Reconciling GSTR-2B

GSTR-2B is an auto-drafted ITC (Input Tax Credit) statement that is generated on the 14th of every month. The source of information for GSTR-2B is GSTR-1, GSTR-5, GSTR-6 and ICEGATE system (Indian Customs Electronic Gateway), hence, it will not contain the TDS and TCS details.

Prerequisite

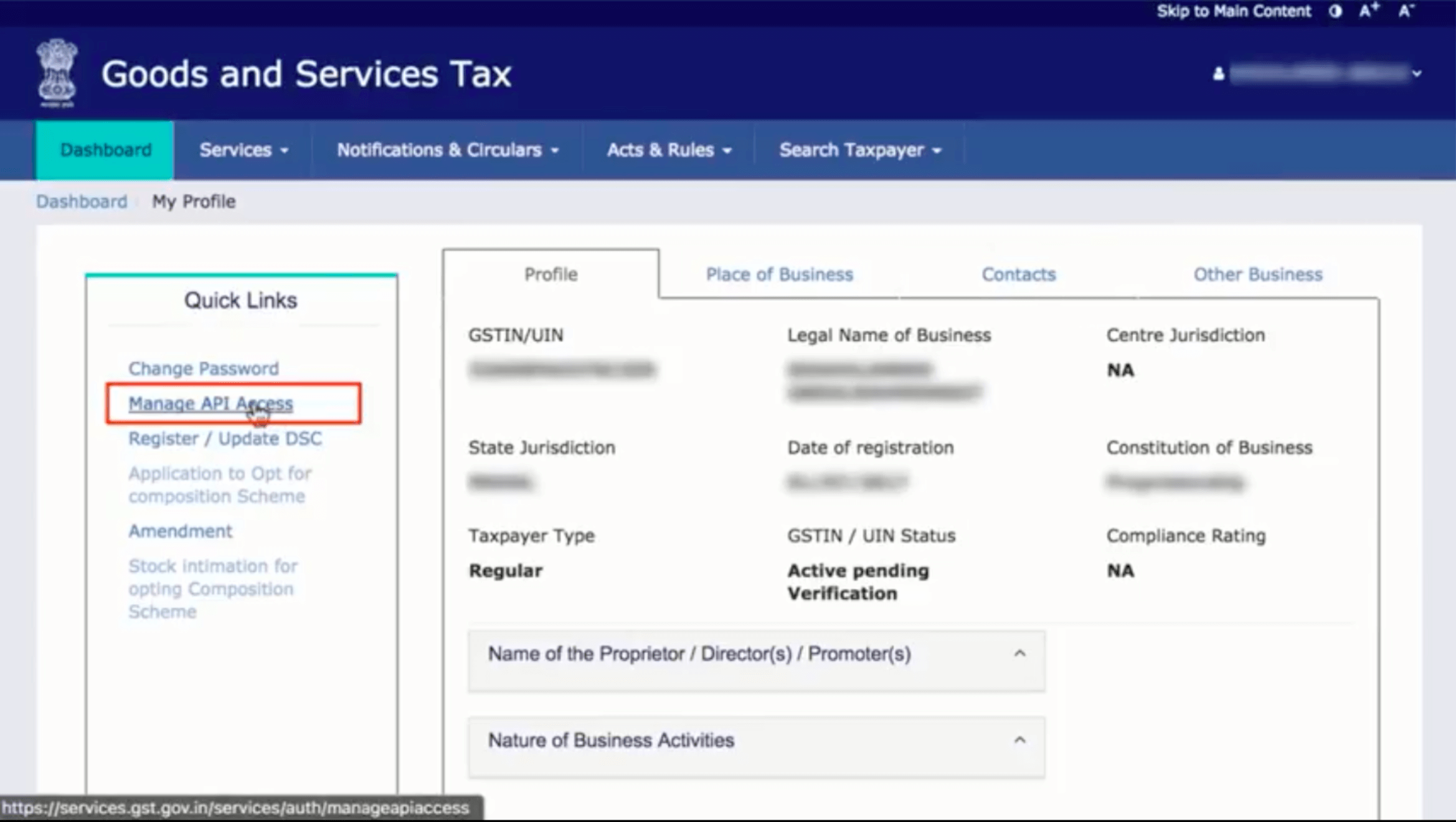

You’ll need to enable API access for Zoho Books in the GST Portal. If you’ve not enabled it, you can follow these steps:

- Login to the GSTN portal.

- Click My Profile from the top right corner.

- Click Manage API Access from the Quick Links tab.

- Check the Yes option under enable API Request.

- Select the Duration and click Confirm.

Notes: If you’ve already configured it, you can skip the above step.

Fetch GSTR-2B Transactions from GSTN

Reconciling GSTR-2B is similar to that of GSTR-2A. Firstly, you’ll have to pull the transactions from GSTR-2B available in the GST portal. Here’s how you can do it:

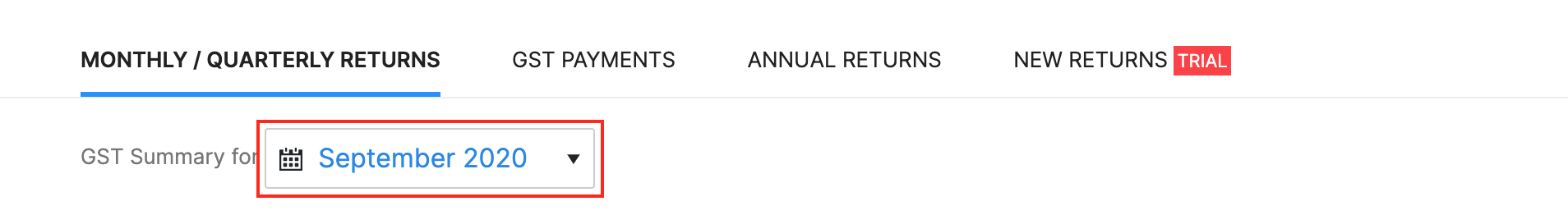

- Go to the GST Filing module on the left sidebar in Zoho Books.

- Select the Month of Filing from the option GST Summary For.

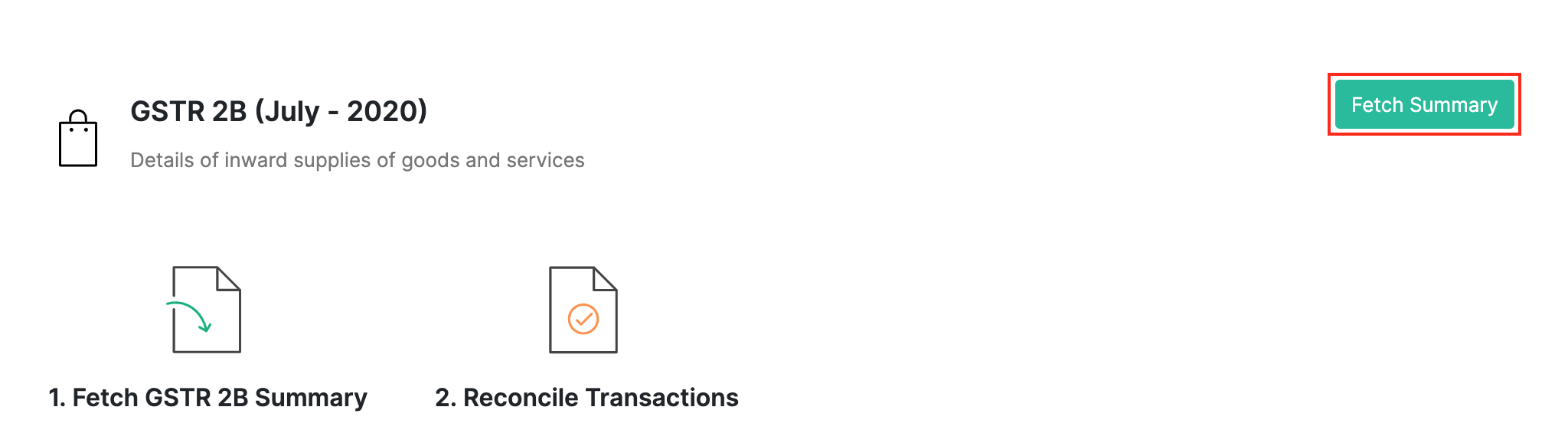

- Click View Summary and go to the GSTR-2B section from the bottom of the page.

- Click Fetch Summary.

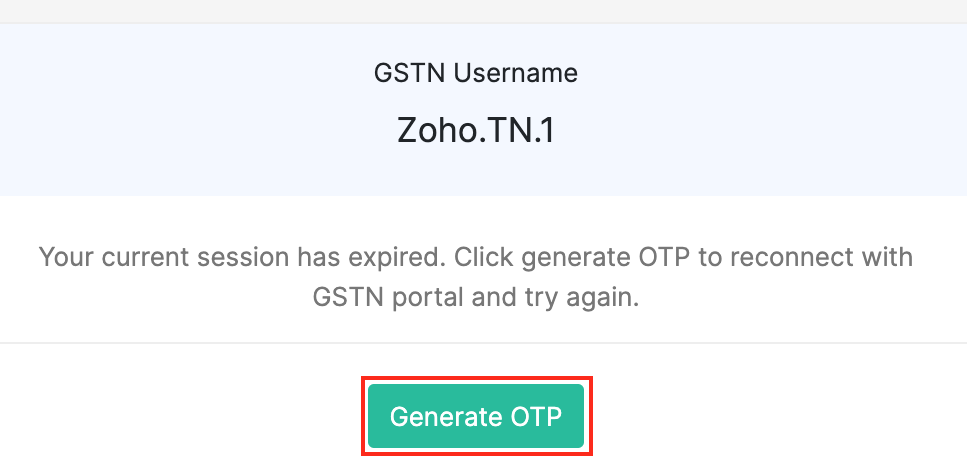

- If your session has expired, a pop-up will appear. Click Generate OTP and enter the OTP sent by the GST portal to your registered phone/email address. You will now be able to view the transactions uploaded by your vendor in the GST portal.

View Reconciled Transactions

Once the GSTR-2B has been fetched from the GST portal, Zoho Books will automatically categorise the transactions as; all transactions, matched, and partially matched.

There will be two sections, View Return and Reconciliations when you click the transactions.

- In the View Return section, you can view the list of all the transactions and

- In the Reconciliation section you can create and match the transactions from the Action dropdown.

| Section | Description | Action |

|---|---|---|

| Missing in GSTN | Transactions that are present in Zoho Books but are not available in the GSTN are displayed under this tab | Click Add to GSTN to move the transactions to the Matched section |

| Missing in Zoho Books | Transactions that are not present in Zoho Books but are available when the GSTR-2B transactions are pulled from GSTN. | Click Create and Match to create a new transaction in Zoho Books and move it to the Matched section. |

| Partially Matched | Transactions in Zoho Books that partially match with those populated from the GSTN. | 1. Click Accept to move transactions to the Reconciled tab. 2. Click Modify and Match to modify the data in your Zoho Books account. |

| Matched | Transactions pulled from the GSTN that match with the transactions in Zoho Books and the transactions that you’ve matched. | - |

| Reconciled | Transactions pulled from the GSTN that match with the transactions in Zoho Books. | - |

Note: The Accept button will be displayed for transactions under the Matched and Partially Matched tabs. If a transaction is in the Missing in Zoho Books tab, the Accept button will not be visible.

Regenerate GSTR-2B

When there are changes to the records in the Invoice Management System (IMS) after the 14th of the following month, it is necessary to regenerate GSTR-2B to ensure it reflects the updated information. You now have the option to regenerate GSTR-2B multiple times for any actions performed in IMS. There is no restriction on the number of times GSTR-2B can be recomputed or regenerated before filing GSTR-3B for that specific return period. However, regeneration is only necessary if there are changes in the actions taken on transactions.

Note: If the GSTR-3B for the previous month is not filed by the GSTR-2B cut-off date, taxpayers should use the regenerate option to generate the GSTR-2B for that month.

Scenario: Let’s say GSTR-3B for November 2024 has not yet been filed, and you attempt to generate GSTR-2B for December 2024, you will encounter an error. Once the GSTR-3B is filed for the previous return period, then you can regenerate GSTR-2B for the current return period.

Here’s how:

- Go to GST Filing on the left sidebar.

- Click View Returns and navigate to the GSTR-2B section.

- Click View Summary.

- Click Regenerate in the top-right corner of the page.

If you are a QRMP taxpayer, you can generate GSTR-2B only at the end of the last month of the quarter.

Let’s say January, February, and March constitute a quarter, GSTR-2B cannot be generated for January or February. It can be generated only in March, the final month of the quarter. If you attempt to generate the return in the middle of the quarter, you will encounter an error stating that GSTR-2B is not applicable for the selected period.