GST is a single tax that has subsumed several indirect taxes that were previously levied on the sale of goods and services. It is applicable to the manufacture, sale, and consumption of all goods and services in India.

This section will cover the following topics

Why do we need GST?

The previous tax system involved multiple taxes, complex compliance procedures, and intervention by several State and Central tax divisions. This made it highly difficult to set up and run a business in India.

Under the GST regime, instead of applying taxes on the total value of the product at each stage, the GST only imposes tax on value addition. Since it provides credit for the input tax paid at each previous stage of a supply chain, this method considerably reduces the overall cost of manufacturing and selling goods.

How can GST change this?

Instead of applying taxes on the total value of the product at each stage, the GST only imposes tax on value addition. Because it provides credit for the input tax paid at each previous stage of a supply chain, this method considerably reduces the overall manufacturing cost.

Let’s take a closer look at how this works with a simple example.

Comparison of Previous Tax Structure vs. GST

Imagine a manufacturer selling zinc-coated steel buckets to a wholesaler located in the same state (let’s call it State 1) for Rs. 1,000 each plus tax.

Note: In this example, we are assuming that all taxes associated with the manufacturing process have been paid and the selling price in the first stage is the final price set by the manufacturer (excluding VAT).

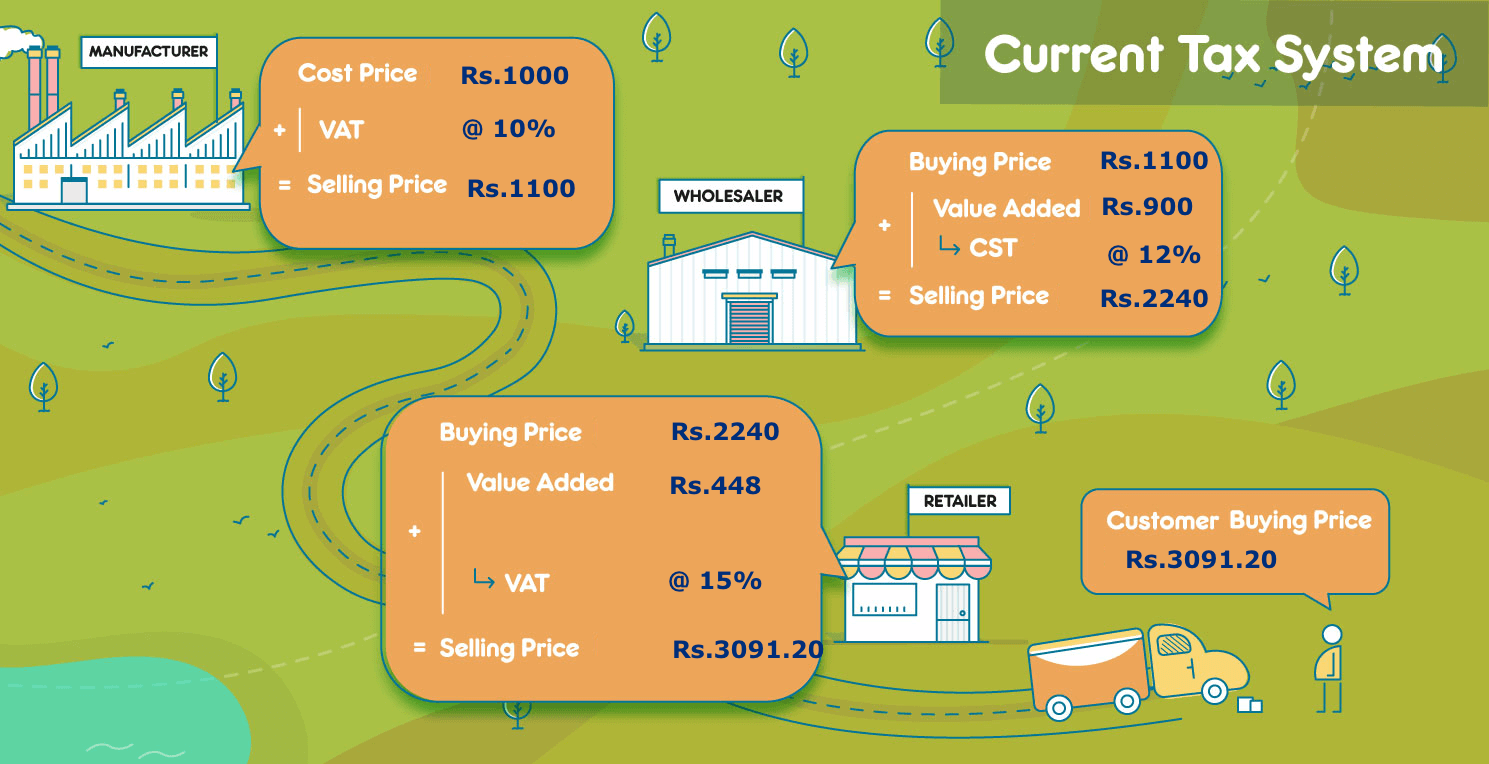

Previous Tax Structure

- The manufacturer sells the buckets to a wholesaler located in State 1 for Rs. 1,000 each plus a VAT of 10% (which adds Rs. 100 per bucket).

- The wholesaler in State 1 buys the buckets for Rs. 1,100 per piece and increases the selling price to Rs. 2,000 per bucket before selling a few of them to a retailer located in a different state (State 2). Under the pre-GST regime, this interstate sale will attract a Central Sales Tax (CST) of 12% on Rs. 2,000 (which adds Rs. 240 CST per bucket).

- The retailer pays Rs. 2,240 per bucket, increases the price by 20%, and offers the buckets to local consumers in State 2 for Rs. 2,688 plus a VAT of 15% (which adds Rs. 403.20 per bucket).

- The end consumer pays a total of Rs. 3,091.20/- per bucket.

Note: Here we have assumed the VAT rate in state 1 to be 10% while the VAT rate in state is 15%. This is because under the pre-GST system, the VAT rates are different across different states.

In the above example, you can see that at every stage of the process, the application of tax is non-uniform. The tax rate and type are different each time, and getting ITC is difficult or impossible because the different taxes are governed by different authorities.

Bottomline - Sellers lose money on taxes at every stage as they don’t get input tax credit or refund on the tax paid on purchase whenever they make a sale.

GST

Now, let’s take the same example, but instead apply the GST model.

- The manufacturer sells the buckets to a wholesaler located in State 1 for Rs. 1,000 each plus a GST of 10% (which adds Rs. 100 per bucket).

- The wholesaler in State 1 buys them for Rs. 1,100 per piece and increases the total selling price to Rs. 2,000 per bucket before selling a few of them to a retailer located in a different state (State 2). Under the GST regime, this interstate sale will attract an IGST of 10% on Rs. 2,000 (which adds Rs. 200 per bucket).

- The retailer pays Rs. 2,200 per bucket, increases the price by 20%, and offers the buckets to local consumers in State 2 for Rs. 2,640 plus a GST of 10% (which adds another Rs. 264 per bucket).

- The end consumer pays a total of Rs.2,904/-.

Note: Here, we have assumed the GST on zinc-coated steel buckets to be 10%. GST for the bucket will stay the same throughout India, irrespective of whether it is an intra-state sale or inter-state sale.

Bottomline - Looking at both the examples, one can see that there is not much difference to the buyer/end consumer. The benefit to the end consumer totally depends on the GST rate associated with a particular item or service under the GST. If we had assumed a higher GST rate for the bucket, the end consumer would have actually paid a lot more than earlier. But then, the real benefit from the GST regime is actually reaped by sellers, manufacturers and traders because the GST allows an unrestricted flow of input tax credits and so they get a refund on the input taxes that they have paid at the time of sale. That said, sellers can pass on this benefit to the end consumer if they choose to by reducing their final selling prices (as they do get their tax money back).

Components of GST

Since July 2017, India has been following the dual-GST model, which is made up of the following components:

SGST - A form of GST collected by the state government

CGST - A form of GST collected by the central government

When the sale of goods and services takes place within the same state, both taxes will be levied.

If the movement of goods occurs between two different states (i.e., an interstate transaction), a combined tax called the IGST or the Integrated GST (SGST + CGST) will be collected by the central government. The IGST will replace the previously levied Central Sales Tax (CST) of 2%.

The tax amount collected as IGST will later be distributed to respective state governments.

To understand the dual-GST model better, let’s take a look at the following scenarios:

Scenario 1: Levy of SGST and CGST

Let us assume that you’re a distributor in Chennai and you buy goods from a manufacturer in Tirupur, Tamil Nadu. Since the sale and movement of goods happen within the state, SGST and CGST will be levied on the sale. You, as the distributor, will get tax credit on the input SGST and CGST.

Scenario 2: Levy of IGST

Let us assume that you’re a distributor in Belgaum, Karnataka, and you buy goods from a manufacturer in Tirupur, Tamil Nadu. Here, the sale and movement of goods happen between two different states, IGST will be levied on the sale.

GST Tax Structure

The four-tier tax structure of GST has the following slabs: a zero rate, a lower rate, two standard rates, and a higher rate. Here’s a brief overview of each GST rate.

Zero rate

The zero rate tax is a nil tax that is applied on goods and services. Zero rated items include milk, eggs, curd, unpacked foodgrains and health & educational services.

Lower rate

A lower rate of 5% will be applied on items like sugar, tea, edible oil, coal, spices, and cotton fabric. This, along with the zero rate, will help prevent inflation from having much of an impact on the prices of essential items.

Standard rate

There are two standard rates that have been finalized by the GST Council: 12% and 18%.

Processed food, butter, and mobile phones will be taxed at 12%. Capital goods, industry intermediaries, toiletries, computers and printers will be taxed the second standard rate of 18%.

Higher rate

A higher rate of 28% will be levied on white goods. This includes items such as washing machines, high-end motorcycles, air conditioners, refrigerators, small cars, etc.

Additional cess

The additional cess, which has been a topic of debate since the GST rates were proposed, is now finalized. It was feared that demerit goods such as tobacco products and aerated drinks, which were previously taxed at 65% and 40%, would become cheaper and too easily accessible if the highest rate of GST was set at 28%. To keep this from happening, the new GST structure will collect an additional cess on top of the 28% GST. The cess will only be applied on demerit goods like like coal, paan masala, tobacco, aerated drinks, and motor vehicles.