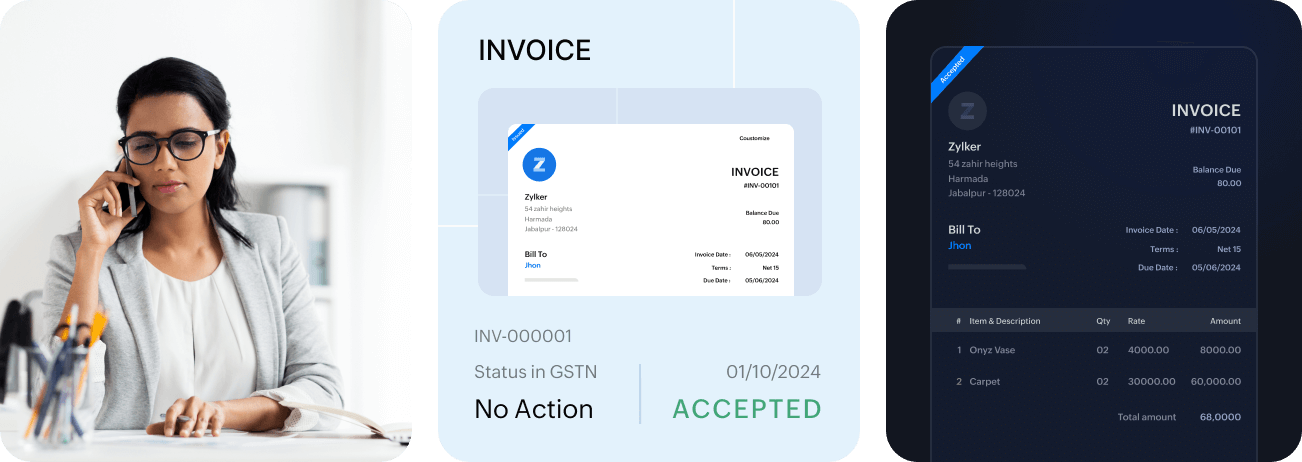

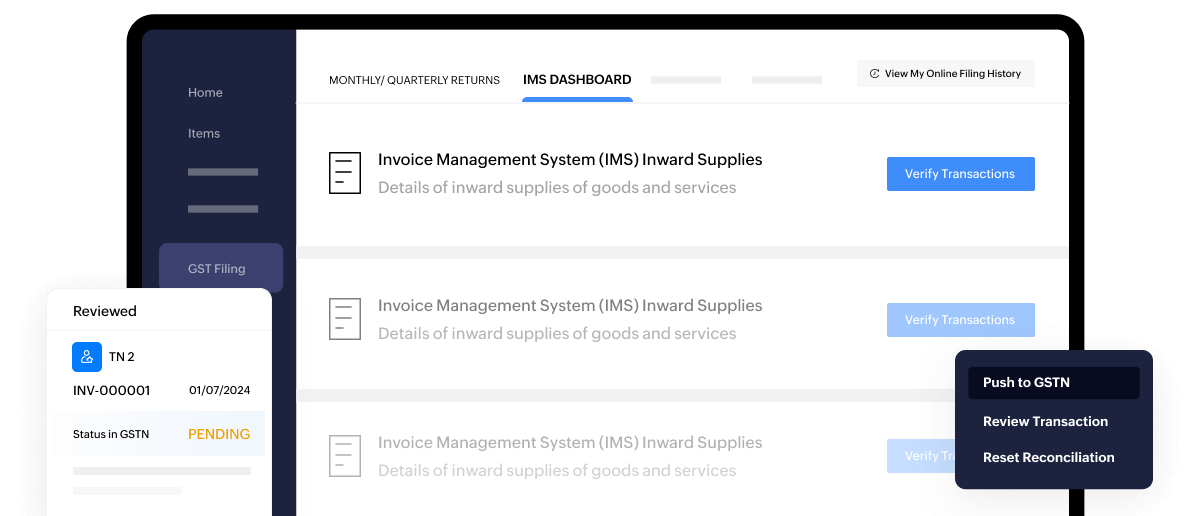

Invoice Management System in Zoho Books

All businesses can now use the system to control invoices that appear on GSTR-2B and GSTR-3B returns to improve the pace of ITC reconciliation.

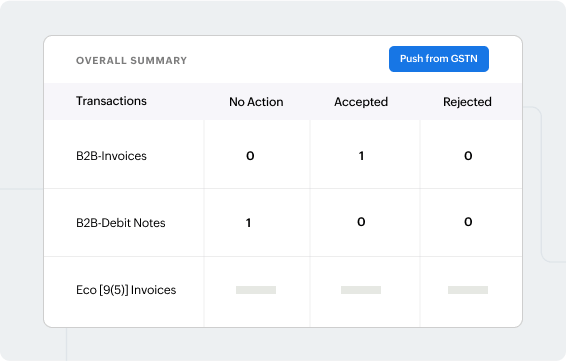

Pull and reconcile transactions from the GST Portal

The IMS inward supply overview can be viewed from the dashboard. The pulled transactions get auto-populated from supplier GSTR-1/IFF returns. This will be reconciled with the purchase transactions in Zoho Books and categorized as matched, partially matched, or missing.

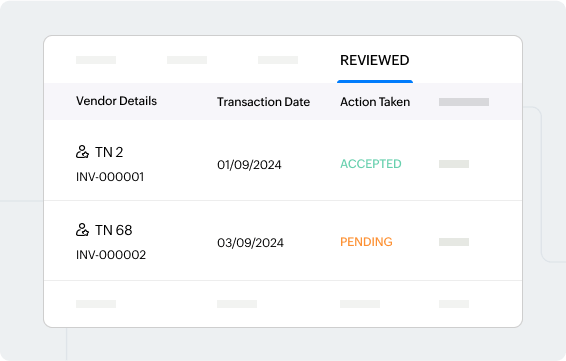

Review and act on reconciled and auto-populated transactions

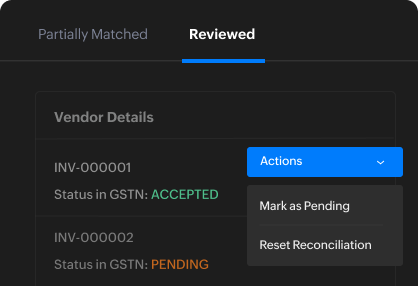

The transaction will appear in the Reviewed tab, showing its current status on the GST Portal and the action taken in Zoho Books, along with its push status. The bulk action is performed by selecting multiple transactions and applying actions to all of them at once, which helps save time.

Optimizing IMS Workflows

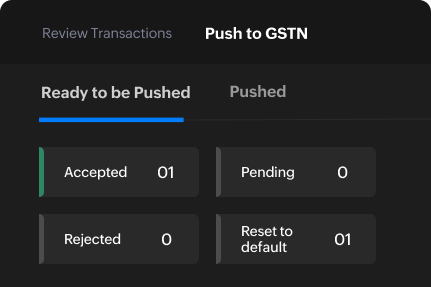

Push to GSTN

The reviewed transactions are pushed to the GST Portal through the Push to GSTN tab. Once the transactions are pushed to GSTN, they can be viewed under the Pushed tab section in Zoho Books.

Reset action taken on a transaction

The action taken on a transaction can be reverted, resetting it to "No Action" for accurate reconciliation. Unpushed transactions are reset and moved from the Reviewed tab to other sections, reducing errors.

FAQ section

How can I access IMS?

The IMS dashboard can be accessed directly within your Zoho Books organization. Additionally, multi GSTIN/branching enabled organizations can access the IMS by clicking GST Filing on the left side bar > View Return > navigate to the IMS dashboard and view a return.

What records will be available in the IMS for action?

All saved or filed original invoices/records and their amendments by suppliers through GSTR1/1A/IFF will be available for taking action in the IMS. However, some documents will be ineligible for ITC due to:

- POS rule.

- Section 16(4) of the CGST Act, will not appear in the IMS and will directly go to the ITC Not Available section of GSTR-2B.

What will happen to documents on which taxpayers have taken an action on in the IMS?

The documents will be treated in the following manner based on the different actions:

- Accept - Accepted records will become part of the ITC Available section of the respective GSTR-2B. An ITC of accepted records will auto-populate in GSTR-3B. (Note\: in order to get the ITC, the accepted transaction should be filed by the supplier in their returns).

- Reject - Rejected records will become part of the ITC Rejected section of the respective GSTR-2B. The ITC of rejected records will not auto-populate in GSTR-3B.

- Pending - Pending records will not become part of GSTR-2B and GSTR-3B. Such records will remain on the IMS dashboard until the same is accepted or rejected or until the timeline prescribed in Section 16(4) of the CGST Act.

- No Action - Records with a “No Action” status will be deemed accepted at the time of GSTR-2B generation.

Can I download all the data available in the IMS?

Yes, you can download an Excel file of your IMS data on the GSTN Portal.

What about GSTR-2B for quarterly taxpayers?

For quarterly taxpayers, a GSTR-2B will not be generated for the M1 and M2 months of the quarter. However, a GSTR-2BQ for the quarter (M1, M2, and M3 combined) will be generated on the 14th of Q+1 month and re-computation of 2B will be allowed on or after 14th of Q+1 month until the filing of a corresponding GSTR-3B. The same logic for monthly GSTR-2B/3B will be applicable.

What will happen if the recipient rejects the original Credit Note or upward amended Credit Note?

If the recipient rejects the credit note and furnished the GSTR-3B, then the corresponding liability will be added to the supplier liability in the GSTR-3B of the subsequent tax period.