Functions in Payments Received

Let us see the different functions that can be performed in the Payments Received module.

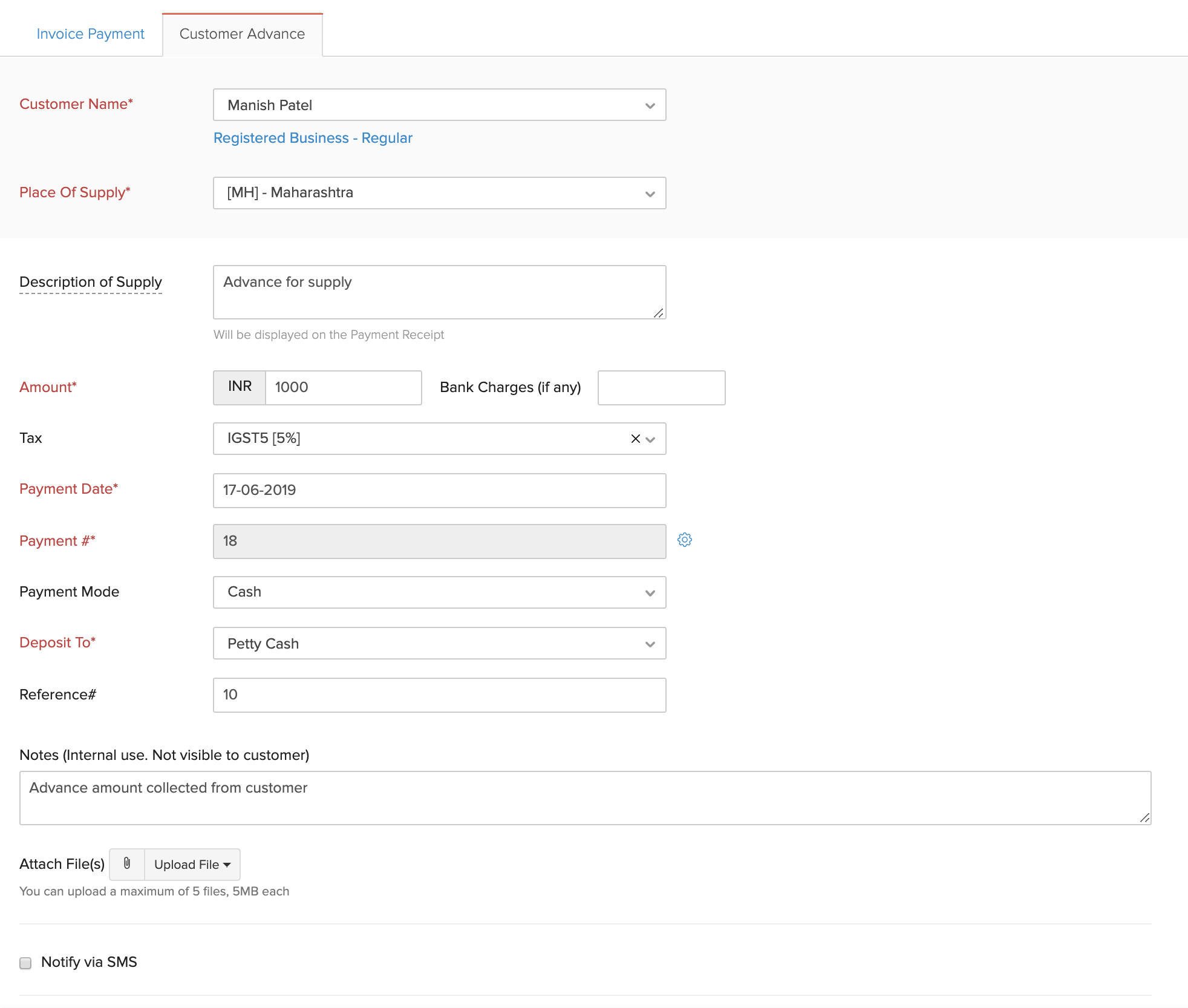

Record Customer Advances

If you receive an advance amount from your customer on which GST is applicable, then you can record this advance in Zoho Books.

To record advance payments from your customers:

- Go to Sales > Payments Received.

- Click the + New button in the top right corner of the page.

- Select the Customer Advance tab on top of the page.

- Fill in the required details.

| Fields | Description |

|---|---|

| Customer Name | Select the customer for whom you’re recording an advance. |

| Place of Supply | Select the location where the supply takes place. |

| Description of Supply | Enter a description of the goods or services that you are going to supply. |

| Amount | Enter the total amount received from the customer. |

| Tax | Select the tax applicable on the supply. |

| Payment Date | Select the date on which you received the payment from your customer. |

| Payment # | The payment number is auto-generated. If you want to configure this, click the Gear icon to the right of this field. |

| Payment Mode | Select the mode in which the customer pays you. |

| Deposit To | Choose the account which tracks the customer advance. |

| Reference# | Enter a reference number for the payment. |

| Notes | Enter any notes about the customer advance for your reference. This won’t be displayed to the customer. |

| Attach Files | You can attach up to 5 files, each of 5 MB, to the customer advance. |

| Notify via SMS | If you have enabled SMS notifications, you can notify your customer about the advance you received from them. |

- After entering all the details, click Save.

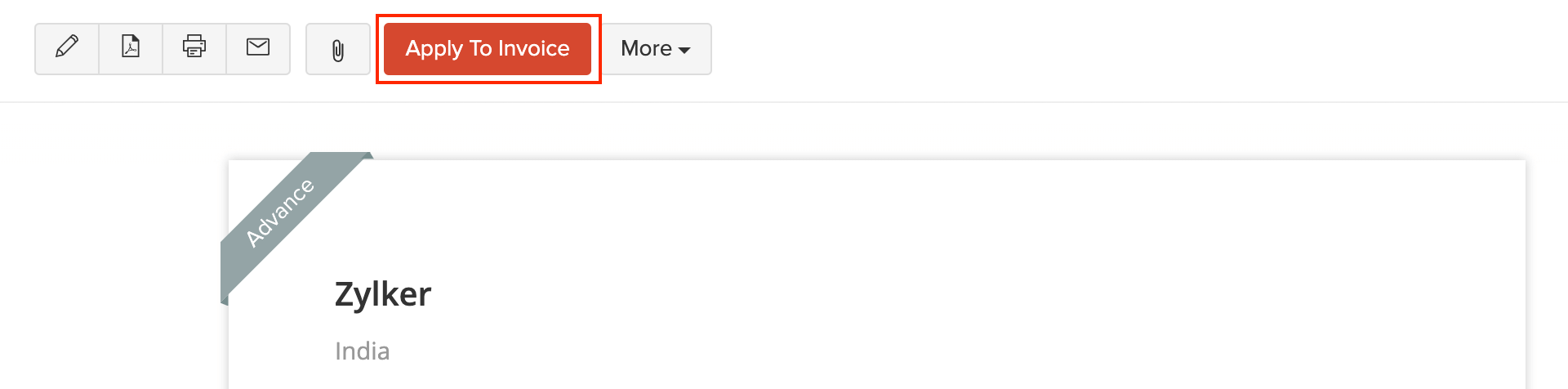

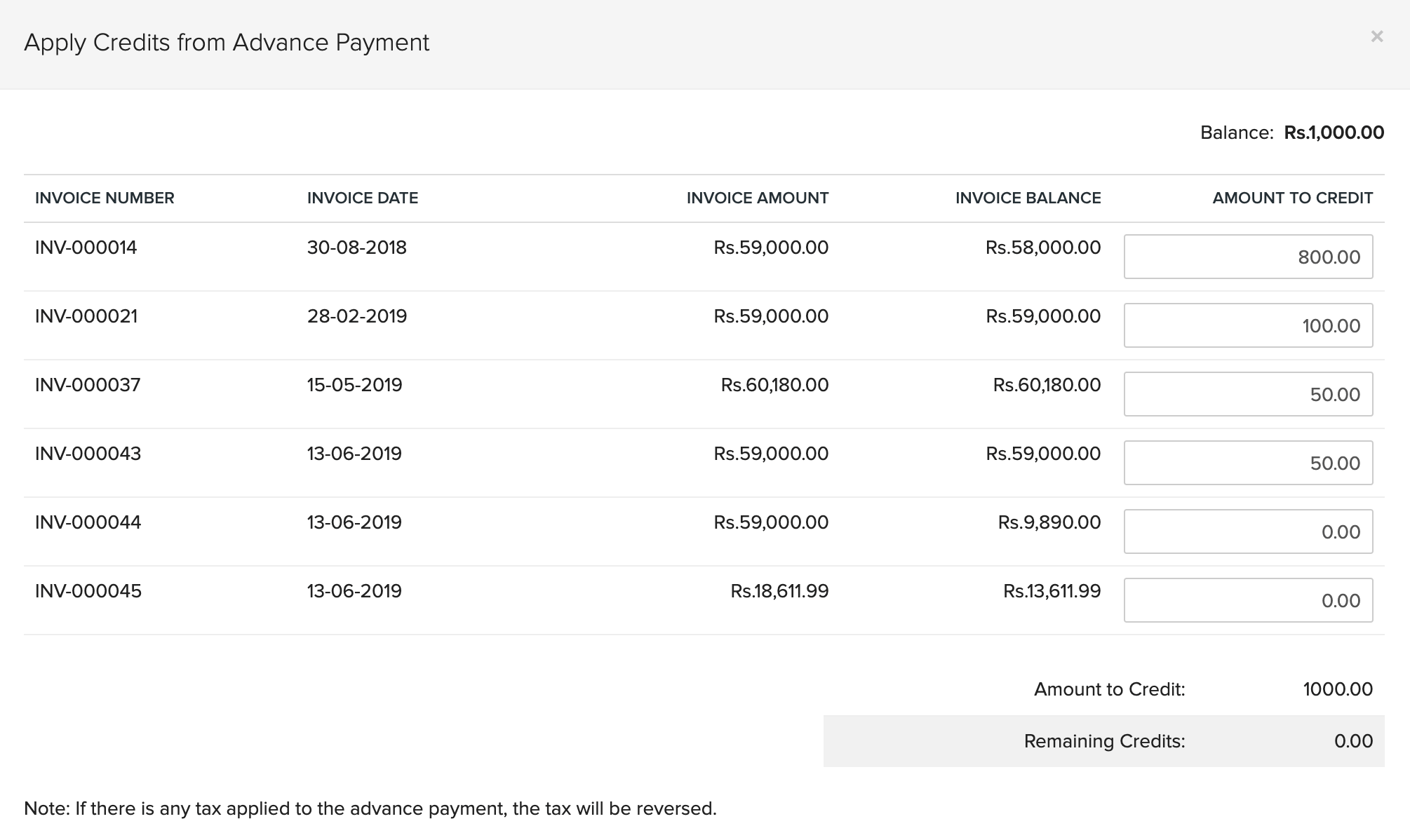

Apply Customer Advance to Invoice

After you have recorded your customer’s advance, you can apply it to their outstanding invoices. Here’s how:

- Go to Sales > Payments Received.

- Select the desired customer advance.

- Click the Apply to Invoice button on top of the page.

- Enter the Amount to Credit for each invoice.

- Click Save.

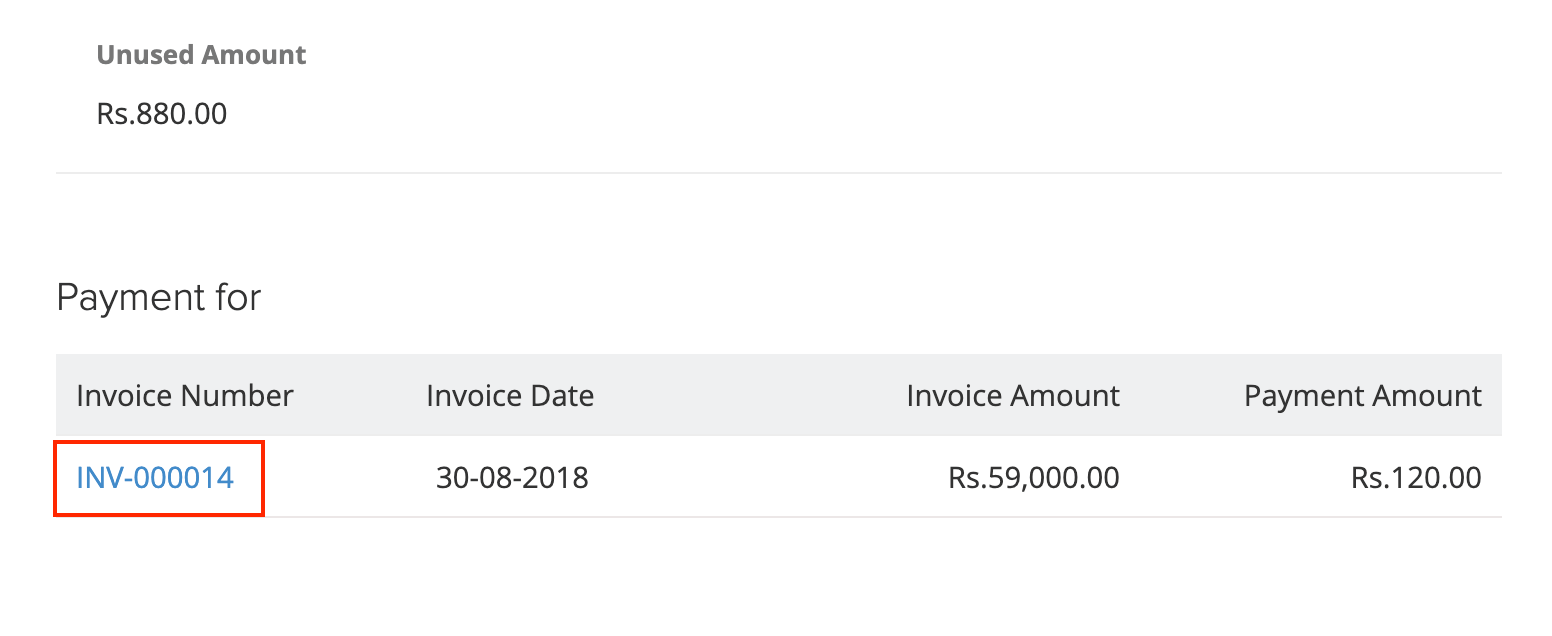

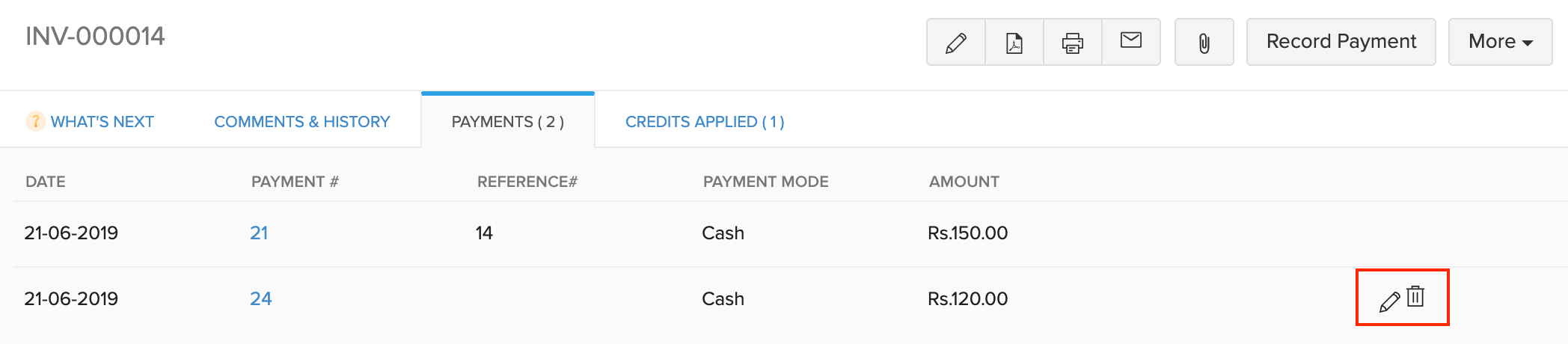

Edit or Delete Payments Applied to Invoices

If you have applied the advance received from your customer to any of their invoices, you can delete these recorded payments. Here’s how:

- Go to Sales > Payments Received.

- Select the customer advance which you have applied on invoices.

- Scroll down to the Payment section and select the invoice on which the payment is applied.

- In the Invoices module, click the Payments tab on top of the page.

- Hover over the payment you’ve recorded.

- From here, you can Edit or Delete the payment.

Refund Payment

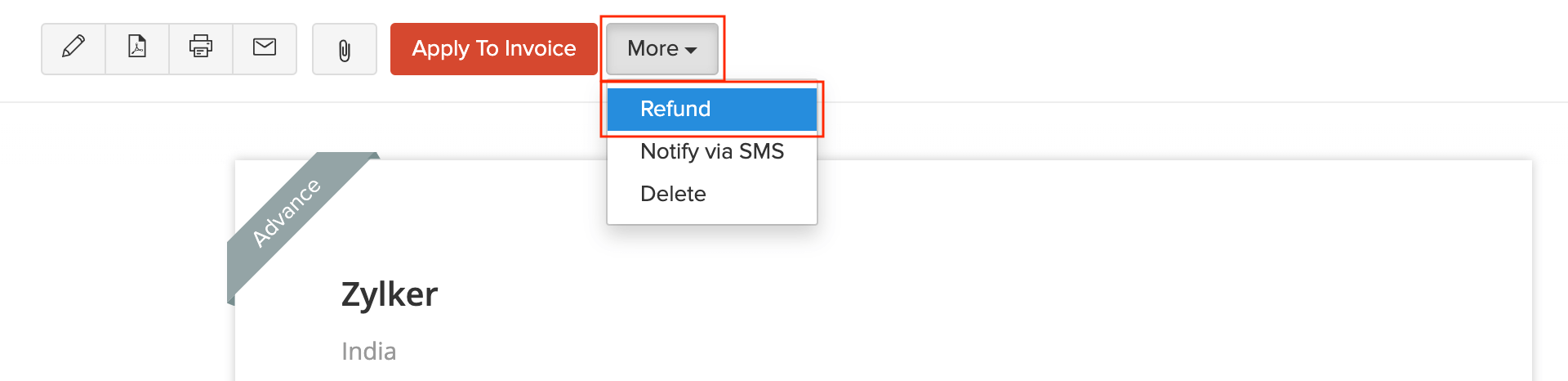

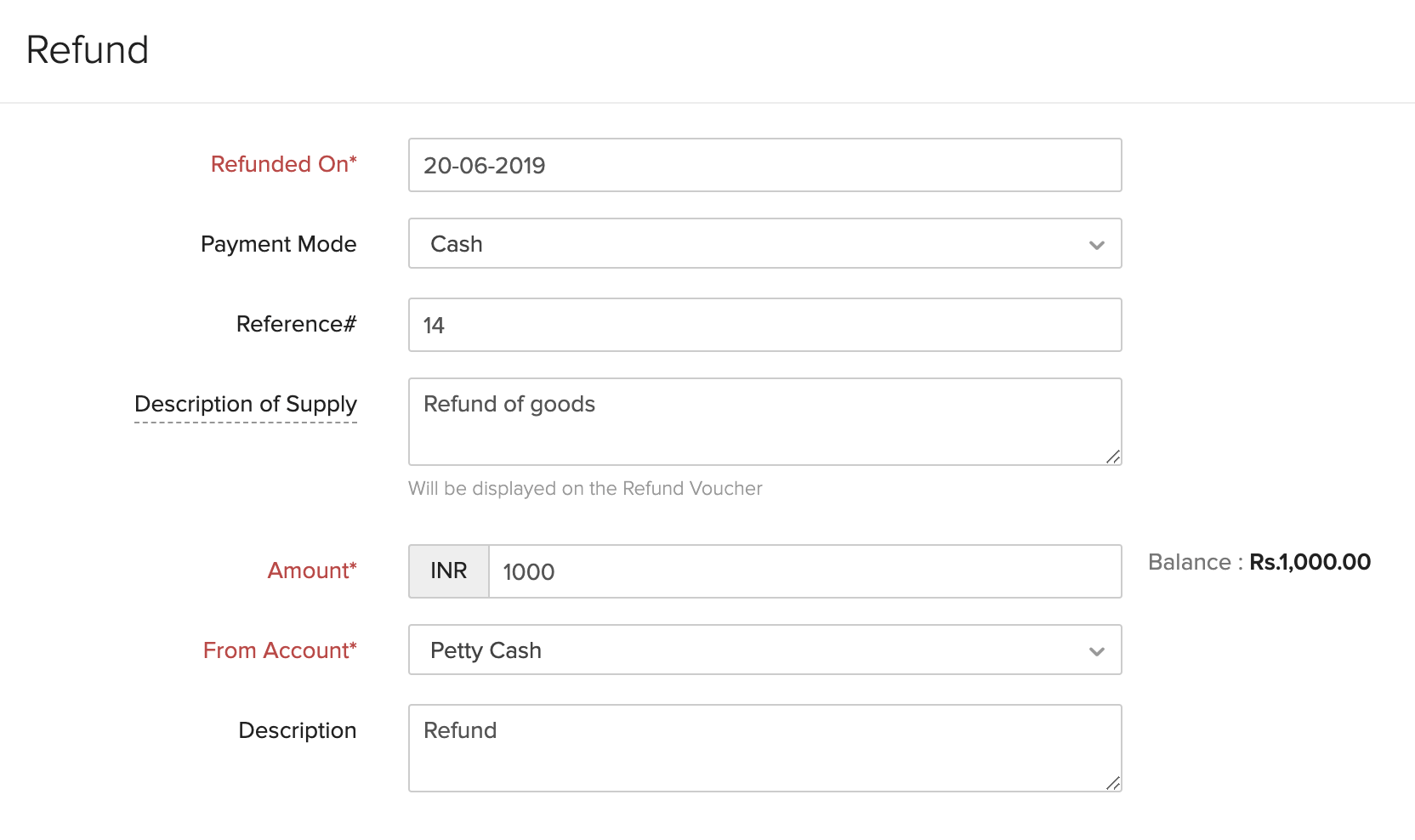

You can refund the advance that you’ve received from your customers. Here’s how:

- Go to Sales > Payments Received.

- Select the customer advance to be refunded.

- Click More > Refund.

- Enter the amount to refund.

Insight: You can enter the amount to refund in full or in part. If you choose to do it in part, the remaining amount can be applied to invoices or refunded later on too.

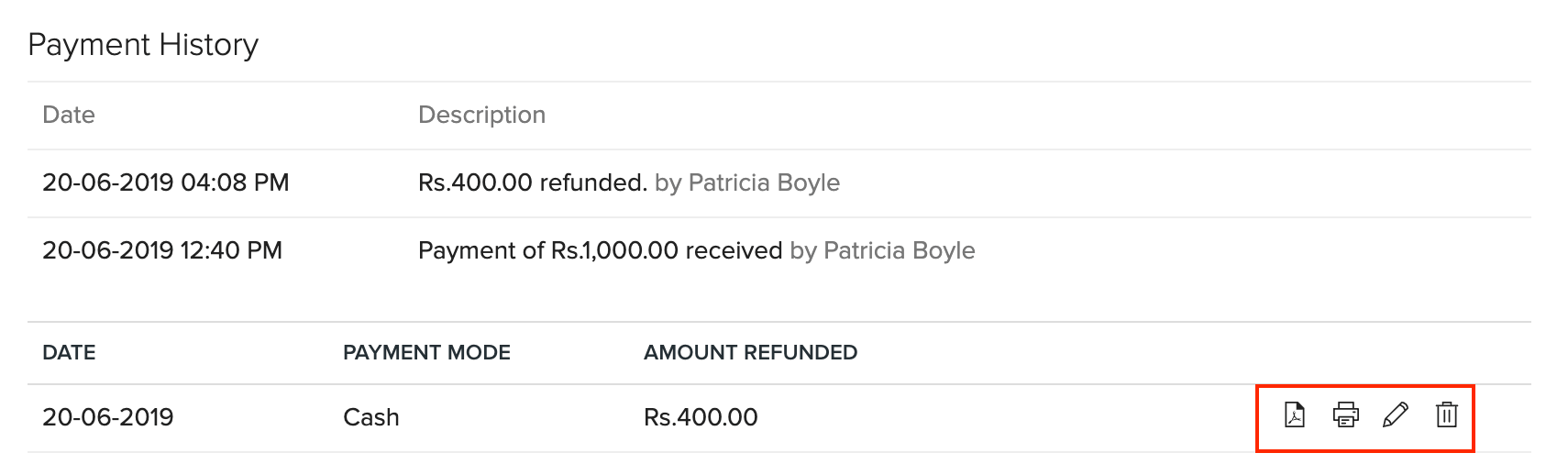

- Click Save.

You can find the amount refunded at the bottom of the page. You can perform various actions such as download it as a PDF, Print, Edit or Delete it.

Notify via SMS

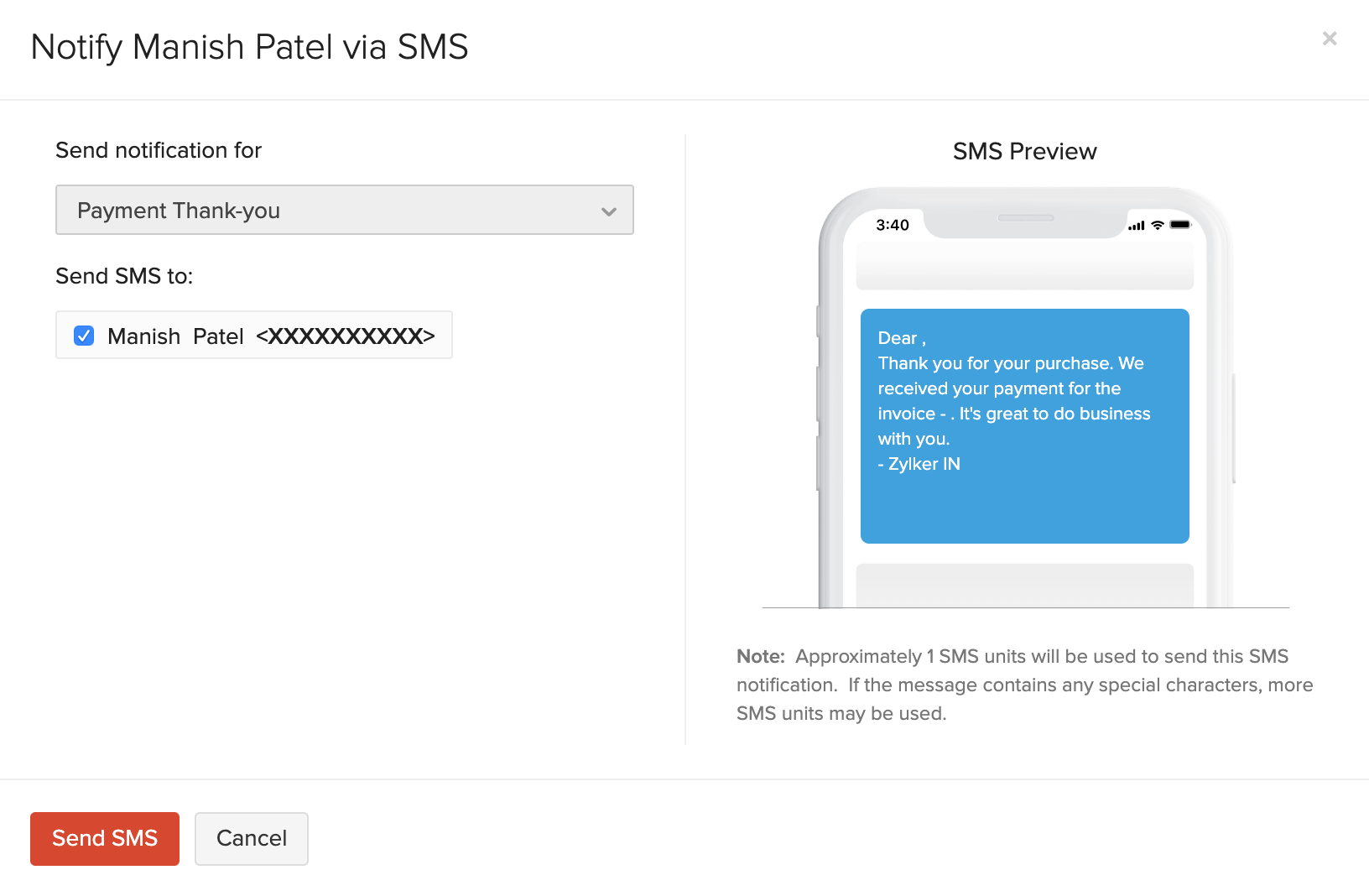

If you have set up SMS notifications in Zoho Books, you can send an SMS to your customer about the advance payment recorded for them. Here’s how:

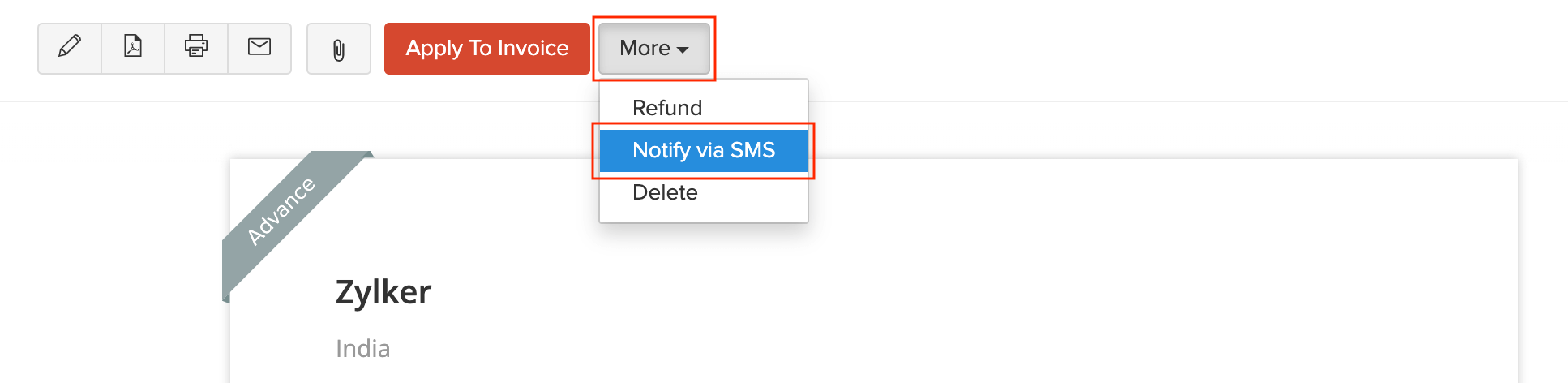

- Go to Sales > Payments Received.

- Select the advance payment which you want to notify the customer about.

- Click More > Notify via SMS.

- Select the customer’s mobile number.

- Click Send SMS.

Note:

If you want to send SMS notifications to your customer, it is necessary that you enter the customer’s phone number in their contact details.

Payment Receipt Template

When you record a payment in Zoho Books, it will be saved in a default template. However, you can change this template and select another one. Here’s how:

- Go to Sales > Payments Received.

- Select the payment for which you want to change the template.

- Scroll down to the Template section and click Change.

- Select the template of your choice.

- Click OK.

Learn more about Templates and Payment Receipt Templates.

Next >

Manage Payments Received

Related

Yes

Yes