Tax Summary Reports

The Taxes section consists of the following reports:

VAT Summary Report

This report provides a detailed summary of different VAT categories, net amounts, and VAT amounts to help you calculate the VAT liabilities and reclaimable VAT amount for your organization.

In the report:

Net Amount is the total income or total expense amount without applying VAT.

Gross Amount is the total amount after applying VAT.

VAT Amount is the difference between the Net Amount and the Gross Amount.

Notional amount is a theoretical value assigned to certain financial assets or transactions which is used to calculate taxes or assess financial transactions.

VAT on Sales

This section includes the sales transactions in your organization, classifying them according to different tax rates.

| VAT Category | Net Amount - Box | Net Amount | VAT Amount - Box | VAT Amount |

|---|---|---|---|---|

| Sales at 19% VAT rate | 81 | The total amount received from all sales transactions with the standard 19% VAT rate. | The total VAT amount received from all sales transactions with the Standard 19% VAT rate. | |

| Sales at 7% VAT rate | 86 | The total amount received from all sales transactions with reduced 7% VAT rate. | The total VAT amount received from all sales transactions with the Reduced 7% VAT rate. | |

| Sales with other VAT rates | 35 | The total amount received from all sales transactions with different VAT rates. | 36 | The total VAT amount received from all sales transactions with different VAT rates. |

Tax-free/Zero-Rated Intra Community Sales with Input Tax Deduction

This section includes tax-free or zero-rated sales transactions made in your organization with EU customers with VAT ID numbers or input tax deduction.

Insight: Input tax deduction enables businesses in Germany to deduct the VAT amount they paid on their purchases from the VAT amount they collected on their sales.

| VAT Category | Net Amount - Box | Net Amount | VAT Amount - Box | VAT Amount |

|---|---|---|---|---|

| to customers with a VAT Id-No | 41 | The total amount received from all sales transactions made to EU customers who have VAT ID numbers. | ||

| Further tax-free sales with input tax deduction (Sales according to § 4 No. 2 to 7 UStG of the VAT Act) | 43 | The total amount received from all tax-free sales transactions with input tax deduction, such as international exports (third country deliveries) |

Tax-free sales without input tax deduction

This section includes tax-exempt sales transactions without input tax deduction.

| VAT Category | Net Amount - Box | Net Amount | VAT Amount - Box | VAT Amount |

|---|---|---|---|---|

| Exempt transactions without deduction (e.g. sales according to § 4 No. 8 to 29 UStG) | 48 | The total amount received from all tax-free sales transactions without input tax deduction. |

Intra-community Acquisitions

This section includes the taxable purchase transactions made in your organization with EU vendors, classifying them according to different tax rates.

| VAT Category | Net Amount - Box | Net Amount | VAT Amount - Box | VAT Amount |

|---|---|---|---|---|

| Taxable intra-community acquisitions at a tax rate of 19% | 89 | The total amount from all purchase transactions made with vendors in EU countries with the standard 19% VAT rate. | The total Notional Tax amount from all purchase transactions with the Standard 19% VAT rate. | |

| Taxable intra-community acquisitions at a tax rate of 7% | 93 | The total amount from all purchase transactions with the Reduced 7% VAT rate. | The total Notional Tax amount from all purchase transactions with the Reduced 7% VAT rate. | |

| Taxable intra-community acquisitions at other tax rates | 95 | The total amount from all purchase transactions with different VAT rates if the applied notional rate is greater than 0%. | 98 | The total Notional Tax amount from all purchase transactions with different VAT rates. |

Tax Liability of the Recipient (Reverse Charge) (§ 13b UStG)

This section includes the purchase transactions under the reverse charge mechanism.

| VAT Category | Net Amount - Box | Net Amount | VAT Amount - Box | VAT Amount |

|---|---|---|---|---|

| Other services according to § 3a para. 2 UStG of an entrepreneur based in the rest of the community area (§ 13b para. 1 UStG) | 46 | The total amount from all EC purchases of services. | 47 | Notional tax amount of EC purchase of services |

| Other services (§ 13b para 2 No. 1, 2, 4 to 12 UStG) | 84 | The total purchase amount for transactions with services under reverse charge, and services purchased from outside the EU. | 85 | The total notional VAT amount from all purchase transactions with services under reverse charge, and services purchased from outside the EU. |

Supplementary/Additional Information On Sales

This section includes various types of taxable and non-taxable sales as per Germany’s VAT Act.

| VAT Category | Net Amount - Box | Net Amount | VAT Amount - Box | VAT Amount |

|---|---|---|---|---|

| Taxable sales, where recipient is liable for tax payment according to § 13b para. 5 UStG | 60 | The total amount received from taxable sales transactions where the customer is responsible for paying VAT. The total amount received for the sales of transactions under reverse charge. | ||

| Non taxable supply of services according to § 18b sentence 1 no. 2 UStG | 21 | The total amount received from the sale of non-taxable services. The total amount received from the EC sale of services. | ||

| Other non-taxable sales (place of supply outside Germany) | 45 | The total amount received from the sale of non-taxable services outside Germany. The total amount from sales transactions under the OSS scheme. (sales to third country outside of EU) |

Total VAT

This is the calculated total VAT amount based on the information in the previous sections.

Total VAT = Box 81 (tax amount) + Box 86 (tax amount) + Box 36 + Box 89 (tax amount) + Box 93 (tax amount) + Box 98 + Box 85

Deductible VAT on Purchases

This section includes deductible VAT on purchases. It includes the VAT you paid on invoices received from other businesses, the VAT amount of the items you purchased from EU vendors, the VAT you paid on imported items, and the VAT amount you can deduct for vendors under the reverse charge mechanism.

| VAT Category | Net Amount - Box | Net Amount | VAT Amount - Box | VAT Amount |

|---|---|---|---|---|

| Input tax on invoices from other businesses (§ 15 para. 1 sentence 1 no. 1 UStG), from services within the meaning of § 13a para. 1 No. 6 UStG (§ 15 para. 1 sentence 1 no. 5 UStG) and from intra-community triangular transactions (§ 25b para. 5 UStG) | 66 | The total input tax amount from all purchase transactions with Standard rates and Reduced rates. | ||

| Purchase VAT amounts from the intra-community acquisition of goods (§ 15 para. 1 sentence 1 no.3 UStG) | 61 | (Notional Tax amount from purchases with Standard rate of 19%) + (Notional tax amount from purchases with Reduced rate of 7%) + (Notional tax amount from purchases with other tax rates) | ||

| Taxes paid on imports (§ 15 para. 1 sentence 1 no. 2 UStG) | 62 | Net tax amount from imported items in purchase transactions. | ||

| Input tax amount for supplies subject to reverse charge procedure according to § 13b UStG (§ 15 para. 1 sentence 1 no. 4 UStG) | 67 | Notional tax amount from purchases with EC services, services from outside of EU, and services under reverse charge. |

Deduction VAT Amount

This is the calculated deduction VAT amount based on the information in the previous sections.

Deduction VAT Amount = Box 66 + Box 61 + Box 62 + Box 67

VAT Payable/Reclaimable

This is the total calculated amount which is the difference between the total VAT and the deduction VAT amount. If this amount is a positive number, it indicates VAT payable and if it is a negative number, it indicates VAT reclaimable.

VAT Payable/Reclaimable = Total VAT - Deduction VAT Amount

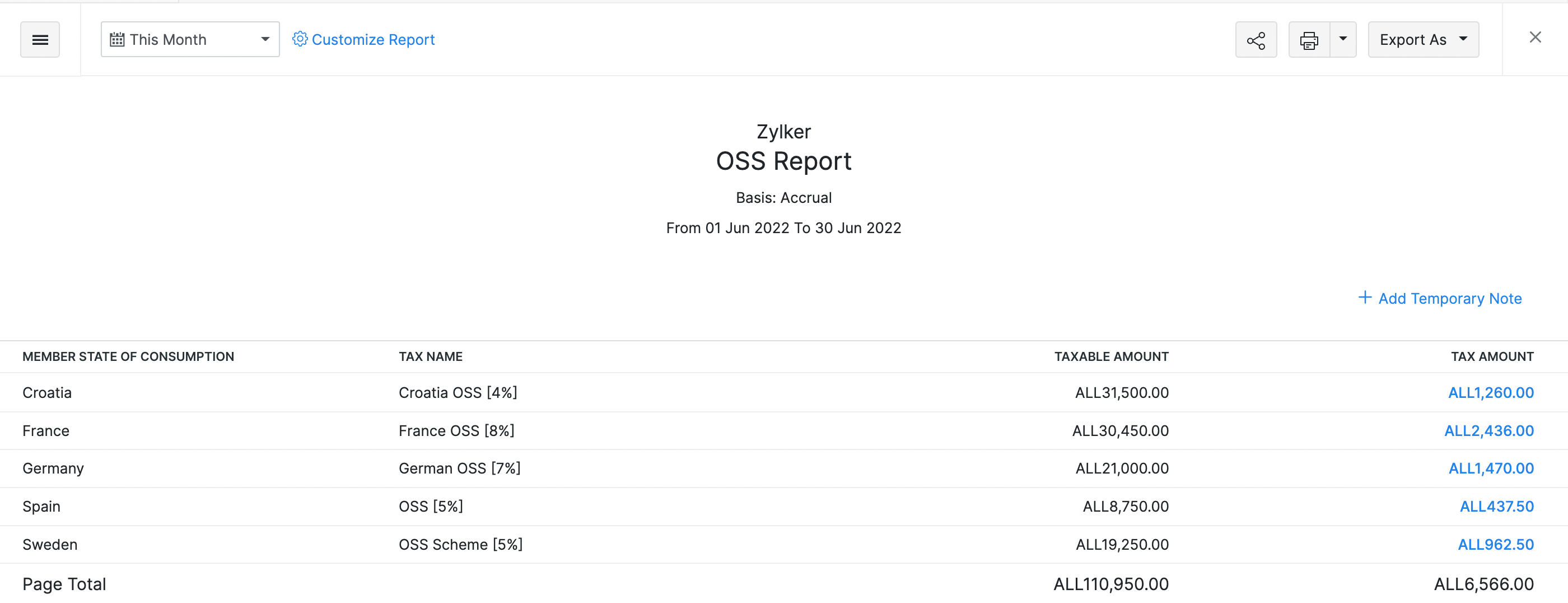

OSS Report

The OSS Report gives a summary of VAT rates applied to transactions in German businesses that provide services to customers in other European countries under the OSS scheme. It helps in tracking VAT rates based on the customer location so you can apply the correct VAT rates.

To view this report:

- Click Reports on the left sidebar.

- Select OSS Report in the Taxes section.

| Column | Description |

|---|---|

| Member State Of Consumption | The country into which the goods and services are imported. |

| VAT | The VAT rate applied for a particular country. |

| Taxable Amount | The total for which you have sold your goods and services. |

| Tax Amount | The tax applied on the total taxable amount for that country. |

You can also customize this report to filter and view it for specific date ranges and report basis.

CWT Reports

CWT Reports give you a detailed report of all the transactions raised under CWT for both contractors and subcontractors.

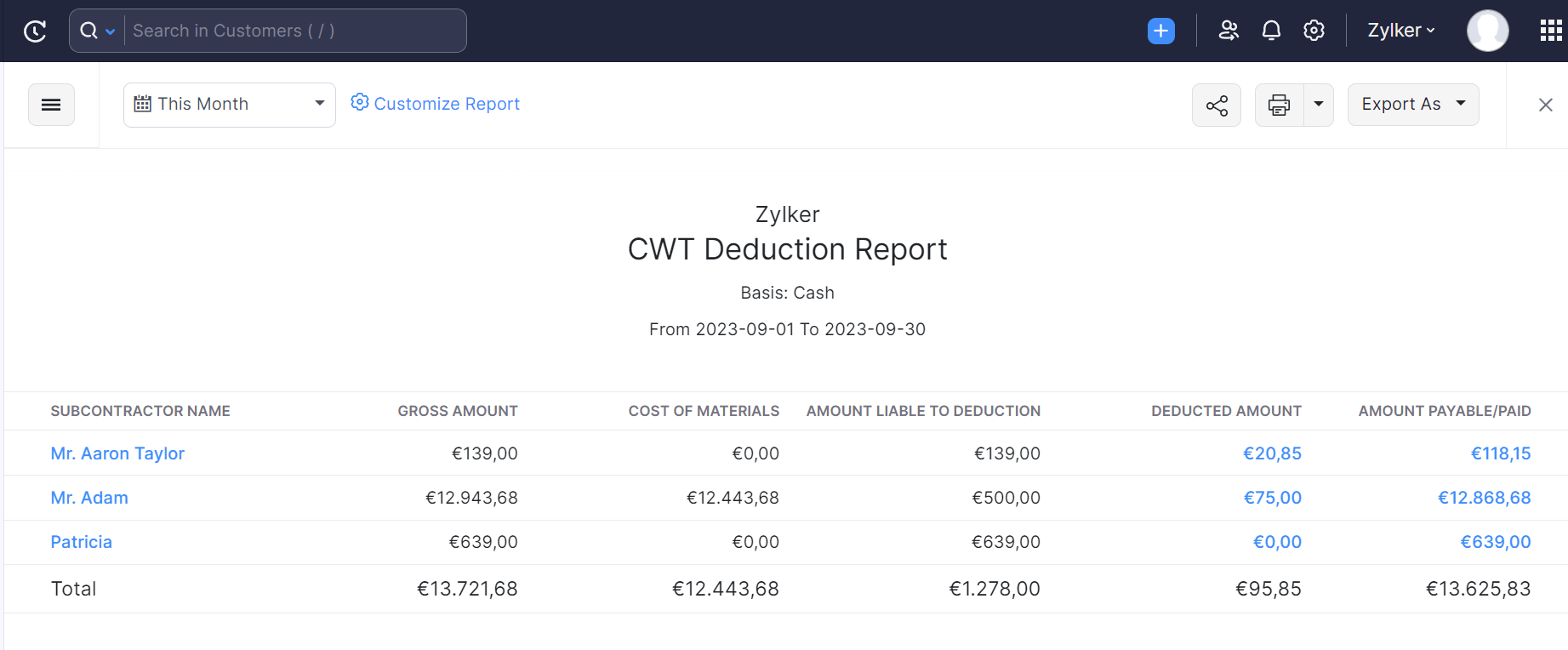

CWT Deduction Report

The CWT Deduction report gives you a summary of the money that a contractor (customer) has deducted from a subcontractor(vendor) to pay the German Tax Office on behalf of the subcontractor.

To view this report:

- Click Reports on the left sidebar.

- Select CWT Deduction Report under Taxes.

| Column Name | Description |

|---|---|

| Subcontractor Name | Subcontractor from whom money is deducted |

| Gross Amount | Total amount that the subcontractor has billed you |

| Cost of Materials | The cost of materials in all the transactions |

| Amount Liable to Deduction | Total amount to which CWT should be applied |

| Deducted Amount | Total amount deducted under CWT |

| Amount Payable /Paid | The total amount which you owe to the subcontractor |

- Click the amount in Deducted Amount or Amount Payable field, to view all the transactions created under CWT for the subcontractor.

Also, you can customize this report to filter and view specific parts of the report.

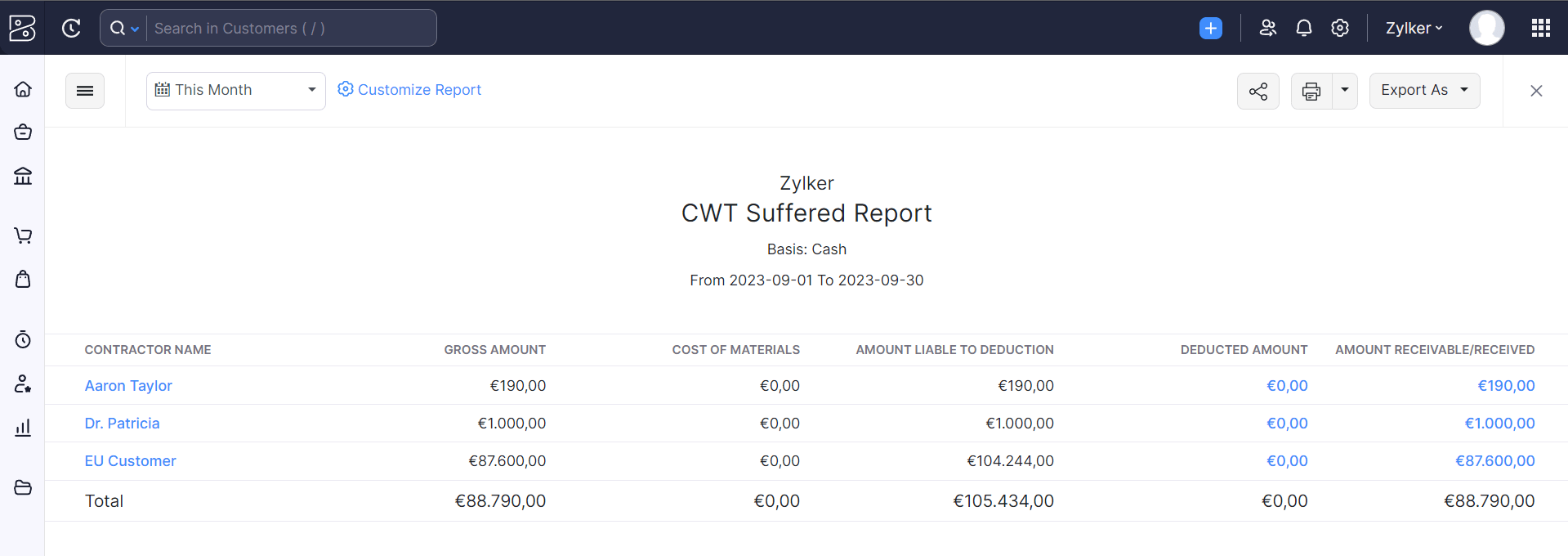

CWT Suffered Report

The CWT Suffered report gives you a summary of the money that a subcontractor has paid the contractor to pay German Tax Office on their behalf.

To view this report:

- Click Reports on the left sidebar.

- Select CWT Suffered Report under Taxes.

| Column Name | Description |

|---|---|

| Contractor Name | Contractor who deducts money from you |

| Gross Amount | Total amount that you have invoiced the contractor for |

| Cost of Materials | The cost of materials in all the transactions |

| Amount Liable to Deduction | Total amount to which CWT should be applied |

| Deducted Amount | Total amount deducted under CWT |

| Amount Payable /Paid | The total amount which you have received from the contractor |

- Click the amount in Deducted Amount or Amount Receivable field, to view all the transactions created under CWT for the contractor.

Also, you can customize this report to filter and view specific parts of the report.

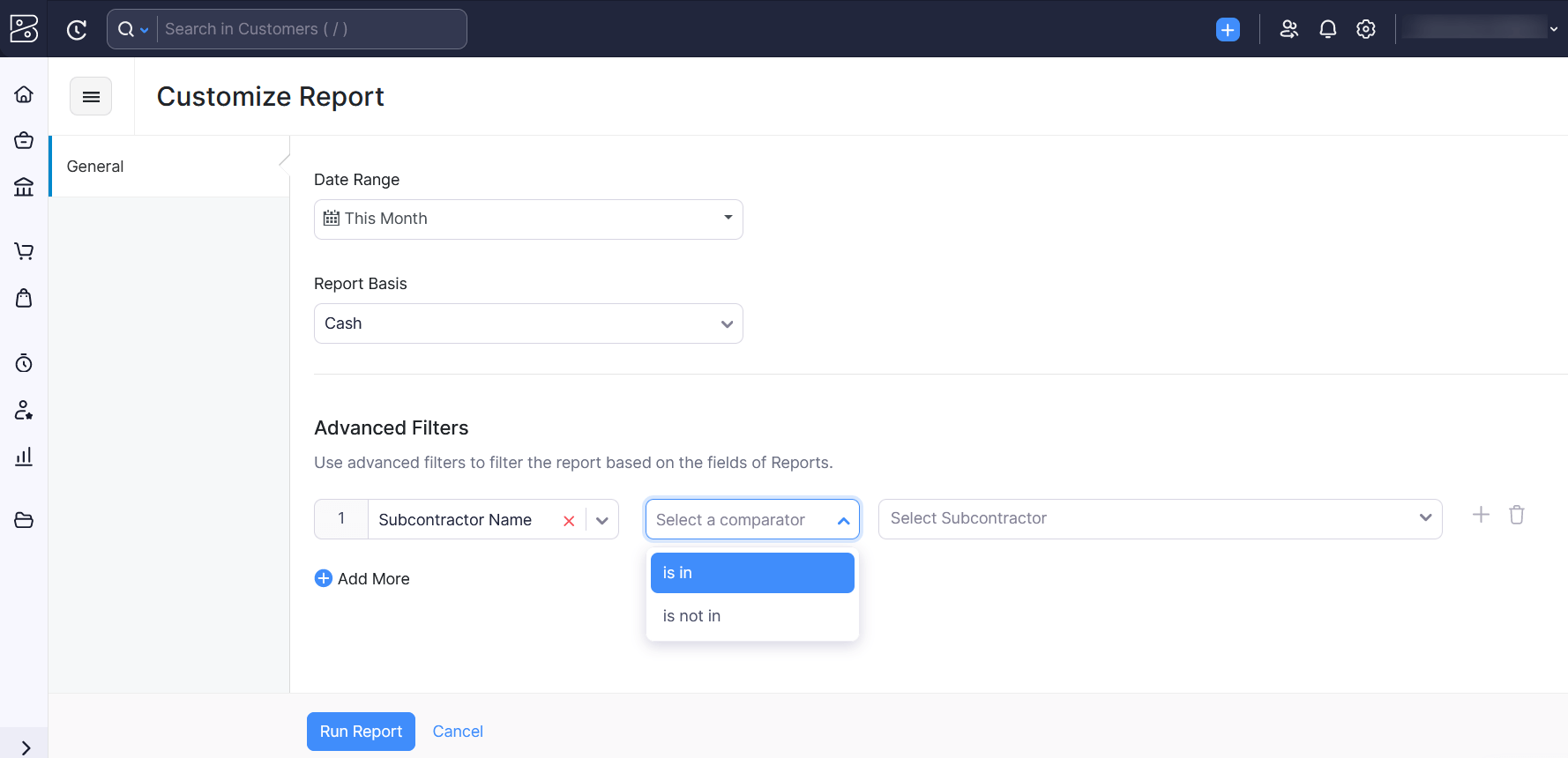

Customize CWT Reports

Customising a report allows you to view transactions by a contractor or a subcontractor and view all transactions created during a specific period.

To customize the report:

- Go to Reports and click CWT Deduction Report or CWT Suffered Report under the Taxes section.

- Click Customize Report on top of the page.

- Select the Date Range for which you want to generate the report.

- Select if you want the report to be generated on Accrual or Cash basis in the Report Basis dropdown.

Note: The reports generated on cash basis will only include transactions for which payment is received/sent under CWT.The reports generated on an accrual basis will include all transactions sent under CWT.

You can use Advanced Filters to customize the report further. Here’s how:

- In the Customize Report page, click Advanced Filters.

- Select Contractor/Subcontractor name field.

- There are 2 comparators which you can select in Select a Comparator.

| Comparator | Function |

|---|---|

| Is in | Generates a report for all the transactions raised for the selected contractor/subcontractor. |

| Is not in | Generates a report for all the transactions excluding the transactions raised for the selected contractor/subcontractor. |

- Select the Contractor/Subcontractor.

You can add multiple advanced filters and customize the report the way you want to view it.

Yes

Yes