CIS Filing

As a contractor, you are required to report the payments made to your subcontractors to HMRC through your monthly returns. Zoho Books allows you to file these returns directly with HMRC and record the payments in your organisation.

Enable CIS Filing

To generate your monthly returns using Zoho Books, you need to enable CIS filing. Here’s how:

- Go to Settings in the top-right corner.

- Select Taxes under Taxes and Compliance.

- Navigate to the Construction Industry Scheme tab.

- Check the Enable CIS returns generation and submission to HMRC option.

- Select the required Business Type.

- Enter the required date in the First Return Generation Date field.

- Click Save.

Note: Please verify that the details you entered when enabling the Construction Industry Scheme are correct, as any inaccuracies could cause an error when filing your return.

User Permissions

If you are the admin of the organisation for which CIS filing is enabled, the option to file returns will be automatically available to you. For other users, you will need to enable access to file returns.Here’s how:

- Go to Settings in the top-right corner.

- Select Roles under Users and Roles.

- Select the role to which you want to provide access to file returns.

- Click Edit next to the role.

- Scroll down to Construction Industry Scheme and select the appropriate option next to the CIS Return field to provide the desired access to the user.

- Click Save.

Generate and and File CIS Returns

You can generate and file your CIS returns directly through Zoho Books, which integrates with HMRC’s system for CIS submissions.

To generate CIS return:

- Go to CIS on the left sidebar and select CIS Filing.

- Select Unsubmitted Return.

- Click Generate CIS Return.

After generating the return, you can either Submit to HMRC or, if you’ve filed them directly with HMRC, you can Mark as Filed in Zoho Books.

File With HMRC

To file your returns with HMRC:

- Click Submit to HMRC.

Note: If the CIS tracking details entered for the vendor (subcontractor), such as UTR or NINO, are incorrect, you may encounter errors when submitting your returns to HMRC.

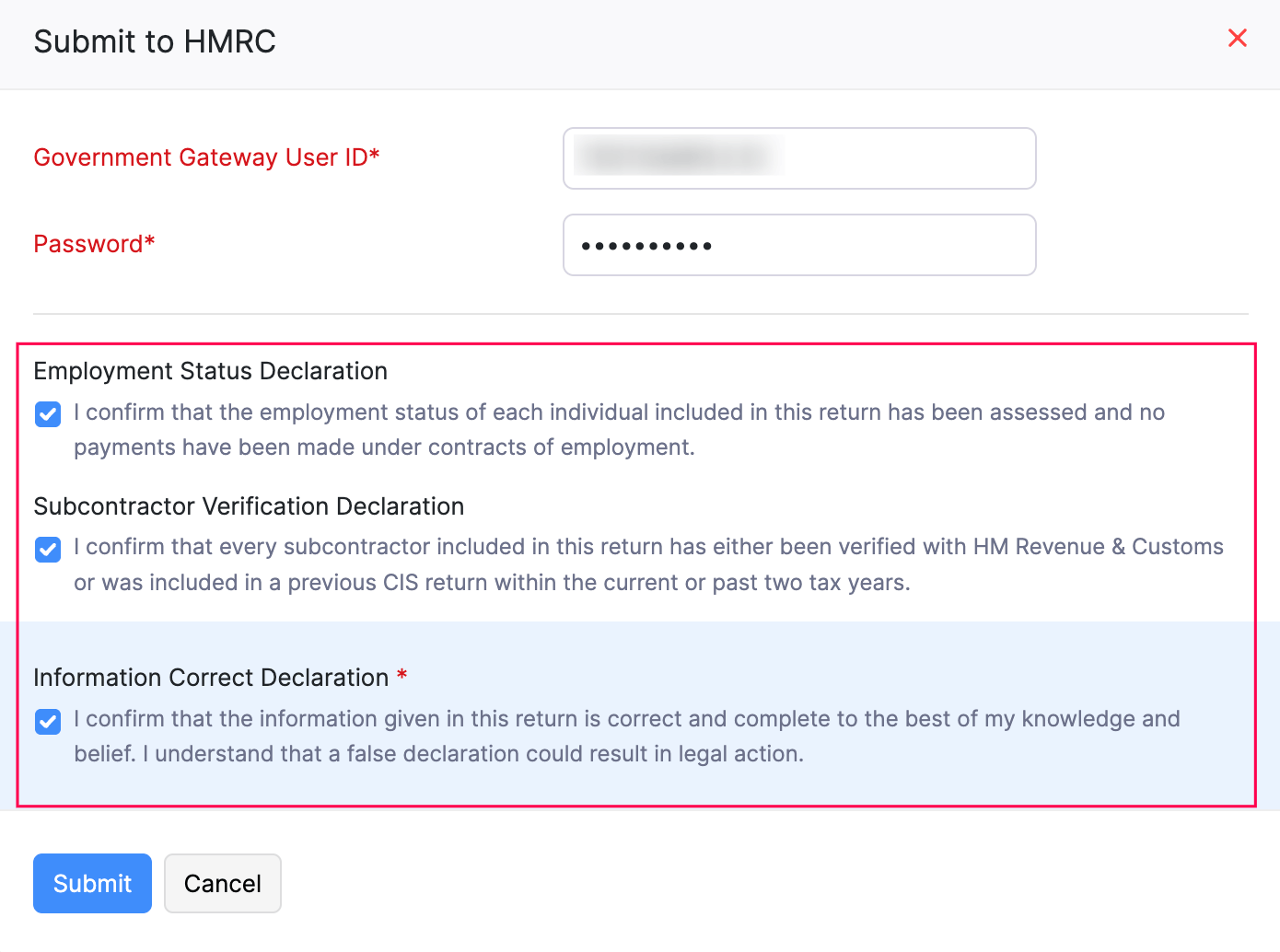

In the the pop-up that follows, enter your Government Gateway User ID, the Password, and acknowledge the following declarations:

Employment Status Declaration (optional): Select this to delcare that you have assessed the employment status of all workers included in the return and that no payments were made under contracts of employement.

- Remember that false declaration may result in HMRC investigation for disguised employment, and will lead to financial penalties and criminal prosecution.

Subcontractor Verification Declaration (optional): Select this to declare that all subcontractors have been verified with HMRC or were included in a CIS return in the current or previous two tax years.

- Remember that false declaration will result in penalties and criminal prosecution.

Information Correct Declaration (mandatory): Select this to declare that the provided information is accurate, and acknowledge that any false declaration may lead to legal action.

- Click Submit.

You can click Refresh after a while to check the status of the return. Once the return is successfully submitted to HMRC, the status will be updated to Submitted to HMRC.

Mark As Filed

To mark your return as filed:

- Click the dropdown next to Submit to HMRC and select Mark as Filed.

- Enter the Date of Filing and click Mark as Filed in the pop-up that appears.

Your CIS return will be marked as Filed.

CIS Payment

To record a payment for your CIS return:

- Go to CIS on the left sidebar and select CIS Filing.

- Navigate to the All Returns tab.

- Hover over the return for which you want to record a payment and click the More icon.

- Click Record Payment from the dropdown.

- Select a Paid Through account and Payment Date.

- Enter the Amount Paid.

- Click Save.

Your CIS payment will be recorded.

Note: You can also record payment for your returns by navigating to CIS > CIS Payments > Payment Dues.

View Payments

To view the CIS payments that you recorded:

- Go to CIS on the left sidebar and select CIS Payments.

- Navigate to the Payment History tab.

You can view the payments that you recorded for your returns.

Note: To edit the payment, go to CIS > CIS Payments > Payment History > click the payment. You can also delete the CIS payment by clicking the Delete icon next to it.

Note: To edit the payment, go to CIS > CIS Payments > Payment History > click the payment. You can also delete the CIS payment by clicking the Delete icon next to it.

Yes

Yes